During this bear market, you more than likely have been searching for the next tour de force. The buzzword of today is layer-1 execution environments. The Sui blockchain believes that it is the next monolithic smart contract execution environment. The Diem successor believes that it has solved problems of scalability, security, and gas fees with its technology. So, has it? This guide covers everything you need to know about the Sui blockchain.

What is Sui?

Sui (pronounced “swee”) is a layer-1 proof-of-stake blockchain with smart contract capabilities. The project is the effort of Mysten Labs, a company founded by ex-employees of Meta’s (Facebook) Project Libra.

Libra is a permissioned blockchain and stablecoin payment system that never quite made it off the ground. Some of the developers who worked on Project Libra (a.k.a. Diem) work on projects like Aptos and Sui.

Sui and Mysten Labs are not based on Diem and have no relationship with Aptos. However, both share common origins.

Mysten Labs also has the backing of popular venture capitalists firms. These include Circle, Binance Labs, and Electric Capital. The Sui/ Mysten team aims to deliver a better user experience through scalability and low latency. The Sui network will allow developers and creators to tailor experiences to the average user.

How does Sui work?

Sui operates in a sequence of epochs (24 hours). A committee of validators manages every epoch. The permission-less validator set rearranges from epoch to epoch.

Users can delegate their stakes to validators. Delegating your stake allows you to consolidate voting powers and earn a share of the fees. Moreover, the Sui network maintains its security properties as long as a quorum of two-thirds of the overall stake is assigned to honest parties.

Validators can scale horizontally via intra-validator sharding. As a result, nodes can scale by devoting more resources. This could be through CPU, memory, storage within a machine, or over multiple machines.

Gas pricing and fees

Gas fees are one of the biggest problems halting the mainstream adoption of blockchains. Users pay gas to complete transactions and have their transactions included in blocks. Without gas, malicious actors would spam the network and cause a denial of service attack as a result.

When a blockchain’s network activity increases, transactions will compete for block space. This results in a spike in fees, network congestion, and poor user experience.

Sui takes a dynamic approach to fees via a price-setting mechanism. At the start of each epoch, validators vote on a network-wide reference price. By this method, users are able to have more predictable gas fees.

Storage fees

Users pay separate fees for transaction execution and storing data. When users submit data to Sui’s “storage fund,” they pay gas fees and fees to Sui. The fund covers the cost for validators to store data; as the network grows, the cost of storage increases.

Move programming language

The programming language of the Sui blockchain is Move. This language is slightly different from core Move, which is based on the Rust programming language and was originally developed by Meta (Facebook).

Sui shares the Move programming language with Diem and Aptos. Former Meta employees founded Aptos as well. Smart contracts on Sui are created with Move.

Sui will work with Move code from other systems, except for Keys and global storage operators. The biggest differences between Move Core and Sui Move are:

- Addresses represent object IDs

- Sui entry points take object references as inputs

- Sui uses its own object-centric global storage

- Has module initializers

- Objects have globally unique IDs

Move vs. Solidity

Sui is the “Ethereum killer,” and that makes Move the rival to solidity. It was created intending to fix problems within Solidity. Move is designed to represent digital assets and perform safe operations over them.

Smart contracts implement functionality on most blockchains. Tokens on Ethereum are smart contracts that keep a record of balances associated with a list of public keys. This is done off of the distributed ledger, as the Ethereum protocol has no knowledge of its existence.

Transactions exchange messages but not actual assets. The global state of Ethereum is the global state of all accounts. This contrasts with the Sui blockchain.

With Move, Sui’s storage is designed around objects, but most smart contract platforms are designed around accounts. These objects are programmable and can flow through smart contracts. Sui’s global state is the pool of programmable objects.

A smart contract in Sui is an object (called a Move Package) that can manipulate Move Objects. Every object has ownership. Its ownership dictates how it is used in transactions.

- Owned by an address — the most common case for moving objects. Move objects transfer to other addresses, after which the receiving address owns it.

- Owned by another object.

- Immutable — Immutable objects cannot be changed. All Move Packages (e.g., smart contracts) are immutable once deployed.

- Shared — Anyone can read or write this object.

Move was developed alongside the Move Prover. This allows programmers to verify that their code executes as intended.

Parallel transaction execution

One of the most interesting feats of Sui’s ability to scale is transaction parallelization. In most blockchains, transactions execute sequentially — or one by one. This prevents some form of competition between transactions and double-spending. However, this also restricts throughput.

Parallel transaction execution allows Sui to reportedly process up to 120,000 transactions on a MacBook Pro per second. For reference, Ethereum can process 7–15 transactions per second. Visa can process 24,000 transactions per second.

Many transactions do not have complex interdependencies with other arbitrary parts of the blockchain’s state. Most often, users simply want to send an asset to a recipient. Sui’s consensus mechanisms reduce the amount of communication required between validators in order to process transactions. As a result, simple transfers validate almost instantly, and complex transactions execute within 2–3 seconds.

Sui consensus mechanism

This is all thanks to Sui’s consensus mechanism. Narwhal, Bullshark, and Tusk collectively create Sui’s consensus mechanism. These systems split the responsibilities of the network.

- Narwhal: ensures data availability.

- Bullshark or Tusk: agrees on the specific ordering of data.

One of Sui’s unique features is its avant-garde approach to a mempool. Sui has a directed acyclic graph (DAG) based mempool, facilitated by Narwhal. The DAG allows parallelization processing at the execution layer.

Bullshark replaced Tusk as the default consensus component for reduced latency and fairness — where even slow validators can contribute. However, Tusk is still available for use.

Sui DApps

Though it is still an early-stage project, many developers have already begun to build on Sui. DApps on the network include DeFi, name services, GameFi, NFTs, and bridges.

SocialFi

Social butterflies can take advantage of Sui’s social DApps: Read2N (a web3 publishing platform), Peeranha (a Q&A app similar to Quora), and SoWork (a platform for remote workers).

On SoWork, users can create their own virtual office to connect teams all over the world. Many businesses, including Microsoft and Harvard Business School, have integrated the social DApp into their workflow.

Bridges

The Axelar Network and Wormhole bridges are two big names integrated into the ecosystem.

DeFi

Some of the DeFi services currently live include Naami, Araya Finance, and SynthMeta. Though many more DApps are coming to Sui, most are still in testnet.

Naami and Araya Finance are decentralized exchanges. Both DEXs allow users to swap wrapped assets, like bitcoin or ethereum. Meanwhile, SynthMeta is a derivatives platform focused on building a one-stop shop for derivatives.

GameFi

Rage, the self-proclaimed “Sui Clash of Clans,” is one of the few live games on Sui. Players can collect resources, build their villages, and battle others.

Aptos vs. Sui

Aptos and Sui share many similarities: they are both the spiritual successors of Diem. The founders of both blockchains came from Meta (Facebook), and they both use the Move programming language. They both even share some of the same investors.

Aptos uses the core Move’s global storage, while Sui uses its own. Moreover, Aptos does not have a concept of resources or objects owning other resources. Any Sui address can own an unlimited number of the same type of resource. A single Sui account could own ten different Sui token objects, each with its own value.

Sui reportedly handles 120,000 transactions per second, while Aptos can supposedly handle 160,000 transactions per second. However, this number fell dramatically at the mainnet launch.

Which one is better?

It is difficult to compare both blockchains at such an early stage. Aptos launched its mainnet in October 2022, putting the altchain about six months ahead of Sui in terms of development.

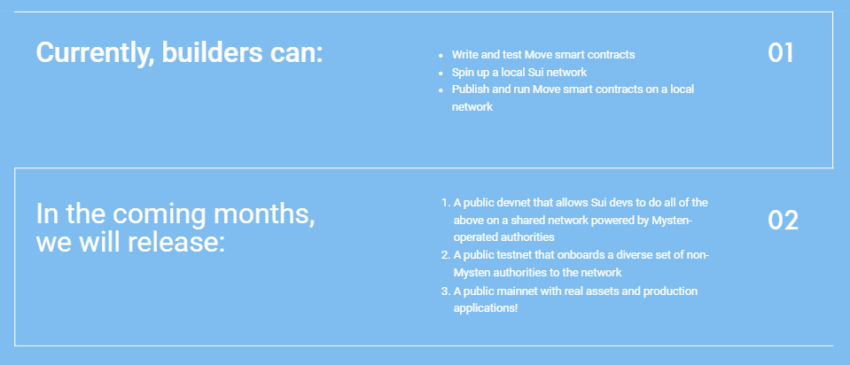

Sui’s roadmap

Sui’s devnet was released in May 2022. It consisted of four nodes operated by Mysten Labs and a Sui Explorer. The blockchain followed up with the launch of its first testnet — Sui Testnet Wave 1 — on Nov. 17, 2022.

The testnet gradually introduced and stress-tested features and mechanisms required for a production-ready mainnet. Its purpose was to validate designs, validators, full nodes, wallets, and developer toolchains and gain operational experience. The testnet was organized in a series of “waves”: Network, Staking, and Updates.

Following the success of both iterations of the testnet, SUI launched a Permanent Testnet on March 29, 2023. This will continue running even after the mainnet goes live.

According to the team, the Permanent Testnet is the earliest version of Sui DevX 1.0. It combines core dev primitives resulting from community feedback implementation and the foundation for refining Sui’s developer ergonomics + efficiency.

The roadmap for Sui looks stacked for 2023. The below graphic explains both the current and future capacities of the Sui blockchain. While the Sui team has not yet given a specific date for the mainnet launch, a recent official tweet states that “The Wave to Mainnet has begun,” with a launch planned for some time in Q2 2023.

SUI tokenomics

The blockchain’s native cryptocurrency is the SUI token. The total supply of SUI is 10 billion and serves four primary functions:

- Delegate and earn a share of the validating rewards.

- Denominate gas fees.

- A unit of account, medium of exchange, or store of value — especially for DApps.

- For governance and on-chain voting.

How to buy SUI crypto

While the general market is not yet open, SUI is available via a SUI token community access program. Users can buy $SUI at a price of $0.1 once General Sales begin. As of April 15, 2023, whitelisted community members — named Sui Champions & Supporters — can buy $SUI at a price of $0.03 in Whitelist Sales via OKX, KuCoin, or ByBit. A total of 594 million SUI have been allocated for this initial sale.

Community access program conditions state that champions were “moderators and testers who significantly contributed to the network.” Meanwhile, the supporters’ category is dedicated to Sui Discord community members who joined before Feb. 1, 2023.

The crypto will be released at mainnet launch and over time as stake subsidies. “Some of the tokens will be set aside for the Mysten Labs team, Sui contributors, investors, and stake subsidies,” Alonso de Gortari, head economist at Mysten Labs, previously stated.

SUI is also set to be distributed to the Sui Foundation — an entity that is separate from Mysten Labs. The Sui Foundation will use its allocation to fund:

- Hackathons, conferences, documentation, and application on the Sui blockchain.

- Projects like standards and practices for DeFi, Sui blockchain wallets, infrastructure, and digital identity.

- Developer teams that will create products to attract users to the Sui blockchain.

SUI airdrop

Despite the success of the Aptos airdrop, Sui has consistently stated there are no plans for any SUI airdrop. To the dismay of many community members, the team confirmed this again in announcing the community access program. Responses have ranged from early SUI users accusing the blockchain of being a “scam” and declaring “no airdrop, no community.”

Can Sui deliver?

Will Sui deliver on its significant promises and mounting community expectations? Firstly, 120,000 transactions per second for a blockchain is impressive but still almost unthinkable. This is a lot, even for a permissioned blockchain. There is a vast degree of separation between processing simple asset transfers and complex multithreaded computations.

In theory, Ethereum could process more transactions if they were simple transfers alone. Complex DeFi applications and services require smart contracts that depend on other smart contracts. This means that a “single” transaction can have multiple dependencies.

These transactions require more gas to complete. Ethereum transactions, and blocks, have gas limits. This decreases the number of transactions that a single block can handle.

Can Sui’s design solve scalability and gas woes?

Many have theorized parallel processing but have yet to create a project that can gain the network effect. This will be necessary to test any network’s execution environment. The Sui consensus mechanism was created to perform in an environment with a particular focus on simple asset transfers.

Sui’s pivot to parallel transaction processing — as opposed to sequential processing — may prove useful. Only time will tell if Sui’s approach to the scalability trilemma proves victorious.

Frequently asked questions

What is the Sui blockchain?

What is Move programming language?

What is Mysten Labs?

What is Aptos?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.