Earning passive income with crypto is not just a pipe dream. Many people add to their income in this manner every day. But how does it work, and are there any methods available for beginners? This guide covers seven ways to earn passive income with crypto safely and efficiently.

- Earning passive income with crypto is realistic

- 7 ways to earn passive income with cryptocurrencies

- Top ways to earn passive income with crypto: An overview

- How to make passive income with cryptocurrency

- Other passive income strategies

- Make informed decisions with crypto investments

- Frequently asked questions

Earning passive income with crypto is realistic

Cryptocurrency trading and investments can be extremely profitable but also very time-consuming. The profitability is in no small part due to the volatility of the market, which can create stress for investors. It’s all due to the constant need for users to track their portfolios and try to capitalize upon opportunities. Managing this kind of economic system is no easy task.

Many investors are unaware that cryptocurrencies can provide passive income. Passive crypto income is possible in 2025 because the market includes a multitude of projects looking to compete with the traditional financial sector. The sole strategy of many investors is to purchase Bitcoin, Ethereum, or other cryptocurrencies. Next, they wait for the value of these assets to increase.

Passive income is earned directly from ownership over your digital assets. It involves no continuous effort. Instead, users must make a few smart choices at the start of their journey. The system is similar to compounding interest, reinvesting dividends, or renting investment properties.

7 ways to earn passive income with cryptocurrencies

1. Staking

Proof-of-stake is a blockchain consensus mechanism that allows distributed network participants to agree on the addition of new data to the blockchain. In many ways, staking is the purest form of earning a passive income from crypto. It is an alternative or even a replacement for the role of the crypto miner. And it can be highly profitable for users over time.

How the earnings happen

Blockchains allow open, decentralized networks that enable participants to join the governance process. This is important because it eliminates the need for central authorities such as banks. Blockchains can randomly select participants to validate transactions, and they are rewarded for their efforts.

Instead of “miners,” who receive new block rewards like in proof-of-work (PoW), the validators get new block rewards in proof-of-stake (PoS). While validators don’t need costly hardware, they must have a large enough cryptocurrency investment to become validators.

How much you make from staking depends largely on the token itself and your initial cryptocurrency investment. The value of the tokens being staked can increase over time. This has happened on different occasions historically. It also involves a certain amount of risk. If the token’s value decreases, so do your earnings. Making the right choices initially can greatly help your chances of being successful.

Cosmos (ATOM), Tezos (XTZ), and Cardano (ADA) are some of the most popular cryptocurrencies that can be staked. All of these are also available on large crypto exchanges.

How staking is designed

In layman’s terms, staking is the act of locking up your cryptocurrency to earn more cryptocurrency. This is typically done at the protocol level — on-chain, but can also be facilitated at the application level. A proof-of-stake blockchain will allow you to escrow your cryptocurrency into a computer program called a smart contract.

This would give you the right to earn a protocol’s native cryptocurrency by processing transactions or blocks on the blockchain. Ethereum 2.0 and Polkadot’s protocols offer this form of staking.

Applications and protocols built on a blockchain allow staking as well. Though they do not have their own native blockchains, protocols built on Ethereum — like Chainlink and the Graph — offer staking. These are also excellent ways to earn passive income with crypto.

2. Yield farming

With the rise of decentralized exchanges and smart contracts, yield farming became very popular. The system relies on users contributing to the protocol’s financial liquidity, also known as liquidity mining.

Investors deposit tokens into a special smart contract called a liquidity pool to earn the reward. The liquidity pool’s traders receive a portion of the fees they generate, which are sometimes rewarded in newly generated platform tokens. This is similar to the mining process and hints at the name liquidity mining. This is a method of contributing to a decentralized exchange system and receiving rewards for it.

How yield farming is designed

You will need to become a liquidity provider (LP) in order to start making passive income through the yield farming system. The system often requires a coin and a decentralized finance (DeFi) token. You may also need to own a stablecoin, such as Tether (USDT), to get started.

After you deposit liquidity, the decentralized exchange will transfer LP tokens to your address, representing your share of total liquidity pool funds. These LP tokens can be staked on supported decentralized lending platforms or exchanges to earn additional interest.

This strategy provides you with two interest rates for a single deposit. Overall, in 2025, yield farming is one of the most popular strategies for earning passive income from crypto.

Yield optimizers make the yield farming process much smoother, which ultimately makes earning passive income with crypto easier. However, it is important to remember that yield aggregators (a.k.a. yield optimizers) only make the yield farming process smoother.

Users can still earn passive income through yield farming crypto without the use of applications. Some of the most popular crypto-earning platforms for yield farming are Curve/Convex Finance, Yearn Finance, and Beefy Finance.

3. Cloud mining

Cloud mining helps you to mine cryptocurrency using cloud servers that are rented. Essentially, you are using somebody else’s computer to mine cryptocurrencies, such as Bitcoin. It is a system worth considering in your bid to earn passive crypto income. However, it requires a good deal of forethought and calculations.

You don’t have to install or run any software. Crypto earning platforms like cloud mining companies allow users to open an account to participate remotely in cryptocurrency mining. This makes it more accessible to everyone around the globe. This type of mining can be done remotely, and it reduces the need for equipment maintenance and direct energy costs.

How cloud mining is designed

With cloud mining, you purchase hash power. The miners receive what is left over. You only pay for the hash rate that you choose at the start. Based on the hashes that you bought, you get a share of what miners make.

The most popular type of cloud mining is hosted mining. This model allows customers to lease or purchase mining hardware at a miner’s location. The equipment is maintained by the miner, who ensures that it works as intended. Customers have direct control of their cryptocurrency through this model. Because of its scaling system, mining farms can reduce the high costs of electricity and storage. However, this type of mining comes with a significant upfront cost.

One of the downsides to earning passive income crypto through mining is the profitability of mining. Mining profitability is calculated by taking the miner’s revenue per kilowatt hour (kWh). When the cost to mine outweighs the rewards created from mining, miners do not reap any revenue. This problem is compounded when considering that many miners must acquire loans to start mining operations. When miners can not earn passive income with crypto mining, they must turn off their miners or sell their mining equipment to cover costs.

4. Crypto savings account

Savings accounts are another conservative, generally safe option for earning passive income from cryptocurrencies. By opening a crypto savings account, users can earn a return on crypto deposits. They work similarly to the financial products offered by regular banks.

These types of interest-bearing digital asset accounts are still a new crypto proposition. Their rate of return is very impressive. It often puts bank yields to shame. Your APY will differ depending on whether you choose a flexible or fixed term. This option allows you to use crypto assets that you plan to hold for a long time. They are more profitable than bank savings and are worth considering.

The mechanics behind crypto savings accounts

The way savings accounts operate is quite straightforward. What you will need to consider is the available options when it comes to taking out your cash. Flexible or fixed terms will be available for withdrawals from savings accounts. Fixed terms will allow you to lock your money up for a specific period and receive higher yield rates. These savings accounts are similar to crypto staking’s high yields. Users earn interest on crypto in exchange for a deposit.

The best interest rates are often found in stablecoins such as Dai (DAI) and USDC. This strategy is especially worthwhile for those looking to remain invested in crypto for a long time. It is a generally safe method of earning passive income on your already-owned assets.

5. Crypto lending

Crypto lending is another good way of ensuring that your digital assets do not sit around idly in decentralized finance. You will be earning a profit by providing liquidity to other crypto users. The loan will be paid back to you with interest, with a DeFi platform acting as the intermediary.

You can borrow or lend digital currency through crypto lending platforms such as Aave or Compound. Essentially, you will be using a DeFi platform to become the liquidity provider in a crypto loan. In exchange, you will be rewarded with an interest rate once the loan is paid back.

How crypto lending is designed

Investors can lend crypto in many ways. All cases involve lending crypto to another person for a period of time in return for a fee. Here’s a quick look at the crypto lending options:

- Margin lending: Users can lend their crypto assets to traders who borrow funds to increase their market positions. These traders repay the loans with interest, and crypto services facilitate these deals, requiring lenders to make their digital assets available.

- Peer-to-peer lending: Users can choose their terms and decide how much they wish to lend, gaining better control over their lending deals. Similar to peer-to-peer trading, crypto platforms match borrowers with lenders, and users must deposit their digital assets on the platform’s custodial wallet before lending.

- Centralized lending: Relies on third-party lending infrastructure with fixed lock-up periods and interest rates. Users need to transfer their crypto funds to the lending platform to earn interest.

Decentralized lending is also known as DeFi lending. As the name implies, this allows users to conduct lending services on the blockchain without any intermediaries. Instead, lenders and borrowers interact using programmable smart contracts. These autonomously and periodically set the interest rate.

6. Affiliate programs, airdrops, and forks

The crypto world is full of projects looking to make themselves known. Some of them will reward early adopters. Others will provide crypto rewards for bringing them business. Both of these are great methods to earn passive income. However, you will need to conduct a lot of research to be on top of all the upcoming projects.

There are many types of affiliate programs available. Most of these focus on crypto-related products or services. Some high-profile exchanges offer affiliate programs as well. These repay you for bringing customers to try their service.

Forks are when an existing coin is branched into a new chain. They reward you because you embraced the original product. Airdrops are usually provided when new coins are created. They act as an incentive to try out a new crypto product.

How airdrops and forks are designed

Each one of these incentive opportunities arrives with different conditions. Forks of important coins reward users of the original system. The creators of the forks hope to promote their coins to the existing community.

The goal of crypto airdrops is to raise awareness about a new service. However, if the product does become highly successful, this will mean, essentially, receiving free cash.

Crypto affiliate programs can be very useful in promoting new crypto products as well. These programs are used by many businesses to increase their sales and trading volumes and grow their customer base. These often use social media channels such as affiliate marketing on Facebook and Twitter to achieve their goals. You should look for a program that has a high commission rate and a good reputation. The affiliate programs are especially profitable if you already have a large audience that is likely to listen to your suggestions.

7. Dividend-earning tokens

A dividend is the part of the profit that is paid to shareholders in a business. It is the reward that they receive for supporting the development of the business. The dividends themselves are paid off either in cash or shares in the company.

Crypto companies can function similarly. Some of these suggest a business system whereby users show their support by acquiring crypto tokens. These tokens can have various functions. One of them is providing rewards based on the profit of the company. This strategy should not be confused with staking. There, a user merely invests in a token in the hopes that its price will increase. Companies like Decred or Ontology pay cryptocurrency dividends.

How dividend-earning tokens are designed

Most cryptocurrencies promise something akin to a passive income. In exchange, users offer their financial support. The income can come in the form of price appreciation of the token or investment opportunities.

Dividend-earning tokens, however, are supposed to resemble the system of stock ownership in a company. The logistics for this are still being worked out. However, the system looks to reward the project backers with dividends based on the company’s profits. These rewards naturally will also depend on the contribution that the users have made to the company.

Top ways to earn passive income with crypto: An overview

If executed correctly, each of these strategies can present you with a handsome crypto profit earned with a minimal amount of effort.

- Staking: Users and validators escrow their crypto and earn rewards in return. Typically, the rewards are given in the form of newly minted cryptocurrency.

- Yield farming: Is a complex form of staking where the user stakes on multiple applications to earn more yield. It is the crypto-native act of rehypothecation.

- Cloud mining: Rents someone else’s hardware to mine cryptocurrency. This allows the cloud miners to reduce operational costs and increase profits.

- Crypto savings account: When you deposit your idle crypto into a crypto savings account you are paid in crypto, similar to a savings account at a bank.

- Crypto lending: Similar to lending in traditional finance, crypto lending utilizes liquidity pools that traders can borrow against. In return, lenders receive fees from borrowers.

- Affiliate programs, airdrops, and forks: These methods require the least amount of startup capital, and can allows users to receive crypto absolutely free in many cases.

- Dividend-earning tokens: These tokens pay users to hold them, in the same way that companies pay out dividends to stockholders.

How to make passive income with cryptocurrency

There are numerous methods to consider when looking to earn a passive income from cryptocurrency. Each present unique opportunities, as well as challenges that need to be considered. Some are more profitable than others.

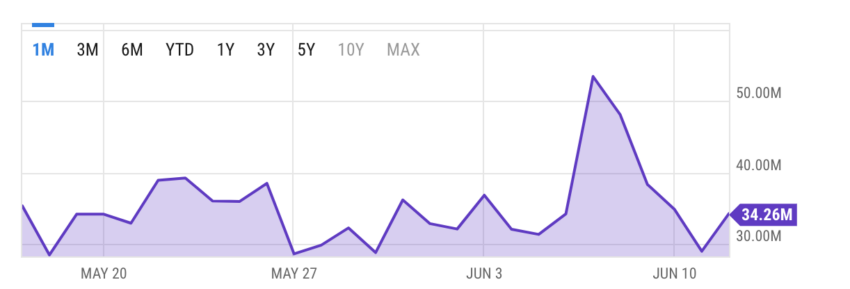

Lending and yield farming are perhaps the most popular ways to earn passive income with crypto. Both involve providing some of your digital assets, for a small period of time, towards a crypto project. In return, you will receive a fee proportional to the amount you have lent.

Other passive income strategies

Mining is another popular method. Currently, the classic PoW model of mining is no longer profitable for most users. Instead, cloud mining can be a great alternative. Crypto staking is another method to take advantage of your digital assets.

Let’s also not forget about crypto savings accounts. These crypto companies will provide a yield to those choosing to deposit funds into the accounts.

The passive income options do not stop here. Affiliate programs and airdrops are also worth exploring. Running a lightning node may be an option for those interested in the technical aspects of blockchain technology. Users can also purchase dividend-earning tokens that will give them a stake in a company. All of these are options worth considering, and all of them require a good amount of investigation.

Make informed decisions with crypto investments

In this article, we have examined seven strategies for earning passive income with crypto. All of them can be valuable to both novice and experienced users. However, each strategy outlined here has its own risks, strengths, and weaknesses. Readers should do further research to determine which methods work best for them.

Frequently asked questions

Yes, anyone can make passive income with cryptocurrencies. However, it requires the determination and drive to conduct research, invest wisely, and manage your investments properly. With the right approach and dedication, almost every individual can generate passive income.

There are many other ways to earn passive income with crypto. Some of these include mining, liquid staking, and liquidity providing. Each method has its associated risks, strengths, and weaknesses.

Each method of earning passive income has its risks. For example, liquidity providing is considered risky because of its complexity. Staking, on the other hand, is typically considered safer.

Crypto enthusiasts can easily earn passive income from their digital assets. Strategies such as staking, yield farming, cloud mining, or crypto lending can be highly profitable. Best of all, they do not require the active management of their assets to generate profit.

Margin lending allows users to lend their crypto assets to traders who borrow funds to increase their market positions. These traders repay the loans with interest, providing lenders a passive income stream. Crypto services facilitate these deals, requiring lenders to make their digital assets available for borrowing.

This depends. Don’t make any risky decisions or give up other sources of income to move in the hopes of living off of crypto. Making a reasonable income from crypto takes a lot of capital, experience, and time. It’s best just to use it to supplement your income.

Strategies such as staking or yield farming can be very profitable for DeFi users. Their rewards will depend on the program and the crypto assets with which they are involved. It is possible by checking the market to earn $100 a day from your already existing crypto assets.

Several projects offer crypto users the possibility of earning passive income. When staking, yield farming, or lending, crypto users will earn rewards through altcoins. The value of their rewards will depend on the platform and the coin itself.

Numerous strategies can provide a high rate of passive income. Crypto staking, lending, and yield farming are the most popular. This is due to their high earning potential.

Crypto staking, lending, and yield farming typically provide crypto users with significant passive income. The level of rewards depends on several factors related to the project that provides the rewards and on the coin being offered.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.