Cryptocurrency staking has become a popular way to earn passive income in crypto. With staking, investors can earn a return on their investment while supporting the blockchain network’s security and stability.

In this article, we will delve deeper into crypto staking and how it works and explore some of the best staking coins available on the market today.

What is crypto staking?

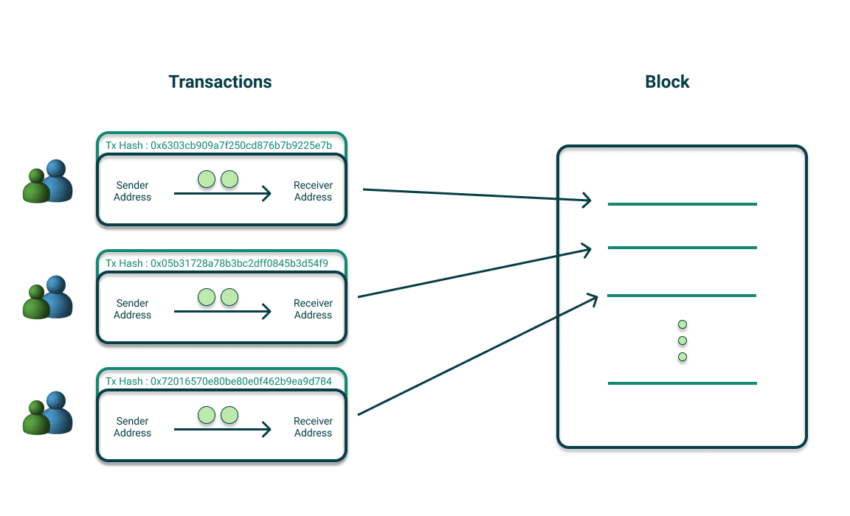

Crypto staking is the process used by proof-of-stake blockchains to secure the network and generate new coins. When staking crypto, it means that the assets are locked up for a predetermined period to support a blockchain’s functioning. By doing so, individuals can earn additional cryptocurrency as a reward.

Several blockchains adopt the proof-of-stake consensus mechanism where participants who want to validate new transactions and append new blocks on the network must “stake” specific amounts of cryptocurrency. Staking helps ensure that only valid transactions and data are included in the blockchain.

To become eligible to validate new transactions, participants must offer to lock up a certain amount of cryptocurrency as a form of security. Some blockchains have a minimum requirement for staking, while others don’t.

“I call the blockchain ‘the Internet of value’ and ‘the Internet of trust.’ Because everything becomes trustless. It’s a big distributed ledger. Think of it like an Excel file that’s being maintained and updated and managed by millions of computers around the world.”

Brock Pierce, DNA co-founder: Medium

In the event of validating erroneous or fraudulent data, the stakers may lose some or all of their stake as a penalty. On the other hand, correctly verifying legitimate transactions and data earns them additional crypto as a reward.

Staking is a crucial part of the consensus mechanisms of popular cryptocurrencies such as solana (SOL), ethereum (ETH), and Binance coin (BNB).

What is proof of stake?

Proof-of-stake (PoS) is a blockchain consensus mechanism. Just like some blockchains use crypto mining to secure the network and generate new coins, staking is an alternative. Cryptocurrencies and blockchain networks relying on crypto staking to establish a well-functioning network often have lower transaction fees and less energy.

Oftentimes, individuals confuse the two main types of blockchain consensus mechanisms, proof-of-work (PoW) and proof-of-stake (PoW). However, these function differently, and PoW coins can’t be staked. Cardano (ADA) is often confused for a PoW cryptocurrency, and look for ways to mine Cardano.

Validators have a higher chance of adding new blocks and earning rewards depending on the size of their stake.

On the PoS blockchains, instead of having miners, we have validators. These are the individuals, or groups of individuals, who stake their assets as a way to show their commitment to the network. They risk having their stake slashed or destroyed if they behave maliciously, such as creating a fraudulent block of transactions.

As validators accumulate stake delegations from various holders, their consensus votes become more trustworthy, and their votes are weighted proportionally to the amount of stake they have attracted.

Furthermore, a stake does not have to consist of only one person’s tokens. For instance, a holder can join a staking pool, allowing stake pool operators to validate the transactions on the blockchain.

Validators have to follow a set of rules depending on each blockchain. Ethereum, for instance, requires each validator to hold a minimum of 32 ETH. Staking pools enable collaboration among individuals and require less than the minimum stake amount. Usually, these staking pools are managed by third parties, not by the blockchain.

What are staking pools?

Staking pools are groups of cryptocurrency asset owners who pool their assets to increase their chances of receiving rewards. In the case of ether, for instance, crypto investors with less than 32 ETH may want to join staking pools as this is the only way for them to participate in crypto staking on the Ethereum blockchain. Also, staking pools allow you to stake without requiring technical expertise.

To participate in a staking pool, users typically have to transfer funds into a crypto wallet and select a staking pool to contribute to by transferring coins.

However, it is important to note that staking pools take a commission from users’ earnings, which means that users do not receive their rewards in full. Some argue that staking pools become too expensive and exert significant control over a blockchain.

Pros and cons of crypto staking

Crypto staking pros

- It provides an easy way to earn interest on your crypto holdings.

- Unlike crypto mining, staking does not require any special equipment.

- Staking helps maintain the security and efficiency of the blockchain.

- It is a more environmentally friendly alternative to crypto mining.

The primary advantage of staking is that it enables you to earn more crypto, with interest rates potentially exceeding 10% or 20% per year. This makes it a potentially profitable investment opportunity, with the only requirement being that you possess crypto that uses the proof-of-stake model.

Staking also plays a vital role in supporting the blockchain of the cryptocurrency you have invested in. Holders who stake their assets help verify transactions and ensure the smooth operation of the blockchain network.

Crypto staking cons

- Crypto assets have volatile prices, which can decrease quickly, outweighing any rewards earned from crypto staking.

- Staking often requires locking up coins for a minimum period, rendering them unusable during this time.

- For some cryptos, when you decide to unstake, there may be an unstaking period of seven days or longer.

The most significant risk of staking crypto is the potential price drop of the cryptocurrency. When considering cryptocurrencies offering high staking reward rates, keep in mind that many smaller crypto projects offer these rates to attract investors but may experience price crashes in the future. If you prefer less risk, you may want to consider investing in crypto stocks instead.

While the staked crypto remains yours, you must unstake it before trading it again. Understanding the minimum lockup period and the length of the unstaking process is critical to avoid any unpleasant surprises.

How can I start crypto staking?

Anyone who owns a PoS cryptocurrency can participate in staking. However, becoming a full validator may require a minimum number of coins, technical knowledge, and a dedicated computer without downtime capable of validating transactions. Any downtime can result in the slashing of a validator’s stake.

Most centralized crypto exchanges offer users the option to start crypto staking.

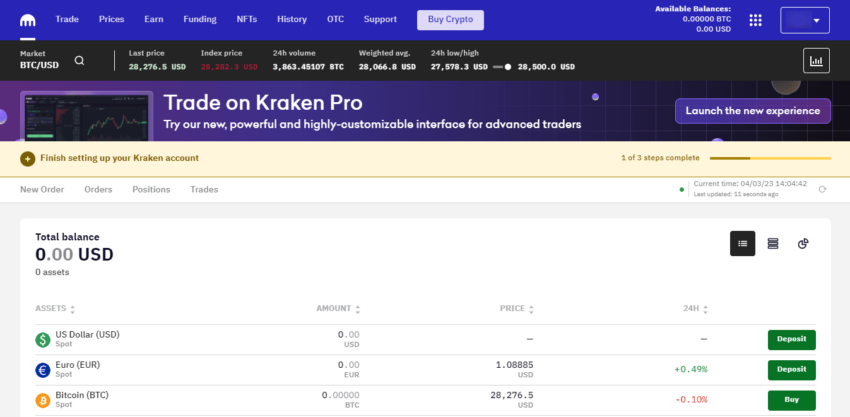

Kraken is a crypto exchange based in the U.S. that provides crypto services to worldwide customers. It has two platforms: Kraken and Kraken Pro. The Kraken Pro Dashboard offers granular insight into order books and highly customizable chart analysis tools. In addition, it provides 13 order types and quick execution.

Additionally, the platform offers high yields in some cases through staking or savings features. Of course, there are other crypto-staking platforms. But we will demonstrate how easy it is to begin staking using Kraken below.

Step 1. Purchase a cryptocurrency that uses proof-of-stake (PoS)

The advantage of using a crypto exchange that also offers fiat services is that you can buy your crypto directly on that exchange, in this case, Kraken. After buying crypto, you can stake it on the same platform without moving it from a crypto wallet to another platform and paying fees.

Another great advantage of using a crypto exchange platform for staking is that you can contribute any amount you wish without purchasing or operating expensive validator hardware.

Note that different exchanges offer to stake for different crypto. You should research this before purchasing your crypto.

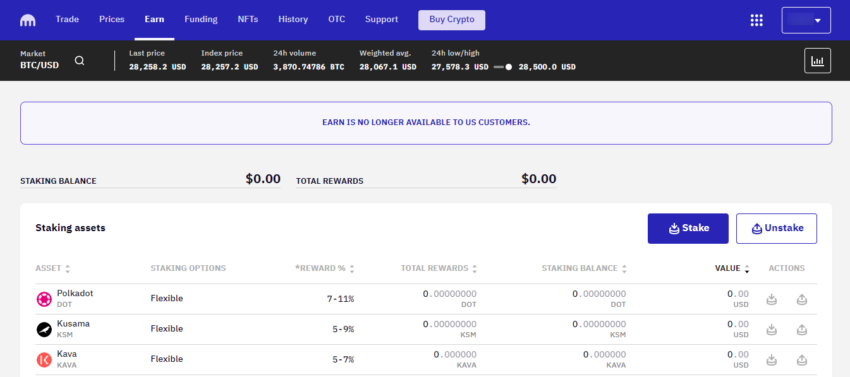

Step 2. Go to staking

Once you purchase your crypto, you can stake it directly on the exchange.

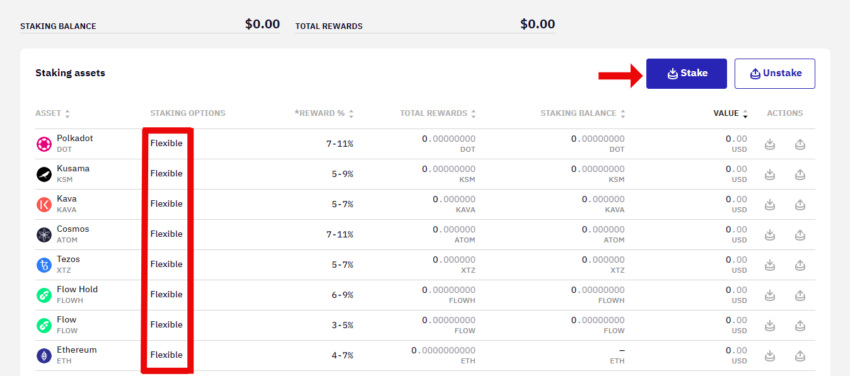

Go to Earn (top menu) on Kraken and choose “Stake.”

On the “Staking” page, search for your chosen crypto.

Step 3. Stake your crypto

Once you have selected a crypto, stake your crypto by choosing one of the staking options on the platform.

Most cryptos can be staked for a set period of time of either 30, 60, 90, or even 120 days. Some cryptos may be staked under a flexible term, meaning you can unstake them at any time and still receive the rewards.

For each crypto offered by the platform, you may choose the type of staking term and the amount you want to stake.

Note that exchanges often have limited spots for staking, and some terms might not be available when you want to stake your crypto but might become available later on.

That’s it! You should soon start earning rewards for staking your crypto.

What are the best staking cryptocurrencies?

Here are the top five best staking cryptocurrencies that may bring you a passive income.

1. Polkadot (DOT)

Polkadot is one of the most lucrative staking coins that allows for passive income. Polkadot’s market cap ranks among the top 10, indicating that it has a bright future and is among the best cryptos for staking.

2. Tezos (XTZ)

Tezos uses a liquid proof of stake (LPoS) model that offers optional delegation, setting it apart from other cryptocurrencies. The XTZ cryptocurrency is generated through a “baking” process. As a “baker” in the Tezos network, you can earn significant rewards by staking your XTZ coins to help validate new blocks of transactions.

Of course, you can also stake tezos using your wallet, and you only need one XTZ to start staking. Your initial reward payments will be credited after 35-40 days, with subsequent payments awarded every three days. Tezos rewards are typically consistent, making XTZ one of the best crypto-staking coins available. The average annual reward ranges from 6.75-10.60%.

3. Polygon (MATIC)

Polygon is a layer-2 blockchain. Its native coin MATIC is a unique staking crypto designed to scale Ethereum and ensure compatibility between every Ethereum-based decentralized application (DApp). It is considered one of the best staking coins because it is capable of validating up to 65,000 transactions per second (TPS), allowing Ethereum networks to process transactions efficiently and effectively.

Delegators can participate in the Polygon network with just a single coin, whereas staking itself requires at least two coins. You can start staking by connecting your MetaMask wallet or using an exchange for staking. The expected annual staking reward for Polygon depends on the number of coins you stake.

4. Algorand (ALGO)

Algorand is a platform that provides scalability through validator nodes and instant transactions, making it an efficient option for staking. ALGO is considered one of the best staking coins because it only requires stakers to have a single ALGO coin to become validators. However, the low staking minimum may also result in some validators not participating as much as they should.

The returns you can expect depend on your chosen staking platform, with an average annual return ranging from 4% to 10% of your total investment.

5. Solana (SOL)

Solana is a blockchain with a focus on scalability, offering low fees and fast transactions. As of writing, It’s ranked as the 10th crypto market cap. SOL is a top-staking coin due to its fast transactions and low cost. While you can’t manage your own node, there are many validators available for staking your coins.

You can participate in the rewards they receive by delegating your stake to validators. In 2021, SOL experienced significant growth, reaching an all-time high of $210 per coin. Annual returns for staking SOL range from 7-11%. You can stake SOL with popular wallets such as Ledger.

Should you stake crypto?

Anyone can stake crypto, but you don’t have to if you don’t want to. However, if you’re looking to earn a passive income using your already-owned crypto, then staking is a great option.

Remember that not all cryptos can be staked. If you don’t own any crypto that can be staked, start by researching any potential crypto investments. Evaluating each coin/token’s long-term investment potential is crucial before buying. Only purchase crypto for staking if you also believe it’s a good long-term investment.

Frequently asked questions

Why is staking important?

What is crypto staking for passive income?

Is crypto staking available for all cryptocurrencies?

Can I lose crypto by staking?

How can I select the most suitable staking pool?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.