The collapse of Digital Currency Group (DCG), particularly its subsidiary Genesis, unfolded a dramatic financial saga in 2022. The repercussions of this debacle are still being felt in the industry. This guide explores the factors that led to DCG’s downfall, detailing the series of events and decisions that contributed to its decline.

KEY TAKEAWAYS

• DCG’s collapse in 2022 was triggered by market downturns and exposure to failed crypto companies.

• Genesis, a key DCG subsidiary, played a central role in the company’s financial troubles and bankruptcy.

• Legal and financial challenges in 2024 continue to impact DCG’s efforts to stabilize and repay debts.

• Despite significant setbacks, DCG remains operational, focusing on restructuring and legal settlements.

What is DCG?

Digital Currency Group is a venture capital firm primarily focusing on web3 and digital asset management. It is headquartered in Stamford, Connecticut. Before the collapse of Genesis, DCG was regarded as one of the crown jewels of the crypto industry.

DCG’s prominence was partly due to its early adoption in the crypto market and its extensive portfolio, which included more than 200 companies.

Prior to the spectacular collapse, its extensive portfolio included various sectors such as banking, layer-1 and layer-2 blockchains, data, analytics, DeFi, corporate blockchain solutions, exchanges, and tools for identity, compliance, and security.

Additionally, DCG was also pursuing investments in the metaverse, NFTs, gaming, payments, privacy solutions, stablecoins, trading tools, platforms, wallets, custody services, and web3 infrastructure.

The company continues to operate even in 2024, although it has undergone significant restructuring and is working on settling debts and addressing various legal issues.

History of Digital Currency Group

The story of DCG begins with Barry Silbert. Silbert previously led a company called SecondMarket, which he started in 2004. It initially dealt with creating liquidity for illiquid stocks under the name Restricted Stock Partners.

He pivoted into blockchain and crypto by creating the Bitcoin Investment Trust in 2013 under the management of his other company, Grayscale.

Silbert sold SecondMarket to NASDAQ, which then rebranded the company as NASDAQ Private Market.

The funds from this sale helped to establish Digital Currency Group in 2015.

After its formation, he integrated other ventures like Grayscale and the Bitcoin Investment Trust under the DCG umbrella. Thereafter, DCG became a major conglomerate that encompassed five specialized firms:

- Foundry

- Genesis (now bankrupt)

- Grayscale

- Luno

- CoinDesk (later sold to Bullish Group)

In November 2021, DCG moved its headquarters from Manhattan to Stamford, Connecticut. This move was incentivized by Connecticut’s then-Governor Ned Lamont. He offered financial benefits including a $5 million grant, contingent on the company creating a minimum of 300 full-time jobs within the state.

Business structure of DCG and subsidiaries

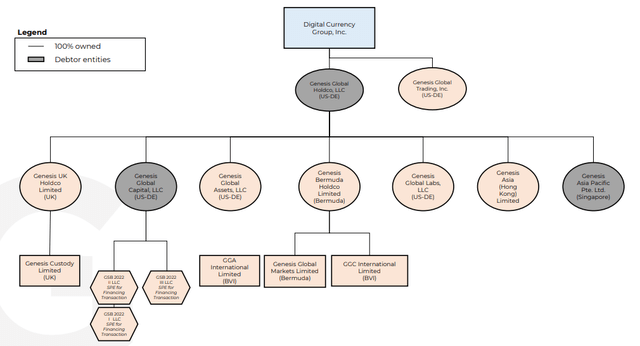

To understand how this story unfolds, it is important first to establish Digital Currency Group’s business structure, particularly Genesis and its holdings.

DCG is at the top, overseeing various entities, including Genesis Global Holdings, LLC, and Genesis Global Trading, Inc.

The chart below shows connections between DCG and its subsidiaries, including those operating internationally, like Genesis Asia Pacific Pte. Ltd. in Singapore.

So, to cut a long story short:

- Genesis Global Capital, LLC specialized in cryptocurrency financial services. It primarily focused on lending to institutional investors and high-net-worth individuals.

- Genesis Global Trading originated as a Bitcoin trading division of Barry Silbert’s SecondMarket. It later relaunched and rebranded under the DCG umbrella in 2015.

- The term “Genesis” typically refers to all these entities, which eventually went bankrupt.

- All these entities played a key role in the events leading to the downfall of Digital Currency Group.

The downfall of Digital Currency Group

In 2022, the cryptocurrency market experienced a significant downturn, or “crypto winter,” which affected many companies. This bear market led to reduced asset values, leading to liquidity issues and financial distress for many firms in the crypto space.

The collapse of Terra Luna and contagion

The downfall of Digital Currency Group and Genesis began in 2022, as multiple events triggered a series of collapses across the crypto market.

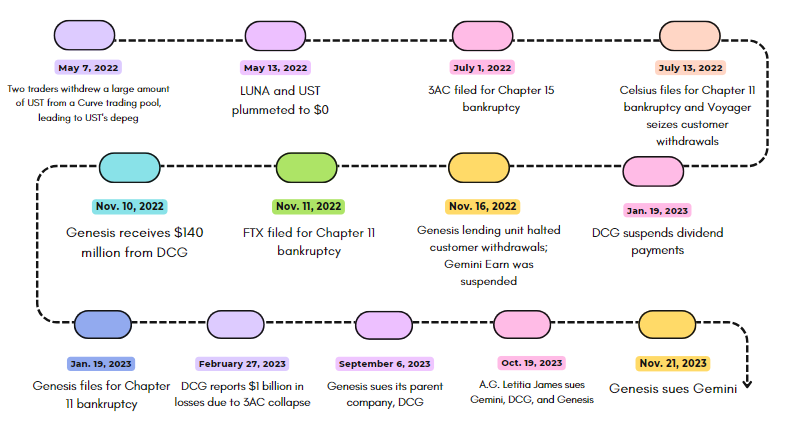

In May 2022, the collapse of Terra UST (UST) and LUNA caused a massive market disruption. The crypto sector incurred significant losses as a result of this incident.

As the market plummeted, many businesses that held cryptocurrency on their balance sheets moved into risky loan-to-value (LTV) ratios. Therefore, when crypto-based businesses were confronted with bank runs and margin calls, they could not meet the immediate demands.

In June 2022, the financial instability in the crypto sector further escalated as Three Arrows Capital (3AC) faced significant issues. 3AC was a significant cryptocurrency hedge fund known for its aggressive investment strategies in the crypto space.

It failed to meet margin calls and repay loans, notably a substantial loan from Voyager Digital. The situation worsened, leading to a default notice from Voyager for unpaid loans.

Subsequently, 3AC underwent forced liquidation by a British Virgin Islands court. In a bid to manage its U.S. assets against creditors, 3AC filed for Chapter 15 bankruptcy on July 1, 2022.

Crypto contagion explained

In addition to Voyager, Celsius was another company affected by the 3AC crash. It already had liquidity issues, which worsened as investor confidence dropped and withdrawal requests increased.

3AC owed Celsius about $75 million, which it could not repay during a period of abundant “bank runs.” Celsius officially filed for Chapter 11 bankruptcy protection on July 13, 2022, revealing a $1.2 billion shortfall in its balance sheet, according to a Wall Street Journal report.

In a leaked investor call from Morgan Creek Digital, it was suggested that BlockFi liquidated 3AC for $1 billion. However, it is important to note that both BlockFi and 3AC lent money to each other.

To put it simply, 3AC owed a lot of businesses a lot of money. The collapse of 3AC sent many crypto businesses into distress, as the company managed about $10 billion worth of assets at its height.

3AC creditors included BlockFi, Celsius, Voyager, FTX, and Genesis — all of which have since declared bankruptcy.

DCG assumes Genesis’s losses

Genesis Trading, Genesis Asia Pacific, and Genesis Global Capital made significant loans to 3AC. Michael Moro, Genesis Trading’s CEO, revealed on Twitter (now X) on July 6, 2022, that the company had also suffered significant losses due to loans to Three Arrows.

In order to guarantee sufficient operating capital, its parent company, DCG, had taken on certain of Genesis’s obligations to Three Arrows.

Many divisions under the Genesis umbrella had significant financial exposure to the collapse of Three Arrows Capital (3AC).

Genesis Global Capital initially loaned the now-defunct company $2.36 billion, of which nearly half was repaid. However, 3AC still had an outstanding debt of approximately $1.2 billion.

To stabilize Genesis, DCG took on this financial burden. However, instead of settling the debt with cash or equivalent, DCG issued a ten-year promissory note, valued at $1.1 billion, with an interest rate of 1% to Genesis.

Despite the turmoil, however, Genesis and DCG remained operational. This would soon change in a matter of months with the collapse of FTX.

On a side note, DCG also had a separate obligation of $350 million to a group of investors through a secured lending facility.

The collapse of FTX

On Nov. 2, 2022, reports emerged that FTX, a popular CEX founded by Sam Bankman-Fried, and Alameda Research were both overly reliant on FTX’s FTT token. The two entities also had unusually close ties, which raised concerns in the market.

This disclosure led to a loss of confidence, triggering massive withdrawals from FTX. This led to its liquidity crisis and eventual bankruptcy on Nov. 11, 2022.

While many anticipated that the potential collapse of FTX would cause a similar contagion to Celsius and 3AC, Genesis Trading insisted that it had no material exposure.

The following day, Genesis Trading revealed that it had $175 million in assets stuck in its account on FTX. As a result, Genesis would acquire a $140 million loan from its parent company, DCG, to shore up its balance sheet.

Genesis Global Capital loaned funds to Alameda Research, using FTT tokens as collateral, which would eventually plummet in price.

Additionally, it was later revealed that Genesis Global Capital was the largest unsecured creditor of FTX, with $226 million owed to them, as reported in court documents.

Genesis and Gemini Earn

Gemini earned yield for its users via Gemini Earn, which lent assets to Genesis. On Nov. 16, 2022, Genesis Global Capital halted withdrawals. As Gemini was a major contributor to Genesis, Gemini was forced to suspend the Earn program.

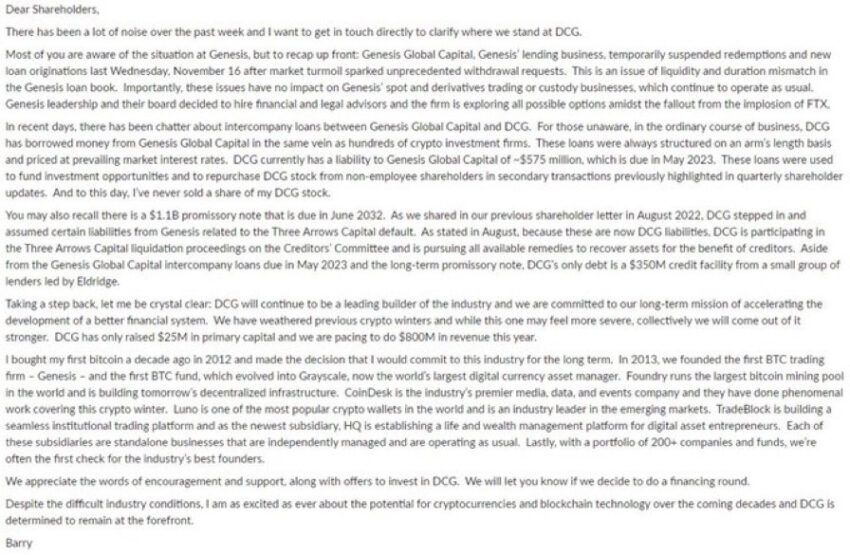

Just a week later, in a leaked letter to shareholders, Barry Silbert revealed that DCG had also taken out loans with Genesis to the tune of $575 million.

The loans were used for stock buybacks, which is a common practice for propping up the price of a company’s own equity (stock). As a result, DCG did not have the funds to pay back Genesis.

Genesis files for bankruptcy

On Jan. 12, 2023, the SEC charged Genesis Global Capital, LLC and Gemini Trust Company, LLC, for the unregistered offer and sale of securities to retail investors through Gemini Earn.

This added to an already distressed Genesis, which could not afford to repay its creditors and had taken out many loans to meet operational demands.

Having spent months “robbing Peter to pay Paul,” the company was at its end. On Jan. 19, 2023, Genesis Global Capital and two of DCG’s other subsidiaries, Genesis Global Holdco LLC and Genesis Asia Pacific, filed for Chapter 11 bankruptcy protection.

Just days prior, DCG also suspended dividend payments, signifying stress in the parent company. A few weeks later, DCG disclosed that it had suffered losses exceeding $1 billion in 2022. These losses were primarily due to the contagion triggered by the collapse of Three Arrows Capital.

However, on the back of its subsidiaries throwing in the towel, the pain for DCG was not over yet. 2023 would prove to be the most tumultuous year yet for the parent company.

Lawsuits galore

Because many bankruptcies were underway, many companies naturally sought to recover as many funds as possible.

As a result of the complex web of loans and business relationships, this resulted in an extremely messy and prolonged fight. On July 7, 2023, Gemini sued DCG to claw back the funds acquired from its customers via Genesis.

On Sept. 6, 2023, Global Genesis Holdco. sued DCG, its parent company. The suit was for $620 million and was an attempt to recover funds from a previous loan of $500 million.

This was possibly a part of the $575 million worth of loans mentioned in Barry Silbert’s leaked shareholder letter.

Adding insult to injury, on Oct 19, 2023, Attorney General Letitia James sued Gemini, Genesis, and DCG for defrauding investors through the Gemini Earn Program.

However, two of the companies would receive some resolution by settling their own dispute. On Nov. 29, 2023, Genesis Global settled its suit with DCG to claw back funds.

Not too long after, Genesis Global Capital sued Gemini for preferential transfers from Genesis at the expense of other customers.

However, Gemini turned around and sued Genesis in late November 2022. Gemini sued Genesis over 60 million Grayscale Bitcoin (GBTC) shares pledged as collateral worth more than $1 billion. This suit was eventually settled on Feb. 1, 2024, with Gemini winning nearly half of the shares.

Finally, Genesis Global Trading eventually unwound its business operations on Sept. 18, 2023, marking the end of a long era for Genesis’s trading wing.

DCG downfall: What happened in the end?

So, what does all of this mean when it comes to Digital Currency Group’s downfall? To put it bluntly, the collapse of Terra Luna sent a shockwave of bankruptcies in the crypto sector.

Many companies fell during the financial contagion, becoming victims of their own interconnection. Nowhere was this more evident than with 3AC during the first wave of bankruptcies.

Numerous companies loaned money and assets to 3AC, including Genesis. When 3AC could not pay back its creditors, pressure piled on companies like Genesis, which was having trouble paying its own creditors.

Genesis and its subsidiaries made many loans to failed crypto companies. The company even made loans to its parent company. However, the company remained operational. This was until the CoinDesk reporting led directly to the FTX bankruptcy. Genesis’s exposure to FTX also eventually led to its own bankruptcy.

Ironically, CoinDesk, another of DCG’s subsidiaries, was the straw that broke the camel’s back, not only to its own competitor but to itself.

Not only did DCG entangle itself by assuming Genesis’s risks, but it was also part of the reason Genesis could not repay its creditors.

Despite that, the firm’s message in 2024 is one of the hurdles having been overcome, with Barry Silbert sharing on X in 2024 that DCG has completed a full paydown of the cash borrowed from Genesis.

A series of unfortunate events

The Digital Currency Group’s downfall was a series of unfortunate events. Yet, while the battle was hard fought, DCG is still operational and making progress in some areas. For instance, the company reported that revenue was up year-on-year in February 2024.

However, with Grayscale GBTC experiencing net outflows into Bitcoin ETFs, DCG still faces risks in a volatile market. As one of its most profitable businesses, Grayscale’s performance will be crucial for DCG’s stability in 2024.

Frequently asked questions

Barry Silbert is the founder and CEO of Digital Currency Group (DCG). He initially was the founder of SecondMarket. Silbert would eventually sell SecondMarket to gain the funds to start DCG.

The DCG controversy begins with its subsidiary Genesis. Genesis made many loans to now bankrupt companies. This resulted in the bankruptcy of Genesis and the eventual lawsuits towards it parent company DCG and partners.

FTX collapsed for a multitude of reasons. The biggest reason was because it could not support withdrawals to its creditors. This could be attributed to over ledgering and hyper-inflating its own value by using its own FTT token.

Barry Silbert is the CEO of DCG. He founded the company in 2015. Silbert sold his company SecondMarket to acquire the funds needed to start DCG.

No, Grayscale is a subsidiary of DCG. It was started before DCG and eventually consolidated under the umbrella of Digital Currency Group. DCG would eventually go on to hold other companies like Coindesk and Genesis.

DCG owned mainly five companies at its height. These were Grayscale, Genesis, Foundry, CoinDesk, and Luno. However, Genesis would eventually go bankrupt and CoinDesk was sold off to Bullish Group.

No, CoinDesk is no longer owned by DCG. CoinDesk was acquired by DCG in 2016. However, it was sold off to Bullish Group.

DCG stands for Digital Currency Group. It is a venture capitalist investment company that has holdings in many sectors in crypto and web3 projects. DCG was founded by Barry Silbert, who is its current CEO.

Michael Sonnenshein is the CEO of Grayscale. Grayscale is a subsidiary of DCG that was founded before DCG. It would eventually come under the ownership of DCG after its founding.

Barry Silbert is the founder and CEO of DCG. He initally founded Restricted Stock Partners in 2004. The company would eventually rebrand to SecondMarket, which was sold off to NASDAQ and generated the profits to start DCG.

Genesis filed for bankruptcy on Jan. 19, 2023. This was the result of a failure to repay its creditors and generate enough revenue to keep its doors open. Genesis would eventually sue its parent company, DCG, and partner, Gemini, to clawback its users’ funds.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.