In recent years, crypto scams have been the dread of the entire industry. Since crypto has become increasingly popular as a form of investment and transaction, more individuals have started to take advantage of those less experienced with blockchain ecosystems.

In this article, we explore some of the most common crypto scams and provide tips on how to avoid falling victim to them. You can better protect your crypto investments by being aware of these scams and taking the necessary precautions.

BeInCrypto Trading Community on Telegram: get reviews only on verified crypto platforms and participate in real airdrops.

Why do scams happen more often with crypto?

Crypto’s susceptibility to scams is due to decentralization, irreversible transactions, and the potential for anonymity.

Decentralization means there’s no centralized authority to flag suspicious transactions. Transactions are irreversible due to blockchain technology. Users communicate through wallet addresses, making it difficult to track them down. The anonymity of the users presents another great advantage. Crypto users communicate through wallet addresses instead of legal names, which can make it difficult to track down specific users, especially if they wish to remain anonymous.

Although crypto may be more prone to scams than other assets, as with any new technology, those will always seek to exploit it.

Types of cryptocurrency scams

There are many types of cryptocurrency scams. However, the most common types of crypto scams fall into the following 15 categories:

- Social engineering scams

- Phishing scams

- Fake apps and cryptocurrency exchange websites

- Giveaway scams

- Investment scam

- Pump and dump schemes

- Romance Scams

- Blackmail and extortion scams

- Upgrade scams

- SIM-Swap scam

- Cloud mining scams

- Fraudulent initial coin offerings (ICOs)

- Celebrity endorsements

- Rug pulls

- Business, government, and job impersonators

Here, we take a quick look at each.

Social engineering scams

Social engineering scams involve deceiving people and using psychological tactics to acquire confidential information related to user accounts. Scammers can impersonate trusted sources like government agencies, businesses, tech support, colleagues, or friends, in order to gain the victim’s trust.

Scammers may take their time to gain the trust of potential victims, and once trust is established, they may request sensitive information or ask the victim to transfer funds to their digital wallet. If a “trusted” entity requests cryptocurrency for any reason, it is likely a scam.

In February 2023, Binance-owned Trust Wallet stated it had lost $4 million worth of USD to a social engineering attack from an organized crime syndicate in Rome. The face-to-face social engineering scam successfully drained the crypto from a Trust Wallet belonging to metaverse start up Webaverse.

Phishing scams

Phishing scams target online crypto wallets. The individual or group behind the scam is looking to discover your wallet’s private keys, which can grant anyone access to the funds stored in that wallet. Often, scammers send emails with links to fake websites and request holders enter their private keys. Once they have this information, they can steal the cryptocurrency. Phishing scams are one of the most frequently used by scammers.

Fake apps and cryptocurrency exchange websites

Fraudsters sometimes create fake cryptocurrency trading platforms or crypto wallets to deceive unsuspecting victims. These websites typically have domain names that are extremely similar to the ones they are trying to imitate, making it tough to tell them apart. Fake crypto websites typically work in one of two ways – phishing sites or theft.

On phishing pages, you are asked to enter the data needed to access your cryptos, such as your wallet’s password, recovery phrase, and other financial information, which ends up in the scammers’ possession.

Other websites simply steal your funds. These websites act normally during initial interactions and might even let you withdraw a small amount of money at first. As your investments seem to do well, you may decide to invest more money in the website. However, when you try to withdraw your money later, the website either shuts down or denies your request.

Another popular technique that scammers use to trick investors is creating fake apps available on Google Play and the Apple App Store. Even though these fake apps are discovered and removed swiftly, they can still manage to impact many users’ finances.

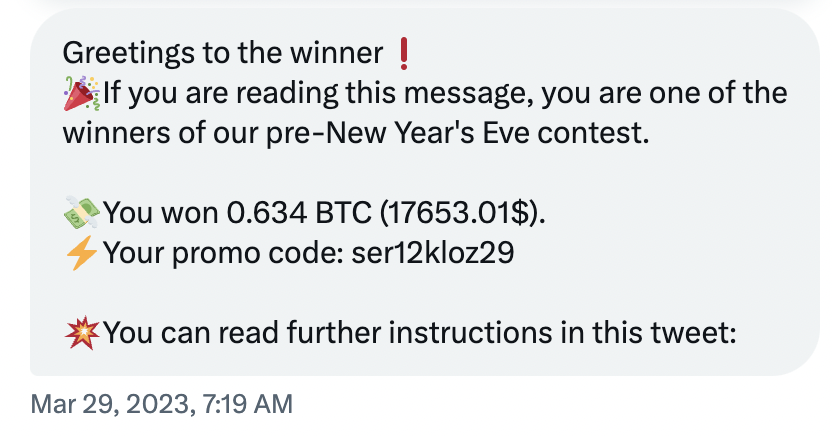

Giveaway scams

Giveaway scams are when fraudsters guarantee to match or multiply the amount of crypto sent to them.

They use clever messaging, often appearing to come from a legitimate social media account, to create a sense of legitimacy and urgency. This so-called “once-in-a-lifetime” chance can entice people to transfer funds quickly in the hopes of an instant profit.

Investment scam

Investment scams involve promises of “huge gains” in exchange for cryptocurrency deposits. The scammers can assume different roles, such as “investment managers,” of new crypto projects that are about to be launched and make ill-founded promises about increasing your initial investment.

/Related

More ArticlesPump and dump schemes

Pump-and-dump schemes are another type of investment scam. A scammer convinces you to buy a lesser-known crypto at a low price, promising its value will skyrocket soon. As soon as you buy, the price rises, and the scammer sells their holdings at the new higher price. This causes the value to crash, leaving you and other victims at a loss.

Investors seeking quick profits are dazzled by fake reports of unbelievable gains in a short time span. These scams usually start on social media, so be cautious of anyone contacting you unexpectedly about your crypto assets. Watch out for people hyping a specific crypto asset on social media platforms like Reddit or Twitter, as these are known as socially-engineered scams.

Romance scams

Fraudsters often use dating websites to deceive unsuspecting targets into thinking they are in a legitimate long-term relationship.

Once trust has been established, conversations usually shift towards lucrative crypto opportunities, leading to the transfer of coins or account authentication credentials. According to the Federal Trade Commission, people who paid romance scammers with crypto reported losing $139 million in total in 2021, more than any other payment amount.

Blackmail and extortion scams

Scammers also use blackmail emails as a common social engineering technique. In these emails, they claim to have records of users visiting adult or illicit websites and threaten to expose them unless they give up their private keys or send cryptocurrency to the scammer. These attempts constitute criminal extortion and should be reported to law enforcement agencies.

Upgrade scams

Cryptocurrency platforms are updated like any other software. Scammers can take advantage of this fact and will try to convince you to give them the private keys of your crypto wallet.

Upgrade scammers can exploit legitimate migrations, such as the recent Ethereum merge. The extent of the scams made the Ethereum Foundation and Robinhood warn users to be vigilant against upgrade scams.

SIM-swap scam

SIM-swap scams are one of the latest cryptocurrency scams. Here, the scammer gains access to a copy of your SIM card, allowing them to access all the data on your phone.

The scammer can use this data to receive and utilize the two-step authentication codes required to access crypto wallets and other accounts without your knowledge. As a result, the victim’s cryptocurrency accounts can be hacked and cleared out without them even being informed.

Cloud mining scams

Cloud mining is a service provided by companies that allow users to rent their mining hardware for a fixed fee and a share of the supposed revenue. This allows people to mine remotely without having to purchase expensive mining hardware.

However, many cloud mining companies are scams or ineffective, and users often lose money or earn less than they were led to believe.

Fraudulent initial coin offerings (ICOs)

Crypto-based investments, including initial coin offerings (ICOs) and non-fungible tokens (NFTs) scams, have provided additional opportunities for scammers to take advantage of your money. Start-up crypto companies use an ICO to raise money from future users by offering a discount on new crypto coins in exchange for active cryptos like bitcoin. However, many ICOs have turned out to be fraudulent.

For instance, scammers may create counterfeit websites for ICOs and ask users to transfer cryptocurrency into a compromised wallet. In other cases, the ICO itself may be to blame. Founders may distribute unregulated tokens or mislead investors about their products through false advertising.

It is essential to recognize that although crypto-based investments or business opportunities may seem profitable, this isn’t always the reality.

Celebrity endorsements scams

Celebrity endorsements are another popular crypto scam. Developers pay famous actors or internet personalities to promote a coin or platform to attract investors and then suddenly abandon the project.

In some cases, these scams may be phishing schemes where scammers use fabricated images, videos, or websites to assert that public figures have endorsed their fraudulent scheme.

Rug pulls

Rug pulls, named after the expression “pulling the rug out,” occur when a developer lures investors into a new cryptocurrency project, usually in DeFi or NFTs, and then abandons the project before completion, leaving investors with worthless currency.

NFTs became a particular hotbed for this type of scam after the market exploded in 2021. Many scammers shilled PFP projects with the promise of delivering value and integrating utility later down the line with fantastical roadmaps that were never delivered.

Zagabond, the founder of the blue-chip Azuki NFT collection, caused chaos in NFT communities in May 2022 after admitting to being behind multi-million dollar rug pulls, detailing how he built and jumped ship from three NFT collections – CryptoPhunks, Tendies, and CryptoZunks.

Rug pulls may sometimes involve a variation of a Ponzi scheme, where investors profit by attracting other users with dishonest financial assurances.

Different variations of rug pulls can happen even with proof-of-stake projects that might convince you to stake their tokens in master nodes.

Impersonators scams

An impersonator of a business or other trusted and well-established entity may try to persuade you to buy crypto and send it to them. These individuals may try to contact you through text, call, email, social media, or pop-up alerts on your computer.

The scammer claims there’s fraud on your account or that your money is at risk and instructs you to buy crypto and send it to them to fix the problem. Others ask you to enter your details on a fraudulent website. Clicking on the link in their message or calling the number on a pop-up will connect you with the scammer.

Often, these scammers might try to deceive people into buying new coins that a famous company has just issued. It’s essential to research online to confirm if a company has issued a coin or token or has issued an airdrop.

In addition, scammers may impersonate government agencies, law enforcement, or utility companies and claim that there’s a legal problem or that you owe money. They instruct you to buy a cryptocurrency and send it to a wallet address they provide for safekeeping. Or, they direct you to a cryptocurrency ATM and give you step-by-step instructions on converting money into crypto.

Lastly, scammers list fake jobs related to crypto on job sites, offering jobs to help recruit investors, sell or mine cryptocurrency or convert cash to crypto. They ask you to pay a fee in crypto to start the job and send you a fake check to deposit into your bank account. Then, they will instruct you to withdraw some of the money and buy crypto for a made-up client. By this point, the money will be gone, and you are liable to repay your bank.

How to spot cryptocurrency scams

Scammers are becoming ever more savvy, and it’s easy to be hoodwinked online. To spot a crypto scam, watch out for the following warning signs:

- Promises of future returns. No investment can guarantee future returns. If a crypto offering assures you that you will make money, it’s a warning sign.

- A poorly made or non-existent whitepaper. A whitepaper is a critical aspect of any crypto project. This document should explain how the cryptocurrency has been designed and how it will work. If the whitepaper doesn’t make sense or doesn’t exist, this is a red flag.

- Extreme marketing. Most fraudulent projects rely heavily on marketing. Their strategies include paid online advertising, paid influencers, and even offline promotion.

- Anonymous team. It should be easy to find out who runs the investment by looking for biographies of the key people behind it and checking for their presence on social media. Be cautious if you can’t find out who is behind a cryptocurrency

- Free money. Any investment opportunity promising free money, whether in cash or cryptocurrency, is likely to be fake.

How to avoid crypto scams

Here are some ways to prevent crypto scams:

- Keep your wallet secure. Always store your cryptocurrency in a self-hosted wallet (not on an exchange!), and never share its private keys with anyone.

- Avoid random messages and calls. Don’t be intimidated by anyone contacting you about a cryptocurrency investment opportunity that comes from nowhere. Be wary of giving out personal information or sending money in an unknown amount.

- Too good to be true offers. Scammers often make false promises about investment returns that are unrealistic. Don’t try to take advantage of get-rich-quick schemes; they’re almost always a scam.

- Urgent investment opportunities. Don’t rush into an investment decision without doing your due diligence and taking the time to research all options thoroughly. Only make a decision with informed choices in hand.

- Be cautious of social media hypes. Scammers often leverage the use of social media to advertise their newest scam and present it as an investment opportunity. Be wary of advertisements that use images of celebrities or high-profile people in an effort to make their investment seem legitimate.

What to do if you have been scammed

If you have fallen for a cryptocurrency scam and have shared personal information or made payments, it is crucial to take immediate action.

Contact your bank immediately if you have used your bank card or shared any sensitive information with the scammer. Know that they may try to target you again or sell your details. That’s why changing your security details and passwords is important, especially for online banking.

How to report crypto scams

If you suspect or fall prey to a crypto scam, research the organizations responsible for financial crimes in your country and ask for assistance. In the U.S., you can also file a complaint or report a scam with the following authorities:

- Federal Trade Commission (FTC)

- Commodity Futures Trading Commission

- U.S. Securities and Exchange Commission

- FBI Internet Crime Complaint Center

- The crypto exchange you sent money to. They might have fraud prevention or other measures in place to protect your assets and finances.

Avoiding crypto scams should be your first priority in web3

As crypto adoption grows, so too has the prevalence of scams. The web3 ecosystem is awash with bad actors, and anyone interacting with crypto must ensure as a priority they practice vigilance. Learn how to spot crypto scams and follow best practices to reduce your chances of being scammed.

Frequently asked questions

What are crypto scams?

What are the biggest crypto scams?

What are crypto romance scams?

What happens if you get crypto scammed?

How can you tell if someone is a crypto scammer?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.