The bull market is almost here, and the buzz around the Bitcoin halving is building. Meanwhile, memecoins are booming, led by Solana and Base Chain. Yet, as the tussle for profits intensifies, the risk of stumbling upon dubious crypto projects looms. Keeping that in mind, this guide demonstrates how to vet scam projects in crypto via a detailed, example-led, realistic framework. Here’s what you need to know about keeping safe in crypto.

- How to locate the red flags and vet scam projects

- How do you know if a crypto project is legitimate? Or is it a scam?

- Team evaluation: How to vet scam projects quickly

- Minimum Viable Product Assessment: A key to validating project credibility

- Project tokenomics: It’s all in the numbers

- Issuance mechanism

- Governance

- How to vet scam projects using vesting and cliff insights

- How to vet scam projects using competitor analysis

- How to vet scam projects using on-chain analysis

- How do scam tokens work?

- Quick hacks for the newbies: How to vet scam projects quickly

- Common crypto scams

- You identified a scam: What next?

- Frequently asked questions

How to locate the red flags and vet scam projects

Before we delve deeper into the framework, here is a quick rundown of the best ways to locate red flags in crypto. This way, you can be proactive and safeguard investments from shady tokens and suspicious projects. Here are the key points, some of which we will discuss later in depth. Be mindful of:

- Unrealistic guarantees and promises: Most failed crypto projects have one thing in common: lofty promises, often led by project heads. Take FTX, the now-defunct exchange, which made huge commitments before implosion under the direction of the now-convicted Sam Bankman-Fried.

- Pressure tactics: There may be unscrupulous parties waiting to create a sense of FOMO or pressurize you into picking newly launched tokens. They do this via Telegram communities, unrealistic screenshots, and more. This is often led by a scammy team with shady intentions.

- Regulatory challenges: Projects may have good intentions, but setting up shop in regions with regulatory challenges can pose risks. This can lead to regulatory actions and eventual bankruptcy proceedings.

Tweets and validations to avoid key red flags

A cautionary tweet against FOMO or panic selling:

GameStop venturing into the NFT space is an example of regulatory challenges resulting in a project being forced to shut down.

A rise in crypto scams now that the bull market is here:

In a bull market, market manipulation by projects with no token cliffs can also be considered a scammy practice. It is a strategy that deliberately pushes prices high. Once retail investors join in, they dump, more like a standard pump-and-dump scheme.

Here is a quick instance of a celebrity marketer promoting a crypto scam:

The meltdown of the Terra-Luna ecosystem in 2022 was also primarily led by unrealistic APYs and other concerns. The Terra-Luna debacle highlighted that one scam or shady project might not be limited to a standalone problem in the crypto space. Instead, the Terra-Luna crash led to a chain reaction, taking the Barry Silbert-led Digital Currency Group, Genesis, and other bodies down with it.

How do you know if a crypto project is legitimate? Or is it a scam?

Locating crypto scams requires focus on a few key areas. These include team presence, tokenomics, investor track records, and product quality. In this detailed framework, we discuss the key aspects of each credibility checkbox in detail in order to demonstrate how to vet scam projects.

Increased activity is often the driver that leads to scams.

Here is a quick entry-level framework to get us started:

- Team transparency

- Whitepaper with clear roadmap evaluation

- History of regular smart contract audits

- Support that is too good to be true (for instance, if a project suddenly claims that Vitalik Buterin is one of the advisors)

- Community engagement and following

- Transparent token distribution habits

- Analysis of code repositories with active developer involvement

- Market performance and liquidity

- Whether it is owned, backed, or endorsed by a known crypto name or not

- Big projects with immediate token launches and surging gains (red flag)

Did you know? In 2018, a controversial cryptocurrency, Petro, came to the limelight. What raised concerns is that it was supposedly backed by Venezuela’s oil reserves, a validation too good to be true.

Keeping track of these factors can help you identify potential crypto scams, all while minimizing exposing yourself to shady tokens, a rug pull, or even a hack. But this quick list isn’t a surefire investor protection strategy. For that, you need to keep reading on.

Team evaluation: How to vet scam projects quickly

In the crypto space, projects will often talk up anonymity while staying outside of the public radar. However, a few indicators can work as investor protection nets for those with clearly set-up teams.

Expertise

For a crypto project to be credible at first glance, it is necessary to have credible crypto-native individuals in the fold. If you can, identify the team members. Then, check if they have relevant crypto-specific or financial expertise.

Looking for the green flags in regards to expertise? Check for these elements:

- Member involvement in the concerned space for over five years

- More than half of the key team members have the necessary skills

- Team members have previously worked together, and at least some of them

- One or more members match in the top 200 crypto-focussed people list

- At least 2000 followers across social platforms

Interested in delving deeper into the team? Here are a few other areas to focus on:

- Team roles are set and available publicly

- Discord channel exists

- Active Twitter handle managed and posted to by founders or involved folks

- Team members previously associated with successful projects

- Timelines in line with the roadmap

- Clearly defined whitepaper

- Experienced advisors

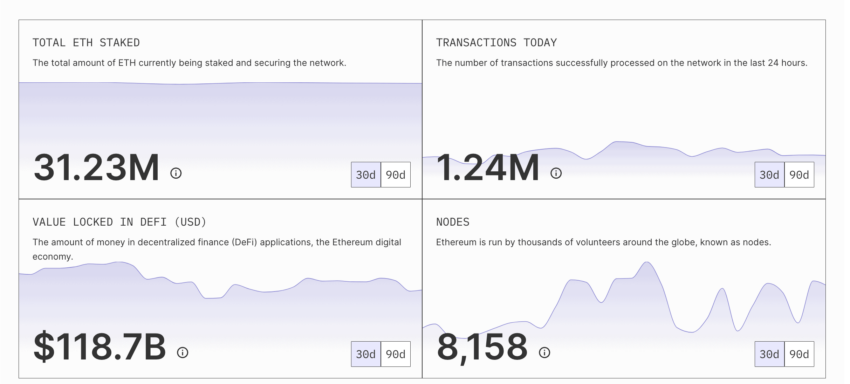

Ethereum and Cardano are two of the key players in the market with highly rated team evaluation metrics. For Ethereum, the core team boasts significant crypto contributions, a robust social media presence, and other elements. Cardano, on the other hand, boasts individuals with deep industry experience and exposure to prior successful projects.

Even the Polygon (MATIC) team is loaded with crypto and blockchain-specific experience — one of many reasons to consider this a credible project.

VC backing: A metric that signals investor confidence

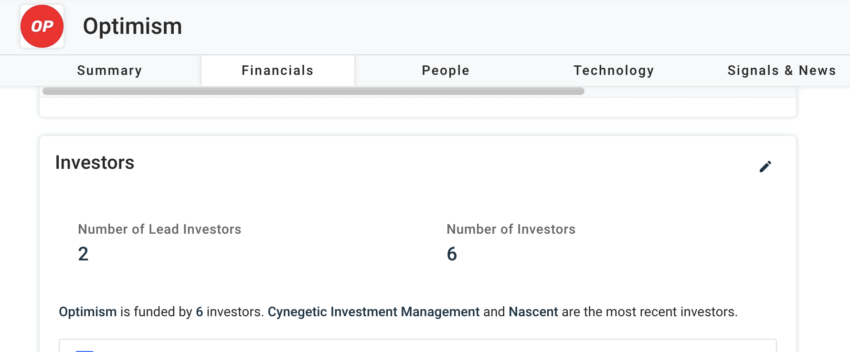

If you find the team credentials good or even satisfactory, you might want to delve deeper into the Venture Capital backing details associated with the project. In most cases, this information is distributed via PR, led by top crypto publications, or will be clearly mentioned on the project’s website. But then, simply acquiring funds from a bunch of venture capitalists isn’t a reliability indicator. Here are the things to consider for avoiding crypto scams:

- Check if multiple VC firms are backing the project.

- Mostly Tier 1 investors, including the likes of Accel Partners, Sequoia Capital, and more.

- The project should clearly illustrate the usage of investor funds, including clarity on the runway and even the burn rate.

Note: Investment runway is the sustainability duration of the project, courtesy of the received funding. The burn rate, on the other hand, is the timeline or the rate at which the capital is consumed. Green flags in crypto clearly mention these elements while making the project public.

One notable example of a popular crypto project backed by Tier 1 VCs is MakerDAO, led by the likes of Andreessen Horowitz, Paradigm, and others.

BeInCrypto connected with Sai Poorna, an angel investor, to pick his brain regarding investing in crypto projects and avoiding scammers. Here is what Poorna told us:

“Investing in early-stage crypto projects demands thorough scrutiny. I look for founders who’ve invested their own money, ensuring they have skin in the game. A product at least at the POC stage and endorsement from a Tier-1 VC are critical indicators of potential. The project must align with current market narratives, supported by a competent team.

To spot scammers, I assess community engagement and product readiness; absence of these is a red flag. Overhyped claims, a noticeable shift in the founder’s humility post-funding, reliance on token launches for quick fundraising, extravagant spending, and a focus on paid marketing over substance are warning signs. I value direct conversations with founders and insights from my investor network to gauge trust and long-term vision.”

Sai Poorna, Angel Investor: BIC

Outliers to focus on: In some cases, it is advisable to delve deeper into the background of the VC firm as well. What happened with Alameda Research (the sister firm of FTX) led to one of the largest crypto bankruptcies. This was despite Alameda being invested in several projects, including Circle, which is known for the USDC stablecoin.

Minimum Viable Product Assessment: A key to validating project credibility

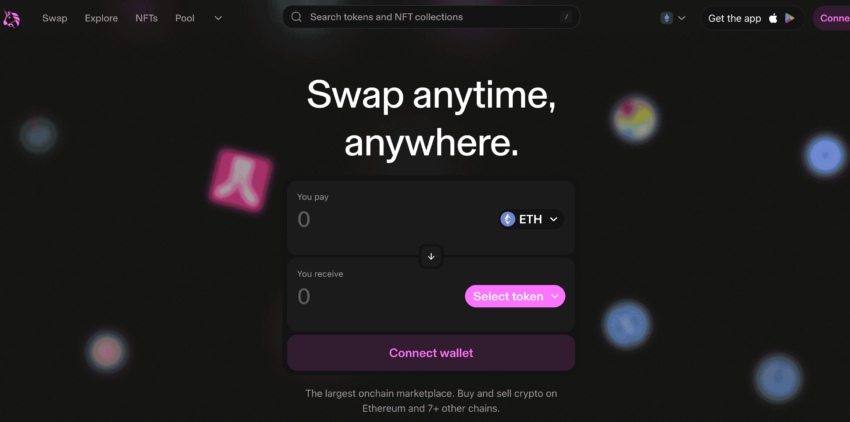

This parameter is crucial for projects that come with highly specific utilities. For instance, Uniswap is a popular DEX with a decently-performing UNI token. For projects like these MVP assessment is crucial. But what sub-parameters do you focus on while conducting an MVP check? Here are the ones we have picked:

Functionality

As an investor, you should always focus on the key functional traits of the MVP. The idea is to track the features via documentation and consider whether more than 75% of the stated tools are provided. Plus, the product-market fit is also necessary.

The MVP also needs to include or adhere to the following requirements for the project to be qualified for a green flag:

- Monthly MVP updates

- A clearly drafted user manual

- Availability of unique features, as compared to competitors

Uniswap brings in the concept of “Concentrated Liquidity,” which allows liquidity providers to feed capital following specific price ranges. Despite being a DEX with competitors like Sushiswap and others in sight, Uniswap aims to introduce unique features with its latest V3, making its product stand out.

User interface

The lack of a seamless user interface is one of the reasons why web3 adoption hasn’t been as fast as many intended. Good crypto and blockchain-specific projects have top-notch user interfaces, often with the following traits:

- Highly intuitive UI, with several positive user reviews

- A clear process to get user feedback on features and tools

- A broad range of accessibility features

- Logical interface flow

- Easy ways for users to get help and assistance

Scalability

Crypto projects need to evolve themselves to fit diverse user requirements. That is exactly what is required to be scalable. In most cases, scalable technologies include rollups, sharding, and more — something Ethereum will introduce as part of its Ethereum 2.0 roadmap.

A credible project is just not about scalability. The project roadmap should include the timelines of these scaling technologies.

Besides the mentioned sub-parameters, investors might consider focussing on further elements, including but not limited to:

- Implemented security standards as part of the MVP

- Social interaction about the MVP

- Interoperability

- Token utility within the product itself

- Past security breaches, if any

- Regulatory challenges related to the product, if any

- Clear-cut performance metrics in play, including active users, costs, and downtime, if any.

Top projects like Aave have metrics like lending rates and TVL that are accessible to the users via platforms like DeFi Pulse and DeFiLlama. This way, investors can make informed decisions.

/Related

More ArticlesProject tokenomics: It’s all in the numbers

While the team, MVP, and VC-based backing are crucial elements, nothing gives better clarity about a project’s credibility than its tokenomics. The concept of tokenomics is multi-faceted and involves several components, including but not limited to:

1. Supply and distribution

A major red flag for a project would be the top 5% holders controlling over 50% of the supply. Plus, multiple token redistribution mechanisms should be in place if the project is credible. A good example of that would again be Uniswap, a protocol utilizing liquidity mining and transaction fees to reward and incentivize liquidity providers and efficiently move tokens within the ecosystem.

Also, a credible project would have a detailed token allocation breakdown available across multiple channels.

Utility

When it comes to asserting the concept of utility, an average investor might want to look at the following signs as green flags:

- Project tokens have clear use cases within the ecosystem and beyond

- Clear incentive for users who hold these tokens

- Tokens necessary for giving a security posture or other benefits to the project

- Robust mechanisms in place to prevent token hoarding, price manipulation, and more

MakerDAO’s DAI stability mechanism is one enforcement that prevents token manipulation. The role of auditable smart contracts and decentralized governance are also crucial in that regard.

Pricing

What investors often do not realize is that the token pricing, at least the listing element, speaks volumes about the credibility of the project. In most cases, the price of the token is determined by the project development costs, token utility, and the rationale followed by the team. However, there are a few things to look for while considering the price of a new token.

First of all, you need to track the DEX price of the token as most tokens start trading over DEXs, and after a thorough investigation and analysis, they are listed on CEXs. A good project is one where, despite the airdrop-led selloffs and CEX-based deposits for dumps, the price doesn’t fall by more than 10 to 20%.

Ethena (ENA) was listed on Binance on April 2, 2024, and after that, a large number of DEX and airdrop-specific tokens were moved to exchanges. Despite this, the token was up over 40% in 30 hours, showing the overall strength of the project.

How CEXs vet scam and legit projects

Vugar Zade, Chief Operating Officer of Bitget, gave BeInCrypto some exclusive insight into the process implemented by centralized exchanges, especially Bitget, to weed out scam projects.

At Bitget, meticulous due diligence is the bedrock of our operations. We delve deep into founders’ backgrounds, scrutinize project viability, assess community engagement, and conduct thorough on-chain transaction analyses. In the fast-paced crypto landscape, the swiftness and quality of listing processes are paramount. Users are eager to unearth promising opportunities and capitalize on potential gains as soon as possible.

For us, warning signs include the absence of an active community and limited on-chain activity. Such indicators raise significant concerns. Equally critical is the implementation of a well-structured vesting schedule for token holders. An imbalanced vesting arrangement can exert immense pressure on token prices, paving the way for rug pulls and investor losses.

Thus, a genuinely commendable project boasts strong leadership, a compelling product vision, early on-chain traction, and, most importantly, a dedicated and robust community. Together, these elements form the cornerstone of success in the dynamic world of cryptocurrency ventures.”

Vugar Usi Zade, COO of Bitget: BeInCrypto

Other pricing-specific green flags include:

- Robust mechanisms to handle price volatility, including market sentiment analysis, on-chain tracking, liquidity provisioning, and encouraging trades via stablecoin pairs.

- Competitive token price when compared to the peers

- Practical token projections

- A balanced order book, which might indicate incoming price stability

Issuance mechanism

Like fiat, cryptocurrencies also follow the tenets of inflation and deflation. And that is why it is necessary to check the tokenomics in depth to learn more about the issuance mechanisms. For instance, Bitcoin has a fixed supply. Until that cap is reached, the asset is moderately inflationary.

Some cryptocurrencies, including SHIB from the house of Shiba Inu, have pre-defined smart contract-powered burn mechanisms in place to lower the token supply and even promote value appreciation. Similarly, Binance’s BNB has a 200 million fixed token supply and a steady burn rate that aims to lower the issuance.

The token supply or adjustment of the token inflation rate should always be a governance-based, decentralized call and should not be based on the whims of the team members.

Governance

Another crucial element of token issuance, which also encompasses the utility, is the governance aspect of the token. If a token boasts governance capabilities, in regards to a crypto project, it must adhere to the following guidelines:

- Clear and accessible guidelines for exercising the governance rights

- Pre-defined minimum token holding requirement for qualifying, which shouldn’t be too low or too high

- Clear demonstration of the voting process and result implementation

- If the project has a separate set of governance tokens, team distribution should be kept to a minimum.

Examples of projects with solid governance structures include MakerDAO, powered by the MKR crypto, and the Compound project, led by COMP.

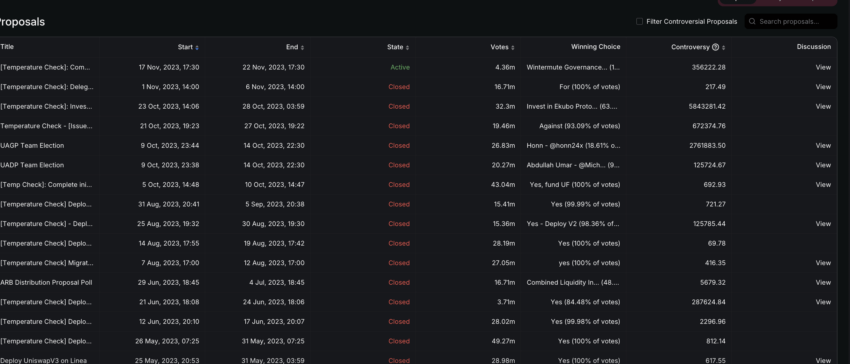

Even Uniswap has a solid governance structure with a list of proposals and challenges listed clearly in this snap:

How to vet scam projects using vesting and cliff insights

Another crucial element or rather sub-parameter of the tokenomics discussion is the element of vesting and cliff. These elements determine how quickly the team can sell the project tokens and how aggressive the token unlock strategy is upon release.

A great indication of the project’s long-term commitment has to be moderate-to-long cliffs followed by long vesting periods, where the sell-offs are steady and not price-threatening. These elements, if present, showcase the pump-and-dump aversion.

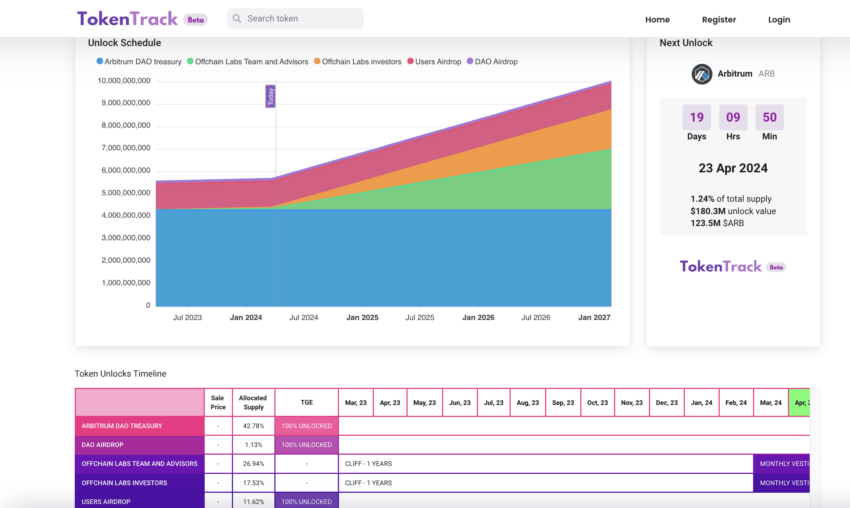

One of the key examples has to be Arbitrum (ARB), a project that boasts a one-year cliff followed by a steady three-year vesting period. Some projects might not have a cliff but instead a steady vesting percentage, for example, Illuvium’s 1.25% each month between March 2022 and March 2023.

A lack of insight related to vesting schedules can be a scam warning sign. Mostly, deceptive tokens that lead to rug pulls offer no clarity regarding the cliff or the vesting timeline.

Besides, lessons from crypto failures like that of the Terra-Luna ecosystem showcase that far-reaching algorithmic balances and pegs intended to create an artificial supply-demand balance are prone to massive risk.

How to vet scam projects using competitor analysis

A project might have good intentions. Yet, it might still not succeed if there is a good enough product to beat its competitors. To understand more about taking a competitor-specific approach, look for these elements:

- The project at least has the same set of products and services the competitors offer, plus more.

- Clear and unique distinguishing factors

- Check if the team owns patents, at least two, or any intellectual property

One of the projects with a patent to its name is Unstoppable Domains — a blockchain-specific domain provider.

Payment providers and solutions must also keep a close eye on the credibility of a token or a project before listing it on their platform. You do not want to pay scam tokens to merchants via payment providers, and even store owners should only want to deal with legitimate crypto to avoid being rug-pulled or even worse.

BeInCrypto spoke with Aharon Miller, COO of Oobit — a pay-with-crypto solution. We asked Aharon about the type of due diligence process Oobit, or any other payment service provider, might need to follow in a world where scam tokens are the new normal. Here is what Aharon exclusively told BeInCrypto.

“Oobit is very exclusive with the token it supports. We’re looking to only add about 10 a year. These tokens must have proper liquidity and a strong community behind them with a proven track record. We undertake thorough due diligence measures to ensure thatonly reputable and legitimate tokens are featured on Oobit.

Currently, our app supports a curated selection of top cryptocurrencies, including BTC, ETH, USDT, USDC, BCH, and our latest addition, VET. Each token undergoes rigorous vetting according to regulatory standards and an assessment of the issuing company’s history and credibility.

Our selection criteria prioritize tokens with real-world utility, aligning with our mission to empower users in their everyday transactions. Take, for instance, our recent integration of VET into Oobit’s Tap & Pay feature, which enables users to utilize VET for everyday transactions.

Aharon Miller, COO and Co-Founder of Oobit: BeInCrypto

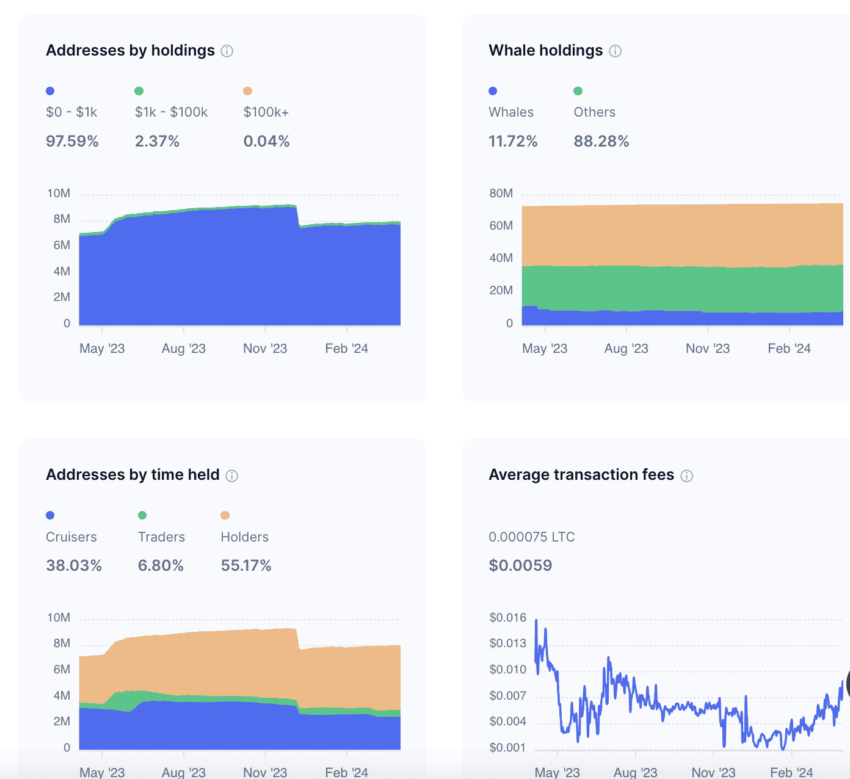

How to vet scam projects using on-chain analysis

While our framework covers most of the project tracking concerns, having experience with on-chain tools can be useful when identifying a crypto project’s legitimacy. Notably, even CEXs, payment providers, and angel investors track on-chain data to make decisions regarding listing, integration, and investment.

Here are a few metrics that can come in handy:

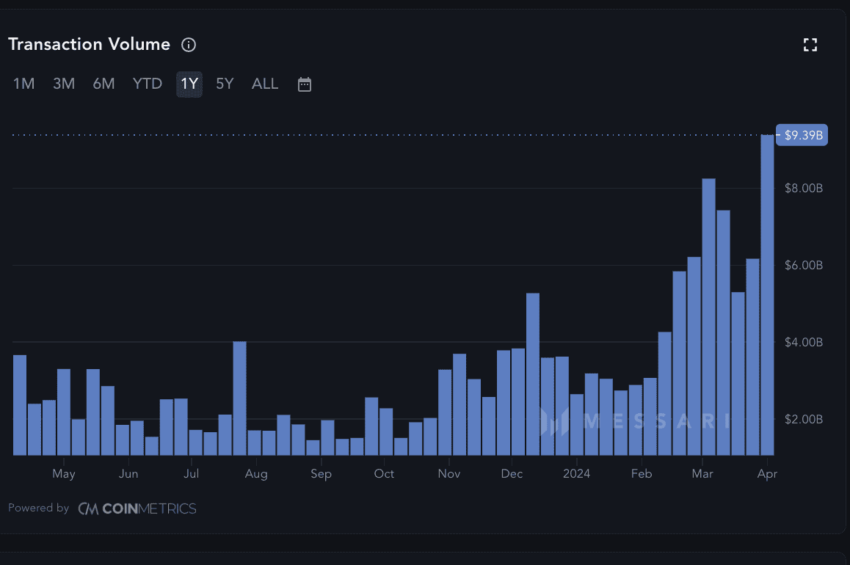

Transaction volume and token distribution patterns

The trick here is to keep checking the transaction volume associated with a newly listed token and see if there are any abnormal spikes to account for without sentimental drivers, such as news events. This might even indicate wash trading scenarios. Plus, if you delve deeper into the analytics, you might even locate the token distribution pattern.

If a small number of addresses hold most of the project’s tokens, things can go wrong really quickly.

How to vet scam projects by checking ‘Holder’ behavior

As mentioned, a higher concentration of the project tokens across a few addresses can be a red flag. However, you can use Nansen’s God mode interface to check for the behavior of these addresses. Unless there is an airdrop preceding the token listing, massive sell-offs or movement to exchanges can hint at shady business.

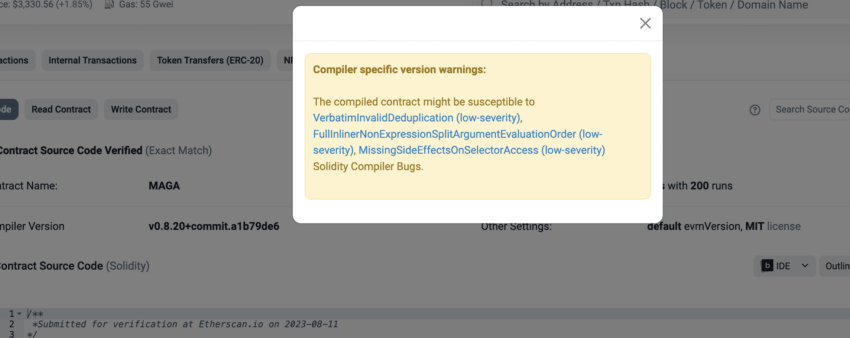

Smart contract analysis

A closer look at the smart contract of a project, or rather the contract address, tells a lot about its credibility. You can find this information on explorers like DappRadar. This allows you to locate red flags like unlimited mining capabilities, obscure triggers associated with token minting, and more. If you see any code-related warning signs, it is best to stay away.

Network health

If a project has been around for a while, it is necessary to keep tracking its health and growth metrics, including active addresses, smart contract interactions, and other insights that can show how solid the trends are.

Developer activity

If the concerned project has a developer base, as revealed during the launch, you can keep track of the code commits on GitHub, on-chain developer activity, and other metrics. Any spike in developer activity is good news, but you need to be wary of sudden dips.

Trading patterns

Finally, if you are a trader, tracking the spread — the difference between the bid and ask prices — followed by order book depth and other insights can come in handy. In some cases of intense market volatility, especially near events like Bitcoin halving, multiple looks at the order book can feature as scam warning signs.

These are only a bunch of metrics that you might consider tracking.

How do scam tokens work?

Now that we know about the key on-chain metrics to track scam projects, it is important to quickly understand how scam tokens actually work. This will enable you to use on-chain metrics better.

Scam tokens mostly start with fraudulent ICOs. Even if the ICO goes well, issues related to exit scams, rug pulls, and financial mismanagement are common.

All of that can lead to investor losses. However, on-chain metrics can help. Here is how:

- Track the transaction volume and align it with the token price. Spikes with low value might be indicative of token fraud.

- Deceptive tokens are the ones with whale wallets and very high exchange-specific inflows. This needs to be tracked.

- If the active participation — in the form of active or new addresses — drops while the price increases, you might be looking at an alleged token scam.

- A scam token or a deceptive ICO token might be the one that suddenly experiences massive gas usage for a particular contract. A deeper dive into the contract then becomes necessary.

Quick hacks for the newbies: How to vet scam projects quickly

Scam tokens aren’t just about the project team running away with investor funds. In most cases, these can be fraudulent ICOs, insolvency in crypto where exchanges and other bodies shut down their operations, cryptocurrency bankruptcies like the FTX implosion, and projects going back on promises due to regulatory challenges.

Pointers to vet and avoid getting scammed

If you are a crypto newbie and don’t understand every pointer associated with the framework and how to vet scam projects, here are the set of steps you can follow for the time being:

- Analyze the whitepaper and check if there is a lot of technical jargon or not. Copy and paste sections onto a plagiarism-detection tool and see whether the team has really put in the effort or has copied elements.

- Review the code on GitHub using ChatGPT or other AI-based tools.

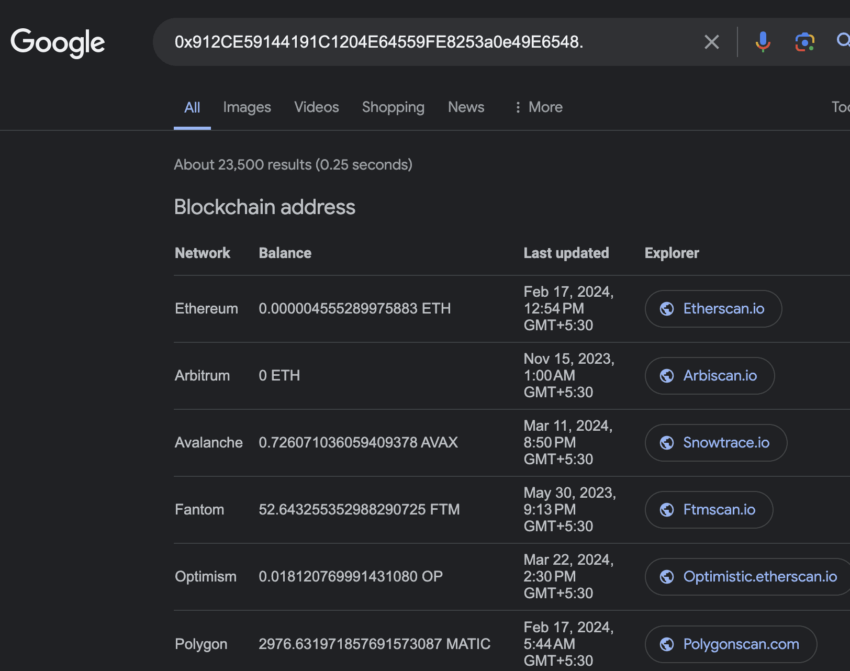

- Review the wallet address of a project by searching the same using Google’s console. If the public address doesn’t return any data, you might be looking at a possible token fraud.

- Closely analyze the project’s social media handles, including X, and check the quality of followers. If you see bots, you might just be staring at red flags.

- If the project launched the token a while back, check how many DEXs it trades on. If there is CEX visibility, the token is more likely to be legit, as CEXs follow a more stringent set of checks.

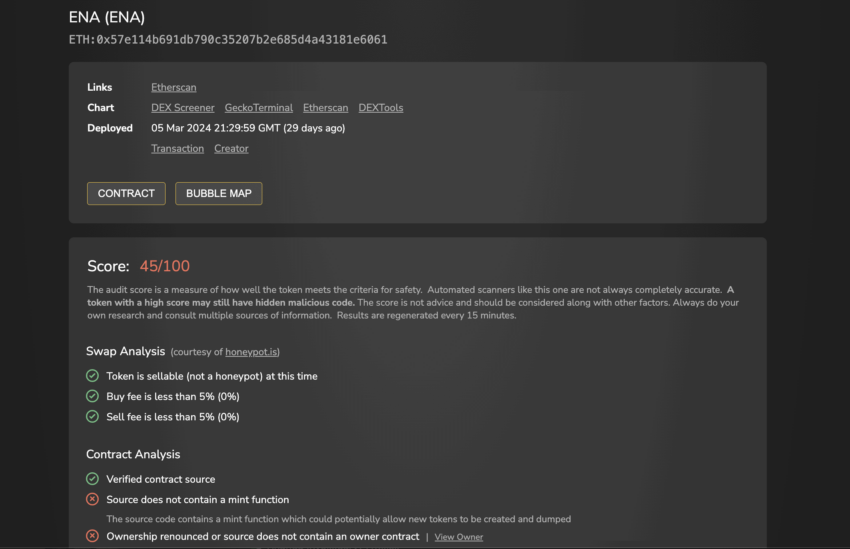

- Check the crypto you are investigating on a token explorer like DappRadar, open the set of contracts, and check for any warning signs. This makes avoiding crypto scams easy.

Crypto newbies can even track X handles like that of Coffeezilla and Zach XBT to gain proactive insights about crypto scams.

Common crypto scams

Here are some of the top crypto scams often led by project owners. Do note that apart from these listed schemes, the ecosystem also suffers from standard hacks and malpractices led by individuals and groups eyeing unsuspecting crypto wallets.

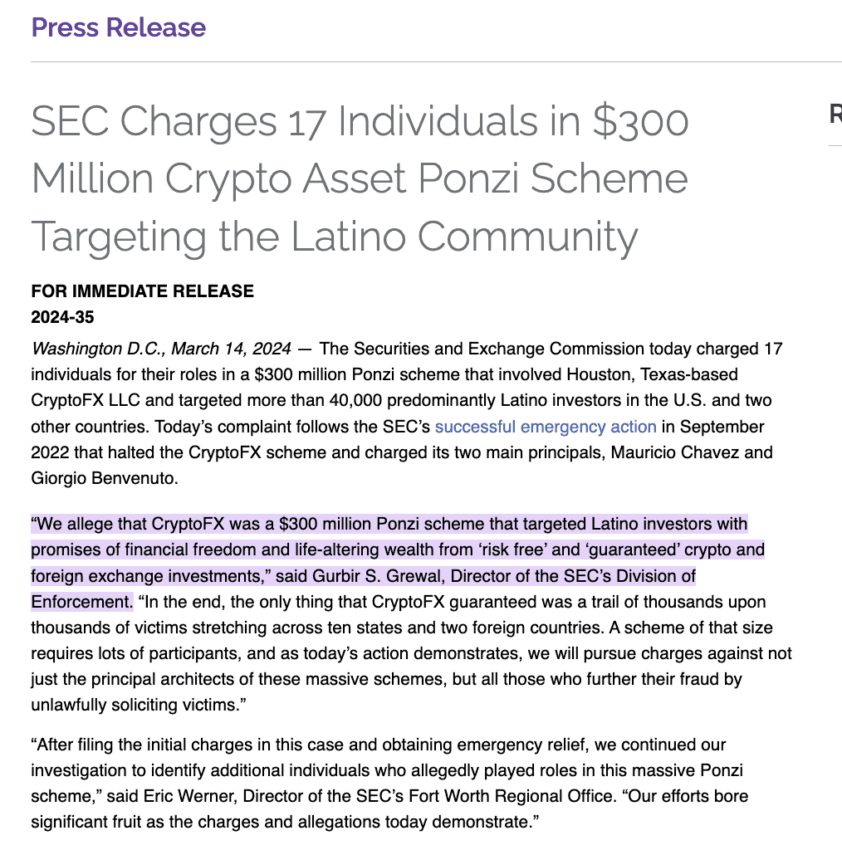

Ponzi schemes

These team-led baits are masqueraded as High Yield Investment Programs or HYIPs and are sold to investors as 10x profit schemes. These projects are often marked by excessive marketing on channels like Telegram and X, with the focus primarily on expected price surges.

Fake websites

This is where fraudsters create fake websites and deceptive tokens to bait users. The idea here is to mimic legitimate projects. Always verify links via official handles, which are available on platforms like CoinMarketCap.

Token stealing

Token stealing happens if you interact with fake websites, wallets, or buggy smart contracts. From standard hacking to phishing, unscrupulous individuals mostly employ token-stealing strategies to get hold of your legitimate tokens.

Token spoofing

Spoofing is when a fake version of a legitimate crypto project is created, with most traits, UI, and other elements mimicked. As the counterfeit or scam tokens can easily make their way to a DEX, investors who haven’t done their due diligence might purchase these instead of the legitimate crypto.

A quick thread on spoofing:

You can use token sniffers to keep issues like token spoofing at bay. If the token is listed on any token aggregator with a contract address revealed, you can feed the account address into the sniffer to get details.

Besides these attacks, you should also keep an eye out for rug pulls, pump-and-dump schemes, and fraudulent ICOs.

Notably, if you do fall victim to a scam, efforts associated with recovering funds are often futile and almost always require taking a legal route. Therefore, it is advisable to follow this framework to the letter and stay ahead of the diverse risks that still come part and parcel with the crypto industry.

You identified a scam: What next?

Even though it is advisable to rely on reputable exchanges for purchasing new tokens — especially CEXs due to their strict focus on legitimacy — following our detailed how-to-vet scam projects framework can immunize you against rug pulls, exit scams, and more. If using the framework lets you locate a few shady projects and scam warning signs, it is your responsibility to report them to concerned regulatory authorities in order to protect other unsuspecting users.

Frequently asked questions

How do you find a crypto coin is real or fake?

How do scam airdrops work?

How do you check if a token is locked?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.