Autocompounding allows for faster and cheaper gains and optimizes yields with little effort required. Beefy Finance is a great example of a platform that utilizes this effective development. Here, we look at what Beefy Finance is, how it works, and its various features.

KEY TAKEAWAYS

➤ Beefy Finance is a multi-chain protocol that optimizes yield farming by automatically compounding user earnings.

➤ The platform’s Vaults automate the reinvestment of user funds, reducing fees and maximizing returns across various blockchains.

➤ The BIFI token allows holders to earn a share of platform earnings and participate in governance decisions.

➤ Beefy Finance enhances yield farming convenience with cross-chain support and a community-driven approach to vault development.

What is Beefy Finance?

Beefy Finance is a decentralized and multi-chain financial platform that is blockchain agnostic. It is also a yield optimizer that enables users to earn compound interest on their token holdings. It takes your yield earnings and reinvests them to boost your gains.

Beefy debuted its platform in September 2020, the same day its governance token went live. Beefy’s first vault opened in October 2020. An anonymous group of individuals founded Beefy Finance. The team believes that the project speaks for itself and that providing the best possible experience for its consumers is more essential than displaying personalities.

Since its inception, Beefy Finance has committed to providing the greatest annual percentage yield (APYs) in an efficient and safe way. It automatically boosts user rewards from a variety of DeFi-based liquidity pools (LP) and automated market maker (AMM) applications. This approach minimizes transaction fees and maximizes scalability within the DeFi ecosystem.

Beefy’s primary product is its Vaults, which it uses to stake users’ cryptocurrency tokens. Users retain complete control of their assets, which are securely stored in the platform’s vaults.

This protocol is also a DAO, and anybody holding its tokens can vote on its governance to participate in future decisions. During this process, the investment strategy is fundamentally tied to a particular vault. In addition, this strategy is a compound yield farm reward that is equal to your initial asset deposit.

Yield optimizer is synonymous with yield aggregator, both of which are platforms that automate the yield farming process.

How does Beefy Finance work?

There are a few primary features of the Beefy Finance protocol decentralized application (DApp) that users should remain aware of. Primarily the Vaults and Launchpool.

Vaults

On DEXs, you may often manually harvest, sell rewards, continually reinvest, or acquire more tokens. Beefy’s Vaults can do this automatically and at the highest possible frequency. Each vault has a unique strategy stated in the underlying structure of the smart contract code.

Specifically, their primary objective is to increase yield. Furthermore, the Vaults’ objective is to automate the process of investing and reinvesting funds, assisting in attaining compound interest at high rates.

Notably, this automation reduces transaction fees and enhances data integrity, making Beefy Finance a key player in the decentralized finance space. On the Beefy platform, three kinds of vaults are available:

- Single asset vaults

- Stablecoin vaults

- Liquidity pools

Beefy Finance continues to expand its vault offerings, ensuring a wide variety of options for users participating in automated yield farming. You may see the vaults by selecting a category from the drop-down menu on its website. Each of these vaults represents a pair of tokens in a liquidity pool or a single token through loan platforms.

The selection process

Each member of the Community team can cooperate and submit new governance and voting procedures to the team. At this stage, the Beefy team will review vault needs through an official forum where anybody may publish their specific requirements.

This community-driven approach ensures that the platform evolves in a way that best serves its users, reinforcing its position as a leading DeFi platform.

Launchpool

The Beefy project employs an initial coin offering vault to promote projects on the Binance Smart Chain. Consequently, the network will push certain types of vaults to offer the highest possible annual percentage yield to its consumers through the partner tokens. This strategy not only boosts yields but also integrates new projects into the multi-chain platform, enhancing the overall DeFi ecosystem.

Beefy Finance features

Many key elements distinguish Beefy Finance from the rest of the DeFi ecosystem. These are:

- Beefy was based on BSC but has now migrated to Ethereum. Its objective is to optimize and maximize yield farming automatically. It returns most networks’ income to users who invest $BIFI, which qualifies them for a dividend-eligible portion of the platform.

- It optimizes yields using the vault system. The platform employs multiple smart contract developers who test and approve vaults, new smart contracts, and investing strategies before releasing them to the public.

- Beefy Finance supports several blockchains, making it highly adaptable.

- By using cryptocurrencies as liquidity, the vault system creates and compounds interest.

- Beefy has its own native governance token, which users can use to vote on and influence platform-related decisions.

The BIFI token

BIFI tokens offer a “dividend-eligible” income share in the BIFI financial ecosystem. It allows holders to benefit from the ecosystem’s earnings. It is a native BEP-20 governance token that also serves as a transaction fee for vault transactions.

The platform earns income by distributing a tiny portion of the Vault’s earnings to holders of BIFI tokens. Additionally, holders have the power to vote on ideas and have a say in how decisions are made. Additionally, users may stake these tokens in the Maxi vault to earn extra BIFI or in the GOV vault to get wrapped BNB tokens.

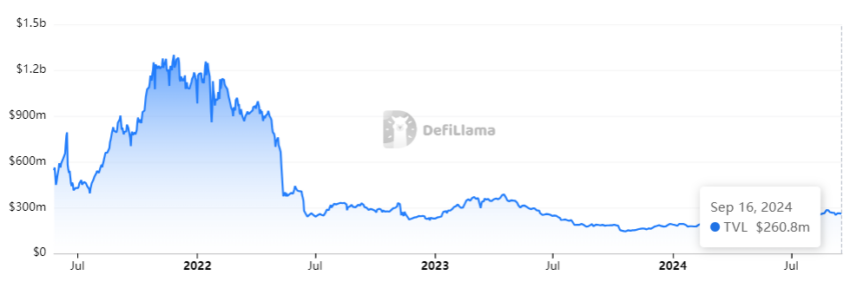

As of July 2025, the total value locked (TVL) of Beefy is over $250 million. It is down from its previous all-time highs achieved in the 2022 bull run but remains steady as of today.

Tokenomics

The native token of Beefy Finance, BIFI, is a governance token with a total supply limit of 80,000 tokens. It launched on the Binance Chain but eventually migrated to Ethereum.

The circulation supply is distributed as 72,000 BIFI and 8,000 for the team to guarantee speedy development and innovation of its protocols. It has a market capitalization of over $24 million as of July 2025.

Additionally, BIFI token holders can participate in the platform’s decision-making process as part of a governance structure. Staking BIFI tokens in the Beefy governance pool allows users to earn wBNB, adding another layer of value to their holdings.

With a limited supply and pre-mined status, BIFI tokens are highly sought after on decentralized platforms like BakerySwap and PancakeSwap.

Users will earn wBNB by staking BIFI tokens in the Beefy governance pool. Furthermore, customers can get a percentage of the vault performance fee generated via yield farming users. Finally, since BIFI is completely pre-mined and has a limited supply, users cannot farm it but may acquire it through decentralized platforms such as BakerySwap and PancakeSwap.

Beefy Finance is making yield farming more convenient

Beefy Finance offers a diverse array of yield farming opportunities to DeFi subscribers. Its vault has taken the “conventional” application of Yearn Finance (YFI) and given it a significant twist. Beefy vaults now provide a convenient yield farming experience.

Beefy Finance’s cross-chain interoperability also distinguishes it from several other protocols in the ecosystem. The primary objective of the Beefy community is to recruit a large number of like-minded people to the crypto sector and to stimulate further growth. While DeFi is uncertain, recent data indicate a more optimistic future for the protocol.

Frequently asked questions

Is Beefy Finance trustworthy?

How do you make money with Beefy Finance?

How do Beefy Finance Vaults work?

What chain is Beefy Finance on?

What does Beefy Finance do?

How do I buy Beefy Finance?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.