When are Ethereum’s gas fees lowest? As a crypto investor, you should be aware that some days and hours are better than others for sending transactions over the Ethereum network.

What are the best times to buy, trade, and send transactions on Ethereum, and how does one optimize for the lowest possible gas fees? We examine these questions here, helping you make better trading decisions when it comes to Ethereum and its ecosystem of assets.

In this guide:

What are Ethereum gas fees?

Ethereum gas fees represent the necessary cost to have the network up and running and performing transactions. All ETH transactions have a fee, which is required to be paid in gas.

The cost of gas fees varies, set by the miners according to the current supply and demand. The Ethereum gas cost depends on:

- the current demand for gas

- the computational power demand for processing smart contracts

- the total number of transactions

- the size of the smart contract you want to be executed

When cryptocurrency investors are pondering when Ethereum fees are lowest, they are actually seeking the times and ways to pay lower gas for performing transactions on the network.

Transactions can fail on Ethereum if the gas amount is too low. This means miners aren’t incentivized enough to accept and add that transaction to the ledger.

If you want to be more precise, the gas is often specified in gwei, which is a denomination of ETH.

- A gigawei (gwei) is 1,000,000,000 wei.

- The smallest Ether unit base is wei.

- One wei equals 10–9 ETH (0.000000001 ETH).

- Consequently, 1 Ether is 1 billion gwei.

Now that you understand how the Ethereum network works and what is the fee you must pay to execute smart contracts, let’s find out what are the main reasons for the exaggerated gas fees.

Reasons for high gas fees

Gas fees are necessary to process transactions on the Ethereum network. However, with high activity, the gas fees can skyrocket and transactions can fail. When can that happen, and what causes it?

DeFi (Decentralized Finance)

Ethereum was the original blockchain to introduce smart contracts. There, in turn, allowed developers to build decentralized applications. With an increasing number of apps built on top of the blockchain, the network quickly became congested, and gas prices went up.

ETH gas prices increased more than 20 times over the time of 2020, and DeFi was a major contributor to this. However, gas prices tend to be lower during bear markets, when fewer investors move their funds.

Ethereum is an innovative network, but it still uses the proof-of-work (PoW) consensus mechanism, and this is a restrictive foundation that doesn’t allow scaling. Ethereum can perform an average of 15 transactions per second, and the gas price increases with the network throughput.

NFTs (Non-Fungible Tokens)

An NFT is a non-fungible token — each token is unique and can only have one owner, with this registered on the blockchain. Over time, NFTs can fluctuate in value.

Nowadays, an NFT can be a representation of art, or any other digital assets, such as tweets or pieces of content. Anyone can create an NFT by minting it on the blockchain. The minting process requires a fee and specialized NFT platforms guide you through how to mint, buy, and sell NFTs.

An NFT can either be a standalone art piece from an artist’s collection or a digital asset minted by anyone on the Internet. It can also be an asset that has usability within DApps or a blockchain game.

One of the first NFTs was the virtual cats from the CryptoKitties blockchain game, a DApp built on Ethereum.

In 2017, the famous CryptoKitties DApp launched, clogging the Ethereum network due to high on-chain activity. The entire frenzy got gas fees to 0.008 ETH from an initial 0.002 ETH to play the game and caused the Ethereum network to reach an all-time high transaction number and significantly slow down the platform.

Today, NFTs are getting more attention than ever, and platforms such as OpenSea and Rarible are guiding new investors into the digital art world.

But this huge NFT inflation causes a critical surge in gas prices, spurring investors to look for ways to pay the gas fees at the lowest possible cost.

Ethereum 2.0 promises to lower network fees

The ethereum price has skyrocketed with the increasing number of DApps deployed, and finding a way to scale the platform was essential.

Fortunately, the Ethereum Foundation announced an update for the blockchain, which will introduce a proof-of-stake (PoS) consensus mechanism. The updated version is Ethereum 2.0, and all updates should be complete by the end of 2022. Ethereum supporters and investors can already boost ETH 2.0 by staking ethereum, which in time will replace miners.

The update to a PoS consensus will drastically reduce gas fees and address the scalability issues. The Ethereum team said that ETH 2.0 could handle 100,000 transactions per second (compared to the current 15 TPS on proof-of-work Ethereum).

Ethereum vs Polygon (MATIC) vs Binance Smart Chain (BSC)

Developers have to take into consideration transaction fees when it comes to choosing the platform for an NFT game or DApp.

The leading smart contract blockchains are Ethereum, Polygon (formerly known as MATIC), and the Binance Smart Chain (BSC). Since Ethereum gas fees have increased dramatically, alternatives have appeared.

Built on top of Ethereum, Polygon (MATIC) has a hybrid proof-of-stake (PoS) and Plasma side-chain protocol, enabling Ethereum developers to scale DApps. They call Polygon “the Ethereum’s Internet of blockchains” because it integrates Ethereum-compatible blockchains.

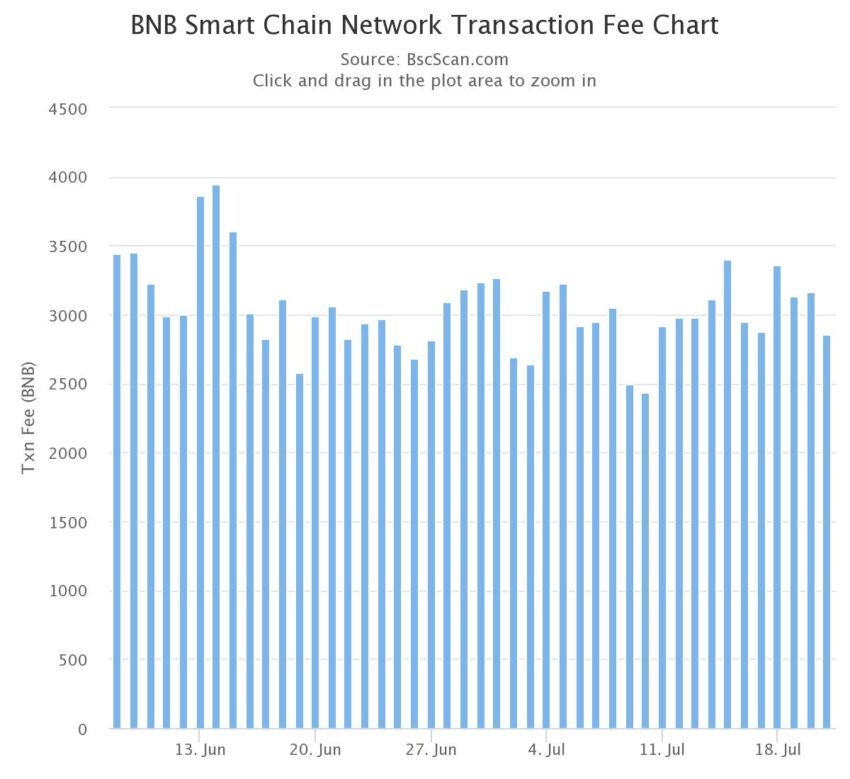

The Binance Smart Chain (BSC) launched in September 2020 as a modified hard fork of Ethereum. It uses the proof-of-stake authority (PoSA) consensus ━ a hybrid between proof-of-authority (PoA) and delegated proof-of-stake (DPoS). BSC has been one of the fastest-growing chains in DeFi, not subject to Ethereum’s congestions, and many users have moved to BSC.

The main advantage of BSC is that many ETH tokens have BSC pegged tokens on a 1:1 ratio. Comparing the low BSC transaction fees to Ethereum’s magnitude higher gas fee makes choosing BSC a no-brainer for many.

The transaction fees on Polygon and BSC networks are much lower than that of Ethereum. Crypto investors looking for the lowest Ethereum gas fees are considering both Polygon and BSC as great alternatives.

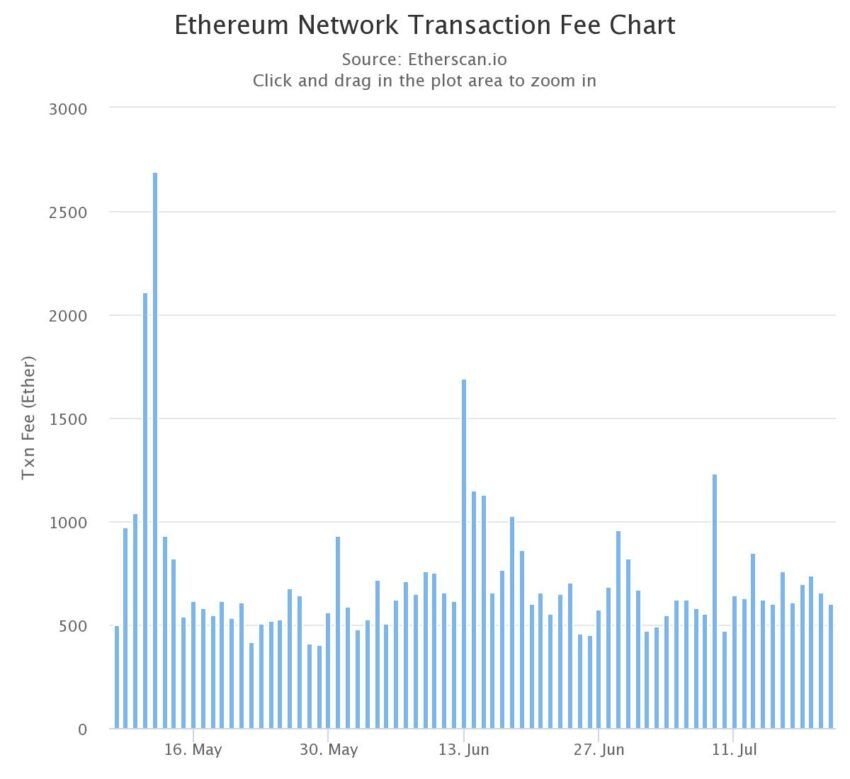

In July 2022, the daily Ethereum fees are around $928,675 (605 ETH, 1 ETH = $1,528.39) per day.

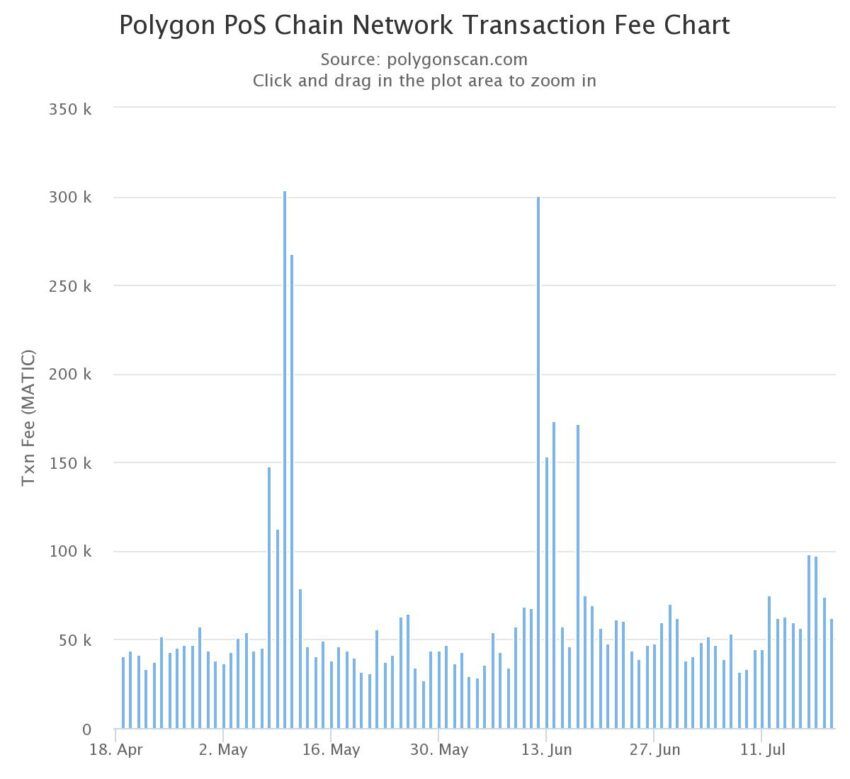

The daily transaction fees on the Polygon (MATIC) network are $63,404 (74,602 MATIC, 1 MATIC = $0.8499) per day.

The daily transaction fees on the Binance Smart Chain (BSC) network are $731,904 (2,859 BNB, 1 BNB = $256) per day.

When are the Ethereum gas fees the lowest?

It is clear that transactions on the Ethereum blockchain have to do a great deal with supply and demand. Miners must perform the computational work necessary to register transactions on the blockchain, and this requires sufficient incentivization.

With that in mind, there are certain days and time frames in which the network gets fewer transactions and thus has lower Ethereum fees. When are the Ethereum gas fees the lowest?

Using the research of Flipside Crypto, when mapping out Ethereum transactions by the hour, it becomes easy to understand when people make the most transactions on Ethereum. The above chart is designed to show the average fees in 2020, where the bars point at the average value, and the black dots are outliers.

The highest transaction fees on Ethereum are between 2 and 6 pm UTC. If you want to pay the lowest Ethereum fees, you should perform transactions early in the morning, between 1 and 3 am UTC, or late at night, between 9 and 11 pm UTC.

You should take into consideration that most transactions are performed in the U.S., Europe, and Asia. Historically, Saturdays and Sundays are days in which gas fees are lower since not everyone is working during the weekend. Aim to avoid their work schedule, and you will benefit from lower gas fees on Ethereum.

You can take a look at the price for gas fees on Ethereum by the time of the day. You can also check the gas price in gwei in real-time on Etherscan.

Remember that the gas fees depend on ETH price and the level of congestion of the network.

Ethereum gas fees in the future

Ethereum gas fees should be significantly lower in the future with the Ethereum 2.0 upgrade. With this, many investors can look forward to the improvements that will help the network become even more mainstream.

When are Ethereum gas fees the lowest?

This is a question you should be asking yourself before sending funds over the Ethereum network. While some days are better for lower fees than others, aiming to use alternative blockchains such as Polygon (MATIC) or BSC are perfectly good options for crypto transactions, which will save tons in terms of transaction fees.

However, if you still want to use Ethereum for sending funds, it is best to perform transactions over the weekend or early in the morning between 1 and 3 am UTC.

Frequently asked questions

What time are ETH gas fees lowest?

Where can I buy ethereum with the lowest fees?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.