Crypto exchanges enable seamless digital asset trading by matching buyers and sellers using a centralized order book for each cryptocurrency pair. This guide will explain what an order book is and the role it plays in crypto trading.

What is an order book?

An order book displays buy and sell orders for a specific cryptocurrency trading pair on a centralized crypto exchange. It provides traders with valuable information about market demand, supply, favorable entry points, and overall market trends.

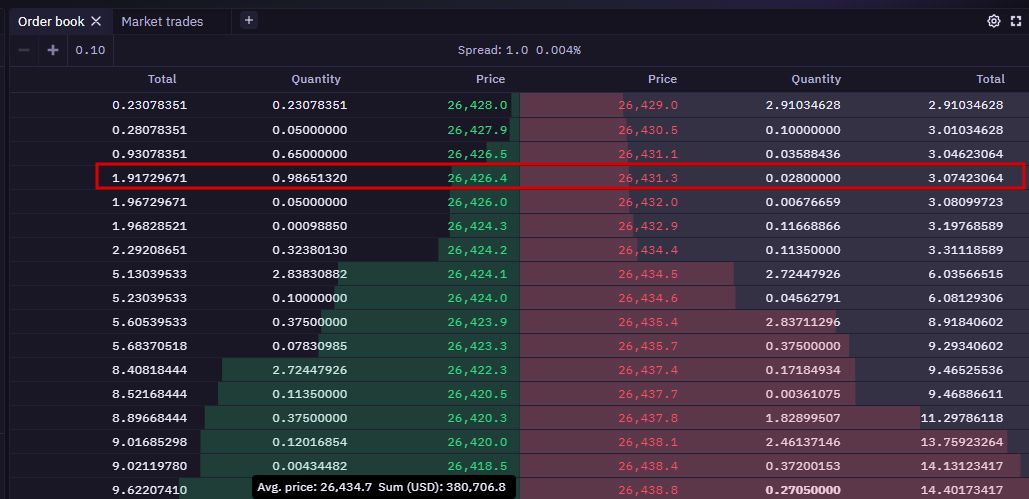

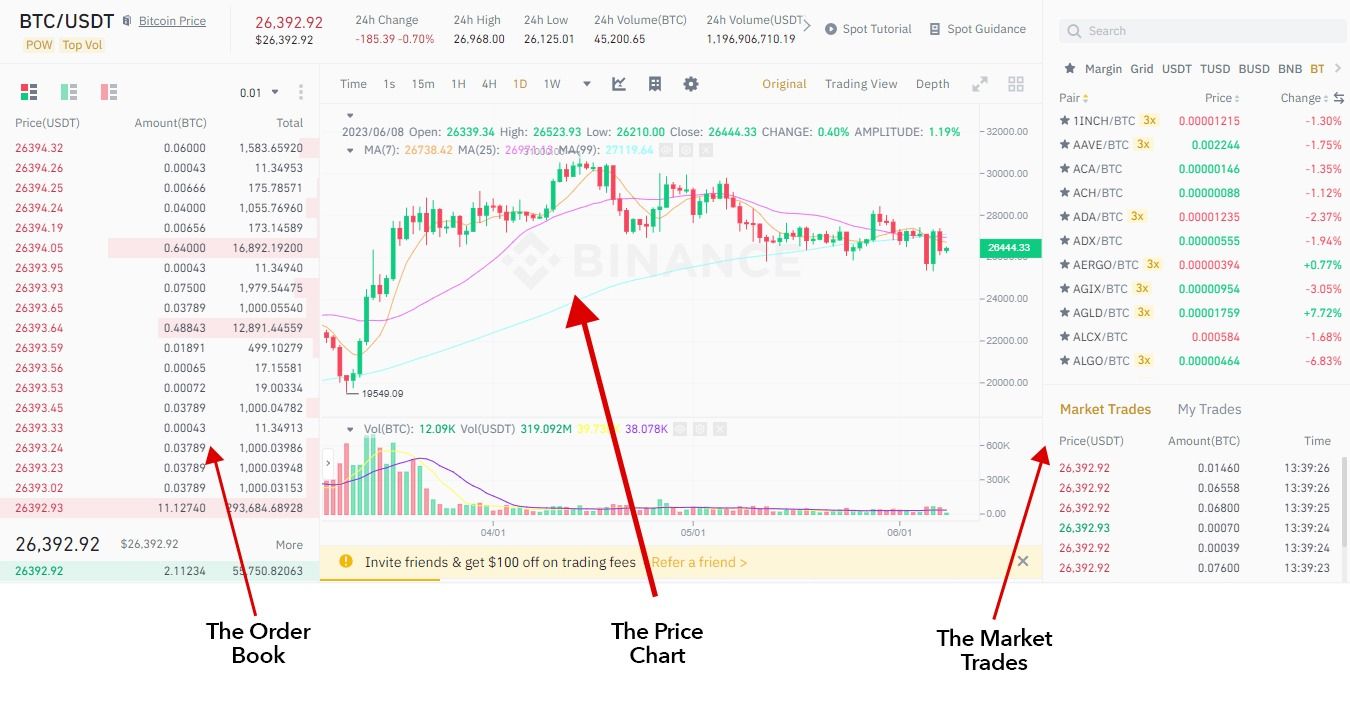

Crypto exchanges continuously update their order books. Having current data is essential for traders to obtain real-time information, enabling them to make informed trading choices. However, the visual presentation of each exchange’s order book may vary slightly. To illustrate this, the images below compare the order books on Kraken and Binance.

While order books look different from exchange to exchange, they have the same functions and features across different trading venues.

Understanding the components of an order book

Bid and ask

An order book has three columns: price, amount, and total. These columns are divided into two sections: the buy side and the sell side. The buy side displays bids, indicated in green, representing buy orders. On the other hand, the sell side represents asks, shown in red, which represent sell orders. Bids reflect the asset’s demand, while asks represent its supply.

A bid is the price a trader is willing to buy a cryptocurrency. On the contrary, an ask is the price a seller will take in exchange for a specific cryptocurrency.

The quantity signifies the number of active orders or trading volume, sometimes referred to as “volume” on certain cryptocurrency exchanges. In contrast, the total quantity represents the cumulative quantity of orders ranging from the highest bid or lowest ask to the current price level. The price reflects the valuation of pending orders.

Let’s look at the numbers using the highlighted row in the Kraken order book below.

On the buy-side, the number of open orders at the $26,426.4 price point is 0.98651320. The total combined quantity of orders from the highest bid to the observed price level is 1.91729671.

On the sell-side, the number of open orders at the $26,431.3 price point is 0.02800000. The total combined quantity of orders from the lowest ask to the observed price level is 3.07423064.

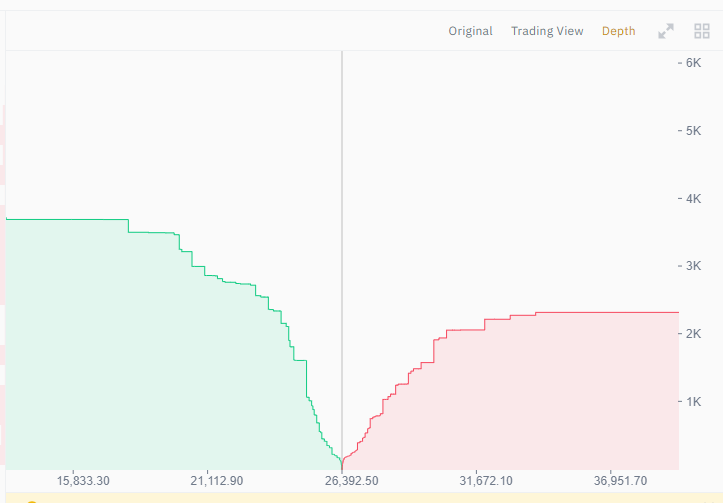

Market depth chart

The market depth chart provides a visual representation of the order book. It indicates a cryptocurrency’s real-time supply and demand at various price points. A market depth chart takes the form of a standard graph with horizontal (x) and vertical (y) axes.

Taking the Binance market depth chart as an example, the x-axis denotes the prices of the listed orders, while the y-axis represents the quantity of open orders at each price level.

Market depth charts always have a buy and sell side. Traders can use these charts to spot buy and sell walls. A buy wall forms when there are substantial buy orders at a given price. On the other hand, a sell wall emerges when numerous sell orders are at a particular price level. The midpoint of the chart illustrates the bid-ask spread, the difference between the highest bid and the lowest ask. This price also reflects the current market price.

Market depth refers to the capacity of the market to handle substantial orders without causing significant price movements. Therefore, as additional buy and sell orders are placed, the depth of the order book expands. There’s more buying interest below the current market price when the green side is higher than the red side. Conversely, when the red side is higher than the green side, this indicates more selling interest.

In addition to the market depth chart, the trading dashboard on an exchange often also provides a candlestick price chart. The chart displays the recent price movements of the digital currency. Moreover, the dashboard provides a trade feed that shows the most recent trades for a particular cryptocurrency. The trade feed includes a 24-hour clock indicating the current time.

Important terms

Here are several terms you’ll need to understand when interacting with order books:

- Bid-ask spread: The difference between the highest bid and the lowest ask. Market makers capitalize on this difference as their profit.

- Slippage: Slippage occurs when a trader’s order is filled at a different price than the expected price. This happens when an exchange cannot fulfill a market order at the preferred price due to high volatility and thin order books.

- Limit order: An instruction to execute an order at a specific price or a better price than the current market price.

- Market order: A market orders is an instruction to execute an order at the best market price currently available.

- Order book liquidity: Liquidity refers to the smoothness of trading a cryptocurrency without causing a significant price impact. A highly liquid order book entails a substantial presence of buyers and sellers transacting substantial quantities of an asset. Also, a highly liquid market has a smaller bid-ask price than a low-liquid one.

- Support and resistance: Support is the price level with a considerable amount of buying interest. On the contrary, resistance is the price level with a significant amount of selling interest.

- Top of the order book: Top of the order book refers to two price extremes represented by the highest bid and the lowest ask.

- Stop loss: An order that automatically executes to sell a cryptocurrency when the stop price is reached. A stop loss protects traders from incurring too many losses.

- Take profit: An order indicating the price at which to exit an open position for a profit. A take-profit order maximizes a trader’s potential gains.

Did you know? Support and resistance are fundamental concepts of technical analysis? Check our guide on crypto trading patterns to learn more!

How to use an order book in trading

Price discovery

Should the market depth chart indicate a higher number of buyers than sellers, it may signal an imminent bullish trend characterized by upward price movement. Alternatively, a market depth chart with more sellers than buyers could mean a downtrend is coming. In the event of a downward trend, it is important to be cautious of catching a falling knife. Still, this crypto trading pattern could generate a profit if you buy an asset near or at the bottom of a downtrend.

Generally, an asset’s price uptrend may encourage people to spend more, which can help to boost a cryptocurrency’s adoption.

“Whenever the price of cryptocurrency is rallying, people start spending a lot more,”

Shapeshift’s founder Erik Voorhees: Via Stormgain

However, you should conduct further market analysis to confirm that an uptrend or downtrend is imminent. For instance, you may use the Wyckoff method to predict market movements. Additionally, you could calculate the RSI indicator in your technical analysis to determine the possible future price of a cryptocurrency. The results of these analyses will help you decide whether to buy or sell.

Liquidity

A market depth chart will have a wide horizontal wall at price levels with more liquidity. Thin walls, on the other hand, indicate low liquidity areas. A slope (not a sheer cliff) implies liquidity across a range of price points.

Understanding the liquidity of a particular market is crucial in helping you decide which assets to trade. To illustrate, a low liquid market may likely mean that you probably cannot buy or sell an asset easily and quickly. A highly liquid market, instead, allows traders to buy and sell assets fast and easily. Whales might also find it easy to manipulate low-liquid markets.

Pricing an order

Let us look at the Kraken order book below for the BTC/USD trading pair.

You can see that on the buy side, the highest bid is at the top of the list. This price is $26,428.0 (green). On the sell side, the lowest ask is at the top of the list as well. The price is $26,429.0 (red).

If you want to buy BTC, you can accept the lowest ask price, which is $26,429.0. But assuming you prefer making your own offer, then your bid should be better than $26,428.0.

Benefits of order books

Order books have many benefits depending on the context. The most obvious benefit to using an order book is that it gives buyers, sellers, and market makers a way to efficiently price and trade cryptocurrencies.

On the surface, this may seem like a simple feat, but it was actually rather difficult to accomplish, considering the history of trading. In times past, trading relied on face-to-face interactions and open calls on trading floors, which was rather chaotic and inconvenient.

However, if you change the context to liquidity pools (e.g. AMMs), order books also have an advantage. When compared to liquidity pools, order books have less slippage when there is sufficient liquidity.

They also have better price discovery, as buy orders are matched directly with other sell orders. Therefore, they are better for executing trading strategies with special order types (e.g. limit orders) at a specific bid price or sell price. This contrasts with liquidity pools, where prices are deterministic and based on the supply of assets in the pool.

Order books are useful trading tools

An order book is a useful tool for traders if they can understand the information it contains. Whether they are carrying out spot, options, or futures trading on any of the best crypto trading platforms, order books are an indispensable tool to help traders make sound trading decisions.

Nevertheless, traders shouldn’t rely on order books alone. They should use the information order books provide, together with the results of technical and market analysis. Moreover, traders leverage trading strategies like automated crypto trading to generate a trading profit in the crypto markets.

Frequently asked questions

Can I trust the order book in a low-liquidity market?

How do market orders affect the order book?

How does an order book work?

How to read crypto order books?

What is the use of order books in the crypto market?

Who maintains the order book?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.