This guide handpicks the top crypto passive income ideas that have been tried and tested in the industry. With them, you can use your existing cryptocurrency holdings, crypto hardware, and insights to earn money. Passive income options in crypto are diverse — from crypto staking to mining and more; learn everything you need to know in this guide.

KEY TAKEAWAYS

► Crypto passive income options are diverse, including staking, mining, yield farming, airdrops, and liquidity mining, each with varying levels of risk and reward.

► Staking on proof-of-stake (PoS) networks remains a popular choice, with leading platforms like Coinbase, Kraken, and Binance offering competitive staking rates for popular cryptos.

► Crypto mining, while profitable, is energy-intensive and requires a significant initial investment, although alternatives like cloud mining offer a less costly entry.

► Earning passive income from crypto also comes with risks, and it is important to choose credible platforms, conduct thorough research, and stay aware of the tax implications.

1. Crypto staking

Arguably the gold standard of passive income generation, staking coins is common and offered by several centralized and even decentralized crypto exchanges. The idea is simple: you lock your crypto assets inside a protocol or chain, bolstering network security, helping verify transactions, and earning a regular fee in the process.

Note that crypto staking, as a passive income strategy, only works with proof-of-stake blockchains.

But which coins should you stake in 2025 or beyond? While the chances at higher APY and staking possibilities might change with time, Ethereum remains one of the top staking coins, especially post-merge. Besides that, Tezos (XTZ), Polkadot (DOT), Solana (SOL), and Cardano (ADA) comprise an aggressive staking portfolio.

Staking strategies

The best staking strategy is to avoid mistakes while staking coins/tokens. It is common for newbies to fall for high-yield promises, easy staking options, and platforms where a heavy commission is charged. Another staking mistake is to rely way too much on custodial staking entities.

Even though using centralised exchanges (CEXs) is okay, it is always better to be safe and work with non-custodial wallets like MetaMask, later connecting to CEXs and DEXs to completely control the assets.

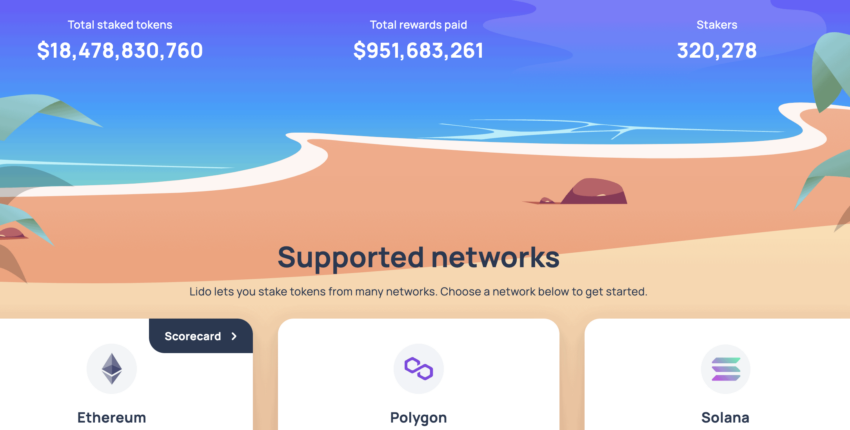

To stake, you can also connect with a liquid staking platform like Lido or Rocketpool for staking ETH or choose to be a validator by staking a minimum of 32 ETH.

Top coins to stake

It is not enough to just stake crypto, you must also know which coins to stake to earn a decent profit. Some coins and tokens have a high issuance rate and may offset your profits. In another case, some protocols may have low transaction fees, which leads to low profits. Here are some of the top coins to stake based on these considerations:

- Filecoin

- Helium

- Ethereum

- Solana

- Chainlink

Some of the processes for staking these cryptos may differ. For example, Filecoin staking is about contributing to network security. To get things rolling, you need to connect with a reliable Filecoin staking platform like Gemini or Coinlist.

You can choose any compatible wallet that holds your FIL, such as Ledger, connect with the choice of staking platform, and analyze the APY rates.

On the other hand, when staking Helium (HNT), you can connect, choose Binance or OKX, and stake HNT directly from your wallet. For helium staking as a validator, you must lock at least 10,000 tokens. Or, you can head over to the mentioned CEXs and use wallets like the official helium wallet, Ledger, etc.

2. Crypto mining

Cryptocurrency mining is a tad more personal to the blockchain ecosystem than staking. Bitcoin, the first commercially successful cryptocurrency and consistently holding the largest market share, still adheres to the crypto mining proof-of-work consensus. The “work” in proof-of-work can be identified as mining.

Bitcoin and altcoins

Even though Bitcoin supports BTC mining, there are other altcoins that can also be mined. Mining crypto is an energy and cost-intensive process. However, the end result is the ability to earn a steady passive income.

To mine Bitcoin or any other PoW crypto, you can follow various approaches, including setting up your own mining hardware, relying on cloud mining services, joining cryptocurrency mining pools, and more.

In case you want to set up your own rig for mining Bitcoin from home, you must consider the energy-specific costs and the fact that it is time and cost-intensive to build a mining rig from scratch.

As a miner, you should also be careful of unscrupulous, free Bitcoin mining scams that promise access to free mining pools, free BTC, and zero-cost services. The best approach would be to conduct detailed research about the coin you are mining before proceeding.

What else can you mine?

While Bitcoin mining is still largely profitable, some of the other profitable gigs include mining Ravencoin (RVN), Grin (GRIN), and Monero (XMR).

Monero mining

For mining Monero, you might want to invest in a powerful GPU. It is worth noting that CPU mining is also supported by XMR, but yields are better with a graphics card. Once you have the GPU, you should invest in the right software module — like XMRig or XMR-STAK-RX.

As XMR mining is difficult, it is better to join a mining pool. Once done, you would want to configure the miner by setting up software, wallet address, and pool information. After that, you can start mining.

Ravencoin mining

Ravencoin mining can be handled by both ASIC and GPU miners. Additionally, you would also need to invest in Ravencoin mining software like T-Rex or GMiner to get things started. Post that, you can join a mining pool, get the RVN wallet, choose the pool’s server location, and start mining.

Grin mining

Grin (GRIN), a privacy-focused cryptocurrency, can also be mined with exceptional yields. To go about it, you can start with a GPU. The choice of GPU would depend on the type of algorithm you use. You can use BMiner or GMiner as the choice of software, enlist to a mining pool, and set up the wallet and other specs to get started with Grin mining.

Also, if you want some other options to generate passive income from crypto mining, Ethereum Classic and Litecoin mining options can also be profitable.

The role of cloud mining

If you want to amplify your passive income from crypto mining, cloud mining is a handy way to get started. This strategy ensures that you do not need to invest in a separate mining rig, and you can get started right away by simply renting computing power.

To get started, it is always better to rely on cloud mining services that are credible, have transparent pricing, and boast positive reviews. Some of the best picks include NiceHash and Genesis Mining. Once you choose a cloud mining website, like Hashing24, or even some of the compatible CEXs like Binance or KuCoin, you need to choose your preferred crypto to mine.

If you want to try out the traditional way, you can buy yourself an ASIC mining rig and get started.

However, you can also try out YouHodler for free cloud mining Bitcoin (BTC). If you are willing to pay, onboarding BitFuFu, Binance, IQ mining, and other platforms can help you with Bitcoin mining from home.

Free Bitcoin mining: What’s that?

To mine and earn free Bitcoin without investment, you need to install a mining browser. This passive mining strategy still uses power to mine the BTC.

There are several free cloud mining service providers like HoneyMiner or BitzFree that also use the power of your computing device to mine BTC.

However, these services aren’t completely free, as earning via advertisements, referrals, paid plans, and user resources are often the more utilized and preferable options.

Therefore, it is advisable to do extensive research before making a decision when choosing a free mining service. Here is Vitalik Buterin’s take on mining using your phone’s computing power:

“Mining on phones is a fool’s game. Goes against everything we know about hardware economies of scale and more likely to trick users with false hope than help them.

*Staking* on phones, OTOH, is IMO quite promising…”

Vitalilk Buterin, co-founder of Ethereum: X

Even if you mine using your computing device(s), ensure that the details of your credit cards or other personal info are not shown or shared.

Is crypto mining profitable?

Still on the fence about crypto mining? If you are ready to take into account the electricity costs associated with Bitcoin or altcoin mining, things can get really interesting regarding profitability.

Besides that, crypto mining profitability also depends on the type of rig or hardware you plan on using. Other factors include mining difficulty, operational costs in case you plan on using cloud mining services, and the current market price of an asset.

Did you know? Ethereum’s transition to proof-of-stake realm made the Ethereum network more energy efficient, reducing the overall energy consumption by 99.95%. This aligns with Vitalik Buterin’s initial projection that the PoS transition would lower the global consumption of electricity by 0.2%.

Now that we have discussed crypto mining at length, let us explore other passive income-generating ideas in crypto.

3. Airdrops and forks

Crypto airdrops and blockchain forks are two proven ways to earn free crypto and amplify your passive income-generating chances. Let us delve deeper.

Unpacking airdrops

Crypto airdrops represent the free distribution of tokens or coins within the cryptocurrency community that are sent to targeted wallet addresses. In most cases, crypto airdrops are initiated to reward loyal project users or as a shilling attempt to market the project.

Besides coins and tokens, even NFTs are airdropped as an attempt to market projects or reward users. Crypto and NFT airdrops also make the projects more decentralized, ensuring that the community holds a sizable chunk of the offerings.

To earn steady passive income, you must keep track of upcoming airdrops for the given year. One of the more anticipated airdrops was Arbitrum’s native ARB crypto, with over 42 billion tokens claimed within the first 60 minutes of the airdrop event going live. There will be many more top airdrops waiting for us in 2025.

Unpacking lockdrops

When it comes to earning free crypto, lockdrops can also come in handy. Unlike airdrops, where new coins are credited to specific wallets, lockdrops require users to lock certain tokens of a specific cryptocurrency to gain a set number of the new, lock-dropped tokens.

Something similar happened with Edgeware (EDG), as users had to lock their ETH into a smart contract for a specific period in return for EDG tokens.

Lockdrops reduce the circulating supply of the more established asset while increasing the value of the new token by making it available to interested users.

Forking and passive income

For the uninitiated, forks are like new, contentious versions of older blockchains. They often lead to the issuance of new tokens, which the users holding tokens of the parent chain are awarded as free cryptocurrency. Forks are not as common as token airdrops, but they are certainly a great way to generate passive income.

A notable example would be how Bitcoin forked to make way for Bitcoin Cash (BCH). Existing Bitcoin holders were given BCH coins equivalent to their BTC holdings.

4. Yield farming and liquidity mining

Both yield farming and liquidity mining are core concepts of decentralized finance (DeFi). And while even staking forms a part of the DeFi catalog, these strategies aren’t restricted to PoS cryptocurrencies. Let us understand how each works.

How does yield farming work?

Yield farmers provide liquidity to a DeFi protocol, making them eligible for rewards. Simply put, yield farming refers to staking or lending crypto assets within a decentralized financial ecosystem powered by smart contracts. Some of the leading blockchain ecosystems with credible yield farming exposure include Ethereum, BNB Smart Chain, and Polygon.

Top platforms to yield farm on Ethereum

If you are an Ethereum native and interested in exploring the world of passive income, here are some of the top yield farms on Ethereum,

1. UniSwap

Native token: UNI

UniSwap is one of Ethereum’s most popular DEXs and a DeFi protocol. It is best known for its automated liquidity provisioning feature.

2. Yearn Finance

Native token: YFI

Using Yearn Finance, you can move funds or rather shift liquidity between diverse lending protocols.

3. Curve

Native token: CRV

This protocol excels if you are interested in stablecoin swaps. Curve also boasts several deep liquidity pools and has one of the lowest fees and slippage in the space.

4. SushiSwap

Native token: SUSHI

Here is a community-driven DEX that excels in automatic market-making, allowing users access to deep liquidity repositories.

5. Aave

Native token: AAVE

Aave is a leading DeFi lending platform, allowing users to borrow assets as well as lend and earn interest.

Top yield farms on BNB Smart Chain (BSC)

BSC or the Binance Smart Chain is a worthy Ethereum alternative in case you are looking to explore other passive income generators. Some of the top yield farms on BSC include the Venus Protocol, AutoFarm, PancakeSwap, Pancake Bunny, and the BakerySwap. Notably, some of these firms double down as DEXs, AMMs, and NFT marketplaces.

Top yield farms on Polygon

Polygon is yet another popular DeFi ecosystem. Here are the top-yield farms on Polygon that you can explore:

- Aave

- SushiSwap

- DFYN

- QuickSwap

- Polycat Finance

Some yield farms like Aave have a multi-chain presence, making them the epitome of blockchain interoperability.

Top yield farms of Fantom

Fantom happens to yet another credible DeFi ecosystem. If it’s your native chain to work with, the top Fantom yield farms include SpiritSwap, HyperJump, SpookySwap, and Waka Finance.

If you are a DeFi degen, we recommend trying out all the mentioned yield farms and sticking with the one that’s best for you.

Liquidity mining vs. staking

| Liquidity mining | Staking |

|---|---|

| The act of creating markets or liquidity pools for traders to swap cryptocurrencies. | The act of depositing a cryptocurrency into a smart contract to earn yield. |

| Used to create a peer-to-peer marketplace for traders. | Used to secure a blockchain or protocol. |

| It can be done for trading, borrowing and lending, or insurance liquidity pools. | It can be done for validating blockchains or decentralized applications (DApp). |

| Slightly more difficult than DApp staking but less difficult than solo validator staking. | Difficulty varies but yields are more consistent than liquidity mining. |

Staking is a relatively straightforward way of earning passive income. Most CEXs offer dedicated staking services, and PoS cryptos allow direct staking, where you can simply lock your native holdings to secure the network.

Plus, staking also branches out to liquid staking. This works like a staking derivative, allowing users to lock any number of tokens for any period without worrying about liquidity. For instance, stETH is a liquid staking alternative to standard ETH and is synonymous with the Lido staking platform.

Liquidity mining is a tad more complex. The idea is to have two sets of coin/token holdings and add both to a pool, with those two coins/tokens forming a pair.

For instance, if you hold both ETH and DAI, you can head to UniSwap and add liquidity to the DAI/ETH pool. In return, you earn steady passive income in the form of trading fees, typically in UNI.

Liquidity mining is riskier and comes with the impermanent loss risk, but it can facilitate higher returns. However, even staking, precisely liquid staking, can give high returns, provided you know where to look.

Unpacking yield farming

Yield farming can become complex as it involves a lot of associated strategies, such as re-staking the rewards. Note that liquidity mining is one step in the process of yield farming, where users simply supply liquidity to specific pools and earn a steady passive income stream, after which they take the LP tokens that they receive and stake them on other platforms.

Top passive income ideas compared

Each idea for earning passive income has a vast amount of knowledge associated with it, and it can be a lot to take in. Here is a brief comparison to make to make everything simple.

| Methods | Description | Difficulty |

|---|---|---|

| Staking | The act of escrowing or locking your tokens up to perform some task in exchange for cryptocurrency or some other privilege. | Easy |

| Mining | When you use hardware to expend energy and perform computations to secure a blockchain. | Hard |

| Airdrops and forks | Airdropping is when a project sends tokens to addresses for free, while forks are when a blockchain splits into separate databases, creating another set of cryptocurrencies for the user. | Easy |

| Yield farming and liquidity mining | Liquidity mining is market-making for cryptocurrency, while yield farming is when you take LP tokens from one platform to another and compound your yield. | Medium |

Throughout this guide we have mentioned several crypto service providers — exchanges, staking solutions, cloud mining services, and portfolio trackers. The names listed include Coinbase, Kraken, OKX, Uphold, Binance, YouHodler, Hashfrog, and Hashing24. Yet, none of these choices were random as we followed a set criteria to identify the best options on the market for everyone from crypto experts to complete novices. All recommended platforms benefit from a solid reputation, extensive security measures, relatively low fees, and are straightforward to use.

Additional strategies to generate crypto passive income

While we have covered most of the common strategies, there are a few other ways to earn passive income with crypto. These include:

Crypto savings accounts

Centralized exchanges sometimes allow users to use their crypto holdings to earn interest by locking them into a savings account of sorts. This way, you can even earn an annual compounding rate similar to the ones offered by traditional banks.

Crypto lending

On DEXs like Compound and Aave, you can lend out your cryptocurrencies to earn interest. Some CEXs also offer lending services. For instance, you can lend out USDC via the Compound DEX and earn interest in COMP.

Crypto stocks

Many traditional global companies have crypto exposure or offer services related to crypto mining in the form of rigs. Investing in crypto mining stocks like those from BitFarms Limited, Riot Blockchain, and more can be beneficial should mining gain popularity.

Besides mining stocks, you can also invest in companies like Coinbase and Microstrategy that either offer crypto services or have exposure to crypto. Stock price appreciation and dividends are the possible ways of earning passive income when invested in these stocks.

NFTfi

Let us circle back to the section where we discussed NFT airdrops. Well, if you get one NFT airdrop in your wallet and the asset appreciates in value, you can flip it to generate some income. Plus, certain platforms also allow you to borrow funds against your NFTs — which you can use to engage in staking, liquidity mining, and other activities to earn passive income.

Additionally, NFT staking on platforms like MOBOX and Binance Powerstation is another lesser-known strategy. This option lets you earn passive income while interacting with communities and projects. Note that NFT staking requires the highest level of due diligence and is an extremely high-risk investment.

Token governance

One of the lesser-known lucrative strategies to earn extra income is to participate in the token governance of any DeFi protocol. For instance, COMP holders can propose and vote on changes made to the protocol. And active voters receive additional tokens. The same concept holds for other ecosystems like MakerDAO.

Is crypto passive income safe?

If you work with credible staking platforms, mining services, projects, and DeFi protocols, there will be fewer safety concerns with crypto passive income. It’s important to be wary of scams and ensure you only click official links. Regulatory barriers also exist, depending on whether a region allows CEXs to offer staking services or miners to run mining pools due to high electricity costs and heat generation. In case you are a miner, ensure you are operating in a region where Bitcoin mining is legal, as BTC is certainly the most popular and mineable crypto around.

It is always advisable to refrain from yields, free mining services that promise exceptional payouts, unverified airdrops, and other opportunities that sound too good to be true.

Besides that, you should do your own research, ensure local law compliance, and revisit the regulatory landscape before proceeding.

Is crypto passive income taxable?

Crypto profits and passive income are taxable in several countries. For instance, in the United States, staking rewards and even yields are subject to capital gains tax. In the U.K., taxes apply on mining, staking, and airdrops. Besides these countries, Canada, the entire European Union, India, and Australia are some other regions where you must pay taxes on passive income from crypto, mostly as capital gains tax.

Crypto passive income options are plentiful

From staking to mining to airdrops to liquidity provisioning and beyond, this guide has covered most passive income options in crypto. However, not every strategy is meant for everyone.

Before you onboard any plan, you should look at past records and regulatory standards in the given region, ascertain your risk appetite, and then move forward. It’s wise to stick with tried and tested avenues such as ETH staking or Bitcoin mining. Always do extensive research and never invest more than you can afford to lose.

Frequently asked questions

Can you make passive income from crypto?

Can you make $100 a day with crypto?

How do you make $1000 a month mining crypto?

Which crypto is best for passive income?

Which cryptocurrency pays daily?

How do I start earning passive income with crypto?

What is passive income staking in crypto?

Can I earn passive income on Binance?

Which crypto is best for passive income?

How to earn passive income with USDT?

Can you lose crypto by staking?

Is crypto a good passive income?

What are the methods of making passive income in crypto?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.