Blockchain-based tokens can represent various physical assets, such as bonds, cash, and real estate, on a decentralized network. These tokenized real-world assets (RWAs) are transforming how we interact with traditional investments. This article explores how tokenization works, the benefits of RWAs, and their growing importance in decentralized finance (DeFi).

KEY TAKEAWAYS

• Tokenized RWAs are digital tokens that represent tangible assets like real estate or art, stored and traded on a blockchain.

• They enable fractional ownership and easy trading by converting physical assets into digital tokens.

• The benefits of tokenized RWAs include increased liquidity, broader market access, and enhanced security through blockchain technology.

• Challenges associated with tokenized RWAs include regulatory uncertainty, custody risks, and limited market liquidity for certain assets.

- What are real-world assets (RWAs)?

- Why are RWAs important in DeFi?

- How does tokenization work?

- Pros and cons of RWAs?

- What are some examples of RWAs?

- How RWAs are growing

- Why are RWAs useful?

- Clever use cases for tokenized RWAs

- Regulation in a tokenized economy

- Bridging traditional and digital markets

- Frequently asked questions

What are real-world assets (RWAs)?

Real-world assets (RWAs) are tangible physical items that can be valued, such as artworks, commodities, government bonds, and real estate. The tokenization of these assets is one of the most promising use cases for blockchain technology. It essentially means that the assets, as well as existing in real life, are represented on the blockchain as digital tokens.

This process allows assets to be traded directly or divided into fractional ownership, which then makes them accessible to multiple investors. Fractionalized real estate, for example, demonstrates how tokenization can democratize asset ownership; it allows more people to invest in properties that were previously out of reach.

Nearly anything of value can be tokenized and stored on the blockchain.

A 2023 report by digital asset management firm 21.co estimates the potential market value of tokenized real-world assets could reach trillions of dollars by 2030.

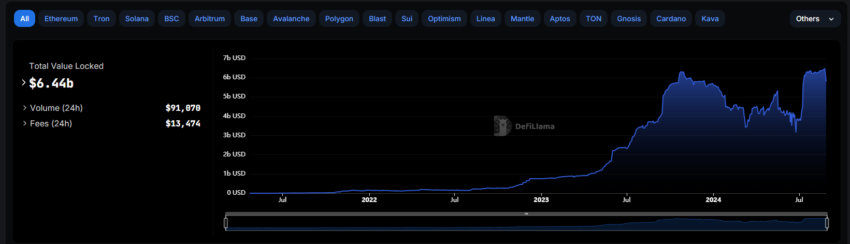

As of Aug. 27, 2024, the total volume locked (TVL) in real-world asset tokens is approximately $6.5 billion.

Why are RWAs important in DeFi?

RWAs have the potential to democratize investment, increase accessibility, and unlock liquidity opportunities in DeFi.

DeFi platforms use RWAs such as art and real estate as collateral for borrowing and lending, thereby allowing loans in various crypto assets like stablecoins while lenders earn interest. This approach enables people to convert traditionally hard-to-sell assets into divisible, transferable pieces on a blockchain network.

Index funds in decentralized finance could use RWAs to offer diversified exposure through a single investment, lowering investors’ risk. By linking assets to stable goods, RWAs allow DeFi investors to engage with markets that are less volatile than the crypto sector.

However, while RWAs offer versatility, their integration into DeFi brings regulatory challenges that require strong mechanisms to secure and manage these tokens.

“The tokenization of RWAs will revolutionise DeFi and TradFi,”

Oculus Crypto, crypto investor: X

How does tokenization work?

The tokenization of real-world assets transforms the concept of physical ownership. It converts ownership rights into digital tokens that are verified and stored on a blockchain network.

Here’s how the tokenization process works:

- It starts with selecting and valuing a real-world asset that will be tokenized. As the worth of the RWA is determined at this point, a decision is also made about how many digital tokens the item will be divided into.

- Next, a legal framework is established to define the token’s ownership rights and ensure compliance with all applicable rules. Developers then create smart contracts that govern the creation, management, and trading of the digital tokens.

- The next step is to choose a compatible blockchain platform with advanced smart contract features to automate essential processes. After selecting the platform, digital tokens representing ownership of the tangible asset are created.

Each token represents a small piece of the asset’s worth, using the token standard of the respective blockchain.

Once created, the blockchain records who owns each token and its transaction data, ensuring transparency and validity and thus reducing the risk of fraud. The digital tokens are then available for investors to purchase and trade on relevant exchanges and marketplaces.

Pros and cons of RWAs?

| Criteria | Pros | Cons |

| Accessibility and inclusivity | Fractional ownership lowers entry barriers for high-value assets. Improves access for small-scale investors. | Nil |

| Automated asset ownership | Smart contracts automate management and transfer of tokenized RWAs. | Nil |

| Investment diversification | Allows investment in various digital and real-world assets. Potential for earning yields in DeFi. | Nil |

| Increased liquidity | Facilitates easy and quick trading on DeFi platforms. | Liquidity can be limited for certain tokenized assets. |

| Reduced volatility | More stable than cryptocurrencies; helps stabilize the DeFi ecosystem. | Subject to market volatility, especially in niche or emerging markets. |

| Trading of tokenized RWAs | Enables global access, management, and trading of RWAs without intermediaries. | Security concerns, including cyber attack and smart contract bugs. |

| Unlocking new investment vehicles | Enhances liquidity of illiquid assets like real estate, creating new opportunities. Bridges digital and traditional finance. | Nil |

| Custody of physical assets | Nil | Challenges in securely linking digital tokens to physical assets. |

| Market volatility | Nil | High price fluctuations can impact tokenized RWAs. |

| Security concerns | Nil | Lack of adequate investor protection; exposed to cyber threats. |

| Unclear regulation | Nil | Regulatory frameworks are evolving, leading to compliance uncertainty. |

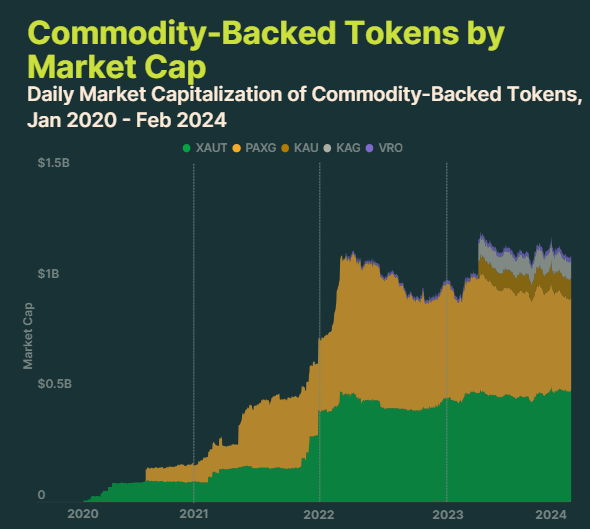

What are some examples of RWAs?

The tokenization of RWAs has created various use cases. These include:

- Art and collectibles tokenization: Tokenizing a piece of art or collectible helps transform ownership, enabling collectors and enthusiasts to invest in art that is high-value thanks to fractional ownership. Platforms like Angelo or Maecenas make it possible for art collectors to purchase fractional art.

- Bonds tokenization: Digital tokens created from tokenizing real-world assets, such as tokenized bonds, can be used to earn yield. A good example is the U.S. government bonds that have been tokenized and can be traded on the blockchain.

- Real estate tokenization: Real estate tokenization is a promising aspect of tokenized RWAs. Tokenized real estate creates a new investment vehicle for small-scale investors to buy and own a fraction of a specific property and even get rental income. This allows investors to gain exposure to assets that are traditionally hard to acquire due to financial constraints. In addition, fractional ownership also allows for crowdfunding for property development. Ark7 is an example of a fractional real estate investing company.

How RWAs are growing

The tokenization of real-world assets (RWAs) has seen significant growth, highlighting the increasing interest and adoption within the crypto and decentralized finance (DeFi) sectors. The market for RWAs in crypto has been expanding at a clip, driven by the need for more stable and tangible investment opportunities within the volatile crypto environment.

Did you know: The on-chain value of RWAs grew by over $1 billion in 2023 alone, according to investment firm Galaxy Digital.

Adoption by major DeFi platforms

Major DeFi platforms are increasingly incorporating RWAs into their ecosystems. MakerDAO, one of the leading DeFi protocols, has integrated RWAs as collateral for its stablecoin, DAI.

This move has proven highly successful, with a significant portion of MakerDAO’s revenue now being generated from real-world assets. The inclusion of RWAs has added a layer of stability and diversification to the DeFi ecosystem, attracting more traditional investors to the space.

MakerDAO’s integration of RWAs has led to a 15% increase in its collateralized assets, with RWAs now accounting for over 30% of its total collateral.

Diversification and stability

One of the primary reasons behind the growing popularity of RWAs in crypto is their ability to provide diversification and stability. Unlike purely digital assets, RWAs are backed by tangible assets, which tend to be less volatile.

This stability is particularly appealing to investors looking for long-term, secure investments in the crypto market. The ability to fractionalize high-value assets like real estate and art also lowers the entry barriers, making these investments accessible to a broader audience.

Future prospects

As more traditional assets are tokenized, the market is expected to grow exponentially. This should further bridge the gap between traditional finance and the decentralized digital economy. This growth will likely lead to the creation of new financial products and investment opportunities, enhancing the overall maturity and stability of the crypto market.

Institutional investments in tokenized RWAs have surged, with platforms like Centrifuge and Franklin Templeton collectively managing over $2 billion in tokenized assets.

Why are RWAs useful?

- Tokenized RWAs can help investors build a borderless, decentralized, and regulated investment portfolio.

- RWA tokens provide a solution to several challenges plaguing most traditional financial assets. For instance, RWAs exist outside the digital world. However, their tokenization allows them to exist digitally and find a spot within the DeFi ecosystem.

- Tokenization also opens RWAs to new opportunities, allowing for the lowering of the entry barrier for investors through fractional ownership. The fractionalization of assets helps to reduce the upfront capital needed, which improves financial accessibility and inclusion for people who previously had no access to such markets.

- Fractional ownership has seen massive adoption, with platforms reporting a 20% increase in user participation and a 25% increase in the number of tokenized assets available for fractional ownership.

- RWAs utilize blockchain technology. Blockchain networks offer a platform where assets formerly limited to jurisdictional restrictions become globally accessible to people. As a result, people from all over the world can get exposure to new opportunities that they would otherwise be denied.

- Using crypto exchanges and marketplaces also improves the liquidity of these traditional illiquid assets. Investors can quickly enter and exit trading positions based on the changing market conditions.

- Because tokenized RWAs allow for the democratization of investments, the division of physical assets becomes possible, resulting in a more level playing field for investors.

Clever use cases for tokenized RWAs

The tokenization of real-world assets creates a new paradigm shift in asset investment and management. Real-world tokenized assets help to improve accessibility, efficiency, and liquidity. This approach has led to use cases for tokenized RWAs across various industries.

The art and collectibles industry

Tokenization has made it possible for investors to own and trade pieces of high-value collectibles and artworks, thereby transforming access to what was previously a private market.

Carbon credits

Carbon credits are tradeable assets that depict reduced greenhouse gas emissions. They can be tokenized on the blockchain, tracked, and sold to various businesses. This could improve liquidity while assisting companies in complying with emission regulations and offsetting the needed emissions.

Private equity

Private equity investments are an alternative investment instrument that acquires or invests in privately held companies. These types of investments tend to be risky and illiquid.

However, they can also be profitable. The tokenization of private equity can allow more investors to access this asset class and enhance the market’s competency.

Real estate

Real estate is a relatively stable and large global asset class. However, it’s also one of the most illiquid assets, as it’s not easy to buy and sell quickly.

Tokenization in real estate can create fractional ownership of properties, which can help make real estate a lot more accessible to small-scale investors who lack the capital to purchase an entire property.

Regulation in a tokenized economy

With different jurisdictional laws linked to RWAs globally, trading these assets can be an uphill task with the need for a common regulation.

Blockchain tokenization can provide potential solutions to address the absence of a regulatory framework. Key players can utilize different blockchain networks to automate various compliance and legal frameworks through smart contracts. Simply put, it means utilizing technology to govern technology. This would make the cross-border transactions of RWAs more secure.

There is a continued call for a universal standard for tokenized RWAs to build investor confidence. Moreover, it can create new opportunities by building a regulated and standardized system that allows blockchains to be interoperable.

Bridging traditional and digital markets

Tokenized real-world assets can bridge the gap between traditional finance and digital finance. The RWA market is growing quickly, with companies like BlackRock already using blockchain to tokenize assets and offer new investment opportunities.

With more companies joining in, this has continued to create room for new opportunities to emerge. This trend is improving liquidity, increasing financial accessibility, and diversifying investment portfolios. Despite challenges like regulatory uncertainty, tokenized RWAs have the potential to transform asset ownership.

Frequently asked questions

The RWA tokenization process is the process through which real-world assets are tokenized and converted into secure tokens that are then managed and stored on the blockchain. The process involves the selection and valuing of an asset, the creation of its legal framework, the creation of a smart contract, the selection of a blockchain network, and the creation of the digital token.

An example of tokenized real estate would be a $10 million apartment in your favorite neighborhood, tokenized into 10 million digital tokens, with each token representing a $1 share of the underlying property.

The tokenization of real estate faces challenges such as regulatory uncertainty, which complicates compliance across different jurisdictions. Additionally, managing the physical asset’s connection to digital tokens can be complex and risky. Limited market liquidity for certain tokenized properties may also hinder easy buying and selling.

Some of the challenges of tokenization in real estate include an ever-evolving legal landscape, given that it’s a new innovation. Moreover, an acceptable universal legal framework around real estate tokenization doesn’t exist. This means that not all jurisdictions can handle this new investment instrument, which poses cross-border issues.

Tokenization in the U.S. offers benefits like increased liquidity, which would allow assets to be easily traded and fractionalized. It also enhances accessibility to enable a broader range of investors to participate in markets previously limited to high-net-worth individuals. Additionally, tokenization provides transparency and security through blockchain technology, reducing the risk of fraud.

Real-world assets (RWAs) benefit the DeFi ecosystem by providing stability, diversification, and increased liquidity. Tokenizing tangible assets like real estate, art, and commodities allows for fractional ownership, making high-value investments more accessible. This tokenization also enhances transparency and security through blockchain technology, attracting more traditional investors to the DeFi space and fostering trust within the ecosystem.

RWAs are increasingly being used to promote sustainable finance by enabling the tokenization of green bonds and other environmentally friendly investments. By integrating sustainability metrics into the tokenization process, investors can more easily support projects with positive environmental impacts. This trend could introduce a new era of transparency and accountability in sustainable investments, allowing for better funds tracking and ensuring that capital is directed towards genuinely impactful initiatives.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.