Though the terms are often used interchangeably, tokens and coins are two distinct categories of cryptocurrency. It is important to know the difference as there may be different trust assumptions associated with using one or the other. This guide covers the differences between tokens vs. coins and highlights recommended platforms for purchasing each.

Methodology

BeInCrypto chose the top platforms to purchase coins and tokens was thorough and conducted over a period of six months. Our criteria for the best platforms were safety, fees, availability, reputation, features, and assets offered. Many were considered, however, the platforms that scored the highest are:

- Coinbase

- Kraken

- Binance

- YouHodler

Here’s some insight into why each was selected.

Coinbase

As the most popular U.S based crypto brokerage and exchange, and perhaps second most popular exchange globally, Coinbase is one of the top options for purchasing cryptocurrency. The company is known for its adherence to compliance, which gives it a large degree of safety.

Kraken

Kraken is well known for its advanced trading features, user interface, and derivatives offerings. The exchange also has earning features which allows it to be more than just a simple trading platform. The highly secure CEX also offers NFT, margin and futures trading.

Binance

As the largest exchange by trading volume, Binance is the preferred exchange for deep liquidity in many markets. The exchange also has an ultra low trading fee of 0.1%. Binance is considered an all-in-one exchange, as it has multiple features for many types of crypto activities.

YouHodler

YouHolder is an E.U. based exchange that serves customers in multiple regions. It is perhaps known for its earning features which allows customers to deposit crypto and earn interest in return. Users can also take out loans using crypto as collateral on YouHodler.

This methodology was peer-reviewed and fact checked to ensure accuracy. To learn more about BeInCrypto’s Verification Process, click the following link.

- What are cryptocurrency coins?

- How do crypto coins work?

- What are crypto coins used for?

- Popular crypto coins

- What are cryptocurrency tokens?

- How do crypto tokens work?

- Exploring the uses of crypto tokens

- Popular crypto tokens

- Cryptocurrency coins vs. tokens

- Crypto coins vs. tokens vs. TradFi

- What are stablecoins considered in the token vs. coin debate?

- Understanding the risks of coins vs. tokens

- Frequently asked questions

What are cryptocurrency coins?

In cryptocurrency, coins are digital assets native to a blockchain. Put another way, they are assets built into the blockchain itself rather than on top of the blockchain.

We can think of this in terms of nations. The native currency for the United States is the United States Dollar (USD), the British Pound Sterling (GBP) for the United Kingdom, and the Euro (EURO) for the Eurozone. Similarly, the native cryptocurrency for the Bitcoin blockchain is Bitcoin (BTC), Ether (ETH) for Ethereum, and Solana (SOL) for the Solana blockchain.

Let’s take this further. The U.S. Department of the Treasury issues seven denominations of paper currency ($1, $2, $5, $10, $20, $50, and $100) and five denominations of coins (1¢, 5¢, 10¢, 25¢, 50¢). In the same way, cryptocurrency coins have several denominations as well.

| Bitcoin | Ethereum |

|---|---|

| 1 BTC | 1 ETH |

| 0.1 dBTC (decibit) | 0.001 finney |

| 0.01 cBTC (centibit) | 0.000001 Szabo |

| 0.000001 μBTC (bit) | 0.00000001 gwei (gigawei or Shannon) |

| 0.0 000001 sat (satoshi) | 0.000000000001 mwei (megawei or Babbage) |

| 0.00000000001 msat (millisatoshi) | 0.000000000000000001 wei |

How do crypto coins work?

There are two popular methods for creating a blockchain’s native coins — UTXO (unspent transaction output) and the account model. While cryptocurrencies like Bitcoin and Litecoin use the UTXO model, other cryptocurrencies like Ethereum and the BNB chain use the account model.

UTXO

A UTXO is created when a transaction occurs. When miners mine a block, they make a Coinbase or a transaction to pay themselves for updating the blockchain. A coinbase transaction is the first transaction in a block a miner creates.

When a transaction output is created, it becomes a UTXO until it is spent. Each UTXO contains information about its value (e.g., how many coins it represents). Once created, the outputs can only be used once as input in a new transaction.

This is similar to a transaction made in coins or bills. A UTXO is like a coin or bill itself, while the bill’s value can vary, similar to how the value of a UTXO can vary. Once spent, you can not retrieve the bill you used to pay once, just like UTXOs can only be used once. The buyer receives any change left over from the transaction. Another UTXO is created and sent to the recipient when a UTXO is spent.

If the original UTXO exceeds the amount sent, a second UTXO is made, and the sender receives the remainder via a change address. Each UTXO must reference a previous UTXO as its input, except for special cases like coinbase transactions where new coins are minted. This creates a chain of custody from one UTXO to another based on the history of transactions. You can trace a UTXO back to the transaction where it was created as an output.

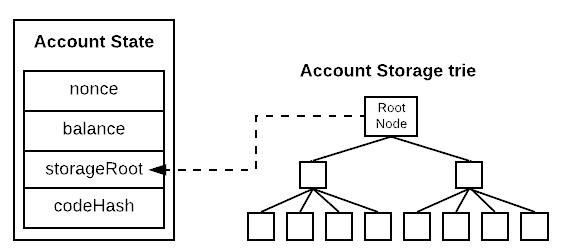

Account

While the UTXO model records transactions in a way that is similar to transacting with bills and coins, the account model is similar to traditional banking. In this model, accounts hold balances that increase or decrease with each transaction.

When you send a transaction, the blockchain directly adjusts the accounts’ balances. It also debits the amount from the sender’s account and credits the same amount to the recipient. As a result, the coins technically are not “sent.” Rather, there is a ledger that updates with each transaction.

Another important detail to keep in mind is the account nonce. The account nonce is simply an index of the number of successful transactions of a single account. It ensures that transactions from a single account are processed in the order they are sent. This is important for maintaining the state consistency of the account, such as the balance of Ether.

The term nonce (number used once) is used quite frequently in crypto and tech-related fields. “Account nonces” have a separate purpose from nonces in blockchain mining, message authentication codes (MAC), and other systems.

What are crypto coins used for?

Blockchains are distributed databases requiring a network of nodes to maintain all the data it stores. The nodes are computers or servers maintained by individuals or organizations. However, keeping these databases comes at a cost. Unlike Amazon Web Service or Microsoft Azure, the database (or blockchain) nodes are anonymous and distributed globally. Therefore, paying these node operators for their work in a fiat currency is impossible.

When a block is created, the node that mines or proposes the block receives a coinbase or a stipend for maintaining this distributed database.

Another reason that coins exist is to pay gas and transaction fees. When you create a transaction on a blockchain, a node must pick up your transaction and expend resources to execute it. A transaction fee is paid to the miner or proposer (validator) that executes the transaction. Alternatively, gas fees are the cost to execute the transaction, and transaction fees are the cost to pay the miner or validator to execute the transaction. Users pay both transaction and gas fees in coins.

Popular crypto coins

1. Bitcoin (BTC): Created by the pseudonymous Satoshi Nakamoto, Bitcoin is the original cryptocurrency. While Bitcoin was designed as a medium of exchange, it has since found a stronger use as a store of value.

2. Ether (ETH): Ether is the native cryptocurrency to the Ethereum blockchain. It is used as gas for the Ethereum virtual machine, which allows developers to create applications with some level of complexity.

3. Solana (SOL): As the native coin of the Solana network, SOL is used as payment for gas and transaction fees — which are extremely low on Solana. The smallest unit of SOL is a Lamport, named after Leslie Lamport.

4. Avalanche (AVAX): Avalanche is a layer-0 protocol that uses the AVAX coin as its native crypto. On Avalanche, users can launch subnets using their own nodes.

5. Cosmos (ATOM): Cosmos is a hub allowing founders to create blockchains using the IBC. This enables blockchains to communicate, share information, and transfer assets like ATOM securely and standardized.

What are cryptocurrency tokens?

Unlike coins, developers do not build cryptocurrency tokens directly into the blockchain. Instead, they create tokens as cryptocurrencies using smart contracts on a blockchain. The logic for what “qualifies” as a token and governs its behavior depends entirely on the developer that creates it.

With most blockchains today, the network does not recognize the tokens built on it. A few blockchains like Sui and Aptos offer rare exceptions to this rule. As such, some communities have developed token standards specific to their blockchain ecosystem. Token standards govern how accounts are updated. Some of the logic that they manage includes:

- Transfer logic

- Event logging

- Balance updates

- Supply and issuance schedule

- Burning mechanism (if applicable)

Perhaps the most popular token standard is the ERC-20 standard for the Ethereum ecosystem and EVM-compatible chains. There is also the BEP-20 standard for the BNB chain, SPL (Solana Program Library) for Solana, and, more recently, the BRC-20 standard for Bitcoin.

The concept of tokens is not specific to cryptocurrency. Many examples of tokens exist in the real world. In this case, a token is just a physical representation of some right or privilege. For example, you could consider the deed to a house or the title to a car as a token or proof of ownership of those assets.

Tokenization is the digital representation of rights and privileges. In the case of tokens created by smart contracts, the token represents the right to transact value.

How do crypto tokens work?

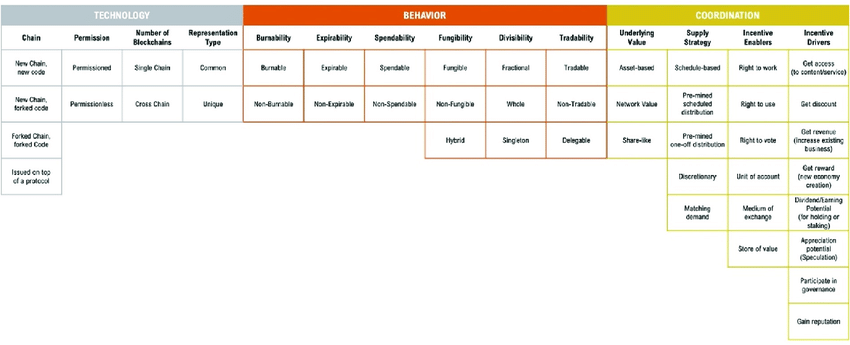

Aside from the standard logic, tokens work in many different ways. Founders typically create tokens with a purpose in mind and will tailor their behavior to the decentralized application (DApp) or ecosystem in which it will operate.

Many have attempted to create frameworks for classifying token logic. This is quite the herculean feat, considering that they are as diverse as the developer is imaginative.

In the case of ERC-20 tokens, the logic for the token exists completely within the smart contract. So technically, addresses on Ethereum do not actually “hold” tokens. Rather, the smart contract is like a ledger for an accountant. It keeps a record of the balances of each address that owns tokens.

When someone “sends” tokens to another address, the smart contract updates the balance of both addresses. That is why it is important to create tokens using well-tested standards and best practices. Unless developers are careful, a hacker could game poorly formed token logic.

Exploring the uses of crypto tokens

As stated previously, many have attempted to create standards for classifying tokens. This is difficult, considering tokens gain new use cases every year. The most popular uses for tokens are:

- Governance: Gives the holder the right to make decisions for a protocol or application. It also grants the holder certain privileged rights, such as operating a protocol or application.

- Utility: Utility cryptos provide the holder access to specific products or services. For example, holding a utility token as an in-game currency may allow you to play games on an application.

- Medium of exchange/unit of account: A unit that measures the value of goods and services and allows parties to buy and sell goods and services.

- Speculation: A non-productive asset that doesn’t produce income, interest, rent, or earnings. They are specifically created as an investment that has the potential for a high return, after which it is immediately sold.

Popular crypto tokens

1. Chainlink (LINK): Chainlink is most notably known for its blockchain-agnostic oracle services. The team behind Chainlink also creates infrastructure for cross-chain communication, bridging, verifiable randomness, and more.

2. The Graph (GRT): Often described as the Google of web3, The Graph is a protocol for indexing information stored on the blockchain. It allows users to query, publish, and use public data to build applications.

3. Render (RNDR): Render is a project that allows users to transact in a GPU marketplace. Sellers can rent out their GPU power while buyers utilize it for graphic rendering tasks.

4. Uniswap (UNI): Uniswap is Ethereum’s most popular decentralized exchange (DEX). The UNI token gives its holders governance rights over the protocol.

5. Gala (GALA): Gala Games is a blockchain-based gaming platform that lets players own, develop, and trade in-game assets with cryptocurrency.

Cryptocurrency coins vs. tokens

Here’s a comparison chart that outlines the key differences between crypto coins and tokens. This chart helps to delineate the differences between crypto coins and tokens, portraying how they are used, where they operate, and their characteristics in the cryptocurrency ecosystem.

| Features | Coins | Tokens |

|---|---|---|

| Definition | Native cryptocurrency of its blockchain | Built on existing blockchains using standards like ERC-20, |

| Blockchain | Have their own blockchain | Do not have their own blockchain, reside on others like Ethereum |

| Purpose | Primarily used as digital currency | Can represent assets, provide utility, or function in DApps. |

| Creation | Created through mining or pre-mined | Created through smart contracts. |

| Use Cases | Used for payments, store of value | Can be used for voting, access to a service, represent assets (physical or digital). |

| Examples | Bitcoin, Ethereum (ETH), Dogecoin | USDC, Chainlink, Shiba Inu (NFT). |

| Governance | Governed by the protocol’s rules. | Governed by the rules of the host blockchain and the specific smart contract. |

| Interchangeability | Fungible (each unit is the same as every other unit) | They can be fungible or non-fungible (NFTs). |

Crypto coins vs. tokens vs. TradFi

You can compare coins and tokens to currency in traditional finance (TradFi) in many ways. From an accounting perspective, the ledger that records and issues the currency is centralized in trades, decentralized with coins, and depends on tokens.

In traditional finance, there are different forms of money because of the system’s complexity. For example, USD can come in bank deposits, fiat (e.g., bills and coins), treasuries (e.g., bonds, notes, etc.), and central bank notes.

“When most people think of money, they picture rectangular pieces of government-printed paper, known as fiat currency, decorated with historical figures. Although it is the most well-known form of money, it is only a small part of what constitutes money in the modern financial system.”

Joseph Wang: Central Banking 101

This complexity complicates the ledger; however, at the end of the day, the system is mostly centralized under the U.S. government. On the other hand, coins built on blockchains are part of a decentralized ledger that is maintained by a global community.

In the case of USD, the U.S. government can sanction any country to prevent it from using dollars. With a blockchain, anyone has the right to update the ledger (mint more coins), but no one can exclude anyone else from doing so or transacting. However, tokens do not necessarily have this ability. It all depends on the smart contract itself.

What are stablecoins considered in the token vs. coin debate?

Despite the name, stablecoins are primarily tokens. Developers create stablecoins on vetted and seasoned blockchains. This makes them tokens. The reason is that mature blockchains already have the infrastructure for users to utilize stablecoins.

If stablecoin providers had to build their blockchains to issue coins, they would also have to find a way to attract developers to build apps on their blockchain or the applications themselves. Both of these options are extremely costly. There could also be significant ramifications if these providers built their own blockchains and bridged the stablecoins to other ecosystems.

- Users would put their stablecoins at risk, requiring a custodian to hold their coins and mint new tokens on the destination chain.

- Custodians could rug-pull bridge liquidity, leaving the wrapped tokens worthless.

- Bridges would have to build clients resolving the ledger or state of the source and destination chain.

- Hackers could potentially hack bridges or bridge operators.

Understanding the risks of coins vs. tokens

This comparison between crypto coins and tokens highlights substantial differences between asset types. You must thoroughly research and understand these distinctions for safe trading practices. Staying well-informed will empower you to navigate the cryptocurrency sector safely and effectively.

Frequently asked questions

Coins are cryptocurrencies that have their blockchain. Tokens are built on blockchains but do not have their own. They are simply smart contracts that exist outside of the source code of a blockchain.

Ethereum is a blockchain. The native coin of Ethereum is Ether. Though many cryptocurrencies exist on Ethereum, their logic is not built into the source code of Ethereum.

Tokens are useful for utilizing services on decentralized applications (DApps). For example, traders can not use native Ether in many applications on Ethereum. They must use Wrapped Ether (WETH), a tokenized (smart contract) version of Ether.

There are many different classifications for tokens. Utility, governance, security, non-fungible, and transactional are the most common. Tokens are often difficult to classify because their uses and purposes grow with time.

Tokens are not a phenomenon specific to cryptocurrency. They also exist in the traditional world. For example, a deed to a house or car title could be considered a token.

Examples of tokens include Chainlink (LINK), the Graph (GRT), and Shiba Inu (SHIB). Nearly all stablecoins and most meme coins are also tokens, except Dogecoin. Cryptocurrencies like ETH, BTC, and AVAX are not tokens because their logic is built into the blockchain. However, wrapped versions of these tokens (e.g., WETH, WBTC, and WAVAX) are considered tokens.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.