Ethereum is a game-changing crypto player. It is a protocol with multifaceted capabilities related to smart contracts, decentralized applications (DApps), and more. In this detailed guide, we discuss everything you need to know about the second-largest cryptocurrency by market cap, helping you decide if buying ETH is right for you.

KEY TAKEAWAYS

► Ethereum is a general purpose blockchain that supports smart contracts, decentralized applications (DApps), and more.

► You can buy Ethereum through centralized exchanges (CEX) like Kraken, Binance, or decentralized exchanges (DEX) like Uniswap.

► Ethereum’s competitors offer varying transaction upgrades, but Ethereum’s proof-of-stake mechanism and ecosystem make it a dominant force.

► Earning with Ethereum is possible through staking, yield farming, and liquidity providing, which offers passive income opportunities.

How to buy Ethereum

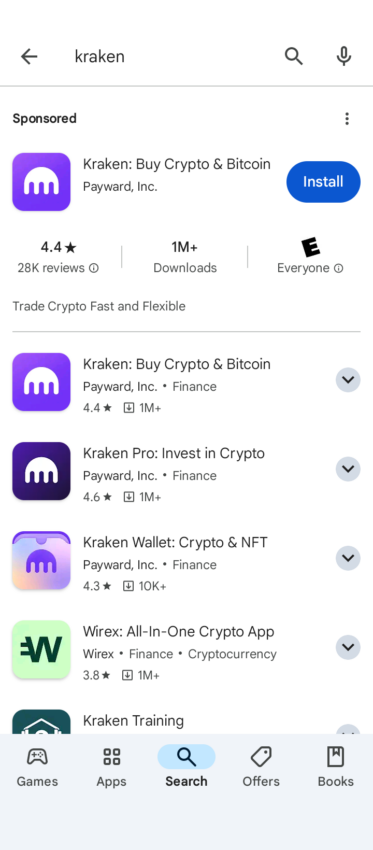

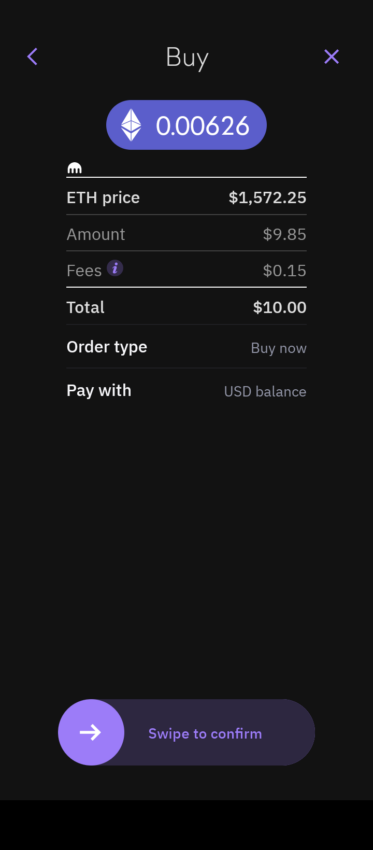

IF you want to purchase Ethereum, you will first need to select an exchange. For our demonstration, we will use the Kraken exchange.

How to buy Ethereum and hold the asset?

1. Firstly, go to your device’s mobile app store. Search for Kraken and select install.

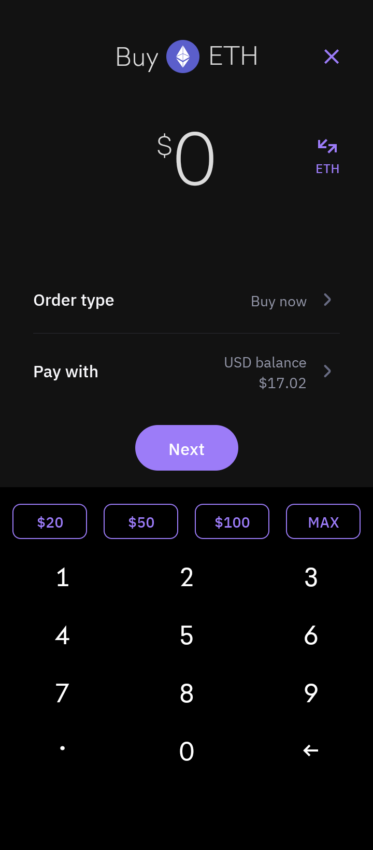

2. Next, open the Kraken app, find Ethereum, and press “Buy.”

3. For the third step, select the amount of ETH that you would like to purchase.

4. Finally, swipe the slider to the right to confirm your transaction.

You can buy Ethereum (ETH) on a centralized (CEX) or decentralized exchange (DEX). To purchase ETH on a CEX, all you need is to create an account, verify your credentials, and fund the exchange wallet.

Different exchanges offer different payment methods in case you want to rely on order book buying. Exchanges like Binance, OKX, and more also allow you to buy Ethereum via P2P trades, provided you hold USDT or any other compatible crypto.

For DEX-based purchases, you must connect your wallet and move funds to swap and acquire ETH. Once you buy Ethereum, you can rely on the right wallet — hardware, software, or mobile — to store the asset.

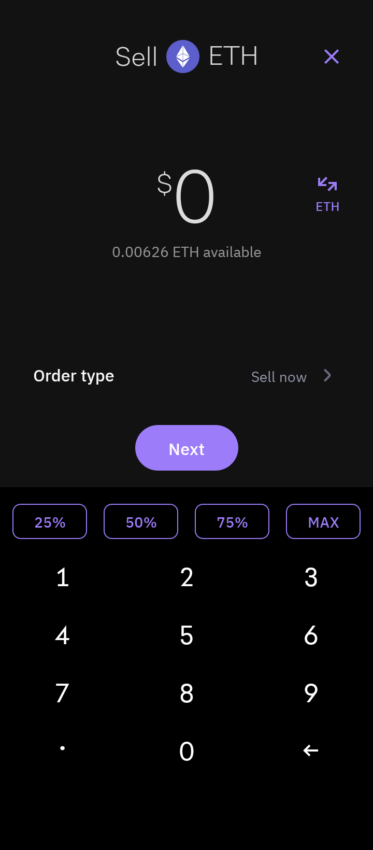

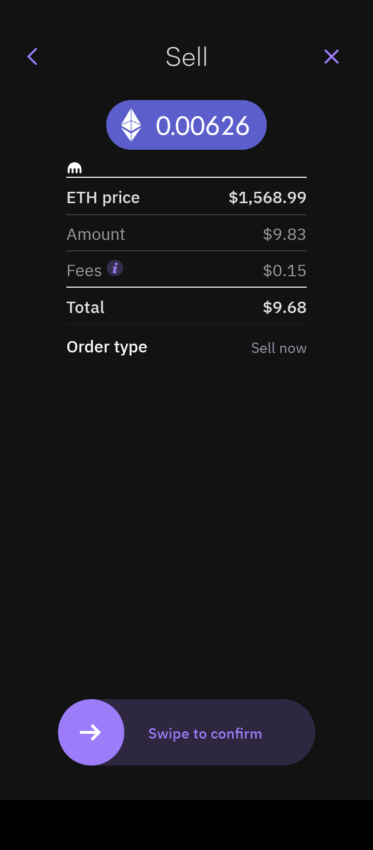

How to sell Ethereum quickly?

If you have ETH stored in your wallet, perhaps you have bought or earned it through mining and staking. While some evangelists may look to HODL long term, others will be keen to know how to sell Ethereum.

Just like when you bought ETH, selling the same can also be initiated via CEXs and DEXs. You can even swap your ETH for exchange tokens to quickly offload the same for fiat. You can also rely on P2P cryptocurrency trading to sell your holdings for BTC, USDT, or any other compatible crypto.

1. First, open the Kraken app, go to the portfolio, and select Ethereum and “Sell.”

2. Select the amount of ETH that you would like to sell.

3. Lastly, swipe the slider to the right to confirm your sell order.

Where to buy Ethereum: Top platforms

- Coinbase: Our detailed evaluation of the platform has demonstrated that the PRO version is worth the switch for the seasoned trader due to the advanced analytics and tools available. Another noteworthy perk we noticed is the platform’s unique approach to incorporating educational elements into its rewards program. With this approach, the exchange encourages users to expand their knowledge while reaping financial benefits.

- Binance: The platform’s fee structure is transparent and competitive compared to other leading exchanges. Based on our experience, Binance’s homegrown NFT marketplace, along with its futures and options trading desks, is particularly appealing to traders with diverse interests and risk appetites.

- OKX: We particularly enjoyed OKX’s diverse trading options, which included peer-to-peer trading and automated trading bots. These features have proven to be incredibly useful, and we found the platform to be consistently user-friendly and efficient. The peer-to-peer platform proved to be flexible enough so we could execute transactions on our terms.

- Kraken: Our experience using Kraken for futures trading has been largely positive, with its advanced interface providing an insightful overview of market trends and potential investment strategies. We also found the depth of its trading features pretty handy, especially for those of us who appreciate a more nuanced approach to trading.

The above platforms all represent excellent options for buying and selling ETH. All have decent liquidity, and the majority boast a global presence. Furthermore, all of our recommended platfroms benefit from solid customer protection and security offerings. While no crypto transaction is completely risk-free, sticking with these reputable options is advisable.

Top platforms to buy Ethereum compared

| Platform | Type | Availability | Fees |

|---|---|---|---|

| Coinbase | Brokerage | 100+ countries | $0.99-$4.19 |

| Binance | Exchange | 100+ countries | 0.1% |

| OKX | Exchange | 100+ countries | 0.14%/0.23% |

| Kraken | Exchange | 160+ countries | 0.25%/0.40% |

However, if you’re keen not to KYC when you buy Ethereum and would prefer to purchase crypto anonymously, a number of leading decentralized exchanges also support the second largest crypto. Solid offerings in this space include Uniswap and dYdX.

Unpacking the Ethereum network

While the Ethereum roadmap is illustrious and the Ethereum community is exceedingly tech-oriented, buying ETH requires an additional understanding of the ecosystem. Let’s explore this further.

What is Ethereum?

Ethereum was conceptualized in 2014 and led by Vitalik Buterin and other notable personalities, including Gavin Wood and Charles Hoskinson. It is best viewed as an open-source network leveraging distributed ledger technology.

It acts as a stage for smart contracts—blocks of code for autonomous deployment. The support for smart contracts allows individuals to build apps on top of Ethereum, known as DApps. All of that makes Ethereum more like an operating system than a vanilla digital currency.

A deeper look into the Ethereum network reveals its original vision. The founders precisely wanted something more than a payment system—an idea that eventually helped the project raise $1 billion in funds. However, like any other successful crypto, despite the underlying innovation, the Ethereum price quickly became important to crypto traders and investors.

Did you know? Ethereum’s first live release, Frontier, came to the fore in July 2015. This marked the first milestone of the Ethereum roadmap.

What are smart contracts?

If you want to buy Ethereum (ETH), you should know its capabilities. Most of these — like hosting DApps and helping build new tools and resources for an all-encompassing web3 outlook — hinge on the network’s support for smart contracts.

For the uninitiated, smart contracts are self-executing code bits that identify as condition-based, trustless agreements. These smart contracts lay the foundation for decentralized finance, NFTs, blockchain games, and more—all hosted on Ethereum.

Choosing an Ethereum wallet

Before getting started with an Ethereum wallet, know that it can either be a software or hardware wallet to store ETH or even ERC-20 tokens. And wallets are like keys, which you can use directly to interact with DApps, DEXs, and other relevant resources. As for the types of wallet, you can look at mobile, web, cold, and hot wallets, choosing one that aligns best with your needs.

If you choose to buy Ethereum, it is important to keep crypto wallet security as a top priority. Ensure you can secure your seed phrase, and do not share your private key with anyone.

Best Ethereum wallet to choose from

Top Ethereum wallets include the Ledger Nano X or Trezor One, both of which are leading hardware options. The likes of MetaMask and Exodus offer decent desktop and mobile solutions. Another viable option is MyEtherWallet. Consider whether a wallet is multi-signature and offers two-factor authentication. Also, check a wallet’s reputation around ease of asset recovery before proceeding.

Is Ethereum a good investment?

Now that we have covered some of the elements associated with the Ethereum ecosystem, it is only appropriate to tickle the fancy of traders.

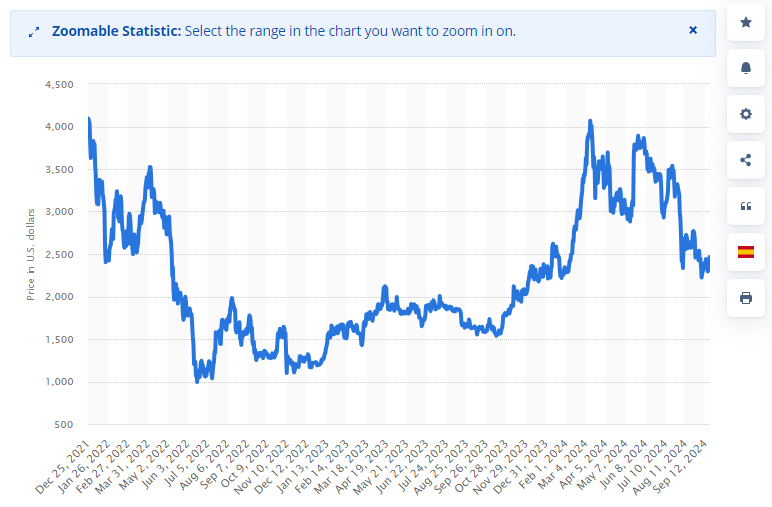

This chart shows the day-to-day price fluctuations of Ethereum (ETH) from July 1, 2021, to September 20, 2024. The data reveals a period of significant fluctuation, marked by a pronounced peak in the latter part of 2021. This surge reflects a potential uptick in investor interest or a bullish sentiment in the market.

As the timeline progressed, Ethereum’s price declined, stabilizing at lower values for an extended period. Towards the end of 2023, the price ascended sharply, indicating a possible revival of investor confidence or favorable market conditions.

“Medium-term $8000-$10,000.”

Clem Chambers on ETH’s growth potential, Founder of Umbria Network: BeInCrypto interview

Key observations:

- Late 2021’s peak suggests investors aggressively accumulated ETH, increasing its value.

- The subsequent price drop may reflect market sell-offs, evolving investor perspectives, or economic trends impacting the cryptocurrency.

- The steep increase in late 2023 points to a renewed market rally, possibly driven by the adoption of Ethereum and its technological improvements.

- Innovations in layer-2 solutions likely enhance Ethereum’s efficiency and affordability, contributing to the positive price movement observed in the chart.

“I am hopeful for the long term on Ethereum and @VitalikButerin have played a positive role on crypto and the community.”

Tom Lee, Co-Founder of Fundstrat: X (ex-Twitter)

Ethereum vs. competitors

Before you head out to buy Ethereum, ensure you take a look at its competitors. This can give you insights regarding network adoption and how other native tokens are performing. And while Ethereum has many supposed “killers” or rather Ethereum alternatives, we have analyzed the top three options.

| Network | Token | Mechanism | Purpose | Block time |

|---|---|---|---|---|

| Ethereum | ETH | PoS | Smart contract platform | ≈ 12 seconds |

| Litecoin | LTC | PoW | Payments | ≈ 2.5 minutes |

| Solana | SOL | PoH | Smart contract platform | ≈ 0.8 seconds |

| Ethereum Classic | ETC | PoS | Smart contract platform | ≈ 13 seconds |

Litecoin vs. Ethereum: What’s the difference?

The Litecoin vs. Ethereum debate holds little weight now that the latter has embraced a proof-of-stake (PoS) consensus mechanism. However, when Ethereum was proof-of-work (PoW), the Litecoin network was one of its closest competitors. As for the differences post-merge, Litecoin still boasts lower transaction fees compared to the Ethereum network.

Solana vs. Ethereum: An ultimate comparison

The Solana vs. Ethereum bit makes more sense as both these ecosystems can host applications, NFTs, and smart contracts. While Solana relies on PoH or proof-of-history, Ethereum is purely PoS. Despite the instances of outages plaguing Solana rather frequently, the network still boasts lower transaction fees and faster transaction finality than Ethereum.

Solana-based meme coins vs. Ethereum-based meme coins

Solana and Ethereum have become hotbeds for meme coin innovations, each with its own standout tokens. On Solana, Dogwifhat, BOME, and Bonk are leading the charge, drawing in users with their unique blend of humor, community engagement, and potential for growth.

Ethereum’s ecosystem, on the flip side, also has viral successes like Shiba Inu and Pepe, which have captured the imagination of investors and meme enthusiasts alike. Moreover, Base chain meme coins on the Ethereum network like Toshi, Degen, and Base God have hopped on the meme coin bandwagon, carving out their own niches and offering a new layer of diversity.

Ethereum Classic vs. Ethereum: Where do the chains differ?

Ethereum Classic vs. Ethereum makes the most sense as a comparison, as both these blockchains originate from a single codebase. The former is a fork of Ethereum, following the infamous DAO hack in 2016. It is worth noting that while Ethereum has transitioned to PoS, Ethereum Classic is still PoW.

Earning with Ethereum

Another reason to buy Ethereum (ETH) is to hold the coin and earn passive income. Let us see how this works.

Ethereum staking: The go-to passive earner

Staking is a way of locking ETH up, primarily to secure the network — all while earning passive income on it. While staking ethereum has many benefits, there are also a few drawbacks. These include the high staking limit to become a validator and the chances of getting your funds slashed.

If you are unsure where to stake Ethereum (ETH), the best options include Lido and Rocketpool. These are liquid staking platforms where the staked ETH isn’t actually locked and can be redeemed per your requirements. Apart from Lido and Rocketpool, other platforms like Binance, Stakewise, and more exist to stake ethereum.

Ethereum interest rates: Exploring the options

While staking is one way to generate passive earnings with ETH, there are other strategies like lending, liquidity provisioning, and more with high Ethereum interest rate options to explore. However, suppose you do not manually want to search for passive earning options. In that case, platforms like Nexo, BlockFi, Liquid, and more can offer rewarding interest rates on ETH deposits and do all the heavy lifting on your behalf.

High-yield options for earning interest with yield farming

If you are new to the Ethereum ecosystem, yield farming is a process where ETH holders stake their corpus on select liquidity pools. The approach supports compounding and can also be a lead-generating strategy for a new token launch.

The top yield farms on Ethereum include Curve, Aave, Uniswap, Yearn Finance, and SushiSwap. To check and validate new options, you should carefully analyze the total value locked, liquidity pools, quality of smart contracts, and other factors.

Is Ethereum the rocket fuel for your crypto portfolio?

The Ethereum blockchain is much more diverse than the Bitcoin network, which maintains a strict stance as a peer-to-peer cash system. Some who want to buy Ethereum (ETH) and hold the asset long-term are optimistic about the likelihood of flippening — a possible future event where the Ethereum market cap surpasses that of Bitcoin.

With the Ethereum network opening arms to smart contracts, DeFi, NFTs, and even institutional ethereum adoption, flippening might not be out of the equation in the years to come.

Frequently asked questions

Yes, Ethereum is an altcoin. Altcoins are any cryptocurrencies other than Bitcoin, and Ethereum falls into this category. It is one of the most well-known and widely used altcoins in the cryptocurrency market.

Various factors, including supply and demand dynamics, market sentiment, technological advancements, network upgrades, regulatory news, and the cryptocurrency market’s overall health, influence Ethereum’s price. Major developments within the Ethereum platform and upgrades to improve scalability, security, and functionality can also significantly impact its price.

If you are a beginner, onboarding a centralized exchange to buy Ethereum makes the most sense. To start buying ETH on a CEX, you must first create an account and then verify the KYC credentials. On the exchange, you can even buy ETH via peer-to-peer trading.

Yes, you can invest $100 in Ethereum, provided you onboard a relevant exchange that has a minimum buying limit of less than 100 bucks. Some exchanges have a fiat deposit and crypto buying limit of $1, making it easy to purchase $100 worth of ETH. Also, if you follow Ethereum’s price action, with it moving from under $1 to $4800, even a $100 investment makes sense.

Yes, Ethereum is available on Coinbase. You can buy, sell, and trade Ethereum (ETH) on the platform, which supports various Ethereum-related features and other cryptocurrencies, making it highly accessible to users.

Buying Ethereum (ETH) is relatively safe as it is one of the less volatile cryptocurrencies. It is the second largest crypto player by market cap, a feat that lends it credibility. And even though it is trading a lot lower than its all-time high of almost $4900, there is no immediate threat of the prices crashing to sub-2016 levels.

While both Bitcoin and Ethereum are blockchain-based cryptocurrencies, they have distinct purposes and capabilities. Bitcoin was created primarily as a digital currency to facilitate peer-to-peer transactions. Ethereum, on the other hand, extends beyond being a digital currency by providing a platform for building decentralized applications (DApps) and smart contracts, which automatically execute transactions when certain conditions are met. Ethereum’s native token, Ether (ETH), is used to power transactions on its network.

You can buy BTC or ETH, depending on your personal preferences. If you prefer PoW cryptocurrencies, Bitcoin makes more sense. However, Ethereum is more energy-efficient, courtesy of the PoS transition. Also, Ethereum is priced lower per unit than Bitcoin.

Ethereum is a decentralized entity and, therefore, has no owners. However, it has co-founders, with Vitalik Buterin being the most popular name. Other known individuals associated with the founding team are the Cardano Founder Charles Hoskinson, Anthony Di Lorio, Joseph Lubin, Mihai Alisie, and Gavin Wood.

If you are looking for an ETH holding pattern, Vitalik Buterin is the biggest individual ETH holder. His address, VB 3, is ranked 25th and holds 0.20% of the total supply. However, if you want to include businesses, Binance 7 and Binance 8 — two hot wallets of the Binance ecosystem — hold over 2.3% of the total supply.

To buy ETH in the U.S., you can rely on compatible centralized exchanges like Binance U.S., Coinbase, and more. You can also buy ETH via U.S.-based P2P exchanges, which include Paxful and LocalBitcoins. However, you must check the regulations posted by the platform before proceeding.

Yes, Ethereum is completely legal in the U.S. Per the N.Y. Court, ETH is tagged a commodity and not a security, as initially argued by the SEC. Therefore, trading in Ethereum isn’t subject to the same set of regulations imposed on bonds and stocks.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.