Forks play a critical role in the blockchain space. They allow networks to evolve by implementing new features and addressing disputes. At the same time, they also enable changes to blockchain protocols, sometimes even creating entirely new chains. This article explores the ins and outs of crypto forks, how they work, and their impact on different user bases.

KEY TAKEAWAYS

➤ Crypto forks commonly take two forms; hard forks or soft forks.

➤ Hard forks create irreversible splits in a blockchain, which often results in new cryptocurrencies, while soft forks modify rules compatibly.

➤ Crypto forks typically impact users through coin splits, wallet compatibility issues, and potential market volatility.

➤ Proper preparation for forks involves staying updated about the technical details and taking adequate security precautions.

What are crypto forks?

A crypto fork occurs when a blockchain network splits into two distinct versions to create a new, independent blockchain. This happens when developers decide to implement changes that cannot be incorporated into the existing chain using standard updates.

Forks result in new sets of nodes and transactions, which lead to variations in blockchain data. They essentially rewrite the blockchain’s rulebook, either permanently splitting it or introducing backward-compatible changes that modify existing rules.

Why do crypto forks happen?

Crypto forks can happen for various reasons, such as protocol upgrades, addressing security vulnerabilities, or scaling issues. For instance, Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS) required a fork due to the significant change in the consensus mechanism.

In other instances, forks may happen due to philosophical differences within the community on how a blockchain should evolve. Such disputes generally lead to splits where each faction supports a different set of rules.

Ultimately, forks allow developers to implement significant changes that might otherwise require extensive consensus from a diverse set of stakeholders (which can be difficult to achieve).

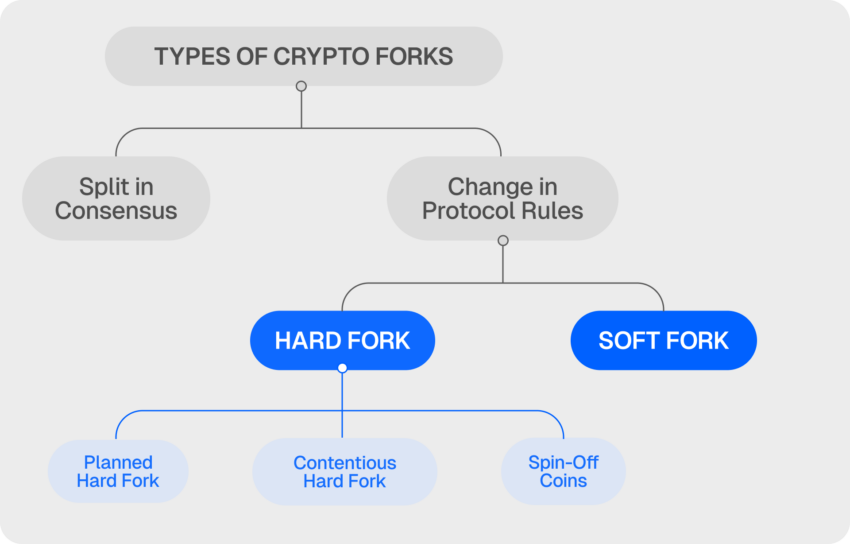

Types of forks

Forks are generally of two types: hard forks and soft forks. Let’s take a closer look at each.

Hard forks

Hard forks involve substantial, non-backward-compatible changes that create an entirely new blockchain. They change the blockchain’s fundamental aspects, such as the consensus mechanism, block structure, or transaction verification rules.

How hard forks work

When a hard fork takes place, all nodes must decide which version to support. They can either upgrade to the new protocol or remain on the original chain.

Nodes that continue running the old software become incompatible with the nodes on the upgraded chain. This separation leads to a new blockchain with its own unique transaction history and native cryptocurrency. Meanwhile, the original chain persists as a distinct network.

Hard forks generally result from disagreements within the community or the need to implement major protocol changes that cannot coexist with the existing blockchain.

These forks result in coin splits, where users may receive coins on the new chain equivalent to their holdings on the original chain.

For instance, Ethereum’s 2016 hard fork following the DAO hack altered the transaction history to return stolen funds to investors. This decision led to the formation of Ethereum Classic, which maintained the original transaction record.

Hard forks may also involve technical changes, such as modifying block rewards or changing block time intervals. Nodes or miners failing to upgrade become isolated and continue operating on the pre-fork chain to form a parallel network.

Technical aspects of hard forks

- Consensus mechanism modifications: A hard fork may switch from one consensus mechanism to another. For instance, Ethereum’s upgrade to Ethereum 2.0 involved transitioning from PoW to PoS. This transition fundamentally changed how transactions are validated, and new blocks are created.

- Block structure changes: Some hard forks change the data structure within blocks. This can include increasing the block size limit or reorganizing how transactions are stored. Bitcoin Cash’s hard fork increased the block size to 8 MB, which allowed for higher throughput and lower fees.

- Protocol-level changes: These involve changing the rules governing transaction validity. Examples include the introduction of new opcode instructions or modifying existing ones to support complex smart contracts. Hard forks that enable new scripting languages or virtual machines typically require all nodes to upgrade.

Examples of hard forks

- Bitcoin Cash (BCH): Bitcoin Cash was introduced in 2017 as a solution to Bitcoin’s scaling issue. It increased the block size from 1MB to 8MB to allow more transactions per block, thereby reducing congestion and lowering transaction fees. This change required a hard fork since it was not backward-compatible with the original Bitcoin protocol.

- Ethereum Classic (ETC): Ethereum Classic was created when Ethereum reversed transactions from the DAO hack, but some nodes opted to stay on the original chain. This split preserved the immutability principle, which many felt should not be violated. Hence, this divergence led to the formation of two parallel chains.

Soft forks

Unlike hard forks, soft forks are backward-compatible modifications that do not split the blockchain into separate entities. The nodes that do not upgrade can continue validating transactions and blocks so long as they follow the new rules.

Soft forks typically involve tightening existing rules, adding new transaction types, or upgrading features without causing a permanent split. The network remains intact, and non-upgraded nodes recognize transactions and blocks created under the new rules as valid.

How soft forks work

Soft forks modify the blockchain’s protocol by introducing changes that are accepted by old and new nodes alike.

For instance, if a soft fork reduces the maximum block size, nodes operating on the older protocol will still recognize the smaller blocks as valid. But, if a block exceeds the new limit, older nodes will reject it. This ensures backward compatibility, minimizing disruption.

Soft forks often require a majority of miners or validators to adopt the new rules for them to be successful. In other words, the network can not enforce the updated rules without sufficient support, rendering the soft fork attempt a failure.

Technical aspects of soft forks

- Script and opcode changes: Soft forks may introduce new script rules for executing transactions or add opcodes that expand the functionality of smart contracts. Existing rules are not changed in the process. For example, Bitcoin’s SegWit introduced a new address format and updated the transaction structure.

- Tightening of rules: Soft forks can tighten existing rules. For example, it can decrease the block size or add new constraints to the way transactions are formatted. This maintains compatibility with the old chain while enforcing stricter validation requirements.

- Activation methods: Soft forks can be activated through various methods, including miner signaling or predefined block height activation. The latter sets a specific block number at which the new rules take effect, giving nodes and miners time to upgrade.

Examples of soft forks

- SegWit: SegWit, short for Segregated Witness, was implemented on the Bitcoin network in 2017. It optimized block capacity by separating transaction signatures from the transaction data.

- Taproot upgrade: Taproot expanded Bitcoin’s functionality by introducing Schnorr signatures and enhancing privacy features. The soft fork took place in 2021. It allowed more complex transactions to be executed without compromising security or increasing the size of individual blocks.

Accidental or temporary forks

The two types of forks we have discussed above are intentional forks, i.e., they are implemented intentionally with a clear objective in mind. However, sometimes forks can happen unintentionally. These are called accidental or temporary forks.

Accidental or temporary forks occur when two miners generate new blocks almost simultaneously, causing a temporary split in the blockchain.

Some nodes might recognize one of the newly mined blocks in such cases, while others validate the competing block. This is a natural result of the time it takes for information to propagate across the network, causing a brief disagreement over the correct chain.

How temporary forks resolve

In temporary forks, both chains coexist briefly until one is abandoned, or “orphaned,” by the network. This happens when the majority of full nodes choose one chain over the other, effectively causing the competing chain to die out.

Eventually, the nodes sync with the accepted chain, and the blockchain continues without any permanent split. These types of forks occur frequently due to the decentralized nature of block mining and typically resolve on their own without long-term effects on the network.

The impact of crypto forks

1. On users

Hard forks generally create new coins and provide users with additional assets on the forked chain. Users must decide whether to support the new chain, hold both assets, or sell one of the coins.

This decision can ultimately lead to price speculation and trading opportunities. However, hard forks also introduce risks such as replay attacks, where a transaction on one chain can be broadcast on the other.

Users need to understand the implications of a hard fork and use wallets that provide replay protection and support for both chains.

Meanwhile, soft forks typically have less impact on users since the changes are backward-compatible. Nonetheless, users must still ensure that their wallets and nodes are compatible with the new rules to avoid transaction delays or invalidation.

Soft forks can enhance usability, security, and functionality without disrupting the network.

2. On crypto developers

Forks present developers with a new avenue for introducing new features, fixing critical bugs, or modifying network parameters.

Specifically, hard forks offer the flexibility to make sweeping changes, like transitioning from one consensus mechanism to another. Alternatively, developers have the option to introduce new transaction types or even rewrite entire sections of the protocol.

Contentious hard forks can split the developer community, leading to resource dilution and competing versions of the same blockchain.

On the other hand, soft forks allow for incremental improvements without causing network disruptions.

3. On the crypto market

Market reactions to forks vary widely. Hard forks generally result in increased price volatility as traders speculate on the value of the newly created coin.

A successful hard fork can boost the value of the original and new coins, but failed or contentious forks can lead to losing confidence in the project.

For example, Bitcoin’s price was just under $2,000 on July 16, 2017, two weeks before the BCH fork. It surged to over $4,300 by August 15, 2017, two weeks after the fork.

The market’s overall response often depends on whether the fork addresses critical issues, introduces innovative features, or resolves governance problems.

Hard fork vs. soft fork impact compared

| Aspect | Hard forks | Soft forks |

| New cryptocurrency | A new cryptocurrency is created, splitting from the original chain. | No new cryptocurrency is created; changes are backward compatible with the original chain. |

| Impact on the original chain | Can subtract value from the original chain, although the impact may diminish over time. | Maintains the original chain’s integrity without diluting its value or creating economic division. |

| Tokenomics | May dilute tokenomics by creating a carbon-copy chain that circumvents supply restrictions. | Preserves the tokenomics of the original chain without creating additional coins. |

| Ownership and distribution | Users receive an equivalent amount of the new coin, depending on exchange and wallet policies. | No new distribution; existing holders continue to use the original coins seamlessly. |

| Governance and ethics | Can challenge the principles of decentralization, particularly in ethical cases like the DAO hack. | Preserves the original chain’s governance, focusing on technical improvements without ethical dilemmas. |

| Custodial services | Custodial exchanges may not distribute forked coins, leading to potential locked value. | No such complications; users maintain their holdings as the soft fork applies to the existing chain. |

| Node participation | Requires participants to upgrade to the new chain | Maintains node participation without requiring them to adopt all new rules or chain. |

How can you prepare for a crypto fork?

1. Stay informed

Follow announcements from project teams and track community discussions to stay updated on upcoming forks. Many projects publish detailed roadmaps and technical documentation outlining what the fork will change, how it will impact the network, and what steps users need to take.

Participating in test networks or development discussions can provide valuable insights into the fork’s feasibility and potential issues.

2. Wallet compatibility

Verify that your go-to crypto wallet for the relevant blockchain supports both the original and forked chains. This includes ensuring that wallets can handle chain splits, provide access to new coins, and support replay protection.

Note that some wallets offer dedicated tools for managing forks so users can safely split their funds and interact with both chains.

3. Security considerations

Beware of phishing attempts and scams during forks, as these events may attract malicious actors trying to exploit confusion. Use only trusted wallets and exchanges, and avoid transacting immediately before or after a fork to reduce risks.

It’s also advisable to withdraw funds from exchanges temporarily, as not all exchanges support both chains during a hard fork.

A key part of blockchain development

Crypto forks play an integral role in the evolution of blockchain networks by paving the way for upgrades and innovation. At the same time, they also present certain unique challenges for users, developers, and the broader cryptocurrency market.

The best way to overcome these challenges is to understand the technical details of how crypto forks operate and their impact on the network. To do so and handle these events smoothly, stay informed, check wallet compatibility, and ensure to prioritize your security at all times.

Frequently asked questions

What is the difference between a hard fork and a soft fork?

Do I get free coins during a crypto fork?

Are crypto forks always planned?

Can a crypto fork be reversed?

How do crypto forks affect the price of cryptocurrencies?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.