Unlike the U.S. Dollar, where the government can print more money to increase supply, cryptocurrencies like Bitcoin are created through a process called mining. But what exactly is it, and how does it function? This guide considers the concept of free Bitcoin mining, explaining it in detail and exploring how you can participate in this process.

KEY TAKEAWAYS

► Bitcoin mining requires significant investment in specialized hardware and incurs high electricity costs, making profitability a challenge.

► Mining pools allow miners to combine their computational power to increase the chances of earning Bitcoin.

► Choosing a mining pool involves considering factors like hardware compatibility, task assignment mechanisms, transparency, payout thresholds, and fee structures.

► Bitcoin mining legality varies by country; while it is legal in most places, some governments have banned it due to concerns over financial sovereignty.

Does free Bitcoin mining exist?

The first and most critical tool for mining is a specialized application-specific integrated circuit (ASIC) miner. A new ASIC can cost between $1,000 and $5,000 or more. But that’s not the only consideration when running a mining operation. ASICs consume immense amounts of electricity—a cost that could easily exceed that of the device consuming power.

You will also need Bitcoin mining software to join the network. These aren’t as expensive as the hardware; in fact, some options are even free. To determine whether free Bitcoin is profitable, you will have to consider the following:

- Cost of hardware

- Possible software costs

- Electricity costs

- Current Bitcoin value

- Possible taxes

At first glance, you might think that Bitcoin mining is a profitable endeavor. As of Oct. 1, 2024, BTC is worth over $62,000, so mining a block and getting the reward will net you over $190,000, not including the fees. But you’ll need an army of mining rigs to be profitable. Bitcoin mining’s electricity consumption can be pretty extensive.

Data from the Congressional Research Service shows that a single ASIC can consume as much power as 500,000 PlayStation 3 consoles. To run a mining outfit from home, you’ll need to pay incredible sums.

In fact, the cost of electricity will most likely be the most significant determinant of mining’s profitability for you. This is why miners work with mining pools.

Understanding mining pools

Initially, Bitcoin mining was set up for individual efforts. People could use their home devices to mine Bitcoin. However, with cryptocurrencies gaining more mainstream attention, mining became more competitive and less profitable to run from home.

Several people wanted to be first, so they got more advanced tools — Graphics Processing Units (GPUs). These tools, which were designed to run high-power games, can easily be retrofitted to work for mining instead.

Then came Application-Specific Integrated Circuits (ASICs), which are now the industry standard. These provided even greater power than GPUs, enabling Bitcoin miners to be more profitable. By delivering greater computing power at lower energy consumption levels, these devices have phased out CPUs.

How to pick a free Bitcoin mining pool

When choosing mining pools, it’s important to consider several key factors. Here are a few points to consider:

- Infrastructure compatibility: The first point of consideration will be the pool’s compatibility with your mining device. Some pools don’t allow CPUs, while others have specifications for miners running GPUs and ASICs.

- Task assignment mechanism: Mining pools assign tasks to miners using different methods. Say pool A has stronger miners while those in pool B are comparatively weaker. A pooling algorithm running on the server should be able to distribute tasks across the available subgroups.

- Pool transparency by operator: Mining pool operators must also promote transparency and trust among pool members. Some of these transparency measures could be real-time dashboards that miners can view to ascertain their share of the pool’s resources.

- Payout threshold: If your hardware is on the low end of the computing power spectrum, then avoid pools with higher payout thresholds. Your contribution to the pool will be less, and you’ll get a lower portion of your earnings. So, you will have to wait longer to hit the payout threshold and get your payment.

- Pool fee structure: While some pools charge a nominal fee for miners to use their services, others don’t charge at all. However, you will need to be careful with pools’ payout formulae, which might come with some hidden charges. For instance, some zero-fee pools could only offer this free service for limited periods and charge later.

Is free Bitcoin mining legal?

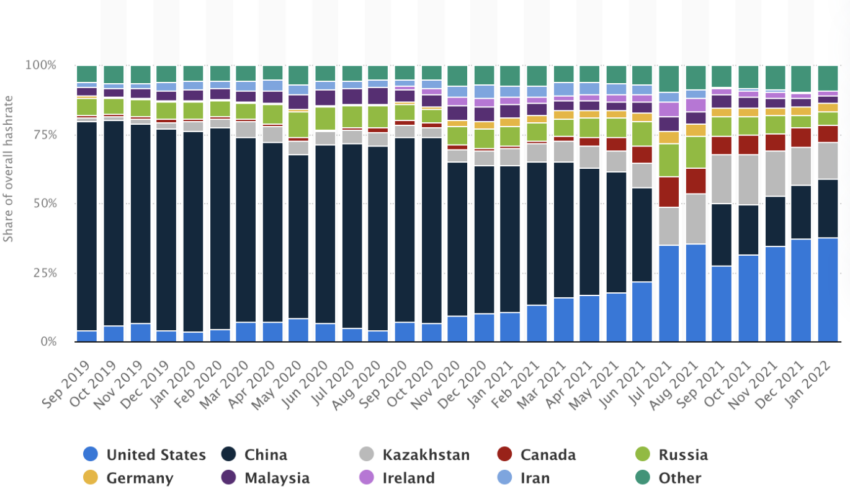

The legality of Bitcoin mining depends on your location. Some governments have come to recognize the threat that Bitcoin mining poses to their financial and monetary sovereignty. This has led to several crackdowns on the sector, including mining.

Some examples of countries where mining is illegal include Pakistan, Ecuador, Egypt, Algeria, and Nepal. However, Bitcoin mining is legal in most countries.

What is Bitcoin mining?

Bitcoin mining is the process involved in verifying Bitcoin transactions and adding them to the asset’s blockchain. It’s a form of auditing that involves securing the network and minting new Bitcoin.

The people who conduct this activity are known as “miners,” they’re required to solve sophisticated mathematical puzzles before a new block of transactions is added to the blockchain. Every time a miner adds a new block, they are rewarded with compensation called a “block reward,” which is 3.125 BTC.

The block reward is halved every 210,000 blocks (or roughly every four years). At the next halving event, it will be cut in half again and again until all 21 million Bitcoins are mined.

How Bitcoin mining works

Bitcoin mining used to be quite easy, but as the network has become more saturated and complex, mining has also become difficult.

Bitcoin miners primarily work as auditors. They ensure that all transactions processed are legitimate and that blocks are added to the blockchain in a timely manner.

In 2024, the block size limit is about four megabytes (although the size of blocks in practice is generally around two MB). For a miner to receive mining rewards for a block of transactions, it has to be the first to solve the mathematical puzzle and then add the block to the blockchain.

This mathematical problem is where the work really lies. Unlike getting a random test question that you can easily solve on your laptop, the problem is more like coming up with a 16-digit hexadecimal number (known as a “hash”) that is either less than or equal to a specific target hash.

For Bitcoin beginners, this process is known as “proof-of-work” or PoW. Essentially, PoW is more like guesswork. However, considering that we’re looking into 16-digit hexadecimal, the number of guesses you need to arrive at a precise number could run into the trillions. Evidently, no one has the time or capacity for that work.

This is where mining machines come into play. These machines lend their computing power to solving the math problem.

“Bitcoin mining is like a digital process. Imagine a group of computers, not real people, working together all the time to keep track of transactions in a record. They create new Bitcoins through a process called mining, and no company, country, or third party is in charge.”

Andreas Antonopoulos, Bitcoin advocate: Youtube

The possible risks of free Bitcoin mining

While it might seem like a risk-free endeavor, mining isn’t without its dangers. For one, Bitcoin mining is a financial activity. You could purchase thousands of dollars worth of equipment and shell out even more due to electricity consumption and not mine a single block at the end of the day.

Mining pools help to mitigate this risk, but you still run the risk of falling victim to a scam or the pool getting hacked.

Bitcoin mining is competitive

Free Bitcoin mining is very difficult, as BTC is a highly sought-after asset. Bitcoin mining, on the other hand, can be a profitable venture, yet it involves various considerations and risks. As the activity has become mainstream, entry into this field is more challenging than before.

Nonetheless, with careful planning and adequate capital, you can successfully engage in Bitcoin mining. It’s important to stay informed about evolving mining ecosystems and technological advancements to make well-informed decisions and maintain competitiveness in this sector.

Frequently asked questions

Is mining Bitcoin profitable?

Is Bitcoin mining illegal?

How long does it take to mine 1 Bitcoin?

Which free Bitcoin mining service is legit?

Are there fake Bitcoin apps?

How many Satoshi is equal to 1 Bitcoin?

What happens when Bitcoin mining stops?

Can a normal person mine Bitcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.