Binance coin (BNB) is the native cryptocurrency of the BNB Chain, Binance’s blockchain. But what does BNB do, and what role does it play within the Binance ecosystem? This article offers a beginner’s guide to BNB Chain, exploring its features, purpose, and more.

KEY TAKEAWAYS

➤ BNB is a crypto that can be used to trade and pay fees on the Binance centralized exchange.

➤ The crypto allows users to benefit from reduced transaction fees when trading on Binance.

➤ While the asset’s ties to the largest crypto exchange by market cap ensure its enduring functionality and utility, this intrinsic connection also presents a risk — if Binance runs into trouble, it’s likely BNB does too.

What is BNB?

In 2017, Binance introduced the BNB crypto to the market. BNB functions as a key utility coin within the Binance ecosystem. Its primary use is to cover exchange transaction fees and enable participation in crypto sales and various other exchange features.

BNB ranks among the top five cryptocurrencies in market capitalization — sitting below tether but above XRP. The abbreviation “Build N’ Build” symbolizes the network’s evolving commitment to collaboration, participation, and open-source development.

History of BNB

Binance coin (BNB) emerged in July 2017 as part of Binance’s mission to revolutionize digital asset trading. The coin initially raised $15 million through an Initial Coin Offering (ICO).

“An ICO is a valuable tool if you use it correctly. We didn’t plan all of it. This is our first and only ICO. We learned and adjusted our strategy along the way. We were able to execute quickly every time we made an adjustment. We got lucky in a lot of places. We also stepped on a few mines, luckily nothing too major.”

Changpeng Zhao: LinkedIn

During the ICO, 100 million tokens were sold at an initial price of $0.11 each, representing 50% of the total supply.

How does BNB work?

Initially, Binance launched BNB as an ERC-20 token on the Ethereum blockchain. However, it has since migrated to the main BNB Chain, which comprises two interconnected blockchains:

- BNB Beacon Chain: This segment of the network manages governance activities, including staking and voting on proposed network modifications. Previously, this was called the Binance Chain. It’s a consensus layer compatible with the Ethereum Virtual Machine and has multi-chain hubs.

- BNB Smart Chain: Handling the creation and execution of smart contracts, BNB Smart Chain was previously called the Binance Smart Chain.

Over time, BNB expanded its role beyond fee payments. Binance introduced the Binance Launchpad in 2018, allowing users to participate in new token sales with BNB, driving up demand and value.

BNB holders can:

- Save 25% on spot trading fees

- Save 25% on margin trading fees

- Save 10% on futures trading fees

In 2019, Binance launched its blockchain, Binance Chain, leading to the migration of BNB from Ethereum. This change provided more control and led to the introduction of features like the Binance DEX.

Moreover, in September 2020, Binance expanded further with the Binance Smart Chain. The Ethereum-compatible chain enables DApps and smart contracts and enhances BNB’s utility.

How does BNB work?

The BNB Chain blends elements of PoS and PoA to maintain the network. Users must stake at least 10,000 BNB to be selected as a validator. This setup aims to prevent bad actors from becoming validators by sacrificing some decentralization in the validation process.

What makes BNB unique?

BNB crypto boasts several unique features that set it apart from other cryptocurrencies:

- Reduced transaction fees: BNB allows users to significantly reduce transaction fees when trading on the Binance exchange, making it cost-effective for traders.

- Token sales: The Binance Launchpad has hosted numerous successful token sales, with users able to participate using BNB.

- Staking rewards: Users can stake BNB to earn rewards, even without holding massive amounts of the cryptocurrency. Delegating BNB to validators can generate staking rewards.

- Utility beyond Binance: BNB is not limited to Binance but has found utility in various DeFi projects, NFT ecosystems, and other blockchain platforms.

- Regular coin burns: Binance’s commitment to reducing the supply of BNB through coin burns shows a unique approach to managing the cryptocurrency’s scarcity and value.

Tokenomics of BNB

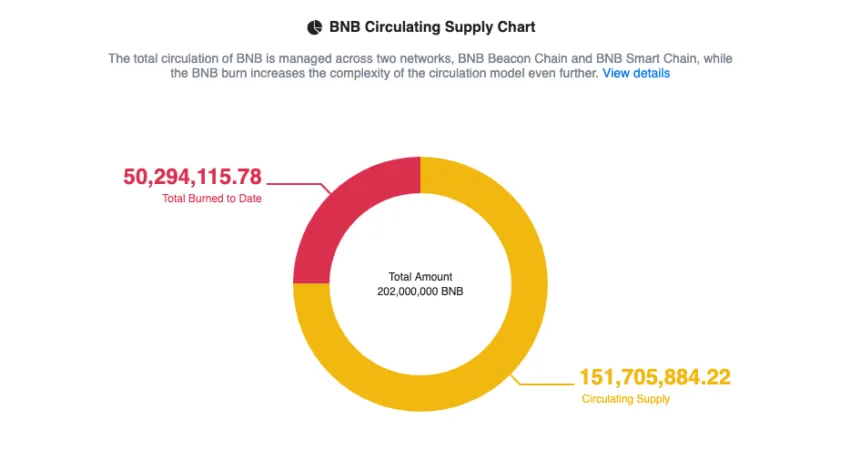

Binance pre-mined 200 million BNB. The distribution process saw founders receive 80 million BNB, vested over four years. As covered previously, the public ICO sale distributed 100 million BNB, while 20 million BNB went to investors without vesting restrictions.

By gradually releasing the crypto, BNB’s tokenomics promotes responsible management and ensures the team doesn’t have instant access to all the coins.

BNB burning

BNB’s deflationary journey began in late 2017 with the “Auto Burn” program. The program has quietly burned over 38 million tokens through quarterly burns.

Binance intends to continue coin burns until 100 million BNB crypto is destroyed — 50% of the total BNB supply. This ongoing process ensures the coin remains deflationary.

How BNB is used

Binance coin functions in several ways:

- Trading: BNB serves as a base currency for trading pairs on the Binance exchange. This means users can use BNB to trade various cryptocurrencies on the platform.

- Transaction fees: BNB can be used to pay transaction fees on the Binance exchange, offering users reduced fees compared to other payment methods.

- Staking: BNB can be staked to earn rewards, such as additional BNB or other tokens. This staking process helps secure the network and rewards users for their participation.

- Utility coin: Binance coin primarily operates as a utility crypto within the Binance platform. It provides various benefits, including reduced trading fees and access to special features and services.

- DeFi and NFTs: BNB has found utility beyond Binance and is integrated into various DeFi projects and non-fungible token (NFT) ecosystems. This broadens its use cases in the wider cryptocurrency space.

BNB wallets

Anyone looking to buy BNB must have a safe and secure BNB wallet to store their coins and facilitate interactions with DApps on the Binance Smart Chain. Consider your wallet as your portal to your assets.

Users can store BNB in either a software or hardware wallet. Trust Wallet is a great hot wallet option as it is the official Binance wallet, thus providing the most seamless experience for BNB — the Binance crypto. Alternatively, Trezor, Ledger, and Safepal are all leading hardware options. When choosing a wallet, prioritize usability, support for other assets (depending on your portfolio or trading or HODLing plans), and crypto wallet security.

BNB: On the fast track of adoption

The BNB crypto’s versatility and role within the Binance ecosystem make it a unique crypto asset. However, BNB is not without its challenges. Binance’s approach to creating a faster and more cost-effective blockchain has come at the expense of decentralization. Nevertheless, BNB’s continued growth and adoption suggest a promising future as a k component of maturing decentralized ecosystems.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Investing in any crypto, including BNB, carries risk. The price of BNB also hinges heavily on the state of the Binance exchange — should the CEX experience any issues, this will likely negatively impact the value of BNB. Always DYOR.

Frequently asked questions

What is the binance coin used for?

Is BNB a good currency?

Is BNB real or fake?

Are BNB and BTC the same?

Should I invest in bitcoin or BNB?

How can I buy BNB?

Can I stake BNB for rewards?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.