Staying can be a profitable activity and is an attractive way to both help support and secure blockchain networks, while earning passive income. That said, staking can only be profitable if you choose the right project (and even then, market forces play a key role). This guide breaks down the specifics of staking and covers which projects offer the best staking coins in 2025.

Top staking coins for 2025

1. Ethereum

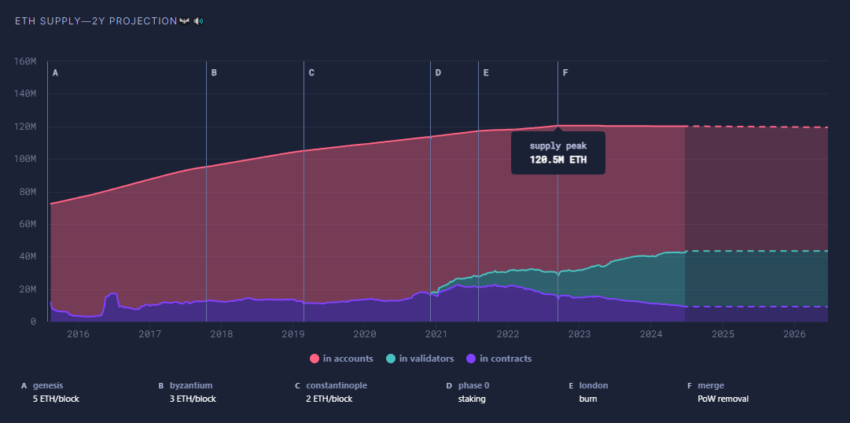

Ethereum is the world’s second most popular cryptocurrency. It’s also a blockchain-based platform for developers to build and export decentralized applications (DApps). Ethereum employs a mechanism that makes ETH net deflationary when a lot of apps and users use the blockchain. This means that ETH holders can benefit from a potential price increase as the supply decreases and the demand increases.

Ethereum validators make fees from not only validating transactions, but also from granting priority transactions block space by accepting priority fees. They also experience diminished rewards from their performance as validators. For example, if they miss block proposals or attestations they will be penalized and receive less rewards.

Either stake via a liquid staking platform like Rocket Pool or Lido, an exchange like Coinbase, or you’ll have to run an Ethereum mainnet client and become a node yourself — ideal if you’re looking to stake 32 ETH.

2. Cardano

Cardano is a proof-of-stake network often compared to Ethereum, though it differs in various key ways. For example, Cardano, thanks to its Ouroboros proof-of-stake consensus method, can process hundreds of transactions a second.

Cardano has a set of few projects coming to life, due to the blockchain’s very specific, peer-reviewed technology. As mentioned, Cardano was designed from the start as a proof-of-stake blockchain network. Considering it’s one of the earlier projects to be this way, it’s certainly one worth paying attention to.

Furthermore, staking on Cardano differs greatly from Ethereum in that you can pull out staked assets whenever you’d like. On top of all this, what’s especially interesting about Cardano is the way it handles staking rewards. If too many people stake ADA in one pool, rewards slowly become less valuable. This incentivizes stakers and to continue creating new staking pools and diversifying their ADA across the network.

What’s exciting about this proof-of-stake native blockchain network is that staking is built into the official Cardano wallets, Daedalus and Yoroi. Because of this integration, staking ADA is incredibly easy for most users, assuming they know how to purchase it on an exchange ahead of time.

3. Tezos

Tezos is a project with a strong focus on governance. While all blockchain networks, including Ethereum and Bitcoin, have some sort of governance method, Tezos’ focus on it is much stronger. In Tezos’ case, users are consistently proposing new ideas and upgrades to its network. Proposals are then voted in or out based on community feelings, creating a democratic environment for Tezos.

What’s especially interesting here, however, is that developers are paid for proposals that are accepted. They earn payment by attaching an invoice to their proposal, which is then paid upon approval, hence the community-centric mantra of the project.

Similar to Cardano before it, Tezos was designed with a PoS system in mind from the start. While users can earn interest for staking their XTZ, as is traditional in PoS, holders also get to participate in the aforementioned governance methods. That’s right, the only way to vote on the Tezos network is to stake (or bake, in this case) XTZ.

Of course, by participating in the network, you’re earning rewards for doing so. Tezos incentivizes an active, invested network via these methods.

Various exchanges feature support for tezos staking, though you can also get involved via the Tezos website. You will have to delegate your stake to a baker through one of these methods.

4. Polygon

Polygon is an attempt at scaling Ethereum. Considering itself as “Ethereum’s Internet of Blockchains,” Polygon exists as a layer-2 protocol that aims to connect all Ethereum-based DApps to ensure they’re all compatible with one another.

With Polygon, transactions between Ethereum blockchains cost less gas and are entirely secured via the network’s validators. Polygon currently provides the power to validate 65,000 transactions per second within its blocks, ensuring the various Ethereum networks can transact with one another without issue.

It’s a valuable project that only works with validators — those who stake their POL and lend their efforts to validating transactions within the network. Of course, those who stake POL also have a say in governance, as is the case with many PoS blockchain networks.

5. Cosmos

Like Polygon, Cosmos intends to be the other “internet of blockchains.” That said, it won’t just focus on Ethereum like Polygon does. Instead, Cosmos aims to make all blockchain networks interoperable.

Cosmos is a proof-of-stake network with validator nodes. The process is pretty standard, requiring users to stake ATOM in order to be considered for transaction validation. The more one stakes, the more likely they’ll be chosen to validate and the more rewards they’ll earn.

Staking for cosmos is available through many of the exchanges mentioned that support the other projects on this list. You can also stake through Cosmostation or wallets like Keplr.

6. Polkadot

Polkadot is yet another Ethereum competitor looking to solve the scalability problem suffered by many blockchain networks. Polkadot requires validators to validate transactions, just like on other PoS platforms. However, it’s worth noting the various differences here compared to other PoS assets.

For one, becoming a validator node on Polkadot is not easy. Setting one up requires some technical knowledge, and becoming a validator also requires a constantly fluctuating amount of DOT.

Ledger, Coinbase, and various other trading platforms have native support for Polkadot staking.

The aforementioned platforms for staking cryptocurrencies, Coinbase, Binance, and YouHodler, were chosen based on their position in the crypto industry. Some of the factors for selecting these top staking platforms include reliability, consistent payouts, yields, and platform security to name a few.

Top staking cryptocurrencies compared

Many of the top cryptocurrencies to stake have similarities, but they also have big differences. Here is a quick chart on how they compare to one another.

| Crypto | Ticker | Max supply | Minimum stake | Reward |

|---|---|---|---|---|

| Ethereum | ETH | ∞ | 32 ETH | 3.19% |

| Cardano | ADA | 45 billion | N/A | 2.85% |

| Tezos | XTZ | ∞ | 6,000 XTZ | 9.52% |

| Polygon | POL | ∞ | 1 POL | 5.83% |

| Cosmos | ATOM | ∞ | N/A | 17.9% |

| Polkadot | DOT | ∞ | 250 DOT | 11.42% |

What is staking?

Staking is the act of locking or storing cryptocurrencies to secure or validate a blockchain’s transactions or for some privilege or reward. By doing so, the staker earns interest based on how much they stake.

While stakers earn interest for their participation, those rewards are provided for a reason. Staking strengthens the security of a network, with users being incentivized with passive income to do this. Those who stake become validators, essentially high-priority users that manage and update the distributed ledger.

While staking sounds great, it’s not a ubiquitous way of running a blockchain network. Staking falls under networks that use the proof-of-stake (PoS) consensus algorithm. This contrasts with the more traditional proof-of-work (PoW) consensus method that Bitcoin uses.

The advantages of staking

Proof-of-stake has various benefits and advantages. For one, nearly anyone can participate. Seeing success as a miner in proof-of-work requires expensive hardware, and you’re generally competing against thousands of others who may have better hardware than you.

There’s no investing in additional hardware or charging up your electric bill to try and make a profit. If you have a device and can afford it, profiting from staking is possible. Plus, the longer you stake, the more you’re guaranteed rewards. It’s an act that generally gives you more of a return the more you commit to it.

Christopher R. Perkins, President of CoinFund: Coindesk

What to consider when staking cryptocurrency

Before getting into staking, you must consider a few things. For one, only stake in a crypto project if you genuinely believe in its mission.

Staking generally requires a long-term time and financial investment. If you believe in a project and want to help it grow and improve, that time and financial investment will be much easier to commit to.

Do some research on a project before investing as well. Ensure the team is publicly available to communicate with and that the surrounding community has a positive sentiment toward the mission. Otherwise, investing in a scam that would rather steal your money than watch it grow is possible.

You should also consider the inflation rate. A hyper-inflated token supply can lead to diminishing returns. So, even if you receive 20% on an annual basis, your profit may diminish if the price of the coin or token falls.

For example, the ETH supply is net deflationary during periods of increased activity. This helps to sustain the ETH price, propping up the Ethereum blockchain’s security.

Should you stake cryptocurrency?

After reading all of this, you might still wonder if you should stake cryptocurrency. Well, if one of these projects speaks to you, and you have the means to invest, many would argue staking is a good idea.

After all, it’s earning rewards for participating in a network rather than betting on a project’s price, for instance. If you feel comfortable staking and can meet the minimum threshold for doing so, depending on the project, it could be worthwhile to do so.

Is crypto staking profitable?

Generally, yes, crypto staking can be profitable. This is because one typically earns interest just for holding coins in a wallet. Considering the process doesn’t necessarily require more investment to generate a profit, it can be profitable when market forces are favorable.

What is the best wallet for staking?

It’s impossible to decide on the best wallet for staking all cryptocurrencies. That said, if you’re only looking at one or two to get involved with, it’s generally best to stake via the project’s official crypto wallet, assuming they have one. Otherwise, a Ledger or Trezor hardware wallet could be the way.

Stake your crypto with caution

While the top staking coins in 2025 offer good opportunities for passive income accumulation, staking crypto carries risk. Staking rewards and staked tokens can lose value when prices are volatile; token devaluation is a distinct possibility. This is the risk you take when locking up your crypto for a certain amount of time. The market can change, and you will not be able to withdraw your coins. In this scenario, your only option is to HODL (hold on for dear life).

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Investing in crypto and staking your assets comes with risk and profits are not guaranteed.

Frequently asked questions

What is staking in crypto?

How does staking work?

What are the benefits and risks of staking?

Which crypto gives the highest staking?

Can you get rich staking crypto?

How often does staking pay?

Does your crypto grow while staking?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.