The 2024 Bitcoin halving has cut miner rewards from 6.25 BTC to 3.125 BTC, reducing the influx of new Bitcoin. While this scarcity aims to boost prices, miners face profit challenges, leading to potential market shifts. Understanding how this halving impacts supply, miner behavior, and price trends is crucial for navigating the post-halving market.

KEY TAKEAWAYS

• The 2024 Bitcoin halving reduced miner rewards to 3.125 BTC, creating scarcity but also causing short-term profitability challenges for miners.

• Key indicators like Stock-to-Flow, Hash Ribbons, and NVT Ratio can help investors assess post-halving price trends and market dynamics.

• Bitcoin halving signals long-term growth but introduces short-term volatility, miner capitulation, and increased competition in mining profitability.

- What is Bitcoin halving?

- Bitcoin halving and the fundamentals

- Bitcoin halving: the mechanics

- Are the BTC halving dates fixed?

- Should I invest in Bitcoin before or after halving?

- Indicators connected to Bitcoin halving

- How does halving impact miner profitability?

- Does Bitcoin halving come with concerns?

- What does Bitcoin halving mean for crypto?

- Frequently asked questions

What is Bitcoin halving?

Bitcoin halving is a programmed event that occurs roughly every four years. It cuts the rewards miners receive for adding new blocks to the blockchain by half. This process limits the rate at which new Bitcoin enters circulation, creating scarcity over time. Halvings continue until the maximum supply of 21 million Bitcoin is reached, which is expected around 2140.

Each halving reduces the block reward, making mining less profitable for some, but the scarcity effect often plays a key role in influencing Bitcoin’s price behavior.

Bitcoin halving and the fundamentals

To understand how crucial Bitcoin halving is, we need a quick refresher. Understanding how Bitcoin was meant to work as part of Satoshi Nakamoto’s vision is instrumental in gauging the importance of this seminal event.

Bitcoin mining

Bitcoin mining involves miners solving complex problems to validate transactions and add them to the blockchain. In return, they receive BTC as a reward. This system is called proof-of-work (PoW), where miners perform real work to secure the network.

Satoshi Nakamoto introduced Bitcoin halving to control the rate at which new Bitcoin enters circulation, ensuring the supply doesn’t grow too quickly.

Rewards and issuance

When Bitcoin was launched in 2009, miners earned 50 BTC per block. However, the reward is halved for every 210,000 blocks mined.

As of 2024, post-halving, the reward stands at 3.125 BTC. This gradual reduction is meant to limit Bitcoin’s supply, encouraging the network to rely more on transaction fees for sustainability.

Decentralization

Halving plays a key role in maintaining Bitcoin’s decentralized nature. By reducing rewards, it shifts miners’ focus toward transaction fees and ongoing participation. This keeps the network secure and ensures no single party dominates through mining rewards. With each halving, the competition among miners increases, fostering a decentralized and secure environment.

Did you know? After the 2024 halving, Bitcoin’s hash rate reached an all-time high despite initial drops due to miner capitulation. Increased adoption of next-gen mining hardware and advancements in energy efficiency have driven the hash rate higher, further securing the network.

Security, incentives, and consensus

Besides fostering decentralization, Bitcoin halving also contributes towards several other network traits, including:

- Improved network security as miners are expected to put in more work to increase their chances of earning.

- As direct rewards continue to decrease, pooling node power is discouraged. This means that more Bitcoin nodes are expected to exist over time, making the network more decentralized and secure.

- As miners, courtesy of issuance reduction, need to put in more work, halving can make mining hardware and computing power more elusive and popular over time.

Computing power, also known as hash rate, is also related to the Bitcoin halving cycle. Here’s how.

Hash rate and halving

Bitcoin’s hash rate, which measures computing power, often fluctuates after halving. As rewards drop, some miners may stop operations, temporarily lowering the hash rate. However, Bitcoin’s difficulty adjustment ensures that mining remains feasible by recalibrating the effort needed to mine a block. This process helps maintain network security and attracts new miners over time.

Here is a quick demonstration of how it all works like clockwork:

As direct issuance drops, non-profitable miners often shut down rigs, lowering the hash rate. However, Bitcoin’s self-upgrading difficulty adjustment mechanism carefully tracks the changes in hash rate after every 2,016 blocks and typically lowers the same after every two weeks post-halving.

This makes it easier to mine BTC, bringing new players into the mix. And once new miners and their gear come into the scheme of things, the hash rate starts to go up again.

Overall, Bitcoin’s halving schedule and difficulty adjustment strategy aim to restore the profitability equilibrium despite declining issuance. This mechanism is what keeps the network secure and miners interested.

Bitcoin halving: the mechanics

Bitcoin’s maximum supply is limited to 21 million BTC, with halvings occurring after every 210,000 blocks, roughly every four years. The initial block reward in 2009 was 50 BTC, and after the 2024 halving, the reward is now approximately 3.125 BTC.

This programmed reduction continues until all Bitcoin is mined by around 2140. The Bitcoin halving countdown considers all of these scenarios, ensuring accurate timing for the event.

Each halving reduces the number of new Bitcoin entering the supply, slowing inflation and increasing scarcity, which is central to Bitcoin’s design for long-term value retention.

Following the end of Bitcoin’s halving timeline, economic incentives will all be fee-specific and have nothing to do with direct rewards.

Impact on inflation

As of September 2024, following the latest halving, Bitcoin’s block reward stands at approximately 3.125 BTC, with an annual issuance rate of about 1,642,500 BTC.

This results in an estimated 0.84% inflation rate compared to the 1.85% pre-halving rate. The reduction in issuance strengthens Bitcoin’s position as a deflationary asset, especially compared to fiat currencies, which often aim for a 2% inflation target.

Updated issuance calculation:

- Current block reward (September 2024): 3.125 BTC

- Projected annual issuance after halving: 3.125 BTC * 144 blocks/day * 365 days = ~1,642,500 BTC

- Current Bitcoin supply (September 2024): ~19,500,000 BTC

- Current inflation rate (September 2024): 1,642,500 / 19,500,000 = ~0.84%

Bitcoin’s hard-coded halving cycles ensure that inflation remains manageable, making it a strong alternative to currencies subject to uncontrolled money printing.

Did you know? The difficulty adjustment timeline of 2,106 blocks is a measure to keep the average block creation time at 10 minutes.

Are the BTC halving dates fixed?

Not exactly. Bitcoin’s halving timeline depends on the block count. The event happens after every 210,000 blocks. Each block can take approximately 10 minutes to form, which translates to the 4-year theory.

While the 2024 BTC halving timeline is almost set, we have specially drafted a timeline-specific chart till the 13th halving event to help you fine-tune the long-term investment plans. This chart might even come in handy if you want your grandchildren to hold onto some BTC!

Should I invest in Bitcoin before or after halving?

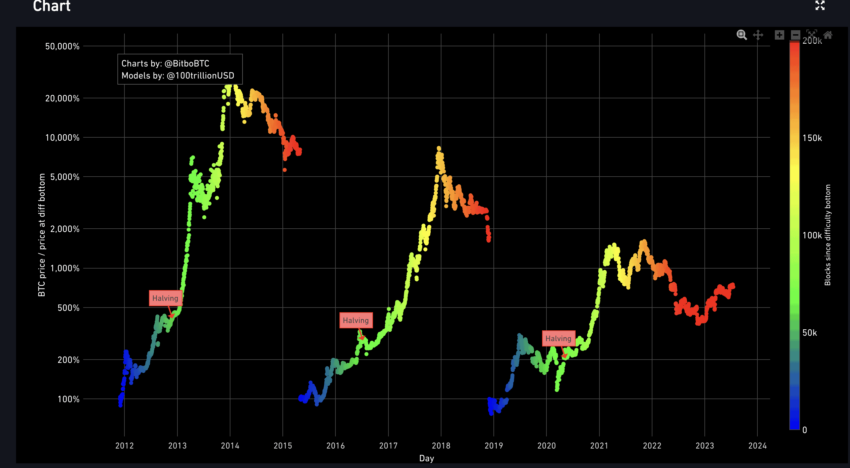

Investing in BTC before or after a halving has always been speculative. A more balanced approach is to look at the historical patterns of previous halving events and how prices reacted over time to strategize your next steps better.

2012 (approximate price points)

The first event happened on Nov. 28, 2012, with the price of BTC at almost $11, 30 days prior to halving. Over the next 30 days, the price went up to $12. However, close to November 2013, BTC was trading at approximately $1,150, translating close to 10,000% in gains.

2016 (approximate price points)

The second halving event on July 9, 2016, saw the prices move from $650 to $600 (approximately), one month between the events. However, by July 2017, BTC was trading at almost $2,500 — translating to almost 300% in year-on-year gains.

2020 (approximate price points)

The last halving event happened on May 11, 2020, when the prices of BTC were trading between $8,500 and $9,500, one month before and after halving. Yet, we all know where the prices moved to by May 2021. At close to $56,000, BTC had amassed almost 500% in gains.

While we will not be speculating future prices, post-halving price surges for BTC have been steady and sustained in previous cycles.

2024 analysis

Now, in September 2024, just months after the latest halving in April, Bitcoin has seen a price increase, but volatility remains. It’s crucial to evaluate this post-halving period with patience, as historical patterns show that it can take several months to a year for the full impact of a halving to materialize.

However, riding these price waves wouldn’t make sense if you do not consider the following factors:

Hype cycles

It is important not to pay a lot of attention to social media talk around halving. There can be conflicting expectations surrounding the investors, and different social handles might present narratives differently. The best way is to cut out anything that happens three months prior and three months after the event.

Risks and drawdowns

We can expect the price of BTC to go through periods of volatility, anywhere between 6 to 12 months post-halving. This is due to the fact that the supply shock and miner dynamics take some time to kick in.

“Bitcoin halving cycle theory predicts bull markets after each halving, but external factors & market cycles can overshadow its impact.”

Gert van Lagen, Technical Analyst: Twitter

Besides hype cycles and risk management, long-term investors must prioritize risk tolerance, a diversified trading strategy, and alignment with market sentiments before proceeding.

Indicators connected to Bitcoin halving

We can better understand Bitcoin’s halving cycles with the help of a few important indicators. As an aspiring or even an experienced trader/investor, you should keep a closer eye on these indicators to better ascertain the price moves and possibilities:

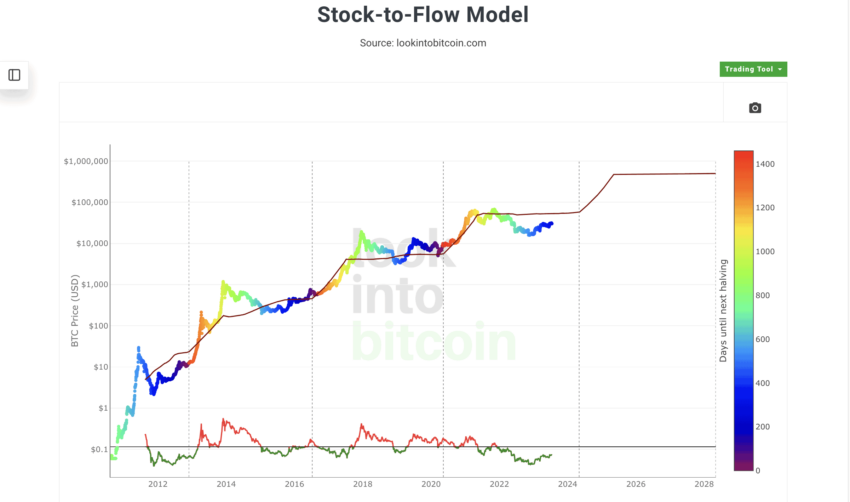

Stock-to-Flow

Bitcoin S2F, or the Stock-to-Flow model, furthers BTC’s scarcity narrative. As halving is a supply-restricting implementation, the S2F model projects a price rise around the event.

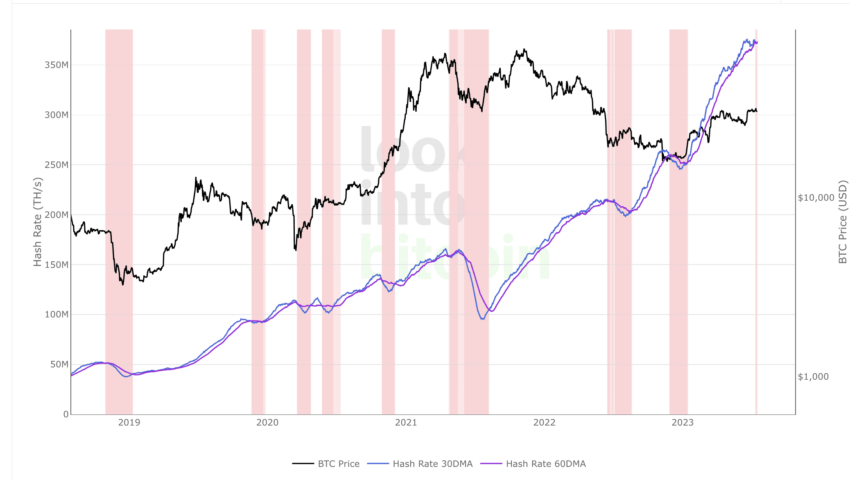

Hash Ribbons

This indicator uses the moving averages related to Bitcoin’s hash rate to locate bearish and bullish trends. Much like a standard moving average crossover strategy, the 30-day MA moving under the 60-day MA signals a bearish trend.

Hash ribbons take a more conservative approach to post-halving price rises, as miners take some time to get back into the mix.

Realized HODL Ratio

This is an on-chain metric representing the ratio between long-term and short-term holders.

During halving, the ratio tends to increase as long-term focus increases, and short-term offloading happens as part of the buy-the-news, sell-the-event narrative.

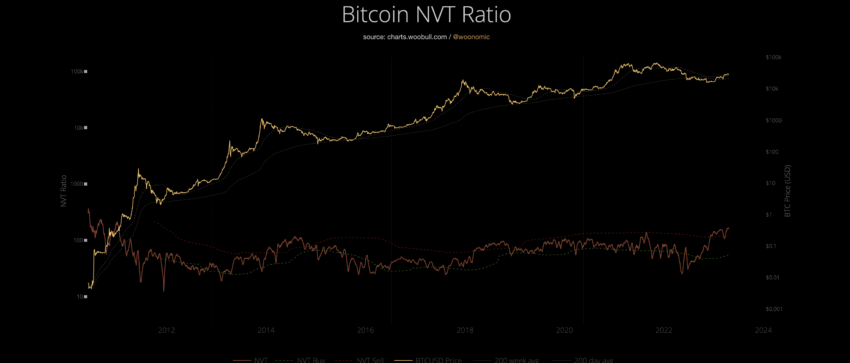

NVT Ratio

NVT, or the Network Value to Transaction Ratio, is a metric that tells whether an asset is oversold or overbought. It is a comparative ratio of BTC’s market cap and transaction volume.

Did you know? Around halving, the ratio seems to spike as the market cap increases due to speculative inputs, but the network activity stays nominal as it isn’t that easy to boost on-chain network activity.

Around halving, the ratio seems to spike as the market cap increases due to speculative inputs. Still, the network activity stays nominal as it isn’t that easy to boost on-chain network activity.

A higher NVT ratio signifies an overbought zone, and the extent shows which point closer to the halving is better to exit or even enter.

Keen to learn more about investing around Bitcoin halvings? Check our in-depth Bitcoin halving investment strategy guide here.

How does halving impact miner profitability?

Bitcoin halving directly affects miner profitability due to the reduction in block rewards. With rewards now at 3.125 BTC per block, miners have seen revenue drop, but the network is expected to stabilize as mining difficulty adjusts over time.

Key miner metrics post-2024 halving:

- Hashrate: A drop in hash rate post-halving has created opportunities for new miners to enter as the difficulty lowers.

- Difficulty: This metric will likely fall in the weeks following the halving, restoring profitability as less competition remains.

- Hash Price: Lower hash prices can indicate mining profitability and efficient operations are key to maintaining margins.

- ASIC efficiency: Post-halving, miners must focus on hardware efficiency to reduce operational costs and stay competitive.

Impact on mining hardware

The impact of Bitcoin halving on mining hardware isn’t all that straightforward.

- As block or rather mining rewards reduce, new hardware purchases do not happen all that aggressively.

- Better hardware options lead to higher ASIC efficiency and chances at profitability. This is where miners start reconsidering entry into the space.

- As BTC price increases, which is usually the case post-halving, new mining players come in as their new hardware investments are justified.

Miner capitulation and BTC bottoms

Miner capitulation is an important factor to consider if you wish to identify the price-based potential of a halving event. As a standalone indicator, long-term capitulation often coincides with price bottoms.

However, you must pair the miner capitulation indicator with the likes of difficulty drop, hash rate, and price moves to confirm the actual bottoms.

Also, a period of high capitulation can mean a couple of things. Firstly, it can mean higher selling pressure on BTC. Secondly, it can also mean that weak hands are slowly moving out, transferring the narrative to long-term holders.

Does Bitcoin halving come with concerns?

Bitcoin halving is one of the most hyped events in the cryptocurrency space. And even though halving aims to strengthen the BTC supply-demand model whilst furthering the concept of decentralization, it isn’t without its share of challenges. These include:

- Immediate and short-term volatility in prices.

- A drop in miner profits.

- Risks of miner centralization as larger players might consider clubbing operations to reap even the most minimal chance at profitability.

- Tighter liquidity immediately around the halving events.

- Increase hype and speculations, especially across social media.

- Chances of growing MEV (Maximal Extractable Value) strategies gaining a foothold as with reduced block rewards, miners will start prioritizing high-fee transactions.

In addition to the threats mentioned, growing FUD and FOMO can surface closer to a halving event.

What does Bitcoin halving mean for crypto?

Bitcoin halving is a major event in crypto and can be a bull market catalyst. Yet, while it positively impacts BTC’s supply and price, short-term challenges like declining mining profitability and market uncertainty can arise. Ultimately, halving reflects a growing and maturing market and emphasizes Bitcoin’s distinct and controlled monetary policy compared to traditional fiat systems.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Bitcoin halving events increase price volatility and trading profits are never guaranteed.

Frequently asked questions

The next Bitcoin halving will likely occur around 2028. Bitcoin halvings happen approximately every four years, or every 210,000 blocks. Since the most recent halving occurred in April 2024, the next one is expected to take place in 2028, likely around the same time of year (April or May), depending on block times.

Bitcoin halving in 2024 is a supply-management event that reduced the existing block reward issuance of 6.25 BTC to 3.125 BTC. This issuance cut of 50% is on the expected lines, based on the hard-coded logic of the Bitcoin ecosystem. The halving event also significantly lowered BTC’s annual issuance from the current level of 1.85%.

Previous halving cycles have revealed that the price of BTC has surged 12 to 18 months after the halving event and not immediately. This might be due to the fact that any kind of supply shock takes some time to set in. Also, this lag, regarding price rise, can be attributed to immediate liquidity tightening, as people tend to hold longer post the halving event.

Halving has several positive implications for Bitcoin. The most important one is to help reduce the annual issuance or inflation associated with BTC by controlling the supply schedule. Lowering issuance provides predictability to a network’s or ecosystem’s monetary policy. Also, halving aims at making the miner network more decentralized by lowering reliance on mining rewards and increasing the importance of transaction fees.

Historically, halving is known to affect prices. In the case of Bitcoin, the first halving event that happened in 2012 led to a nearly 10,000% increase in prices within 12 to 15 months. The reason for this price-based optimism could be how halving impacts the supply and demand dynamics, making the same less prone to inflation. However, the price movements post-halving depend a lot on macroeconomic factors.

If previous halving instances are to be considered, the price of BTC moved by close to 10,000% 12 months after the effects of the first halving event settled. Two of the other halving events, 2016 and 2020, saw extended 12-18-month long bull runs. The broader trend suggests that BTC prices move higher after every halving event, but the surge takes time.

Per Bitcoin’s pre-programmed algorithm, there can ever be 33 Bitcoin halvings in total. The first 32 halving events would aim at reducing the block reward issuance from 50 BTC, right at the onset, to 1 Satoshi. The last halving, or the 33rd one, will lower the block limit to 0.5 Satoshi, post which there can be no further divisibility.

There are a lot of factors to consider if you want to mine crypto in 2023. These include looking at and analyzing mining hardware — ASIC for Bitcoin, mining difficulty, electricity costs, and even the prices of the associated crypto. Also, if you want to mine BTC in 2024, do note that the current block reward is still at 6.25 BTC, which would drop by 50% next year.

Bitcoin halving occurs to ensure that the fixed supply of BTC — 21 million — is reached in a controlled manner while controlling the supply issuance by reducing block rewards by half every four years. Notably, a gradual reduction in block rewards makes the ecosystem’s economic model resistant to money debasing and manipulation.

Bitcoin halving is meant to create a supply shortage. However, in July 2023, with over 19 million BTC already in existence, an immediate supply shrink due to halving doesn’t look obvious. Instead, a more conservative take here would be to lower the issuance of BTC, eventually lowering the inflation and paving the way for a deflationary token economics model post-2140.

Bitcoin halving can affect the network’s security by reducing the miners’ incentive due to the halving of block rewards. If the price of Bitcoin doesn’t increase to offset the reduced reward, some miners may exit, reducing the network’s hash rate. This decrease could make the network more susceptible to attacks. However, the overall impact has historically been mitigated by the increase in Bitcoin’s value and transaction fees, sustaining miner participation and network security.

Bitcoin halving plays a crucial role in its economic model by introducing scarcity, as it halves the rate at which new BTC are generated every four years. This process ensures that the total supply of Bitcoin caps at 21 million, creating a deflationary effect. The scarcity, like that of precious metals, alongside steady or increasing demand, can lead to price appreciation. This mechanism aims to preserve Bitcoin’s value over time, making it an attractive option for investors.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.