Ethereum was created in 2014 not to rival Bitcoin as digital money, but to provide a decentralized financial ecosystem or the ‘world’s computer’ as it has since been dubbed. Over the past five years, it has evolved into the largest blockchain-based programmable network and decentralized application platform in the world.

A non-profit organization called the Ethereum Foundation was formed on July 6th, 2014 and registered in Switzerland. One of the founders, young programmer Vitalik Buterin, envisioned a different way of developing a blockchain network to be more than just a payment system.

A crowdsourcing campaign was launched in the same year where participants were sold Ethereum tokens called Ether, or ETH, to get their vision off the ground. Over $18 million was raised and the first live release of Ethereum known as Frontier was launched in 2015.

What is Ethereum?

Ethereum is an open-source public network and service that uses distributed ledger technology to facilitate autonomous instruction sets, or smart contracts, and cryptocurrency trading without a centralized third party.

The platform also allows developers to deploy decentralized applications, or dapps, making it more analogous to an operating system rather than just a straight form of digital money.

The Ethereum whitepaper described it as a ‘blockchain with a built-in fully fledged Turing-complete programming language that can be used to create “contracts” that can be used to encode arbitrary state transition functions’.

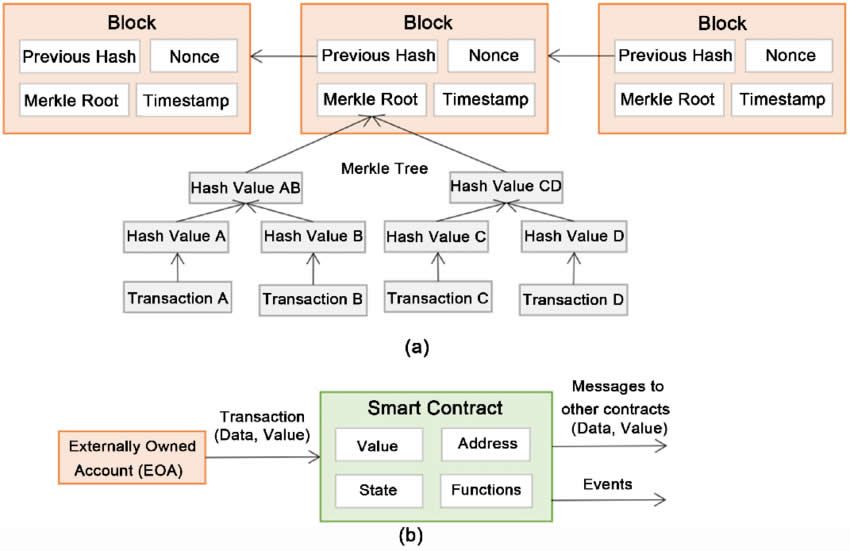

Ethereum can have two types of accounts, privately owned and managed accounts that individuals (or exchanges) use to hold and transfer Ether, and contract accounts which are used to run smart contracts and dapps.

According to bitinfocharts the size of Ethereum’s blockchain at the time of writing (April 2020) is 270 Gb which is around 85% of the current size of Bitcoin’s blockchain.

Ethereum Transfers, Block Times and Confirmations

Ether can be transferred the same way as Bitcoin from one cryptographic address, or wallet, to another. Transfer times largely depend on network load and general usage, as with BTC they will slow down under heavy load. The most memorable example of this was in late 2017 when the virtual cat swapping game ‘CryptoKitties’ ground the Ethereum network to a halt.

Currently, transfer times can range from around 15 seconds to five minutes, they are at the lower end of this range under normal network load. Confirmations are the act of the transaction being included in a block on the blockchain. In general, Ethereum transactions are considered successful and immutable after six confirmations.

Average block times, which are the times taken to add a new block to the chain, are currently around 13 seconds according to blockchain explorer Etherscan. Bitcoin in comparison has an average block time of around ten minutes.

Ethereum blocks are variable in size and much smaller than Bitcoin’s, on average 20 to 30 kb in size. BTC blocks are fixed at 1 Mb in size which makes Ethereum a faster network in terms of performance though as it has grown, scalability concerns have arisen.

Ethereum Consensus

The current Ethereum network, ETH 1.0, uses proof-of-work consensus though the future of the platform includes a migration to a new proof-of-stake blockchain. The Serenity roadmap has had a number of setbacks over the past year or two but the first phases are expected in late 2020 or 2021.

The current consensus algorithm is called Ethash and has been built specifically for the Ethereum blockchain. It employs a system called ‘memory hardness’ which dictates that computational performance is limited by how fast the machine can move data around in memory, as opposed to how quickly it can perform calculations. The notion behind this was to prevent large organizations, specific hardware, or big mining pools from gaining too much influence over the network.

Mining Ethereum

Typically, Ethereum mining uses computational power to solve complex mathematical problems providing the proof-of-work which verifies Ether transactions. The process also includes the creation of new ETH tokens with a block reward that diminishes over time, as is the case with Bitcoin.

Around every 13 seconds a miner finds a block but if they start to solve these problems quicker or slower than this, the algorithm automatically readjusts the difficulty of the problem so that it returns to roughly the 13 second solution time.

The additional memory requirement determined by the Ethash algorithm prevents the dominance of one type of ASIC mining machine. Application-specific integrated circuit hardware currently dominates the Bitcoin mining industry which has resulted in geographical centralization concerns since Chinese corporations are the major manufacturers of the hardware. This isn’t the case for Ethereum mining.

Ethereum can be mined with graphics processing units though profitability is determined by the number and power of them along with electricity costs so it is no longer generally profitable to mine as an individual.

As a result, Ethereum mining pools are a popular way to mine Ether as hash power is combined and payouts are made more frequently and in smaller denominations. Some of the most popular mining pools for Ethereum at the moment are Sparkpool, Ethermine, and NanoPool.

Ethereum hash rate, which is the computational horsepower of the network, varies as it does with Bitcoin. According to bitinfocharts it hit a peak of almost 300 TH/s (terahashes per second) in August 2018 and is currently around 180 TH/s at the time of writing (April 2020).

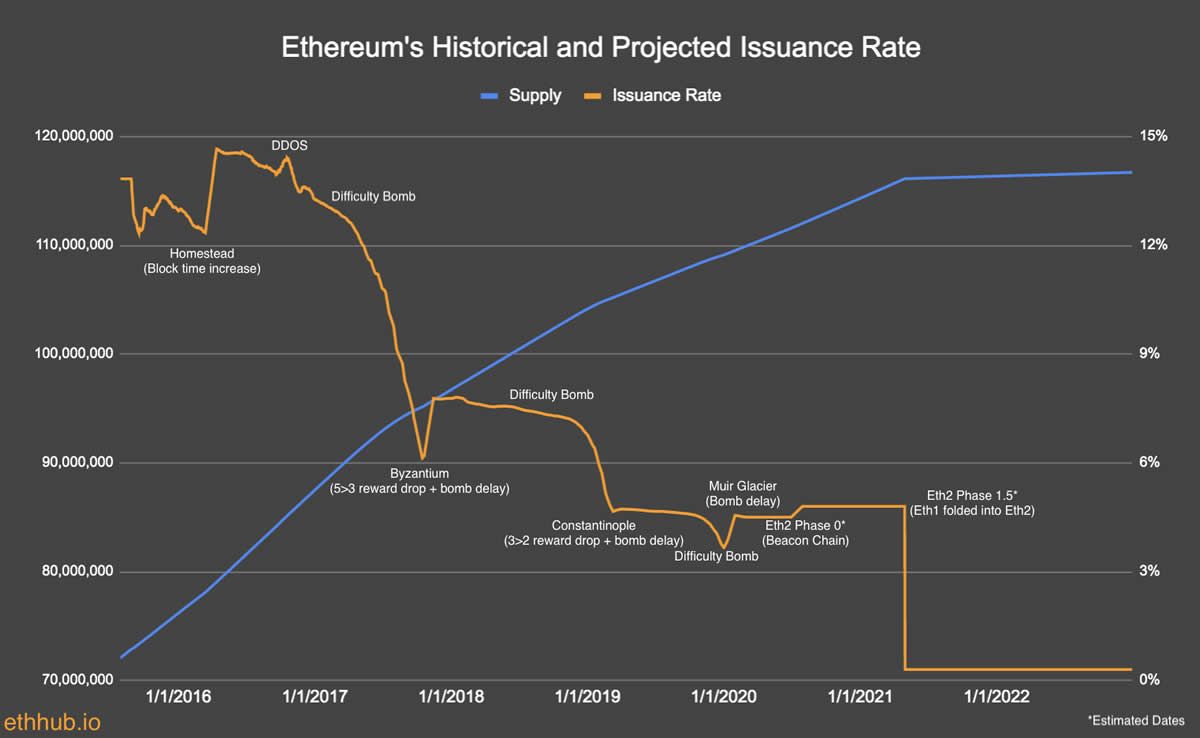

Ethereum difficulty is a measure of how problematic it is to find a hash below a given target. A mechanism called the ‘difficulty bomb’ maintains an average block time by manipulating the mining difficulty required to produce a new block. The difficulty bomb incrementally adds to this mechanism every 100,000 blocks until it ‘freezes’ in what is known as an ‘ice age’.

The original notion was to introduce a disincentive for miners working on the PoW chain when it finally switched to PoS but due to a number of development delays this difficulty bomb has also been delayed.

Ethereum Smart Contracts

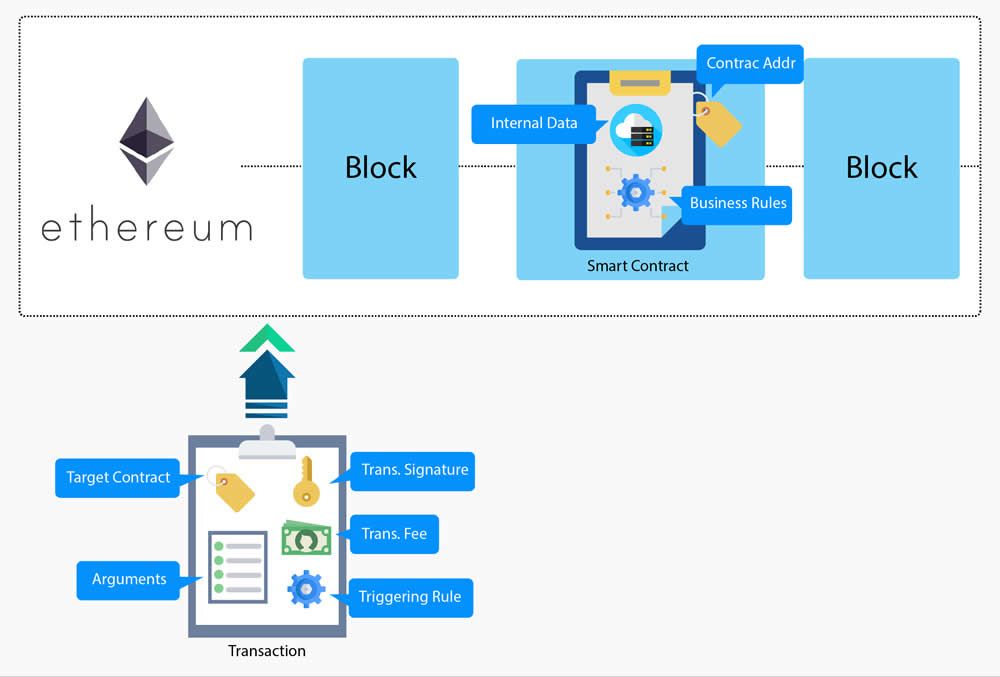

The definition of ‘smart contract’ is a self-executing agreement with the terms between two or more parties being directly written into the code. They are programmed to digitally facilitate, verify or enforce the negotiation or performance or a contract without third-party intervention.

The agreements and code within the smart contracts are distributed on the decentralized blockchain making the transactions irreversible and traceable. In 1994, cryptographer Nick Szabo coined the term defining it as “a set of promises, specified in digital form, including protocols within which the parties perform on the other promises.”

Ethereum is currently the world’s largest smart contract platform and the industry standard for such protocols. These programs run deterministically and are executed by the Ethereum Virtual Machine (EVM). The EVM creates a ‘bridge’ between the executing code and the executing machine which improves the portability and interoperability of the software.

The most common programming language for smart contracts is Solidity, which is similar to JavaScript and C++, however, Vyper and Bamboo languages are also used.

Ethereum Fuel

As with many other crypto platforms, Ethereum needs ‘fuel’ to power its transactions and operations. In this case it is called gas which is a unit referring to the amount of computational effort that it will take to execute certain operations.

All operations on the Ethereum network, from executing a smart contract to a tiny ETH transfer, require some amount of gas. The miners get rewarded in Ether which is equivalent to the total amount of gas it has taken them to execute a complete operation.

The exact price of the gas, or the specific transaction fee, is determined by the miners who can decline to process a transaction if the gas price does not meet their threshold. The higher the gas price, the better priority the operation will have, and the faster the transaction will be processed by the miners.

The Ethereum gas tracker shows current rates and estimated transaction prices in USD equivalent.

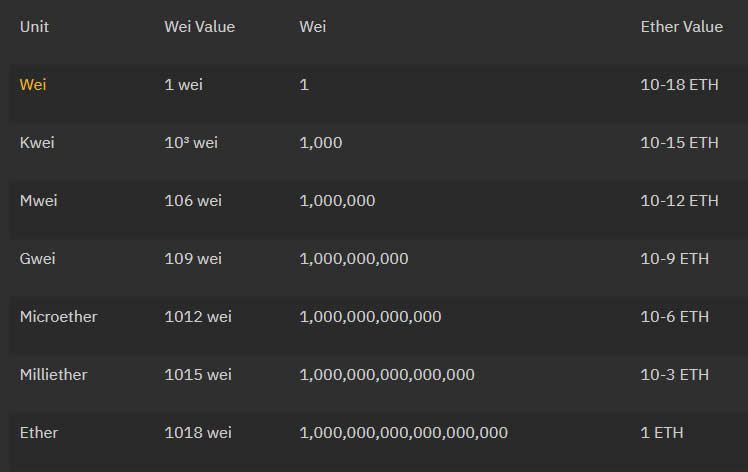

Gwei is another component of Ethereum and is considered to be a denomination unit of ETH. When working with gas, Gwei which is also called nanoether, is the typical unit of conversion into Ether. A unit of Gwei is defined as one-billionth of an Ether so 1 Gwei = 0.000000001 or 10^9 ETH. Gwei is comparable to coins, a little like satoshis to Bitcoin, whereas Ether is the equivalent of banknotes.

When conducting transactions on the Ethereum network, the larger number of Gwei allocated will result in a faster transaction time. If time is not of the essence, a smaller Gwei fee can be applied resulting in a longer transaction time.

There are smaller denominations of Ether with the smallest being Wei which is 10^18 ETH. The full list of denominations can be found here.

Ethereum vs Bitcoin

Ethereum has often been compared to Bitcoin but in essence they are two completely different systems that share some similarities. There is a lot of tribalism in the crypto community over those that favour one over the other but the reality is there is plenty of room for both.

Bitcoin was created to be a decentralized peer-to-peer digital form of money whereas Ethereum is more of a second generation blockchain, or complete financial ecosystem, rather than just a single currency.

They both share the backbone of a distributed ledger, or blockchain, and they both currently operate on a proof-of-work consensus algorithm though Ethereum will soon migrate to proof-of-stake. They both have coins or tokens that can be traded on exchanges or peer-to-peer, and they are both decentralized.

Over the past couple of years Bitcoin has evolved into a store of value or ‘insurance policy’ against economic uncertainty, and t has often been labeled ‘digital gold’ for this reason. Ether was intended to complement rather than compete with Bitcoin as it was designed to be a platform to facilitate immutable, programmatic contracts and applications via its own currency.

Ethereum Use Cases

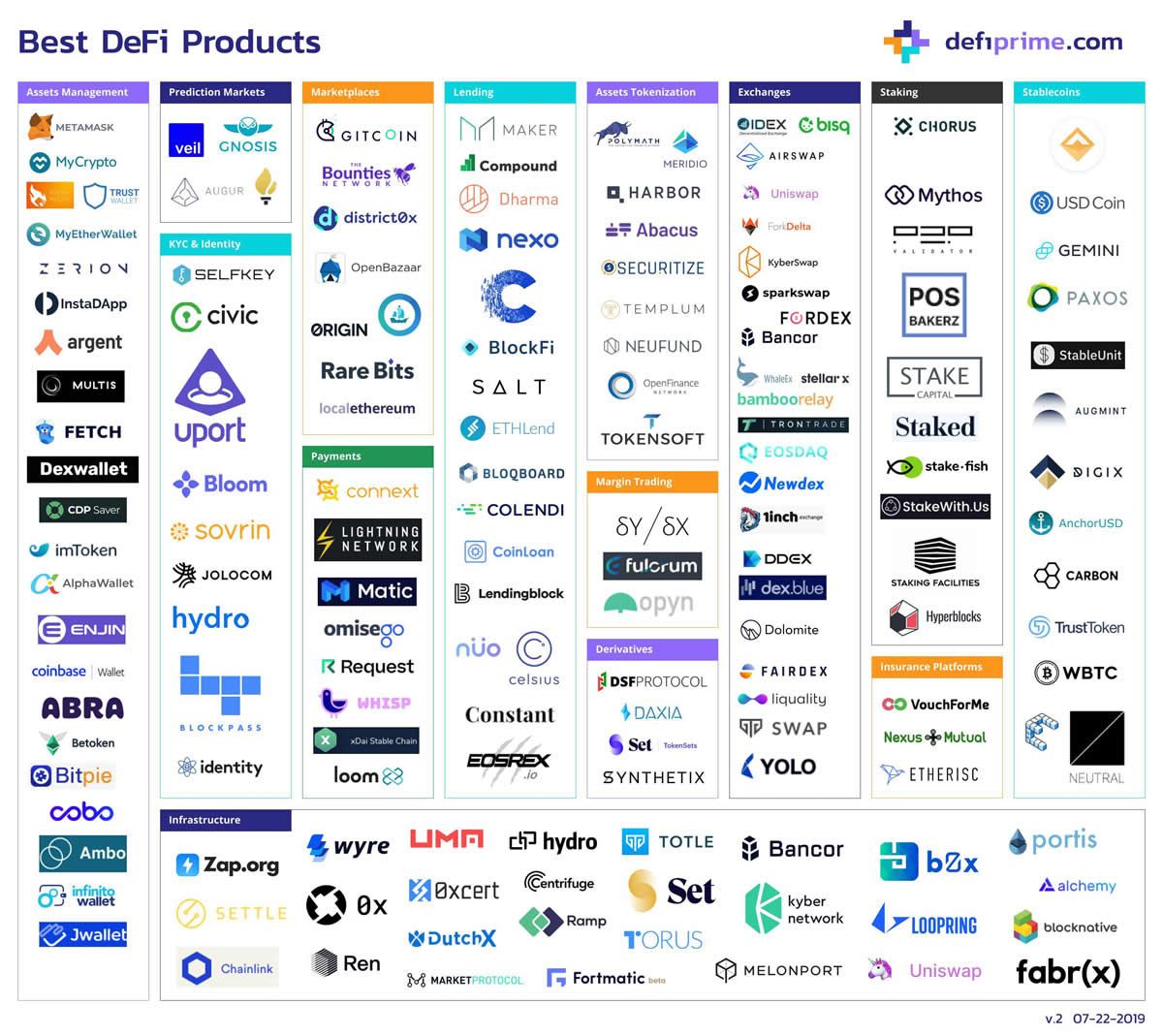

Ethereum has a number of use cases but the largest and most significant one to emerge in recent years is decentralized finance or DeFi.

This fledgling industry involves the collateralization of digital assets in order to fuel a decentralized borrowing and lending ecosystem. Ethereum has emerged as the backbone for this industry due to its smart contract capabilities which are perfectly suited to digital loans and interest payments.

In essence, Ethereum gets deposited as collateral into a growing number of DeFi platforms and decentralized exchanges (DEXs) to either earn interest or take out a loan. No middleman, broker or banker is needed as the smart contracts govern the system on the blockchain.

Ethereum is also the world’s leading decentralized application platform with more dapps and developers than any other at the moment. Rivals have emerged in recent years which include EOS, Cardano, Tron and NEO but Ethereum remains the industry standard.

According to Ethereum blockchain solutions provider ConsenSys, there is a growing number of use cases for Ethereum for enterprise and governmental institutions. These include institutional capital markets, asset management, and global trade and commerce.

Additionally, with Ethereum’s properties comes an entirely new world of gaming, non-fungible digital assets, prediction markets, and countless tokens and stablecoins that are being built on its battle-tested ERC-20 protocol. Add to this entire decentralized autonomous organizations (DAO’s) that can function like societies or corporations.

The Future of Ethereum

Ethereum is only five years old but it has come a long way since its early beginnings. The biggest thing to happen to the network in the next year or two is the transition to proof-of-stake consensus with the Serenity upgrade to ETH 2.0.

This will allow Ether holders to stake 32 ETH in return for rewards rather than miners using computers to churn out calculations under the current proof-of-work algorithm. Staking offers a number of advantages such as a drop in power usage, reduced necessity to produce as many coins which will lower issuance, and lowering of centralization concerns from mining cartels.

In addition to the consensus upgrade, there will be a number of features on the new blockchain which will increase scalability, security and speed. These include side chains or sharding, major upgrades to the EVM which processes smart contracts, and client updates to reduce the load on the primary chain.

A document highlighting the initial phases of ETH 2.0 has been published here.

Frequently asked questions

What is the EVM?

What are Ethereum smart contracts?

How does Ethereum differ from Bitcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.