Wrapped Bitcoin is a clever workaround for the interoperability limitations of blockchain ecosystems and protocols. These wrapped tokens have taken over the market and grown in use since they were introduced. In this article, we will be looking at how it has made Bitcoin transactions simpler and faster.

KEY TAKEAWAYS

► Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin that exists on Ethereum, giving it more functionality than the native coin.

► Traders wrap BTC to use it for DeFi activities, such as collateral, borrowing, or lending to earn yields.

► The main drawback of WBTC is the need to trust a centralized custodian, which contradicts the purpose of decentralized cryptocurrencies.

► Alternatives like cbBTC, RENBTC, and BTCB offer different approaches to integrating Bitcoin into Ethereum and DApps.

What is Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is a tokenized derivative of Bitcoin. Rather than a coin on its own native blockchain, it is a token that exists on other blockchains besides Bitcoin. This is convenient for those who want to use the token for decentralized finance (DeFi) activities (e.g., collateral) on other networks.

Bitcoin is the world’s most well-known cryptocurrency. In fact, it is almost synonymous with the blockchain. However, despite the introduction of the concept of blockchain technology to the world, the technology has grown much further.

We now have a variety of blockchains and cryptocurrencies that serve an array of functionalities. If Bitcoin fails to interact with these blockchains, its relevance becomes questioned — or the other way around. If a blockchain fails to facilitate BTC transactions, its relevance will fade.

That was how Wrapped Bitcoin came into being. People with huge BTC reserves can now make payments on the Ethereum blockchain without bearing the huge delay and costs of the transaction.

History of WBTC

BitGo, Kyber Network, and Ren created Wrapped Bitcoin (WBTC) in 2019. BitGo acted as the custodian for the underlying Bitcoin that backs the WBTC tokens.

In 2020, the now-defunct exchange FTX was the largest minter of WBTC. This spurred concerns for the safety of WBTC holders. However, this was simply due to a misunderstanding of how WBTC works.

As FTX was the biggest minter of WBTC, many worried that they could crash its price. But this is a complete myth. FTX does not control the WBTC smart contract or the underlying Bitcoin backing. Rather, these are made by BitGo and FTX was only a customer.

Dennis Liu, crypto investor and educator, on FTX and WBTC controversy

In 2024, BitGo made a controversial announcement that it would transition to a joint, multi-jurisdictional custodial model through a joint venture with BiT Global. This raised concerns due to the involvement of controversial figures like Justin Sun and led to a surge in WBTC redemptions.

What are wrapped tokens?

A wrapped token is the tokenized version of a cryptocurrency, which may or may not be on the same blockchain. Mostly, wrapped tokens are hosted on a different blockchain than the one it is built on as a quick fix for the interoperability issue.

These tokens are pegged to the value of the crypto asset they represent. Although initially, these were limited to just the Ethereum blockchain, its scope has widened considerably since.

While these tokens are quite similar to stablecoins in the sense that the value of the asset is pegged to another, stablecoins derive value from fiat currencies. That is not the case with wrapped tokens. In most contexts, wrapped tokens derive value from cryptocurrencies.

Wrapped tokens allow assets to go cross-chain (for the most part). If you want to turn them back into their original form, you can do so anytime by unwrapping them.

How does Wrapped Bitcoin work?

As discussed above, an equal amount of the underlying asset backs wrapped tokens. Coming to WBTC, it is an ERC-20 token that holds the same value as Bitcoin. Although both run on different blockchains, as the price of BTC changes, so does the price of WBTC.

In short, it holds a one-to-one peg to the value of BTC and facilitates BTC transactions on the Ethereum blockchain, saving time and cost.

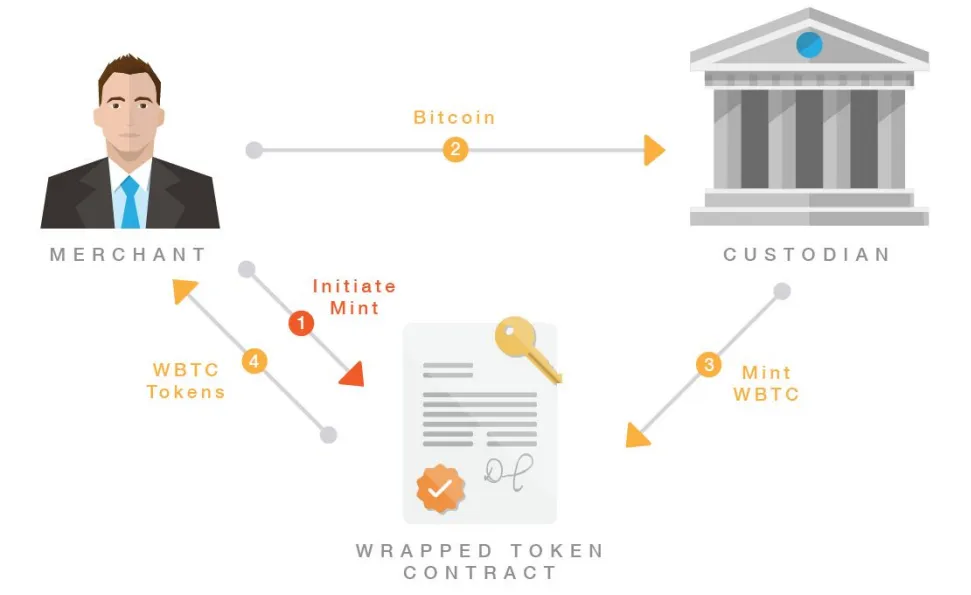

Now, who monitors these transactions? That requires a custodian (BitGo and BiT Global) who locks an equal amount of the asset to the number of tokens wrapped.

You want to convert ten BTC into ten WBTC. For this, you need to first transfer your 10 BTC to the custodian. This transaction to the reserve will be recorded on-chain. Now, the custodian will mint 10 WBTC tokens and send the tokens to you. It is that simple.

If you decide to convert WBTC back to BTC the custodian initiates a coin burn so that they can release the five BTC from the reserve. In essence, the custodian acts as the wrapper (one who wraps) and the unwrapper (one who unwraps) here.

Bitcoin vs. Wrapped Bitcoin: Why use WBTC?

Bitcoin is wrapped simply to facilitate BTC interoperability on Ethereum. WBTC makes it possible for crypto participants to expand the utility of BTC. Crypto sectors like DeFi and NFTs are mostly built around the Ethereum network.

If you are someone with a huge Bitcoin reserve, you will have to go through the hassle of converting your BTC to another coin or a token for a huge transaction fee to participate in DeFi activities. The transaction delay on Bitcoin blockchain is also an annoyance.

The volatility of the market makes the case worse. The slippage can also be shocking at times. To avoid all those troubles, you can simply convert your BTC to WBTC.

What can you do with WBTC?

Because of its peg to BTC, WBTC also makes for good collateral. For example, if you want to earn a yield on your BTC, this is not possible on BTC. You could, however, use your BTC to secure a loan on another network or loan it to earn yield. Here are a few other use cases for WBTC.

- Earning interest: You can submit your WBTC tokens to liquidity pools on lending and borrowing protocols to put them to good use and earn interest in return.

- Yield farming: Yield farming has played a key role in propelling DeFi to unprecedented heights. These pools mostly run on Ethereum or BSC. But that doesn’t mean BTC is left out. You will find an array of WBTC pools on DEXs today, which will earn you a significant passive income.

- Margin trading: Many platforms like Fulcrum allow WBTC holders to margin trade ETH, stablecoins, and ERC-20 tokens. This is one way to generate profit on WBTC. However, it is also worth noting that margin trading is extremely risky.

Pros and cons of WBTC

We have explored many of the benefits of using WBTC, but what are the risks? In summary, many of the risks associated with WBTC involve the same risks as using other tokens, with the added counterparty risk because of the custodian.

| Pros | Cons |

|---|---|

| Use Bitcoin on other networks | Requires a custodian |

| Can be used for yield farming strategies | Scalability issues on the destination chain |

| Better liquidity and utility |

WBTC alternatives

As we mentioned earlier, cbBTC is a WBTC alternative that developed out of a change in custodians. However, there are more WBTC alternatives that existed long beforehand.

RENBTC is a wrapped BTC built on the Ren platform. As an open protocol, Ren makes cross-blockchain liquidity accessible to all. It facilitates the easy transfer of assets from other blockchains to Ethereum DApps.

It maintains an edge in the market owing to the fact that the minting process is simpler. Users have to send their BTC to RenVM, and that’s it. So, despite having the same functions and running on the Ethereum blockchain, many consider RENBTC a better alternative to WBTC.

But what if you want to use BTC on other blockchains? To be more precise, BSC? Binance Smart Chain is faster and more cost-efficient than the Ethereum network. That explains its rise in popularity. To integrate BTC into the network, BSC has BTCB (Bitcoin BEP2).

WBTC: Bitcoin for the future?

Wrapped Bitcoin has played a key role in keeping BTC relevant in the growing crypto market. It has also helped get around the interoperability and liquidity issues to a great extent.

Despite all the utility it brings to the table, decentralized wrapping has not yet seen its full potential. Furthermore, its move to a joint-custody agreement has further damaged its reputation. We do expect to see more WBTC alternatives in the future, particularly promoting decentralized custody.

Frequently asked questions

What’s the point of Wrapped Bitcoin?

Is Wrapped Bitcoin safe?

Is Wrapped Bitcoin a good investment?

Is Wrapped Bitcoin a fork?

Should I buy Wrapped Bitcoin or regular Bitcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.