DeFi emerged as an alternative to traditional banking, with decetrnalized products mirroring commercial bank offerings, such as loans. One such DeFi project is Aave. Aave is a decentralized application (DApp) on the Ethereum blockchain that bridges traditional finance (TradFi) with web3. This guide provides a thorough explanation of what Aave is and how it works in 2025.

KEY TAKEAWAYS

➤ Aave enables decentralized borrowing and lending without intermediaries, using over-collateralization and a peer-to-contract model.

➤ Flash loans, a groundbreaking feature introduced by Aave, allow users to borrow funds without collateral as long as they are repaid within the same transaction.

➤ Aave’s governance is powered by the AAVE token, which allows holders to vote on protocol updates and earn rewards.

➤ While Aave offers innovative DeFi features, users must be mindful of risks such as smart contract vulnerabilities, market volatility, and liquidity challenges.

What is Aave?

Aave is a non-custodial, completely decentralized, community-governed protocol that allows people to earn interest, borrow assets, and build applications around its services. The platform is the most prominent decentralized loan provider in all of crypto.

It allows users to earn interest by depositing funds into the protocol or borrowing funds deposited by another user. Essentially, it is a peer-to-peer loan facility that operates in a trustless manner and eliminates the need for intermediaries like banks.

Aave’s peer-to-peer lending means that a single or group of organizations, companies, or individuals doesn’t have control over the cryptocurrencies deposited by users. As a result, Aave’s mode of operation is quite different from conventional and centralized financial service providers.

History of Aave

Stani Kulechov and a team of other developers conceptualized what would become ETHLend in 2017. It was an idea that revolved around connecting lenders directly to borrowers. This was based on a peer-to-peer model.

However, the project encountered a number of issue around linking borrowers to lenders and liquidity. As a solution, in early 2020, the platform changed its model from peer-to-peer to peer-to-contract, causing a total rebrand from ETHLend to Aave.

EthLend

ETHLend had the basic functionalities of modern-day decentralized finance. The development was sustained via an initial coin offering (ICO) at the end of 2017, raising about $16.2 million.

The first version of ETHLend ran on the Ethereum blockchain in early 2017, which brought about several exciting activities in the Ethereum system.

The platform offered crypto asset-based loans that allowed users to spend funds without selling their crypto holdings. As a result, borrowers could apply for loans by using their cryptocurrency assets as collateral to receive spendable funds.

ETHLend matched users with other users via smart contracts. However, the team realized it was pretty inefficient as there are sometimes difficulties in matching lenders and borrowers. So they came up with a total rebrand.

Rebranding

In Sep. 2018, ETHLend transitioned into a peer-to-contract model. This model offered swift transactions within the system, allowing instant access to funds in the liquidity pool. This solved the challenge of waiting times and accelerated the entire process of using the decentralized protocol.

The platform changed the name from ETHLend to Aave. Aave is a Finnish word for ghost. This means all transactions are done transparently and anonymously.

In January 2020, the Aave protocol fully launched on the Ethereum network and acquired a U.K. Financial Conduct Authority license.

In November 2023, Aave Companies underwent another rebranding, adopting the name Avara. This change reflects the company’s mission to expand beyond decentralized finance and embrace the broader web3 ecosystem. Under the Avara umbrella, entities like Aave Protocol and Aave Labs continue to operate, maintaining their original names.

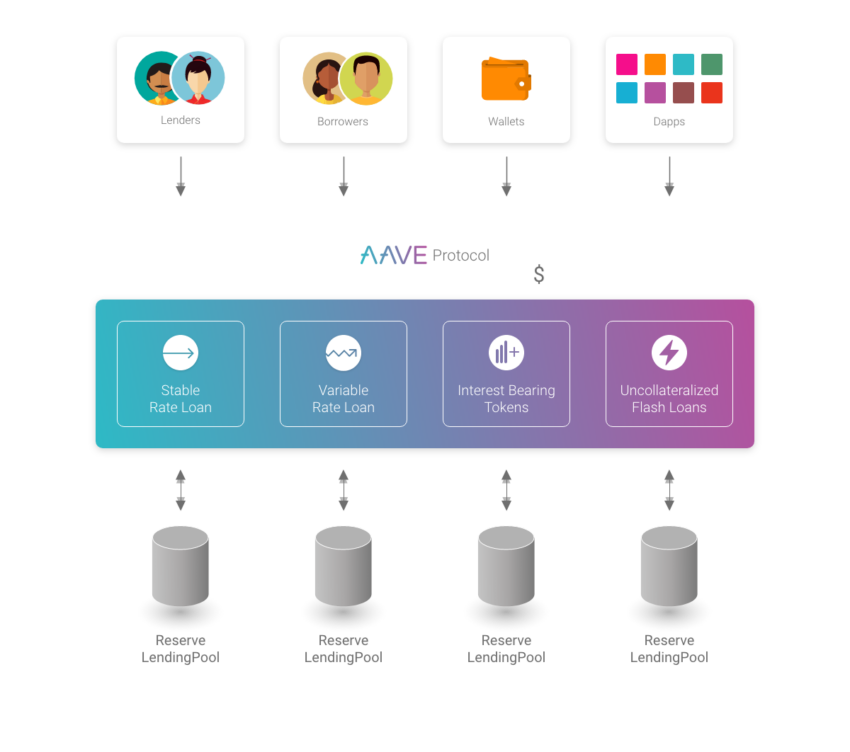

How does Aave work?

Aave allows users to take out loans programmatically or earn interest by lending. It does this in a way that does not require a:

- Credit score

- Underwriter

- Bank account

- Income verification

- Application process

Its working principle involves users supplying assets into the protocol, earning interest based on a fixed interest rate and in proportion to their share of the lending liquidity pool.

For example, a lender can choose to supply and start earning interest in USDT. Once the lenders have supplied USDT, borrowers can take out a loan for USDT on one condition, borrowers must deposit an asset as collateral.

The interest rates for lenders and borrowers are predetermined by the Aave decentralized autonomous organization (DAO):

- For borrowers, the loan rate is like a service fee that they must pay with the borrowed asset upon returning the loan. It depends on the availability of funds (a.k.a. the utilization rate) — the total amount of funds present in the pool at a specific time. As funds are borrowed from the pool, the amount of funds available decreases, which increases the interest rate borrowers pay to take out loans.

- For lenders, the interest rate is the amount that the lender (liquidity provider) earns for allowing borrowers to use their cryptocurrency. The fees collected from the loan rate go to repaying the lenders.

Over-collateralization

Notably, just as on other platforms such as Compound and Sky (formerly known as MakerDAO), loans on Aave are overcollateralized. This means the collateral a user must provide is always higher than the amount that can be borrowed.

So, for example, if you want to borrow $100 USDT, you would have to provide $150 as collateral. This approach protects Aave from liquidation risks or holding bad debt.

Lenders/depositors who supply liquidity (cryptocurrency) to the protocol receive aTokens. The value of aTokens is equivalent to the value of the base token at a balanced ratio.

An aToken is an ERC20 token that represents the amount that the lender deposited in the lending liquidity pool plus the interest earned from the fees collected. It is a liquidity provider (LP) token. In other words, it is like an invoice that a lender uses to get paid.

Additionally, Aave is flexible. It allows users to receive loans in another asset than they deposited. For example, a user can provide Ethereum (ETH) into the pool, then receive USDT to earn a standard yield.

Features of Aave

Aave has several catchy features that separated it from its competitors in the early days of decentralized finance (DeFi). Aside from over-collateralization, there are features like flash loans, which are zero-collateral loans.

Flash loans

A flash loan is a type of loan Aave offers that allows users to borrow any amount of funds without providing any collateral. Flash loans must be repaid in the same block or transaction that the loan was created. This means that flash loans have atomicity.

Atomic transactions are irreducible and indivisible sequences of operations that either happen all at once or none at all.

Aave is the first platform to utilize flash loans. The loans can be used to trade (buy and sell) assets and then repay the original amount plus an additional percentage of the borrowed amount.

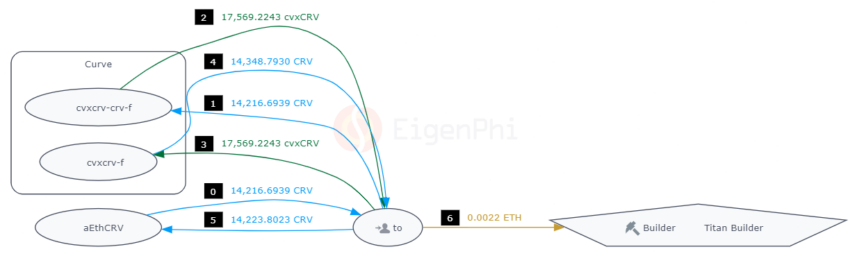

The idea of flash loans can be useful in maximizing profit from MEV strategies like arbitrage. In the example below, there is a price discrepancy of an asset between two liquidity pools on Curve and Convex Finance. Here is a detailed explanation.

- The trader begins by receiving a loan of 14,216.6939 CRV from the aEthCRV pool (beginning in step 0).

- They then deposit the same amount in a Convex Finance pool (cvxcrv-crv-f).

- The trader receives 17,569.2243 cvxCRV in return.

- They then deposit the cvxCRV in a Curve Finance pool (cvxcrv-f).

- The trader then received 14,348.7930 CRV (132.0994 more CRV than they borrowed in step 1).

- They repay the Aave loan for 14,216.6939 CRV back to the aEthCRV pool.

- Lastly, the trader pays Titan Builder a fee of 0.0022 ETH to include this entire transaction in a block.

In summary, the trader used a flash loan to acquire CRV. They then used the CRV to trade into two pools where the ratio of assets in the pool allowed them to receive more CRV than they borrowed. The amount of CRV they received was enough to repay the interest rate to the pool and pocket the rest.

Collateral trading

The Aave protocol allows users to swap deposited assets or collateral. This is done by creating a leveraged position and involves using a flash loan contract to swap the collateral for the preferred asset.

To better understand this, let’s imagine a user has ETH deposited in the protocol as collateral, and received a loan of DAI. They want to swap both their deposited ETH without going through the stress of paying back the loan. They can do this by sending the assets to a smart contract which then swaps the ETH for another asset like UNI.

The AAVE token

AAVE is the native token of the Aave protocol. It is both a utility token and a governance token. Its holders can decide on possible updates to the protocol, including market parameters like interest rates and liquidation rates.

ETHLend (LEND) was the initial token of the Aave protocol. It had its ICO in late 2017. The price debuted at $0.016 a token. Since the protocol is based on Ethereum, these tokens were ERC-20 with a non-inflationary structure.

In mid-2020, Aave launched its token swap. The total circulating supply of 1.3 billion LEND tokens could be swapped for the newly introduced token, AAVE, at the rate of 100 LEND for 1 AAVE. This created a circulating supply of about 13 million AAVE.

AAVE tokenomics

The AAVE token utilizes the Aave Protocol to offer governance and financial rewards. Users hold that hold AAVE share power between stakeholders within the Aave ecosystem to secure the Aave Protocol.

The allocation and distribution of tokens include:

- Core development 30%

- User experience development 20%

- Management and legal 20%

- Promotions and marketing 20%

- Miscellaneous costs 10%

Is Aave really worth it?

Aave seems to be a great protocol for all levels of crypto enthusiasts, offering some unique features and benefits for all users. Just like other DeFi lending protocols, it offers creative tools to allow users to implement the basic functionalities of the Aave protocol into their own DeFi projects.

However, just as with Compound and other DeFi lending protocols, it is important to know that users can be exposed to smart contract, market, and liquidity risks. Make sure that you understand the complexities of a protocol like Aave before you being using it.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Interacting with DeFi protocols carries risk. Do your own research and always take adequate security measures.

Frequently asked questions

What is Aave?

Is Aave crypto a good investment?

How do you use AAVE?

Why is the Aave token popular?

Is Aave safe?

How does Aave make money?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.