There’s a question that many new crypto investors want to know: how to stake ethereum (ETH) and earn a passive income from it? In this article, we’ll explain everything you should know to safely stake ethereum. We’ll also go over the different choices contributors have to earn rewards.

Why is Ethereum so popular?

Ethereum is one of the most popular blockchains because it was the original one to feature smart contracts. These are short programs that can execute a specific code when transactions are sent to them. Smart contracts allow developers to build DApps on the blockchain and are also used to stake coins on the ledger.

Ethereum was launched in 2015, and it functions on a proof-of-work (PoW) consensus mechanism, just like Bitcoin.

The PoW requires brute computational power and huge amounts of energy to keep the blockchain working. Unfortunately, this is no longer enough for the many decentralized applications and tokens created on Ethereum.

While using PoW, the network can only perform 15 transactions per second, and each one demands gas fees — often high. These issues make the platform impossible to scale. It is no longer an alternative for new DApps, which cannot afford the platform’s fees.

Smart contracts made Ethereum famous and widely used, as they permit automation and transparent transactions on the blockchain.

But the Ethereum founders plan to switch to a proof-of-stake consensus over the course of 2022. Updates have been implemented during 2021 to help set the scene for ETH 2.0 and allow users to stake their ethereum funds to validate transactions on the platform.

What is ETH 2.0?

ETH 2.0, also known as Ethereum 2.0 or simply Eth2, is the new version of Ethereum, after the network is upgraded from the PoW to a proof-of-stake (PoS) consensus. The upgrade will greatly improve transaction speed and costs, reaching speeds of up to 100,000 transactions per second.

The upgrade is supposed to reduce the energy consumption required for validating transactions by 99.95%. Running a PoS validator node requires minimal hardware and is significantly cheaper than running a crypto miner. Staking can be done on any laptop or computer.

The new version of Ethereum should attract more node validators, as it requires less equipment and complicated technical knowledge. After the upgrade is complete, ETH 2.0 will be one of the most eco-friendly blockchains platforms available.

With PoS in place, Ethereum will feature sharding, to allow parallel chains to share transactions and data load efficiently. The system is also expected to deploy rollups as well as a batching technique.

Upgrading to a PoS consensus will replace miners by staking ethereum for boosting decentralization. Similar to other PoS blockchains, ETH 2.0 will allow users to stake their funds and earn a passive income by doing so.

Investors can expect a reward of 5% APY (annual percentage yield) for staking. ETH 2.0 rewards depend on the total amount staked and the number of validators on the blockchain.

Benefits of staking ethereum

The main advantage of staking ethereum is that it helps involve more participants in the network, as they can become validators and earn ETH rewards.

If you’re wondering why you should stake ethereum, then take a second to look over these benefits:

- Earning passive income

- Become a validator and help keep the decentralization of the network

- Investors can run their own node

- Smaller investors can stake their funds on cryptocurrency exchanges or using a variety of apps

Drawbacks of staking ethereum

Staking cryptocurrency, in general, doesn’t pose any real risk. Your staked coins are safe, and there is no chance of losing your stake.

As with most blockchain networks, if you want to stake ethereum you should be aware of the drawbacks. These are:

- Becoming a validator requires 32 ETH, which is a big investment to make upfront if you don’t already own that. Validators also have stricter rules. Luckily, there are staking options for all investors, regardless of their funds.

- Ethereum funds are locked while staked. If you are a validator, your funds can be locked for up to two years (until all upgrades for ETH 2.0 are deployed).

- Slashing: ETH 2.0 has special rules in place to prevent network attacks. If the rules are broken by validators, that validator will be slashed and kicked out. Slashing is when part of the validator’s stake is removed and only affects deliberate validators who misbehave.

Following the rules and contributing as an honest participant on the network should stave off risks. It certainly shouldn’t keep you from staking your ethereum.

How to stake ethereum?

Staking on Ethereum is easily available to any investor. You can become a validator by using a staking service or staking directly from your crypto exchange account.

Becoming a validator is one of the most profitable ways to earn passive income if you want to stake ethereum. However, this is a rather more complicated method and requires a minimum of 32 ETH. But the platform wants to welcome all investors to be part of the network.

But you can stake ethereum and earn rewards, even if your funds are less than 32 ETH, using staking pools. You can use the staking pool set up by other entities, like popular crypto exchanges.

Ethereum staking pools

Investors with less than 32 ETH can be part of joint staking using staking pools.

How do you stake ethereum on staking pools?

Pool members receive staking rewards proportionally to the amount of ETH staked. A smart contract is used to keep the pool secure, transparent, and decentralized.

Staking pools charge a service fee and some even have a minimum amount to be staked. While the ETH is locked while staked, you’ll receive a token for it from most pools. This can be used for yield farming or lending. These tokens are ERC-20 tokens.

Become a validator on the Ethereum network

Running a validator node on ETH 2.0 is the most profitable way to earn passively. However, this is an expensive method. And it is also challenging for newbies, as it requires technical knowledge.

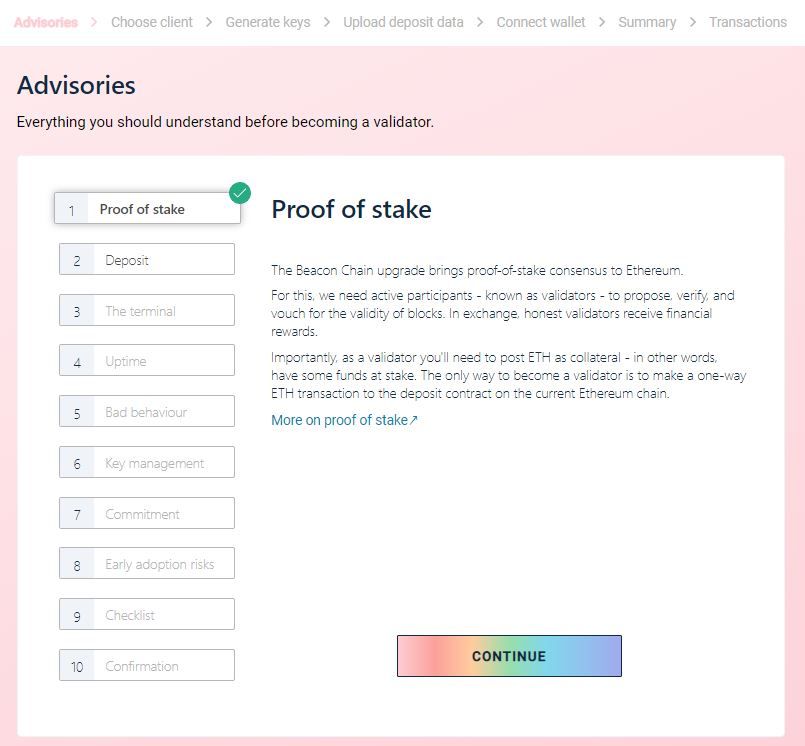

If you do want to become a validator and have the required funds, you can start by following all steps on the Ethereum launchpad page.

Read and accept all conditions of the network before starting.

The 32 ETH deposit is what keeps more investors from becoming a validator. The ethereum deposit is locked on the network until the mainnet merges with the Beacon Chain. This is expected in 2022.

Another condition you should be aware of is the uptime commitment. As a validator, it is your responsibility to keep the validator online and up to date. Failing to do so will attract penalties.

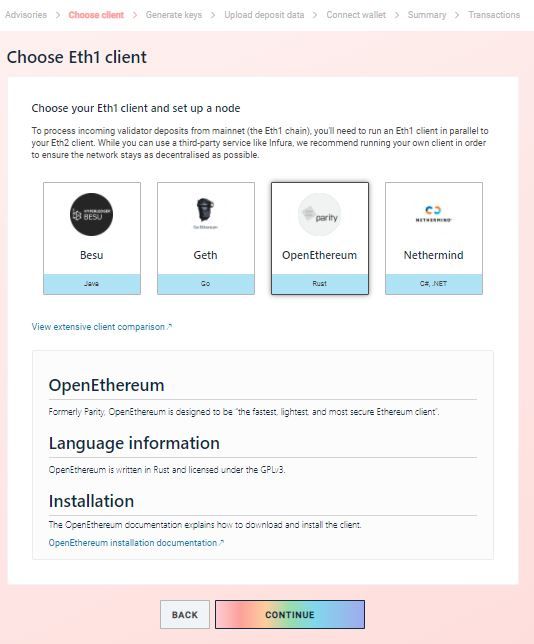

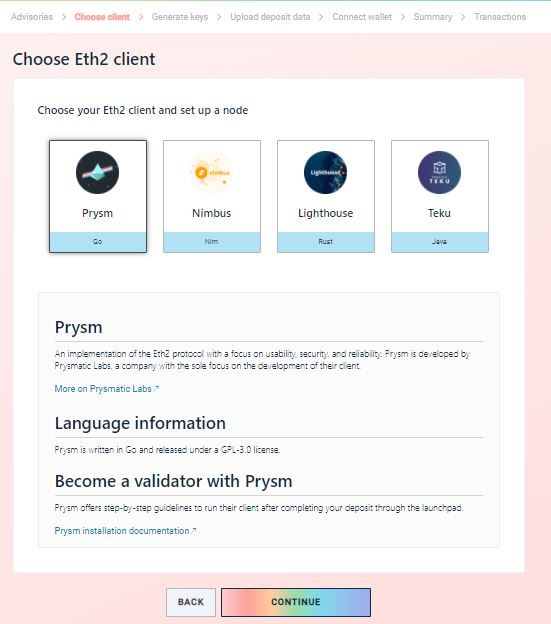

After you accept all conditions, you will be able to choose your desired Eth1 and Eth2 clients to set up your node.

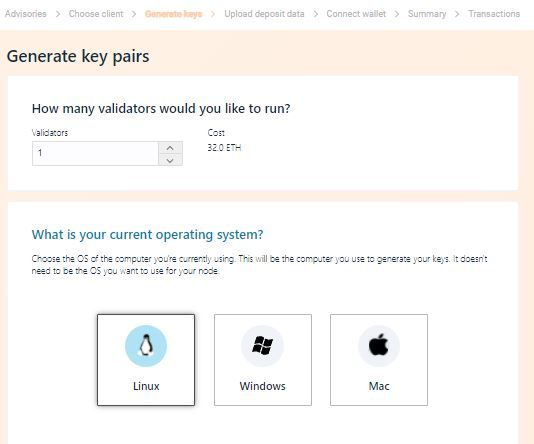

Next, you will need to validate the number of validators you want to set up in order to generate the key pairs. Each validator will require a deposit of 32 ETH.

You will receive instructions on how to install the command line interface app, and you will then need to provide proof you have successfully installed it. The next step will ask for the deposit_data.json file, which was generated during the installation of the node.

Then you’ll have to connect a wallet with the required funds for the validator. Thereafter, you are ready to start validating Eth2 transactions and collecting rewards.

Stake ethereum on Binance exchange

If you have the funds for a validator node, you can use Binance or Kraken or any other similar exchange to stake your ETH funds.

In this guide, we’ll talk about staking ETH on Binance, which will show you how easy it is to generate passive income.

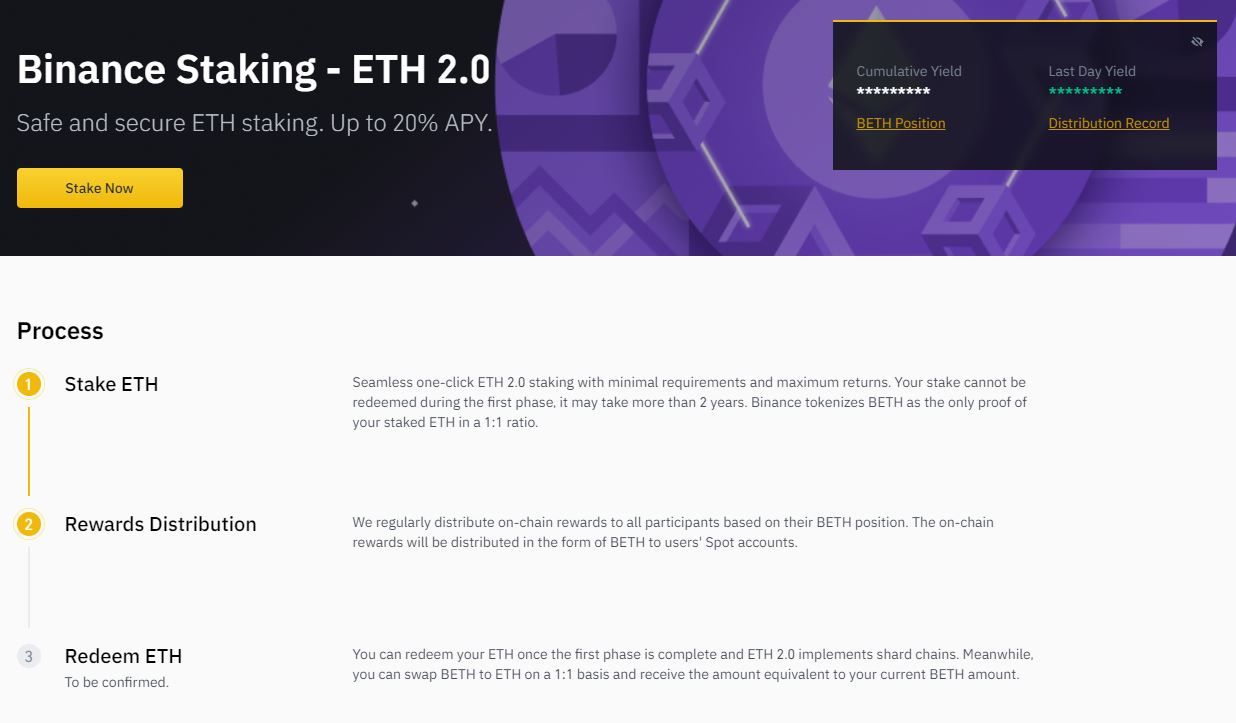

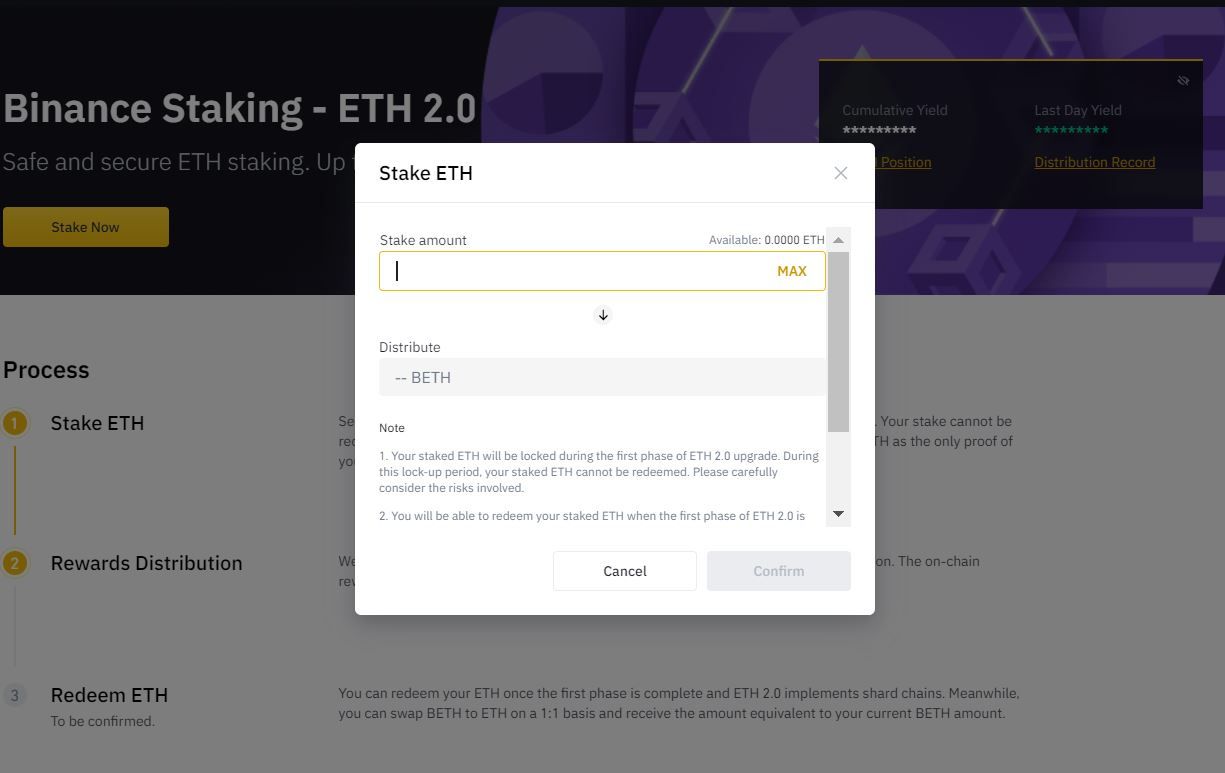

Staking ETH on Binance will not allow you to redeem them until the shard chain is launched, which could take up to two years. However, Binance will award you with BETH tokens on a 1:1 ratio, which can be used for staking. There is no minimum amount of ETH required for staking, but it’s worth mentioning that the APY will slowly decrease over time, as more investors start staking ethereum.

You will need to have a Binance account and to have ETH funds in it. Thereafter, you can start staking ethereum on Binance.

Visit Binance Staking to participate in the Binance staking pool for ethereum 2.0.

You can start staking ethereum immediately.

It’s worth noting that Binance doesn’t charge any service fee for staking ETH, unlike other services.

Stake ethereum: Is it worth it?

Now that you know how to stake ethereum, you must be wondering if it’s really worth it. That depends on the chosen staking method as well as your ETH funds. The more ethereum you have in your wallet available for staking, the more rewards you will receive.

Frequently asked questions

Is it worth staking ethereum?

How much can you make staking Ethereum?

How many ethereum do you need to stake?

What does staking ethereum mean?

Where can I stake my ETH?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.