Like any other industry, the cryptocurrency sector experiences bad faith players looking to exploit investors’ appetite for high returns. When a crypto project pulls the rug, the developers shut it down and disappear with investors’ funds. The decentralized nature of the cryptocurrency industry makes it challenging to trace the developers after a rug pull.

In this guide, you will learn how crypto rug pulls work, how you can detect a potential rug pull, and how to protect yourself from it.

What is a crypto rug pull?

A crypto rug pull happens when developers introduce a token or any other crypto asset and hype it up to generate investor interest. They wait until investors buy the token and then, without warning, disappear with investors’ funds.

These scams typically happen within a short period of time to minimize the chances of investors and industry analysts taking a closer look and realizing that the project was just a scam and never really had any actual value.

Understanding DeFi scams

The DeFi industry is still relatively new and presents varied opportunities to make money. However, there are also chances for malicious players to run Ponzi schemes due to the pseudonymous nature of crypto.

In its annual crime report published in February 2023, Chainalysis placed the value of DeFi scams at $5.9 billion in 2022.

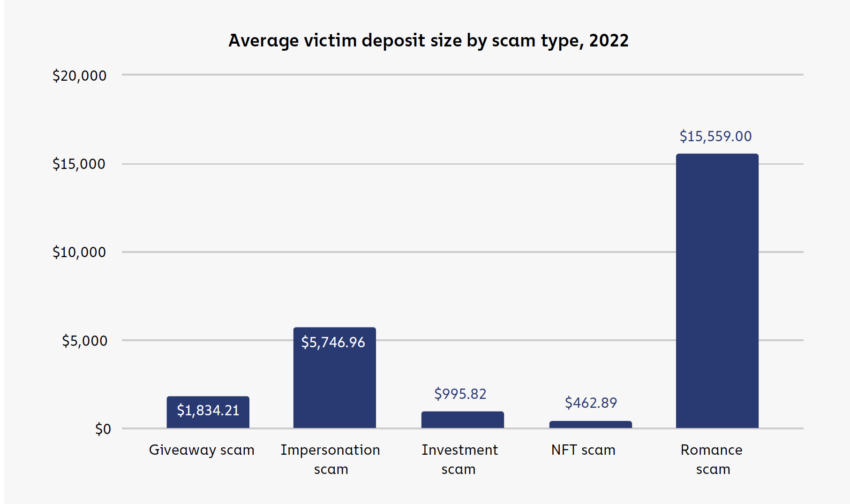

The scams included romance, investment, impersonation, giveaway, and NFT scams, with those involved in romance scams depositing the highest amount on average.

Social media gives malicious actors a platform to appeal to the masses who may not know enough about cryptos to spot a scam. The objective is to cast a wide enough net to attract a large audience without setting off any alarm bells. In some cases, hacking the social media accounts of famous people allows crypto scammers to impersonate them and reach out to their audience.

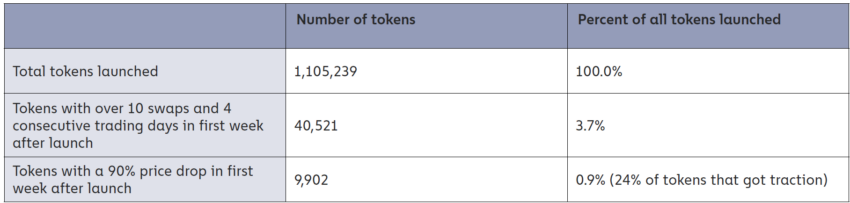

Crypto rug pulls fall under the umbrella of investment scams. In 2022, 24% of the tokens launched were pump-and-dump schemes, with token creators making approximately $30 million in profits.

With varied levels of cryptocurrency regulation from country to country coupled with blockchain’s pseudonymity, DeFi scams have proven easy ways to make money for bad actors. You are less likely to become a victim if you understand how to identify scam crypto projects and can be on the lookout for them when making investment decisions.

How does a crypto rug pull work?

Listing a crypto asset on a decentralized exchange (DEX) is free with minimal scrutiny. Fraudulent developers exploit this, executing pump-and-dump schemes to rip off investors.

There are three parts to a crypto rug pull. First, the project developers hype the project through crypto influencers on Telegram channels, Twitter, Discord, YouTube, and other social media platforms. One characteristic of such campaigns is the bold promises made with little focus on the asset’s utility.

The second part involves investors sinking their funds into the project once they are convinced it presents an opportunity to get rich quickly. In the third and final part, the developers can execute their crypto scams in three ways:

- Liquidity removal: The project developers drive the asset’s price to zero by withdrawing everything from the liquidity pool. Known as a liquidity pull, this is one of the most popular decentralized finance scams.

- Dumping: Here, the creators sell their tokens quickly, with the oversupply driving the price down drastically. Commonly referred to as a pump-and-dump scheme, the scam involves creating hype on social media and exiting the position once an optimal number of people have been lured into investing.

- Limiting sell orders: This scam is executed when writing smart contracts. The contract prohibits anyone else from selling their tokens, leaving the creators as the only parties able to sell. They then wait for optimal positive price action, sell their tokens, and leave the remaining investors holding tokens with no value.

Once the project creators disappear, it can be challenging to trace them, given the lack of cryptocurrency regulation and the pseudonymity that defines the majority of the industry. Even when the project developers are well known, victims find it difficult to seek legal redress due to a lack of a regulatory framework.

Signs of a potential rug pull

When you know what you are looking for, you can spot a potential rug pull and avoid investing in such a project. Here are five red flags you should look out for:

1. Anonymous development team

The developers of a legitimate project would want to let their background establish their credibility and inspire confidence in investors who can put a face to the project. However, bad actors may purposefully remain anonymous to ensure they can disappear into thin air once they execute the scam. They can also run another scam since nothing ties them to their previous projects.

Some developers may provide fake backgrounds that seem legitimate but cannot withstand further scrutiny. If the information provided is not verifiable with other independent sources, there is a high likelihood that the project is a scam.

2. The project’s community interactions

Projects intending to pull the rug often feign enthusiasm on social media. Take a closer look at the conversation in Telegram chats on Twitter and Discord. If the moderators tend to limit conversations that ask critical questions, they may know they cannot offer satisfactory answers.

Additionally, some conversations may not appear natural, with people only discussing the high returns and low engagement rates among community members.

3. Lack of an audit

The lax requirements for listing on decentralized exchanges mean that investor protection measures, such as conducting an audit prior to a token offering, are optional. Only legitimate projects will take the additional step of conducting a smart contract audit by a reputable and independent third party.

Failure to subject a project to audit before listing means any exploitable bugs will not be identified. The developers will be keen to ensure such vulnerabilities are not discovered since they intend to use them to execute the scam.

4. Absence of a time lock

As pointed out earlier, project creators can execute a scam by limiting the sell orders. They do this by writing a code that makes liquidity removal for investors impossible. The creators will leave a loophole that allows them to sell their tokens while you get stuck with yours. At that point, there is no way to sell or utilize them.

Genuine projects will employ a time lock on at least 95% of the liquidity. The security mechanism prohibits the developers from pulling the rug by removing liquidity from the pool.

5. Skewed token distribution

If you check the token distribution and notice that a small group of people has a significant proportion of the tokens, beware since they can crash the price. If the tokens are evenly distributed, the power to influence the price is democratized. There is a chance that the small group will collude to exit their position at a certain point. As a result, the token’s price will crash.

9 biggest crypto rug pulls ever

Over the years, crypto rug pulls have robbed innocent investors, leaving them high and dry. Here are nine of the biggest ones:

1. OneCoin

The scheme’s creator, Ruja Ignatova, pitched OneCoin as the bitcoin killer. According to the FBI, alongside other accomplices, she convinced investors to purchase OneCoin packages and collected at least $4 billion. Currently, she is the only woman on the FBI’s Ten Most Wanted list. Below is a video of Ruja Ignatova promoting OnceCoin in London in 2016. Her whereabouts remain unknown.

The scam was based on the traditional Ponzi scheme’s structure, and the currency was not even based on any blockchain. Ms. Ignatova and her partners paid the early investors using the deposits of new ones. They managed to convince people by simulating transactions using a database entry scam.

2. Thodex

Thodex was a centralized cryptocurrency exchange that operated from 2017 to 2021. At the time of the rug pull, investors lost over $2 billion. Faruk Ozer, the CEO, stopped trading under the pretext of prioritizing putting a stop to cyberattacks on the platform. He disappeared right after.

It is estimated that the $2 billion lost in this scam accounted for 90% of the funds lost to rug pulls in 2021. Ozer was arrested a year later in Albania and will face many years in jail once the case is concluded.

3. Squid Game token

Named after the popular Netflix series, the token was built on Binance Smart Chain (Now called BNB Chain) in 2021. The creator generated hype through press coverage and attracted the interest of investors by positioning it as a meme coin with massive potential.

Within six days, the SQUID coin was trading at $3,000. Liquidity removal happened swiftly, and the creators made off with approximately $3.3 million. They later posted on Telegram claiming they had been hacked and were never heard from again. The players behind the scam have never been identified.

4. Frosties

The creators of the Frosties NFTs promised investors staking features and long-term utility. This was in January 2022, when interest in NFTs was trending upwards, and the two founders, Andre Llacuna and Ethan Nguyen, managed to execute a $1 million rug pull.

When the US Justice Department eventually caught up with them, they were about to launch a second scam that was expected to earn them $1.5 million. Daniel B. Brubaker, the USPIS Inspector-in-Charge, commented on the arrest, saying:

“Today’s arrests involved Non-Fungible Tokens (“NFTs”), opening the door to alternative investment options and substantial risk. These assets may seem like a good deal or a way to become wealthy, but in many cases, as in this situation, only lead to the loss of your money.”

5. Mutant Ape Planet NFTs

Created by Aurelien Michel, the MAP NFT collection rode on the popular Mutant Ape Yacht Club (MAYC) coattails and robbed investors of $2.9 million. Investors were promised exclusive access to other crypto assets, raffles, rewards, and metaverse land.

This was not Michel’s only rug pull; he is associated with others, such as Crazy Camels and Fashion Ape NFT, according to on-chain data. He was arrested in New York in January 2023 and faces fraud charges.

6. AnubisDAO

AnubisDAO creators rode the Dogecoin and Shiba Inu popularity and used canine imagery in their marketing to appeal to investors. At the initial token sale launch, the project only had a Twitter account and a Discord server.

Investors rushed to buy $60 million worth of ANKH tokens even though the project did not have a website, whitepaper, or presence beyond Twitter and Discord. The creators, still unknown today, only needed 24 hours to exit and send all the liquidity to a different address. The token’s value plunged to zero and left investors counting their losses.

7. Sudorare

Touted as a fork for the SudoSwap marketplace and LooksRare, the project offered yield farming to investors looking to stake wETH, XMON, and LOOKs for Sudorare tokens for a week.

The project contract had been flagged prior to launch with common signs of DeFi scams. Observers noted that the high yields, fake followers, and shaky tokenomics all pointed to creators intending to pull the rug. However, this did not stop investors from putting in over $800,000 in the six hours between the launch and the creators draining the liquidity pools. The developers remain unknown after deleting all evidence of the project online and then going dark.

8. Baller Ape Club

This project promoted NFTs of various cartoon figures with fraudulent claims that the NFTs would grant the owners special privileges and various rewards.

Within a day of going live, Le Anh Tuan and his partners withdrew funds from the pool and transferred them through multiple blockchains. In the indictment files, the U.S. Justice Department indicated that investors had lost approximately $2.6 million. Tuan faces up to 40 years for committing wire fraud and international money laundering.

9. Evolved Apes

The Evolved Apes project comprised a collection of NFTs touted as unique apes fighting for survival in a lawless land. Investors rushed to grab the NFTs hoping to make profits with the increased demand that would follow the launch of the Evolved Apes Clash game.

There were several red flags before the rug pull. For example, the creators’ minimal social media presence and unprofessional announcements on the official channels. Most investors brushed this off and chalked it up to inexperience. Additionally, giveaway winners had not received their prizes.

The creator, known as Evil Ape, pulled the rug within a week. They got away with approximately $2.7 million, deleting the website and the official account. The investors rallied together and launched Fight Back Apes, but the project has not shown any signs of success.

How to protect yourself from rug pulls

The appetite for high rewards requires you to take high risks. However, when investing in crypto projects, there are ways you can protect yourself from rug pulls. Here are a few:

Healthy skepticism

Approach each investment opportunity with the assumption that it might not be legitimate. This state of mind allows you to scrutinize the project and identify any red flags. Most rug pulls invest heavily in flashy marketing designed to deter you from taking a closer look.

Patience

As you may have noticed from the examples, some rug pulls happen quickly, from six hours to a week after launch. If you put the project on your watchlist and take your time to observe, the scam may happen before you invest, or the red flags will become more evident.

Don’t let the sense of urgency from the people promoting the project sway you. Remember that most scam projects will try and get people to make swift decisions before they can step back and look at the big picture.

Research

We’ve discussed the signs of a potential rug pull, and these can help guide your research process. You know what to look out for, so take your time and dig deeper into the information concerning the project.

For example, if the project has a whitepaper, take the time to read it and understand its contents. Don’t rely on the watered-down versions being peddled by crypto influencers looking for a commission for their effort.

Look out for crypto rug pulls

The crypto industry provides endless possibilities to make money. However, the lack of investor protection guidelines appeals to criminals who wish to exploit the industry’s decentralized and anonymous nature. Such people are ready to pull the rug once the opportunity to scam their investors presents itself.

Beware of projects promising high returns with very little basis on how those returns can be achieved. Take the time to look beyond the flashy advertising and carefully examine if any red flags stand out to you. While this is not a guarantee to be safe, you will have minimized the chances of being the next victim of a crypto rug pull.

Frequently asked questions

What is the largest crypto rug pull?

Is a crypto rug pull illegal?

What Is the idiom of pull the rug?

What Is the origin of the phrase pull the rug?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.