For those hesitant or intimidated by entering the crypto world yet enticed by its growth, cryptocurrency stocks offer a safer option. These are stocks of companies that provide crypto mining hardware or engage in cryptocurrency mining, such as bitcoin. With crypto-assets gaining mainstream traction, here are some top crypto mining stocks to consider buying or watching now.

Is it smart to invest in the cryptocurrency sector?

When it comes to technology that may or may not pan out, cryptocurrency doesn’t belong in the latter category. Remember when Bill Gates, the world’s biggest farm owner and virologist, said the following about the future of the Internet at Comdex in 1994 — “I see little commercial potential for the Internet for the next 10 years.”.

When it comes to cryptocurrencies, Bill Gates mentioned that he would like to get rid of cryptocurrencies when asked which innovation would leave the world a better place.

In both instances — the Internet and cryptocurrencies — Gates is stifled from thinking clearly because he has ideological blinders. When he ran Microsoft, he always prioritized centralization, tracking, and total control. In contrast, both the Internet and cryptocurrencies represent decentralization.

Creating digital, leaderless assets independent of politicians and central banks that have committed to a historic money supply increase. Bitcoin, in particular, has been hailed as digital gold because its hard coin limit of 21 million renders it a deflationary digital currency.

More importantly, the crypto sector has crossed a lot of major adoption milestones:

- Integration into the world’s largest payment processors like PayPal and Square’s CashApp

- Becoming a reserve crypto asset for dozens of multi-billion hedge funds, corporations, and asset managers

- Achieving greater market capitalization (Bitcoin + all the altcoins) than the world’s top 10 banks

Another adoption threshold occurred with Coinbase crypto exchange getting listed on NASDAQ. Suffice to say, this tremendously increased crypto engagement, as noted by Michael Saylor of MicroStrategy.

The final chapter of the mobile wave is global economic empowerment via mobile assets. These stats imply 10 million new #bitcoin holders per month, and more than 250 million by year end. Within five years, bitcoin should reach a billion people.

Should you invest in stocks or bitcoin?

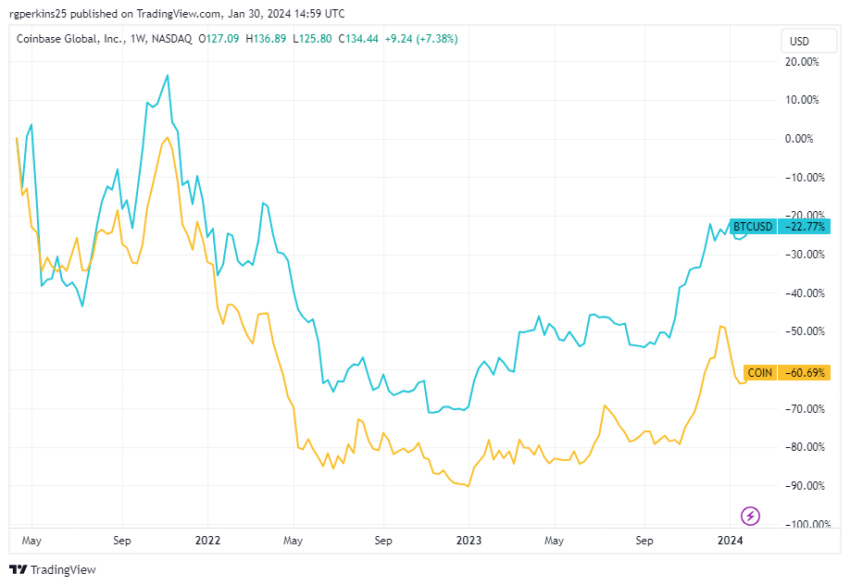

When we take a look at Coinbase (COIN) stock vs. Bitcoin, we see that the cryptocurrency stock is almost entirely in sync with the dominant crypto itself. After all, Bitcoin makes about half of the total market cap of all crypto assets in existence.

By the same crypto, every entity with its holdings tied to Bitcoin’s price moves will follow similar ebbs and flows, be that MicroStrategy, Coinbase, or a crypto mining company.

However, stocks that are not linked to the crypto world rarely generate high yields and dividends that are comparable to cryptocurrencies. On the other hand, notorious crypto volatility demands market discipline.

With that said, although it may seem that Bitcoin is volatile, it is less so than most other altcoins. BTC’s long-term trajectory is the upward one, despite panic-inducing price corrections that inevitably occur.

Predictably, Bitcoin’s price spike follows the unprecedented money supply increase by the Federal Reserve. Physical gold has been a historic tool against currency devaluation.

This time, it appears that Bitcoin is taking this role as a more frictionless, fungible, secure, and mobile digital asset. However, it bears keeping in mind that governments don’t like gold, either digital or physical.

The US government banned the former with the Executive Order 6102, which had been in effect for over 40 years.

In this light, you should view cryptocurrency stocks as a hedge against Bitcoin’s de-platforming. It may come at a time when Bitcoin is deregulated out of having value, as governments deploy their CBDCs — Central Bank Digital Currencies.

In such a scenario, the crypto world would not vanish. Instead, the crypto mining companies would serve privacy coin networks like Monero (XMR) and programmable blockchains like Ethereum (ETH).

Understanding the valuation of crypto stocks

With all these caveats and potential scenarios in hand, let’s take an overview of crypto stocks that have a solid track record and space to grow even further.

But first, here is a brief recap of what cryptocurrency mining, and Bitcoin mining specifically, is all about:

- Due to the way blockchain consensus algorithms work to make it immutable and secure, all computers serving as nodes in the network must solve complex math problems

- As a reward for verifying blockchain transactions, these computers gain network rewards. In the case of Bitcoin, this is 6.25 BTC per block, on average solved every 10 minutes

- The most streamlined such mining operations hold the most fine-tuned hardware, benefiting from the lowest electricity cost.

- In turn, a crypto mining company’s profit comes from the balance between operational costs of running mining rigs and their computational power (hash rate). The higher the hash rate is compared to its costs — hardware, taxes, electricity, space rent — the higher the company’s gains.

These days, one could even rent mining services remotely, as is the case with StormGain, which also serves as a sleek crypto exchange.

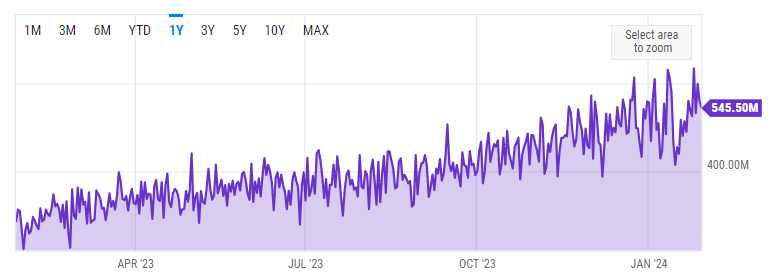

From understanding crypto mining, it is easy to see what drives a crypto stock’s potential value — the hash rate capacity. As of April 26, 2021, the global Bitcoin network hash rate is holding at 545.50 million TH/s (tera hashes per second).

Consequently, crypto mining companies will issue their hashing power in either peta (PH/s) or exa (EH/s). In addition to hash rate power, one also must take into account the crypto-friendliness of the country they are located in.

Lastly, one of the more pertinent factors that go into gauging a mining stock’s value is its growth plan.

Specifically, their plans for future acquisition of mining rigs to expand its hash rate capacity and how it deals with electricity requirements. Moreover, have they formed partnerships with local municipalities or subsidies for renewables?

What are the best crypto mining stocks to buy?

It goes without saying that these companies will be valuable if there are no regulatory surprises or aggressive China-like overtures. Moreover, those that have branched out of Bitcoin into Ethereum and other altcoins stand to be more future-proof, having already adapted their business strategy to attain flexibility.

1. Marathon Digital Holdings (NASDAQ:MARA)

- Current hash rate in EH/s: 24.7

- Possible future hash rate: N/A

- Market capitalization: $4.21 billion

- Location: United States

Main draw: Currently holding 15,174 Bitcoins, the company extended its reach into crypto custody service, particularly for whales. 2020 was not a particularly good one for Marathon as it incurred double the loss — $5.2 million to its revenue of $2.6 million in Q4. Likewise, most of its current BTC holdings are not mined but purchased.

With that said, the company is one of the top public companies that hold the most Bitcoin, second only to MicroStrategy. Due to these factors, MARA may be an investment opportunity if you are willing to hold and wait for a bull market.

2. Riot Blockchain (NASDAQ:RIOT)

- Current hash rate: 10.9 EH/s

- Possible future hash rate: 20.1 EH/s

- Market capitalization: $2.40 billion

- Location: United States

Main draw: Riot Blockchain formerly had two homes in the US — Colorado and New York. The company would eventually move its operations to two locations in Texas.

It owes this to diversified operations beyond crypto mining, which extends to auditing, crypto accounting, and similar services for assets derived from blockchain technology. During 2020, the company mined 1,005 BTC, compared to February 2021, its production went up by 43%.

Currently, it holds 7,362 Bitcoins. Unfortunately, it has not yet diversified into altcoins, given the fact that Bitcoin’s total supremacy seems to be waning in favor of other altcoins that provide unique utility. At the same time, it is unlikely that Bitcoin should falter any time soon.

3. Hive Blockchain Technologies (OTCMTKS:HVBTF)

- Current hash rate: 4.13 EH/s

- Possible future hash rate: 6 EH/s

- Market capitalization: $291 million

- Location: Canada/Iceland/Sweden

Main draw: Headquartered in Vancouver, but spread into Northern European nations, Hive generated 257 BTC in profits in October 2023. This constituted a 0.2% increase month over month.

Hive not only utilizes the abundant hydroelectric power in Canada and the inexpensive geothermal energy in Iceland, but it also owns state-of-the-art, green energy-powered data center facilities in Canada, Sweden, and Iceland. There, Hive strives to procure green energy for mining digital assets like Bitcoin on the cloud.

4. Hut 8 Mining Corp (OTCMKTS:HUTMF)

- Current hash rate: 18.6 EH/s

- Possible future hash rate: N/A

- Market capitalization: $685.34 million (USD)

- Location: Canada

Main draw: At the beginning of 2021, Hut 8 reported to have at least 3,000 Bitcoins as its treasury reserve. Furthermore, almost all of them were self-mined, not purchased.

At the same time, it managed to raise $100 million in equity capital, following its shift of leadership in November of the same year. Even so, when BTC was much lower at the end of 2020, Hut 8 existed the year with a $19 million net income, with a total comprehensive income of $64.7 million.

Hut 8 merged with USBTC in Q3 2023, expanding its mining operations by multiples. This brought its total number of miners under management to over 200,000.

5. Bitfarms Limited (OTCMKTS:BFARF)

- Current hash rate: 6.3 EH/s

- Possible future hash rate: 12 EH/s

- Market capitalization: $780 million

- Location: Canada

Main draw: Founded in 2017, at a time when Bitcoin was less in value, Bitfarms is a veteran crypto miner on the North American continent. It ended 2020 with a gross profit of $2.9 million, with a gross mining profit of $13.8 million, which is an improvement from the previous year. In 2021, Bitfarms raised $80 million in equity capital on top of repaying in full outstanding debt.

Like other Canadian crypto miners, it is well suited to pass the ESG scrutiny, as it mostly taps into hydro, solar, and wind power. These energy alternatives fuel nine facilities on two continents. They maintain a sustainable average cost of about $0.04/kWh.

6. Bit Digital (NASDAQ:BTBT)

- Current hash rate: 3.7 EH/s

- Possible future hash rate: N/A

- Market capitalization: $256.74 million

- Location: United States

Main draw: Formerly known as Golden Bull Ltd, this New York-based mining company is a rising star in the crypto mining world. Judging by its January 2021 output of 424.7 BTC.

Moreover, given the trend of anti-Bitcoin sentiments coming from the eco-circles, Bit Digital is aggressively pursuing going green. It added 40MW worth of hash power in collaboration with Compute North, accounting for 13k new ASIC mining rigs in 2021.

As such, Bit Digital is already ahead in the sustainability game, by having access to a flexible energy network consisting of solar and wind. The company has over 45,000 miners and has mined over 6,196 BTC to date.

Take note of future macroeconomic conditions

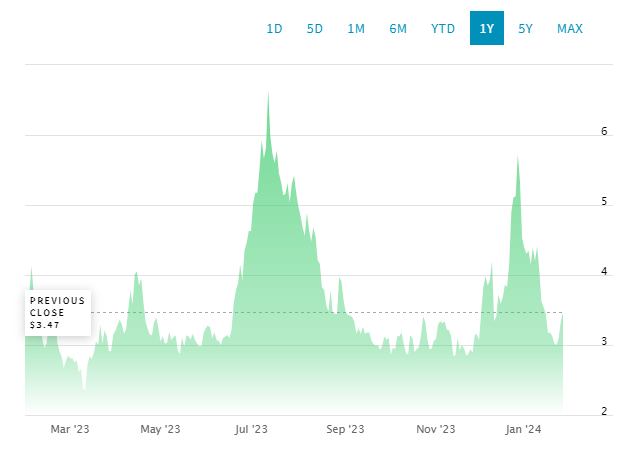

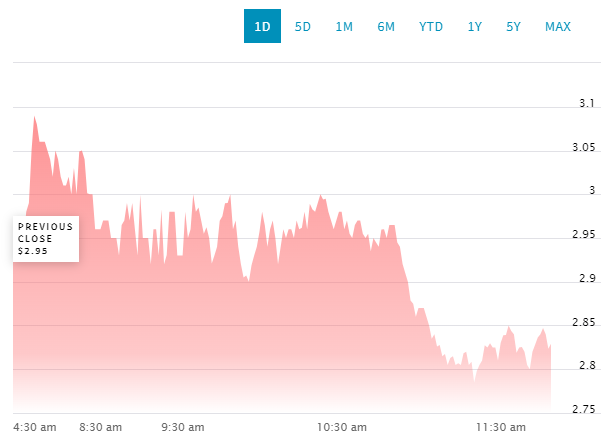

As you can see from the graphs of these crypto stocks above, they follow the slump of the BTC price. At the same time, the Federal Reserve has signaled rate cuts in the near future. Such negative macroeconomic conditions make for a fertile ground for Bitcoin to once again move into the bullish territory.

In the upcoming months, take note of these companies’ hash rates. If they are aligned with their projections, it means they have competent leadership.

Frequently asked questions

The value of crypto mining stocks is intricately tied to hash rate capacity, influenced by factors like location, crypto-friendliness, and growth plans. Successful mining operations balance operational costs and hash rate, emphasizing the importance of a company’s growth strategy and partnerships for renewable energy sources.

Apart from MicroStrategy’s substantial holding of 152,333 BTC, the leading publicly-listed Bitcoin mining companies in terms of Bitcoin ownership include Marathon Digital, Hut 8 Mining Corp, and Riot Blockchain.

Notable crypto mining stocks include Marathon Digital Holdings, Riot Blockchain, Hive Blockchain Technologies, Hut 8 Mining Corp, Bitfarms Limited, and Bit Digital. Each company has its unique strengths, such as Marathon’s expansion plans and Riot’s diversified operations, making them potential investments based on individual risk tolerance and goals.

The value of crypto mining stocks is primarily influenced by the hash rate capacity, location advantages, and growth plans of the companies. Factors like efficient hardware, electricity cost, and adaptability to different cryptocurrencies contribute to the overall valuation of a crypto mining stock.

Regulatory surprises can impact the value of crypto mining stocks, making it crucial for investors to stay informed about potential shifts in regulations. Companies that have diversified into alternative cryptocurrencies, like Ethereum, may be more resilient in the face of regulatory challenges, showcasing adaptability as a key factor in weathering uncertainties.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.