If you’re active in crypto communities, you will no doubt have heard of BRC-20 — a new token standard. An entrant into the crypto dictionary, the BRC-20 token has been the subject of much discourse of late. Reasons include — rhymes with ERC-20 (we all know what it is, right!), connection to the largest crypto network Bitcoin, and a divided community. Here’s everything you need to know about BRC-20.

Top Crypto Trading Exchanges

Best for interest rates

Best for spot trading

Best for altcoins trading

- What are BRC-20 tokens?

- BRC-20 tokens

- The BRC-20 and Ordinals connection: are they the same?

- How does a BRC-20 token work?

- BRC-20 tokens

- Solving the Bitcoin network congestion with tweaks?

- Use cases of BRC-20 tokens

- BRC-20 tokens

- Tokenomics of BRC-20 tokens

- BRC-20 tokens

- Buying or minting a BRC-20: what should you do?

- Difference between BRC-20 and ERC-20

- BRC-20 marketplaces

- The road ahead for the BRC-20 token

What are BRC-20 tokens?

Short story: BRC-20, an attempt at adding fungible use cases to the Bitcoin base layer immediately after the Ordinals protocol, made Bitcoin NFTs an overnight sensation.

Long story: BRC-20 attempts to be a token standard, similar to what ERC-20 is for Ethereum. Like Chainlink is an Etheruem-based token, with LINK being an ERC-20 token, BRC-20 tokens are supposed to be Bitcoin-based. Something that the vanilla version of Bitcoin didn’t originally strive to be.

BRC-20 tokens

Origin of BRC-20 tokens

The launch of the Ordinals Protocol — a strategy to tag and number satoshis, the smallest unit of bitcoin — laid the groundwork for BRC-20. The process involved padding the Sats or Satoshis with extra data, making them unique — kickstarting a new era of Bitcoin NFTs.

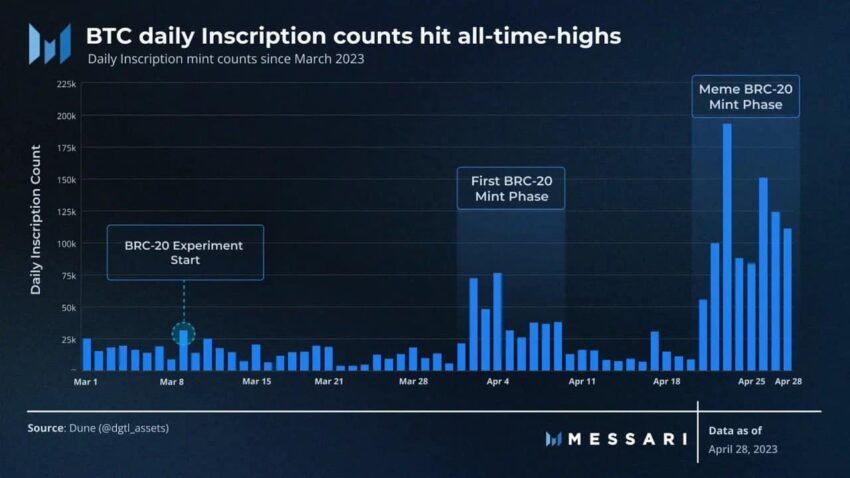

However, on March 8, 2023, Domo — an individual holder of the Bitcoin NFT project Ordinals Face — launched an experimental token standard or BRC-20 for Bitcoin. The idea behind it was to use the Bitcoin base layer for creating inscription-powered tokens, which would otherwise be termed BRC-20.

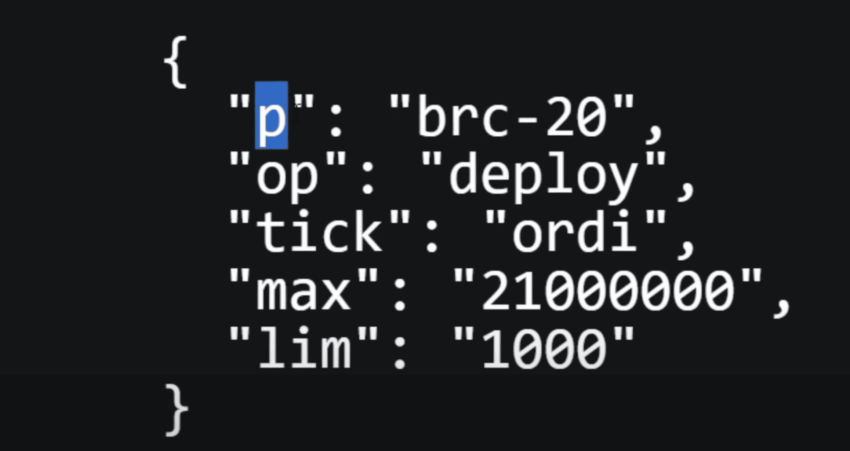

And while inscriptions on Sats existed by this stage, Domo planned to inscribe some JSON (JavaScript Object Notation) data onto a Sat, opening the doors to minting new BRC-20 tokens. You can even consider them to be BRC-20 Ordinals as they use the same protocol and follow inscription.

What are they?

From a distance, a BRC-20 standard looks like any other token that uses a specific base layer, like the ERC-20, BEP-20, and more. However, BRC, as a token standard, is as simple as Bitcoin Request for Comment. There is no built-in smart contract functionality to drive the token utility.

In simple terms, a BRC-20 token uses the Ordinals inscription method to pad a satoshi with JSON data, making the token suitable for deployment, minting, and transfers.

In simple terms:

For any random entity to become a token, it needs wallets that can decode its metadata or padding. While the likes of ERC-20 tokens have smart contracts doing all of this, this is pretty non-complex for the BRC-20 standard.

In the case of BRC-20, a text-based script file is stored on a Sat (remember the JSON data we talked about), attributing the token status to the same. Specific BRC-20 wallets can then understand and parse this script file for the purpose of deploying, minting, and transferring.

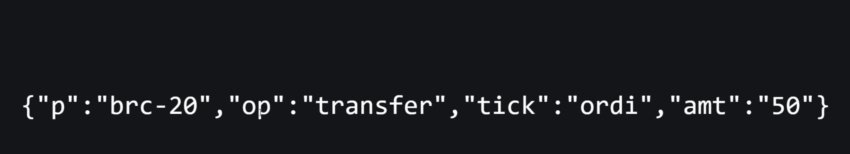

Here is the first instance of JSON data type inscribed onto the Sat. Do note that it has every element listed — protocol, operation (to get things started), ticker (ORDI, the first BRC-20 token), max supply, and the mint limit.

Do note that this JSON script is meant to deploy or create a BRC-20 token. Things change when you need to transfer or mint. But we will get to that later.

A BRC-20 token uses the Ordinals protocol to inscribe a specific type of text to a satoshi, making it a wallet-readable, fungible token.

The BRC-20 and Ordinals connection: are they the same?

If you look closely, BRC-20 is just an experimental use-case of the Ordinals Protocol — the novel inscription strategy. A BRC-20 token isn’t an Ordinal or NFT itself. It simply makes the tagged or numbered Sats fungible to work as standard tokens and not NFTs.

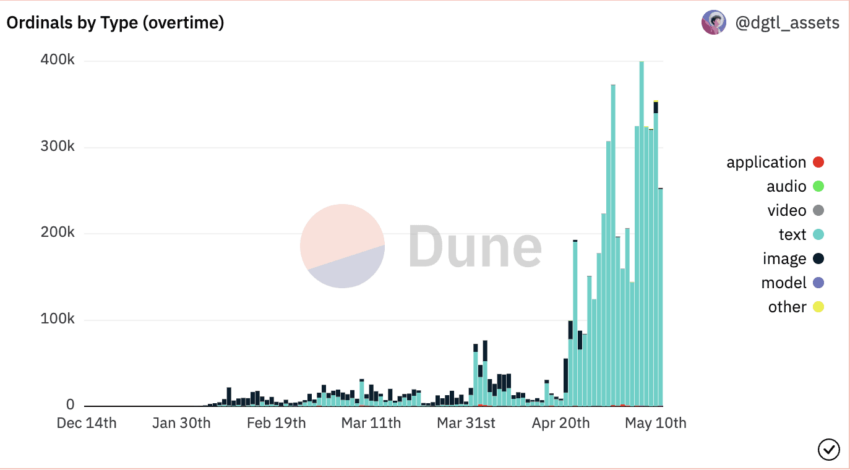

Before BRC-20 existed, people were inscribing Satoshis, the smallest unit of bitcoin, with images, videos, and audio. Since the new token standard, there has been a shift to text-specific inscriptions.

How does a BRC-20 token work?

There are three aspects of a token, including the new type:

- Creating the token or token deployment

- Minting the token or generating new tokens

- Transferring tokens per the buy and sell requirements

Despite being an experimental token standard, every BRC-20 token adheres to these three aspects of token management, per the JSON script we looked at.

Like any other token, how it works or will work depends on how a user can interact with it. Also, it is the distinct difference in fungibility between the BRC-20 and a standard non-fungible Ordinal that makes the former useful and functional.

If the experiment becomes commonplace, the new token standard could ensure that compatible tokens can be created, minted, and even used for trading. The idea is to give Bitcoin another use-case instead of simply tagging it as a P2P digital currency network.

How the process of deploying, minting, and transferring works

Even though a BRC-20 token doesn’t involve any smart contract or EVM support, there is still some behind-the-scenes JSON deployment in the form of an inscription. Let us delve deeper to understand how a BRC-20 token actually works or is made to work.

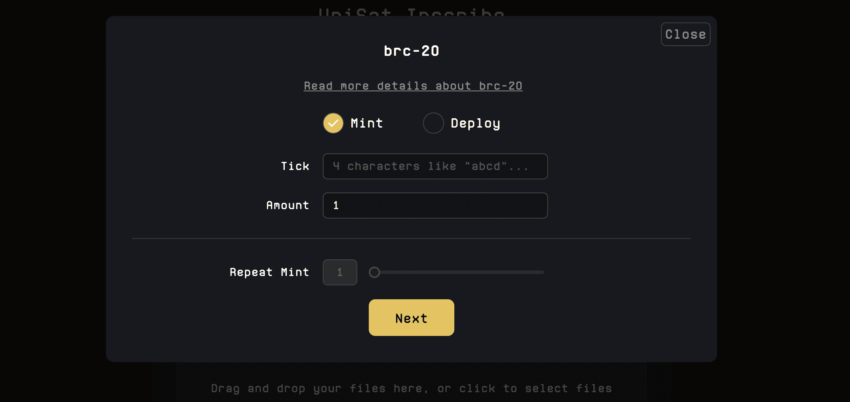

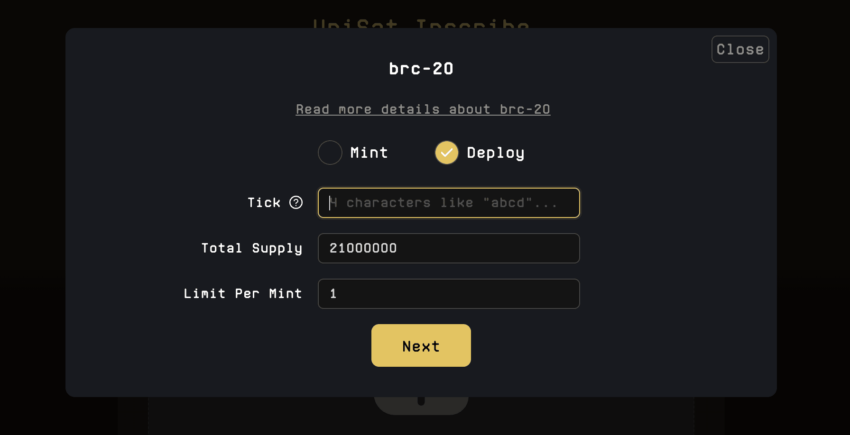

We did see the deployment or token creation JSON script earlier. When you head over to A compatible BRC-20 marketplace or wallet, say UniSat, you can hit deploy. Once you follow the instructions on the screen, you can create your own BRC-20 token. Post creation and assigning traits to the token — say max supply and mint limit — you can start with minting.

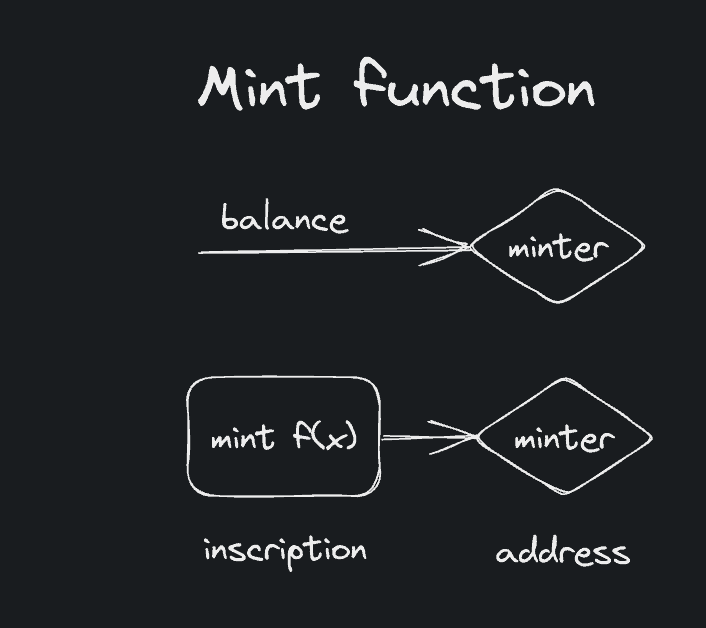

Here is the flow of the “Mint” function:

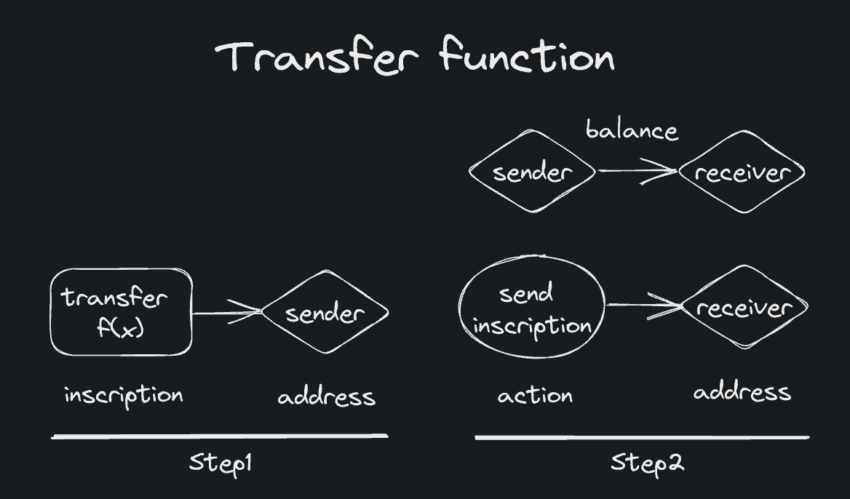

In case you want to transfer the same, per the buy/sell requirement, here is the flow to consider:

What does this mean for BRC-20?

Per the built-in flows, every process is a function or f(x) called by the minter or sender, invoking the steps and completing the job. This means every step is an inscription and qualifies as a transaction.

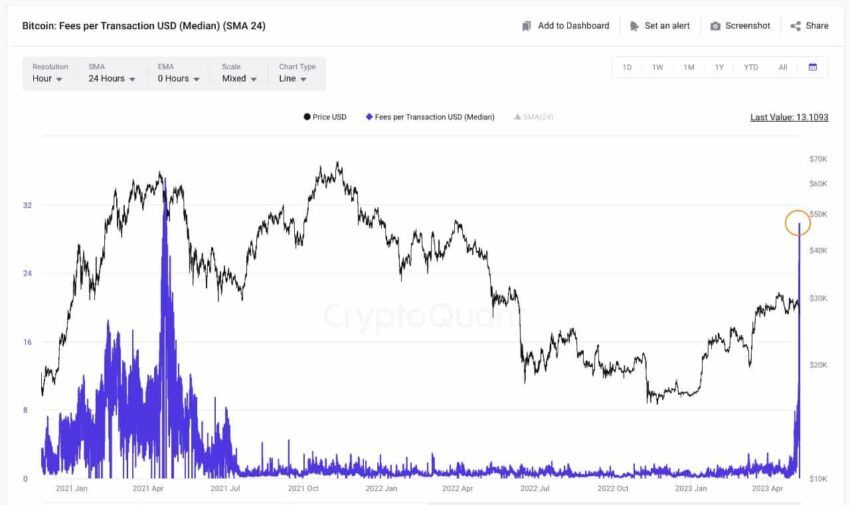

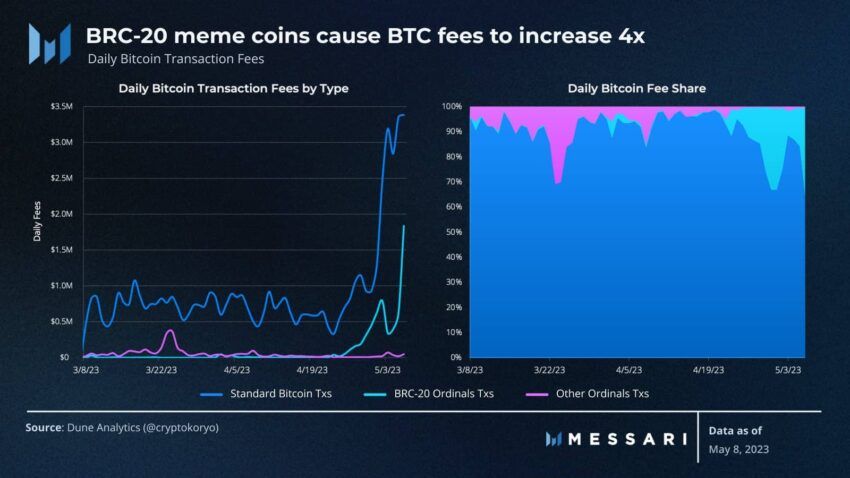

As every small process requires an inscription, it is little wonder the transactions are getting too much to handle, causing network congestion. This is one of the reasons that Binance had to halt bitcoin withdrawals.

Do note that these flows are built within the BRC-20 ecosystem. Users simply need to choose the fields using the front end to get the process underway. This means choosing them to carry out the desired function within the wallet.

But there is another thing to note. Even Domo, the original creator, considers this whole BRC-20 blockchain derived from the Ordinals Protocol an experiment. He even mentions that despite this being a novel token standard, the fungible tokens will be worthless and shouldn’t be minted frantically.

But have people been listening? Let us find out.

Most popular BRC-20 tokens and should you consider them

BRC-20 tokens

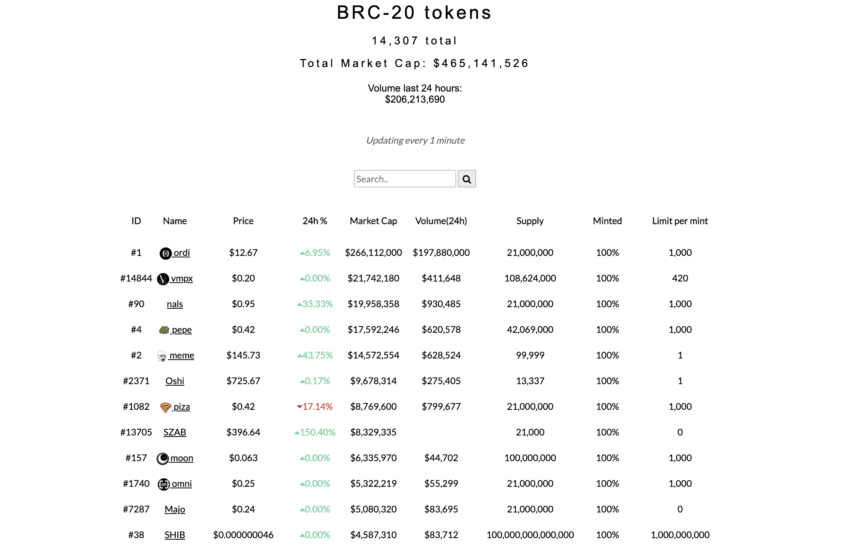

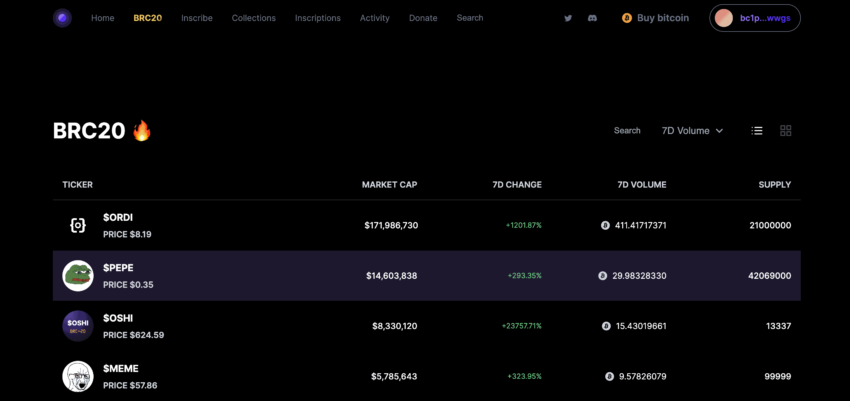

According to the BRC-20 marketplace, BRC-2-.io, there are already 14,307 tokens in existence. So much for being conservative with the experimental and supposed BRC-20 blockchain standard.

As of 2024, the market capitalization of these tokens has surpassed $1 billion. But that’s not it. Here is a list of the popular BRC-20 tokens that are making all the noise:

If you notice coins like SHIB and PEPE on the list, do not get overexcited, thinking they are trading at a different price on this BRC-20 blockchain. They are just faux SHIB and PEPE tokens, and the BRC-20 token minters have simply used their names to get them on the Bitcoin network.

Do note that the ORDI token with ID #1 is the first BRC-20 token to be minted. And there are a few other interesting names as well, including Piza — which derives its name from the Pizza meme.

Advantages of BRC-20 tokens

While there is an ongoing debate encompassing the entire crypto community about the need, relevance, and even the benefits of the BRC-20 tokens. Here is what we can gather:

- The BRC-20 token standard lends a new use case to Bitcoin.

- Creating and minting them is easy as no complex smart contracts are involved like ERC-20.

- BRC-20 tokens derive their security from the securest blockchain ever — the Bitcoin network

- Opens a wide range of possibilities for Bitcoin’s layer-2 and scaling solutions, including the lighting network.

- These tokens are supposed to facilitate fungibility, opening Bitcoin to newer possibilities.

- Increased demand for network space is slowly becoming great news for BTC miners as per the PoW approach; they still need to authenticate and verify the BRC-20 transactions.

Disadvantages of BRC-20 tokens

And while some of the advantages certainly make sense, there are quite a few concerns regarding the BRC-20 token standard. These include:

/Related

More Articles- No deep connection to the Bitcoin network as creating a BRC-20 token is simply a way to embed metadata to a Sat that can be read back and interacted with, depending on the inscribed script.

- A secondary market facilitates their trades, which has nothing to do with the original Bitcoin ecosystem.

- These tokens aren’t easy to manage as you need to interact with a whole set of tools, wallets, and additional steps.

- BRC-20 tokens encourage trading on CEXs as the likes of ORDI tokens have already been listed by the likes of Gate.io. And while there is nothing wrong with that, it doesn’t align with Bitcoin’s decentralized ethos.

- BRC-20 tokens are easy to mass produce as there aren’t any smart contracts to assign more extensive rules.

- BRC-20 tokens using the Ordinals protocol still inscribe on sats individually. Therefore, the otherwise dust-like BRC-20 transactions are steadily accumulating within the network, leading to network congestion.

- If the BRC-20 space explodes, it might start a full-fledged unregistered securities space within the Bitcoin network.

According to market experts, the fallacies of the BRC-20 token space far outweigh the benefits. Luke Dashjr, a Bitcoin core developer since 2011, believes that Ordinals and BRC-20 tokens are spam, are need to be filtered out asap.

“Action should have been taken months ago. Spam filtration has been a standard part of Bitcoin Core since day 1. It’s a mistake that the existing filters weren’t extended to Taproot transactions.”

Luke Dashjr, Bitcoin core developer: Twitter

Did you know? The SegWit and Taproot updates laid the foundation of these inscription-based workarounds concerning the Bitcoin ecosystem by increasing the block space, making transaction costs go down, and other tweaks.

Solving the Bitcoin network congestion with tweaks?

While we have listed several disadvantages of the BRC-20, the surging transaction costs due to network congestion are the most pressing.

In a country like El Salvador, where BTC is the legal tender, people are now paying close to $20 for a transaction value of $100.

Including layer-2 or lightning networks into the mix might be a good idea to quell similar concerns.

Here is a response to the previous tweet by Bitcoin educator Dan Held:

“L1 was never meant to be cheap; that’s what L2 (Lightning) is for!”

Dan Held, marketing advisor at Trust Machines: Twitter

Domo, the creator of the BRC-20 token standard, also highlighted a similar initiative, Taro. Taro is a protocol to create assets on the Bitcoin blockchain, transferring the same to the lightning network to enjoy low fees and high-volume transactions.

What about BRC-21?

Don’t worry, we aren’t complicating this with another token standard. In fact, BRC-21 is quite a simple concept proposed by Interlay Labs — a Bitcoin-specific decentralized platform. Per this proposal, BRC-21 lays the standard to mint and move BRC-20 tokens to and from Bitcoin, in association with ecosystems like Ethereum and Polkadot, while making sure the lightning network is there to support the transfers.

If the BRC-21 is adopted on a wider scale, it might be able to bring in the following functionalities:

- Ability to represent other assets like SOL, ETH, and more on Bitcoin.

- Ideating a decentralized method of minting and transferring cross-chain assets

- Lending some sort of programmability to the entire process by redirecting congestion-creating Bitcoin transactions to layer-2.

- Giving decentralized stablecoins an entry into the Bitcoin ecosystem.

A simplistic way of understanding the BRC-21 is like a wrapped asset on any other chain.

“This allows minting L1 assets like ETH, SOL, DOT, and decentralized stablecoins like DAI, LUSD…onto Bitcoin & use them on the lightning network.”

Alexie Zamyatin, founder of Interlay: Twitter

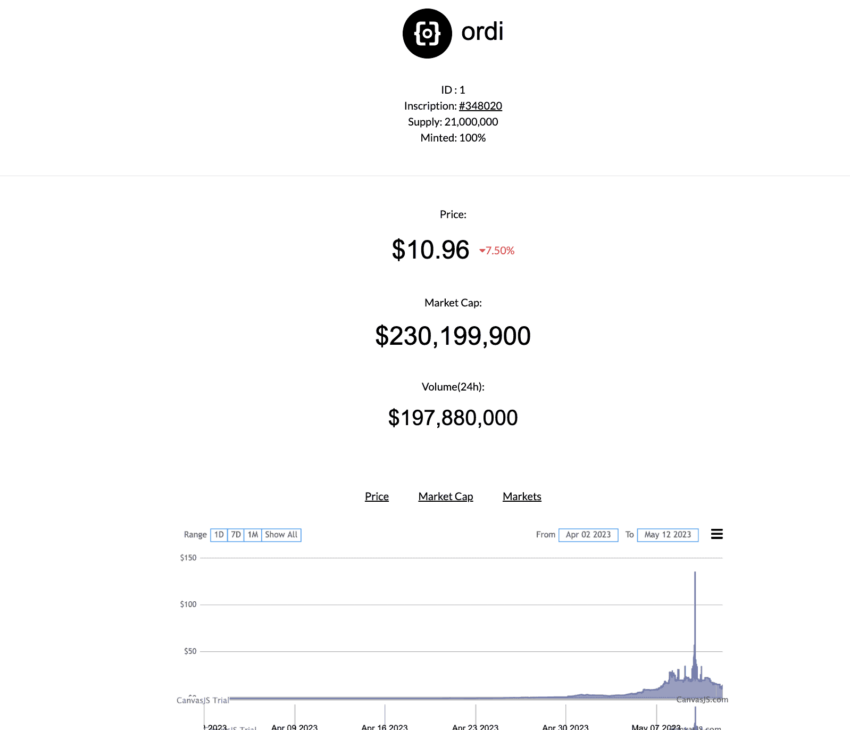

ORDI token economics: BRC-20.io

Use cases of BRC-20 tokens

BRC-20 tokens

Even though the use cases haven’t actually taken form, courtesy of the experimental nature of the BRC-20 standard, here are a few ideas that are floating around:

Tokenization

The BRC-20 token standard can be used to tokenize real-world assets. However, this would make sense only if the lightning network redirects high-volume transactions — keeping the base layer-1 free for the more pressing transactions like P2P transfers.

A new way to P2P

If some of the BRC-20 tokens start gaining traction and thus value, like ORDI getting listed on Gate.io, there might be many takers in regards to using ORDI for P2P payments. Even though this idea is still quite far-flung, crazier things have happened in the crypto space!

DeFi presence

Bitcoin is currently ranked 16 in terms of DeFi presence (TVL-specific rankings). And while the lightning network dominates Bitcoin’s DeFi space by almost 79%, BRC-20 tokens can bring more liquidity into the mix, courtesy of easier integrations. However, for that to work, we might have to look at BRC-20 in association with the layer-2 products and the ambitious BRC-21 even.

Now that we have covered almost every theoretical aspect of BRC-20 tokens let’s explore the concept of tokenization.

Tokenomics of BRC-20 tokens

BRC-20 tokens

Firstly, the token economics can vary for each BRC-20 token. We mentioned earlier that the JSON script during deployment determines the total supply and mint capacity of the concerned token. If you want to deploy a BRC-20 token, you are free to choose your own token economics model.

Token supply

Let us take ORDI, the first BRC-20 token, into consideration.

It has a 21 million token supply (like BTC), and at present, 100% of the supply forms the circulating or the minted supply.

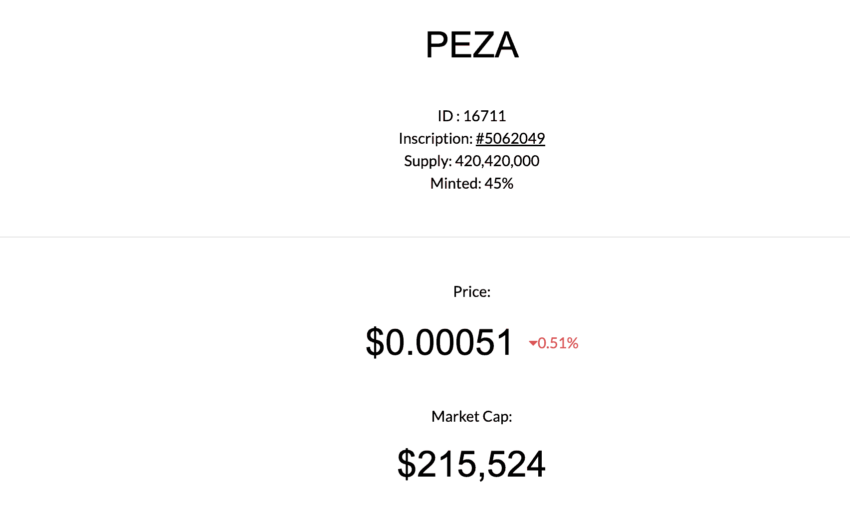

Here is a token PEZA with a total supply of 420.42 million. Out of that, only 45% has been minted, making it possible to mint new BRC-20 tokens.

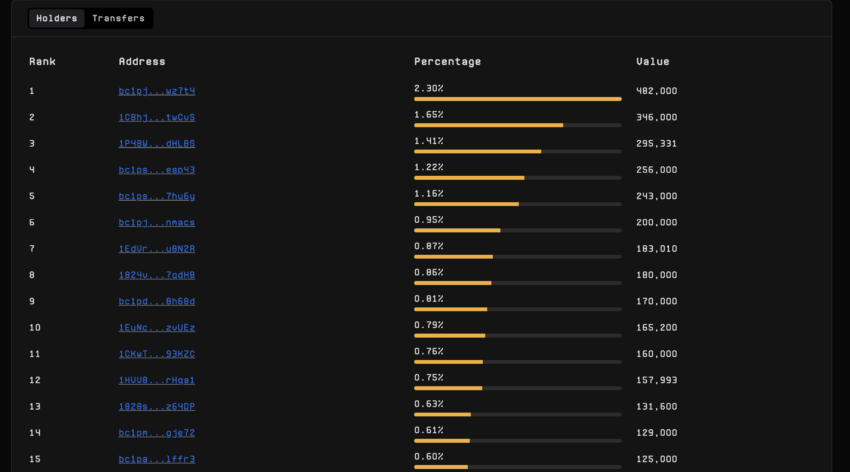

Token distribution

The token distribution is arbitrary. Per the guide released by Domo, if you mint a token using the right function and inscription, the inscription service might own the balance first. The transfer of balance isn’t always automatic and might require a few tweaks.

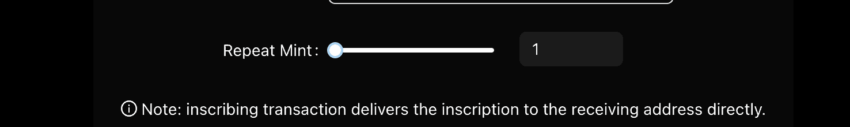

However, if the wallet or marketplace helping with minting and inscription mentions the following beforehand, you simply need to feed your address to get the freshly minted BRC-20 token.

The total supply remains locked and denotes the number of tokens that can be brought into circulation. Once in circulation, the token distribution involves either the minter, the sender or receiver of the token, or both, depending on the ratio of the holdings.

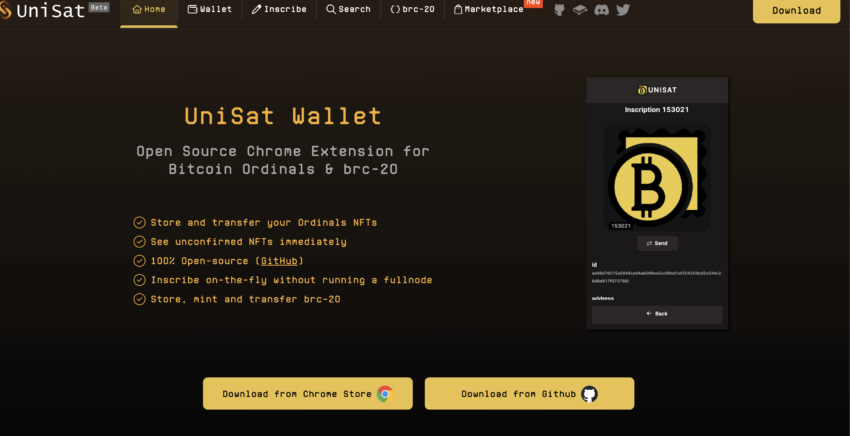

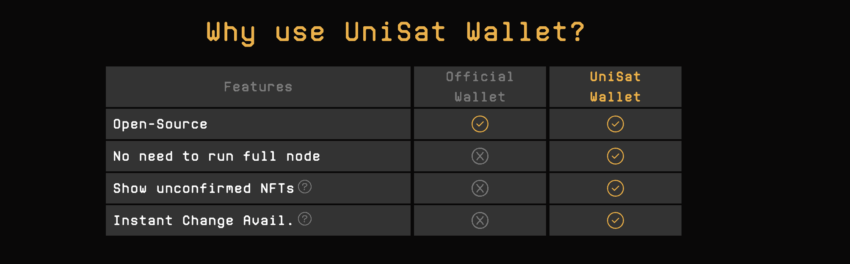

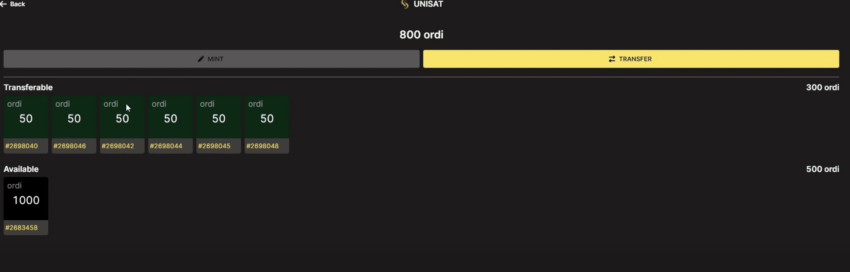

With UniSat — a BRC-20-compatible wallet — you can also track the address-specific distribution.

Token utility

As far as the token utility is concerned, BRC-20 tokens like ORDI and SHIB haven’t yet done anything to prove usefulness as of now. However, ORDI has made it to centralized crypto exchanges like Gate.io, Crypto.com, and more.

The only conceivable utility of a BRC-20 token currently is it allows miners to earn more as fees have skyrocketed. And yes, they are giving the meme coin lovers new options to trade new volatile assets.

Another interesting token utility would be that every token buy event would give a certain percentage to the token deployer as a royalty. This might be one reason so many BRC-20 tokens have sprung onto the scene.

Per UniSat, the deployer royalty can be around 0.2% per bulk buy order.

Wallets

At present, not many wallets support BRC-20 tokens. However, there are a few that you can consider:

UniSat (most popular per current social craze, also open-source and fast)

Ordinals Wallet (supports Ordinals and BRC-20 tokens)

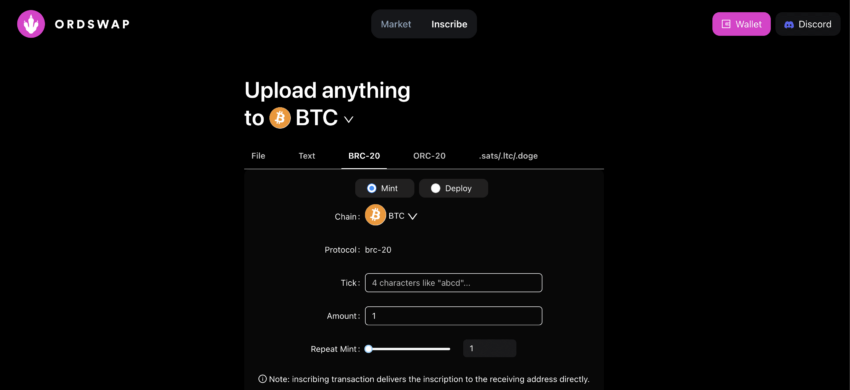

Ordswap (head over to inscribe to mint and deploy)

BRC-20.io (head over to markets to send BRC-20 tokens and Inscribe to mint, deploy, and transfer)

Setting up a BRC-20 token wallet

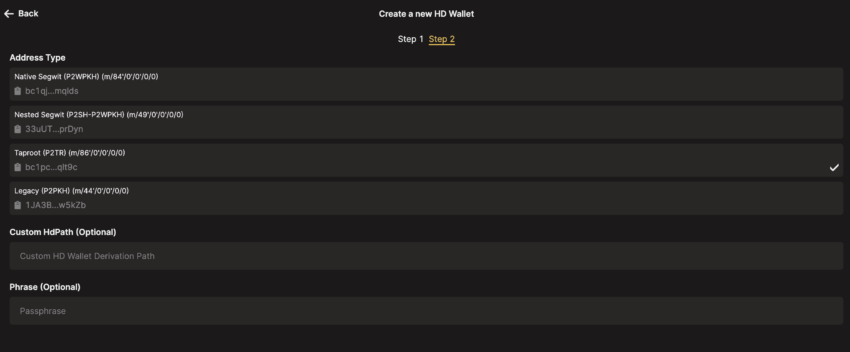

Now we have looked at all the BRC-20 wallets, it is only appropriate to see how you can set one up. We shall take Unisat as an example.

Head over to UniSat.io and set up a wallet.

You must select the Taproot address as only that will support the Ordinals and BRC-20 tokens for you.

Once done, you will reach the wallet dashboard with the “Receive” and “Transfer” option in play.

You can circle back to UniSat’s home page and head over to inscribe to either deploy a new token or mint one whose circulating supply isn’t already equal to the total supply.

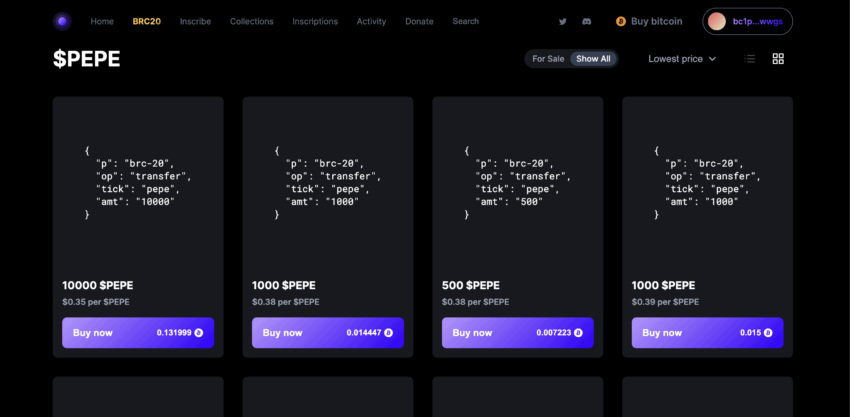

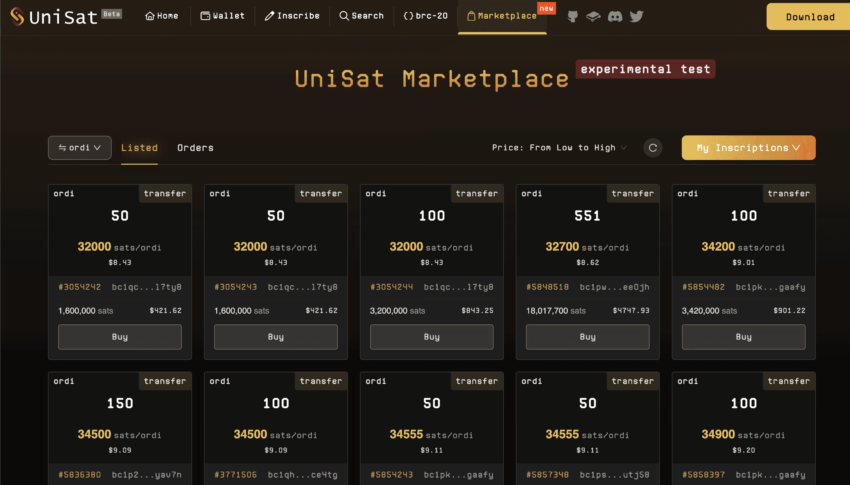

The UniSat marketplace

However, if you want to buy BRC-20 tokens, you can head to the UniSat marketplace to take your pick.

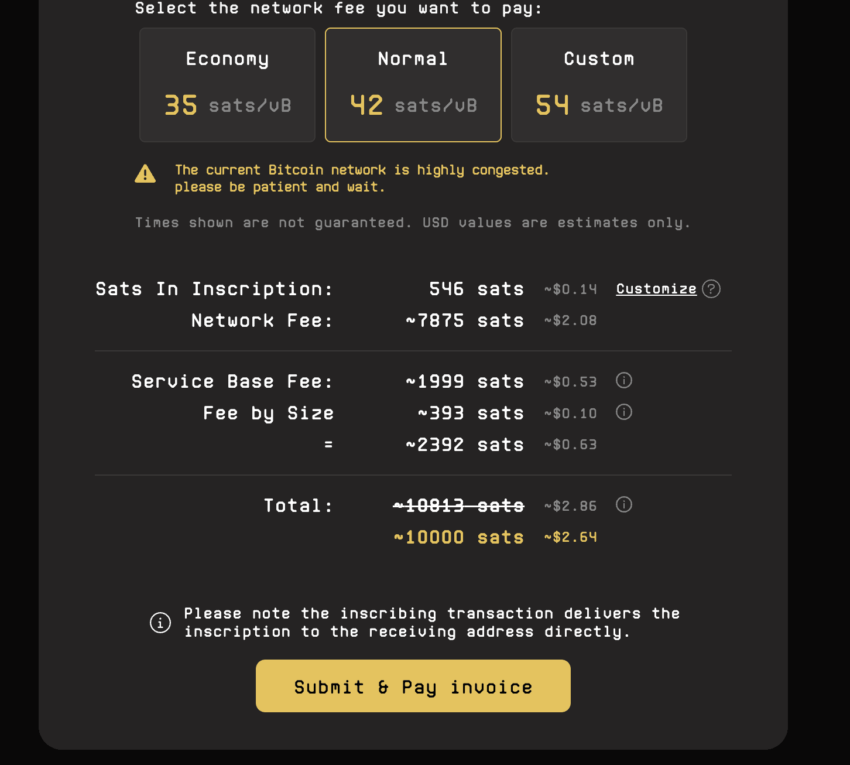

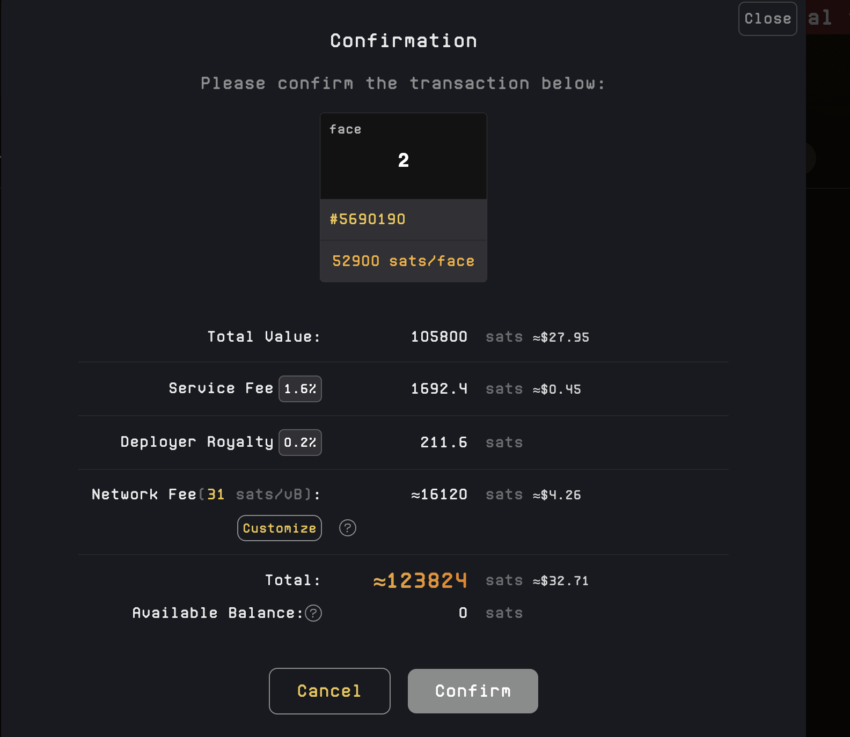

Here we are trying to buy 50 ORDI, paying a network fee of almost $4.52, a 1.6% service fee, and a 0.2% developer royalty.

Once you have bought some BRC-20 tokens or have a few sent to you, you can head over to the UniSat wallet homepage to make transfers, if needed.

As mentioned earlier, each function, including transfer, minting, or deploying the token, would require a separate inscription.

Here is a hypothetical JSON transcription data script for transferring ORDI:

Your UniSat wallet will tell you what amount of tokens you can transfer out.

Pro tip: If you plan to transfer BTC from a centralized crypto exchange to the UniSat wallet, we would recommend creating a SegWit address first. Once you get BTC there, you can move this to your Taproot address and start interacting with the BRC-20 tokens.

Buying or minting a BRC-20: what should you do?

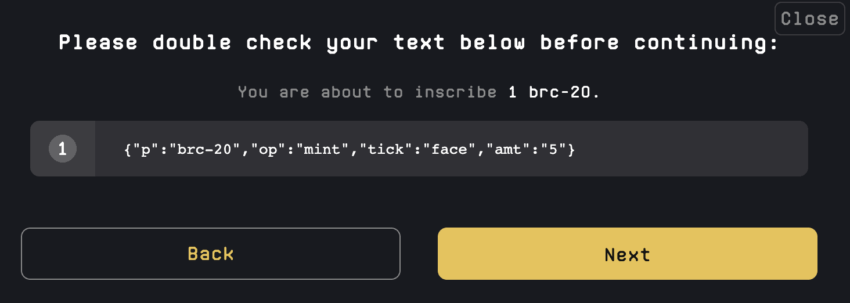

First of all, minting tokens directly is beneficial if some part of the token supply is available for minting. For instance, if you want to get Face, you can mint it directly. Notice that an inscription text is also shown, which you need to check before minting.

On UniSat, it will be directly minted to your address. Once you finalize the section, you will be directed to the address check section and a fee confirmation section. Upon confirming, you should have five Face tokens minted to your address.

There are multiple payment options, making minting on Unisat pretty easy. You can head over to mempool.space to check how long it might take for the transaction to go through.

An actual example from UniSat

If you want to transfer the latest minted Face tokens, you will again have “Inscribe Transfer,” like invoking a function.

As mentioned earlier, every step along the way needs to invoke a function. Also, Inscribing transfer and eventually transferring or listing the Face tokens would incur a network fee — something to keep in mind.

Now compare it to buying Face by heading over the UniSat marketplace. You might have to pay close to $33 to get 2 Face BRC-20 tokens. Therefore, for tokens that are available in circulation, minting is a better option.

For the likes of ORDI, Pepe, or others that are already circulating at capacity, buying is the only way.

In some cases, you will need at least 20 UniSat points to access the marketplace. This means you have at least deployed or minted tokens before coming to the buying market. This 20 UniSat point conundrum was one of the primary reasons for pushing the network prices higher, as each point means one inscription on a Sat or one transaction — which would block some network space.

Difference between BRC-20 and ERC-20

By now, you should be aware of how a BRC-20 token works and how you can interact with them. Now let us now compare the same with ERC-20 to see how elementary the differences are:

Point 1: BRC-20 relates to the Bitcoin network, whereas the ERC-20 token standard is related to the Ethereum ecosystem.

Point 2: BRC-20 tokens come with minimal functionality as they aren’t smart contract capable. ERC-20 tokens can interact with other chains and protocols, depending on their smart contract lingo.

Point 3: These tokens vary in terms of market capitalization. BRC-20 is hitting over $1 billion as of [ 2024], whereas ERC-20 tokens are well above the $150 billion mark.

Point 4: BRC-20 tokens now follow the proof-of-work consensus mechanism, with network congestion good news for the miners. ERC-20 follows the proof-of-stake consensus, focusing on validators and staking.

Point 5: While you can track the movement of ERC-20 tokens using Etherscan, Ordiscan can do the same for BRC-20 Ordinals and inscriptions. You can consider Ordiscan as the Dextools for BRC-20, giving a complete picture of the NFTs, BRC-20 tokens, and everything concerning the Bitcoin ecosystem.

And finally, BRC-20 wallets are still coming to terms with the concept of inscriptions, and only a few dedicated ones have been popular. In comparison, wallets for ERC-20 tokens are already working on the concepts of account abstraction to make life easier for web enthusiasts.

Overall, barring the few alphabetical and numeric similarities, the differences are quite distinct.

BRC-20 marketplaces

While we have already listed quite a few wallets that double as BRC-20 marketplaces, here are the ones you can specifically look to buy and sell BRC-20 tokens.

- OKX

- UniSat

- Gamma

- Magic Eden

- Ordinals Market

- Ordswap

- Open Ordex

- Ordinals Wallet

- Ordinals Market BT

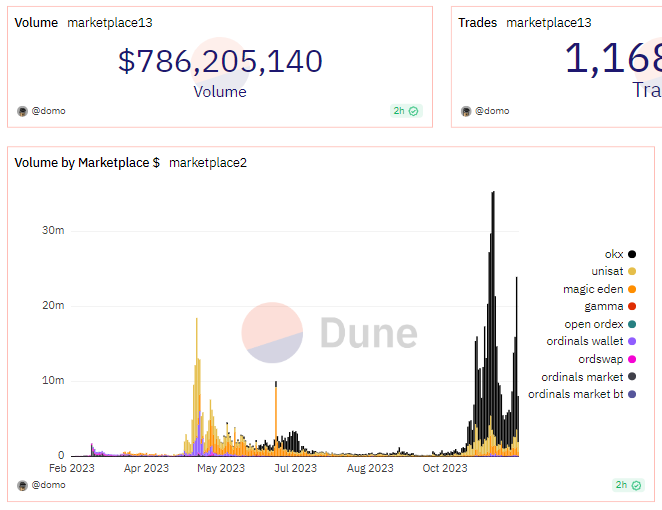

Per data from Dune, OKX sees the most action where BRC-20 marketplaces are concerned.

The road ahead for the BRC-20 token

At present, the BRC-20 token standard isn’t loaded with utilities. Except, of course, for the sudden increase in miner revenue and the deployer royalty when you buy tokens. The community is still divided, with some devs even asking for the removal of these supposedly spammy entities outright. However, the concept intrigues many tech-focused crypto evangelists around the possible use cases corresponding to the Bitcoin ecosystem.

With discussions surrounding the lighting network and BRC-21 integrations, the BRC-20 token standard might just have opened a whole new dimension in web3.

Frequently asked questions

A BRC-20 token is a fungible, native token with a connection to the layer-1 Bitcoin network. It follows the concept of numbering each satoshi per the Ordinals Protocol and can be created, minted, and transferred using inscriptions. Instead of smart contract support like the ERC-20 tokens, the BRC-20 token standard uses JSON inscription data to assign functionality to the tokens.

The concept of BRC-20 was proposed, ideated, and executed by Domo — Twitter name Domodata — on May 8, 2023. He created BRC-20 to bring the concept of fungibility to the Bitcoin ecosystem. Domo has also stated that BRC-20 tokens are experimental and have no value and should be approached that way.

The functioning of the BRC-20 token standard is fairly simple. It follows the concept of Ordinals, where you inscribe each satoshi, the smallest unit of bitcoin, to make it unique. However, if you inscribe the same with JSON data or a set of commands, you can instruct it to work like a token that can be created, minted, and even traded across marketplaces and exchanges.

Yes, BRC-20 is nothing like ERC-20. The latter is the token standard for creating new coins on the Ethereum blockchain. ERC-20 tokens are smart contract driven, follow the proof-of-stake consensus, and have a cumulative market cap of above $150 billion at press time. BRC-20, on the other hand, has a $1 billion market cap and hardly any utility as of 2024.

BRC-21 is a token standard proposed by Interlay to make the Bitcoin ecosystem support cross-chain tokens like ETH, DOT, SOL, and even decentralized stablecoins that might benefit from the security and diversity of the Bitcoin ecosystem. And with BRC-21, the transactions involving high-volume token movements can be shifted to the lightning network or layer-2 for speed and low transaction costs.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.