Crypto slippage is another source of potential losses to be aware of. If traders/investors aren’t careful, they could incur significant losses from crypto slippage over time. So, what is slippage in crypto, and how can it be avoided?

Cryptocurrencies might be one of the best investment opportunities of the century. That being said, investing in cryptocurrencies is rife with potential pitfalls. Prices are notoriously volatile. An army of hackers and scammers is constantly on the prowl, looking for any security weakness that might allow them to steal funds. And 2022’s crypto winter has shown that significant structural weaknesses remain in the crypto financial ecosystem.

If you want to know more about trading meme coins, join BeInCrypto Trading Community on Telegram with like-minded people. Here you can share your experience, discuss and read all the hottest news on Meme coins, Web3 and the Metaverse. Join us

In this guide:

- What is slippage in crypto?

- Volatility and low liquidity — dual drivers of slippage

- How does crypto slippage work? An example

- How to calculate crypto slippage?

- Crypto slippage on decentralized exchanges

- How to avoid slippage on DEXs

- How to reduce slippage on CEXs

- How much should crypto investors worry about slippage?

- Frequently asked questions

What is slippage in crypto?

Slippage occurs when a trader ends up buying or selling an asset at a different price than what they had originally intended. Markets are fast-moving. Conditions can change between the time an order enters the market and when the order actually gets executed, resulting in the trader getting a different price.

Crypto Slippage can be either positive or negative. In other words, whilst traders may receive a less favorable price than expected, they might also get a better price.

Whether slippage occurs or not depends on the type of order placed in the market. If a trader places a limit order, they agree to buy or sell a set amount at a set price subject to liquidity availability.

The upside of limit orders is that they guarantee no slippage. The downside is that it may take longer to fill a limit order, or may not get filled at all. Slippage occurs when traders attempt to buy and sell assets at the available market price. In other words, by placing a market order.

Volatility and low liquidity — dual drivers of slippage

Slippage can occur in the trading of all asset classes, but is notoriously bad in crypto. This is due to the asset class’ high volatility and often very thin liquidity conditions. Indeed, volatility and lack of liquidity are the two main causes of slippage. Let’s examine why.

Volatility

A trader may enter an order expecting a certain price. However, in a fast-moving market, prices could move significantly between the time that the trader enters their order and the time the order is executed.

Thin liquidity

Imagine that a trader wishes to buy or sell a cryptocurrency at a certain price. There might not be enough liquidity on the opposite side of the trade at this price to complete the order. In order to complete the order, the trade would need to execute at a price where there is liquidity. This could result in a price that is significantly different from what the trader had expected.

How does crypto slippage work? An example

Say after seeing bitcoin offered at $20,000 on an exchange, a trader wishes to purchase one bitcoin. They place an order to buy one bitcoin at the market price. After a small delay, the trader realizes that they ended up paying $20,050 for one bitcoin, slightly more than expected. This is an example of negative slippage.

The slippage may have occurred because there wasn’t enough liquidity on the exchange for them to buy an entire bitcoin for $20,000. Maybe the trader’s buy order absorbed all the sell orders at $20,000 and then needed to go to sell orders at a higher price in order to find liquidity.

Maybe between the time that the order was placed and executed, market conditions changed. In other words, maybe other bitcoin buyers managed to snap up the liquidity at $20,000 first, or sellers at $20,000 suddenly pulled their offers. Had the trader secured one bitcoin for under $20,000, that would have represented positive slippage. A sudden influx of offers at a slightly lower price could explain the positive slippage.

Imagine the reverse situation. A trader sees the price of bitcoin at $20,000 and wants to sell one bitcoin directly at the market price. If they get more than $20,000, this would represent positive slippage and vice versa.

How to calculate crypto slippage?

Slippage can be expressed in either a nominal (i.e., currency) amount or as a percentage. In the above example, where a trader expected to buy one bitcoin for $20,000 but ended up paying $20,050, the slippage is -$50. In percentage terms, the trader ended up paying (-$50/$20,000)*100 = -0.25%.

What is slippage tolerance?

Many trading platforms, including decentralized and centralized cryptocurrency exchanges, allow traders to set a preference as to how much slippage they will tolerate. In other words, they allow market participants to prevent any trades from executing if the slippage is higher than a certain percentage.

The definition of slippage tolerance is the difference in price between what the trader expects when placing an order and what they are willing to accept when the trade executes. Usually, trading platforms will express slippage tolerance as a percentage of the total trade value.

Crypto slippage on decentralized exchanges

Decentralized exchanges (DEX) have some significant advantages over their centralized counterparts. Unlike their centralized peers, trading on a DEX doesn’t require Know Your Customer (KYC) background checks that can be exclusionary.

But one of the big drawbacks versus traditional cryptocurrency exchanges is that DEXs often face worse slippage. Why?

Smart contracts power trade on DEXs. That means, unlike on centralized exchanges, a trade on a DEX doesn’t process right away. Rather, there is a lag as the trade is processed on the blockchain, just as there is with any blockchain transaction.

The longer delay between transaction confirmation and transaction execution means that there is a longer window for slippage to occur.

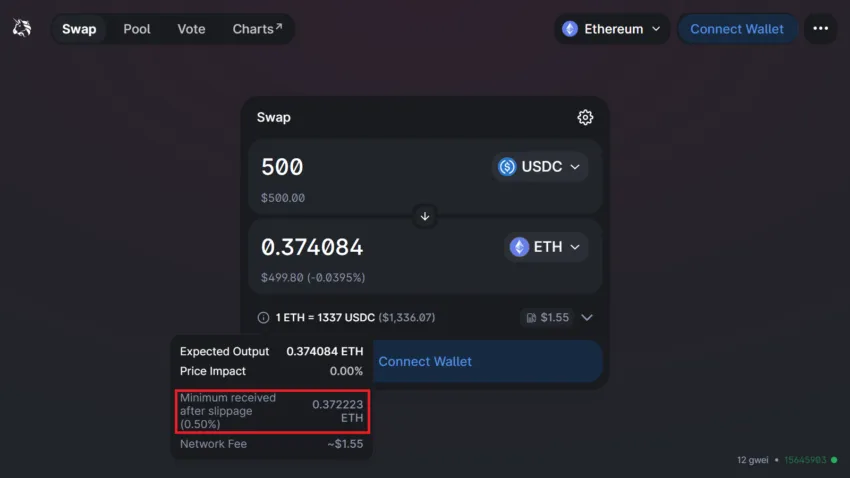

Calculating crypto slippage on a DEX is exactly the same as on any other trading platform. For example, say you want to buy 500 USDC worth of ETH. Uniswap will show you an expected price in ETH. Uniswap allows you to set a slippage tolerance and will also show you the minimum expected output of ETH if the maximum slippage is reached.

How to avoid slippage on DEXs

The following are some of the methods that help traders avoid slippage on DEXs.

Pay a higher gas fee

To conduct a transaction on a blockchain network like ethereum, users need to pay a fee to network validators. This is called the “gas fee” and it incentivizes network validators to either 1) stake their crypto to secure the network (as in the case of proof-of-stake blockchains) or 2) provide their computing power to secure the network (as in the case of proof-of-work blockchains). When a user submits a transaction to the blockchain, it joins a queue of other transactions waiting to be validated.

To reduce the problem of slippage on a decentralized exchange, a trader could take steps to speed up the rate at which their transaction is processed. To do this, they could choose to pay a higher transaction fee (gas fee) in order for their transaction to be pushed further forward in the queue. Traders can use websites like Etherscan to see how much gas to pay in order to get their transaction prioritized.

Trade on a layer 2-based DEXs

Presently, the majority of the DEXs are running on layer 1 blockchain networks. For example, much of the trading that takes place on Uniswap is powered directly by the Ethereum network. When the Ethereum network gets congested, this can slow down these trades and exacerbate the risk of slippage.

However, layer 1 networks like ethereum also have “scaling solution” blockchains. One of the best-known examples is Polygon, which is a sidechain, which runs parallel to Ethereum. Transactions are processed quickly on the network, as the processing does not happen on the mainchain. Polygon is an example of a “layer 2” protocol.

Thus, traders could opt to use a layer 2-based DEX, which could mean faster transactions, less risk of slippage, and lower gas fees. A trader could use an exchange like Quickswap, which is built on Polygon.

Separately, and as already alluded to in this article, traders can also adjust their slippage tolerance in most DEXs. A low slippage tolerance may prevent a trade from filling. But it will prevent unexpectedly large losses as a result of slippage.

How to reduce slippage on CEXs

Similar to DEXs, traders can also reduce slippage on traditional trading platforms like CEXs.

Use limit orders

When trading on centralized/traditional cryptocurrency exchanges, traders can take a mixture of other steps to minimize the risk of loss as a result of slippage. Firstly, a trader could utilize limit orders as opposed to buying at the market price. As explained earlier in the article, limit orders run the risk of not filling, but at the same time, never incur slippage.

Trade during periods of low volatility

Investors could choose to trade at times of the day, which usually don’t incur as much volatility. For example, avoid trading around the time of the European to U.S. crossover or around the time when the U.S. market is open. It’s advisable to avoid trading around the time of big market events (like a major economic data release or a central bank event).

Break up large trades

If traders are looking to buy or sell cryptocurrency in significant, potentially market-moving size, another trick might be to break up the transaction into smaller pieces. By splitting a large trade into a series of smaller ones, the trader may be able to reduce their market impact and potential losses due to slippage.

How much should crypto investors worry about slippage?

Being aware of what slippage in crypto is, and how to mitigate its downside risks, is useful for all cryptocurrency market participants. But some need to worry about it more than others.

For a small-time crypto investor who conducts transactions on an irregular basis and is looking to hold their crypto for a long time, it probably doesn’t matter that much if their slippage is -0.5% instead of -0.25%. This small amount would (hopefully) pale in comparison to the long-term returns of the investment.

To larger scale investors, a -0.25% to -0.5% loss could actually amount to quite a sum of money. So, it might be worth their time and effort to try to minimize this as much as possible.

Meanwhile, cryptocurrency traders who conduct transactions with high frequency (day traders and scalpers) would also do well to take every step possible to minimize losses related to slippage. A -0.25% loss multiple times a day can quickly eat into profits.

< Previous In Series | Crypto | Next In Series >

Frequently asked questions

Does slippage matter in crypto?

How do you stop slippage in crypto?

What should my slippage tolerance be?

Is a higher slippage tolerance better?

Does slippage affect price?

What is crypto slippage?

How do you measure slippage tolerance?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.