Purchasing and selling Ethereum (ETH) can seem complex for newcomers, but it’s become more accessible thanks to numerous exchanges and attractive offers for new investors. Ethereum’s liquidity is high, making it a strong choice for trading. With Ethereum 2.0 currently in play, offering improved scalability and usability, 2024 might be an ideal time to engage with the crypto market. This guide will teach you how to sell Ethereum efficiently.

- How to sell Ethereum?

- Where to sell Ethereum

- 1. Binance

- 2. Gate.io

- 3. OKX

- Before selling, how do you buy Ethereum?

- Earning Ethereum from mining

- Storing your ETH safely

- Ethereum wallets: Where to store your ETH

- Selling Ethereum: Easier than You Think

- Selling Ethereum for fiat currencies

- Trading Ethereum for Bitcoin and other crypto

- Which centralized exchanges could you use?

- A few words on selling Ethereum on decentralized exchanges

- Congratulations, you know how to sell Ethereum!

- Frequently asked questions

How to sell Ethereum?

Selling Ethereum (ETH) has become straightforward with the rise of various crypto trading platforms. Here’s a step-by-step guide to help you sell your Ethereum:

- Choose an exchange: Select a reputable Ethereum exchange that operates in your country. Popular options include Coinbase and Binance, which support dozens of countries worldwide.

- Create an account: Sign up on your chosen exchange and complete the KYC (Know Your Customer) verification process. This usually involves providing some personal information and government-issued identification.

- Deposit Ethereum: If you already own Ethereum, transfer it to your exchange cryptocurrency wallet. Look for the ‘deposit’ option and follow the instructions to transfer your ETH. Make sure to account for any transaction fees during the transfer.

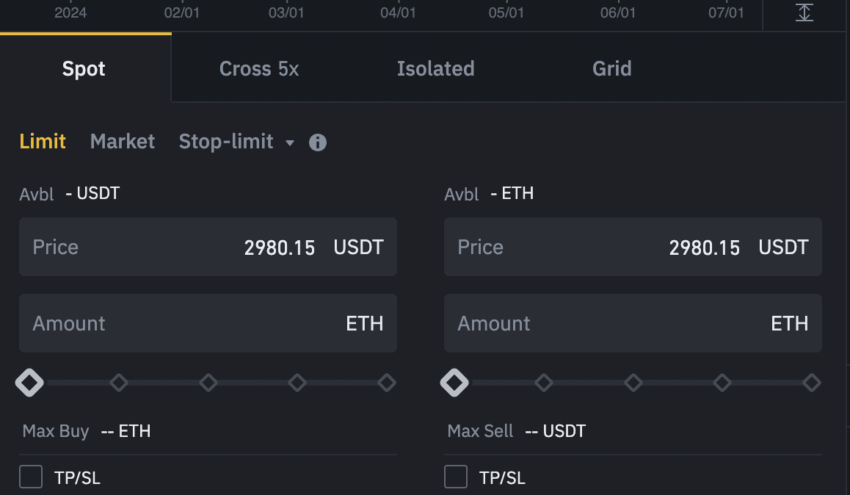

- Sell Ethereum: Navigate to the “sell” section of the exchange. Choose the amount of Ethereum you want to sell and select the fiat currency or cryptocurrency you want to receive in exchange. This is the step where you convert Ethereum to cash or other crypto assets.

- Confirm the transaction:Review the transaction details, including the transaction fees and the final amount you will receive. Confirm the transaction to complete the sale.

- Withdraw funds: Once the sale is complete, you can withdraw your funds to your bank account or preferred wallet. Be aware of any withdrawal fees that might apply. The ease of withdrawing funds has significantly improved in the crypto market.

Ethereum (ETH) already at your desired sell price! Or can it go higher? Find all the possibilities in this Ethereum price prediction piece.

Price elements to check before placing sell orders:

Where to sell Ethereum

There is a high demand for Ethereum, so it is not difficult to sell. You may wonder where you can go to find the best markets and rates for selling. Here are some of the best exchanges where you can sell Ethereum.

1. Binance

Binance is one of the most popular cryptocurrency exchanges in the world, and the largest by sheer trading volume. On Binance you can sell ETH to the exchange or in the peer-to-peer marketplace. The fees for selling to the exchange are 0.1%. P2P fees are more complex. They are typically 0.1% but can increase depending on the fiat currency in use. For example, USD incurs a 0.35% fee for buyers and sellers.

Gate.io is a comprehensive cryptocurrency exchange that services a multitude of users in various parts of the world and has a vast array of products and features. The exchange has a low fee of 0.1% for selling ETH. Utilizing its tiered fee schedule, traders can reduce this fee. However, the fee for selling as a merchant on its P2P markets is 0.2%., which can be reduced for VIP users.

OKX is one of the most popular exchanges in the world. It has become known for its many features, such as wallets, trading products, and derivatives. Due to its zero merchant fees for selling crypto on its P2P exchange, it is one of the top platforms to sell ETH. Regular users can also take advantage of the low selling fees on the regular exchange.

Before selling, how do you buy Ethereum?

Ethereum (ETH) can be bought on several exchanges and be earned from mining as well. At approximately $209 at the time of publishing, the ETH token is far from its all-time high. It is affordably priced, at least compared to 2017 and 2018 levels.

We’ve already written a walkthrough for buying Ethereum. To summarize, you have several options depending on which exchange operates in your jurisdiction. You can use this same exchange to sell you Ethereum as well, which is a subject we’ll move onto shortly. Suffice to say that you have both centralized and decentralized exchanges. The latter being a little more complicated but avoiding any restrictions imposed by jurisdiction.

Earning Ethereum from mining

You do not have to exclusively sell ETH. It is possible to earn Ethereum from mining, though this would require some investment in terms of mining hardware. It is no longer the case that anyone can begin mining ETH profitably, even if mining Ethereum is a little more decentralized than Bitcoin (BTC).

The general process is complicated if you’re new to cryptocurrencies, but in a nutshell;

- You’ll have to have a powerful enough computer that possesses a Graphics Processing Unit (GPU). You will then have to download the Ethereum blockchain, which is currently just over 286 GB in size.

- Join the network as a node, which can either be done through Geth, or more conveniently, through a mining pool.

- After this, you will have to install Ethminer. If all done correctly, you will receive rewards once a block is mined.

- The rewards will be transferred to the wallet linked to the Ethereum mining pool.

In addition to receiving a reward for mining blocks, you’ll also receive rewards for fees associated with transactions. This is the gas fee that you’ll see when you make transactions. You might have also noticed that the transactions with larger fees are prioritized over the smaller ones. This is essentially a way to skip the head of the queue.

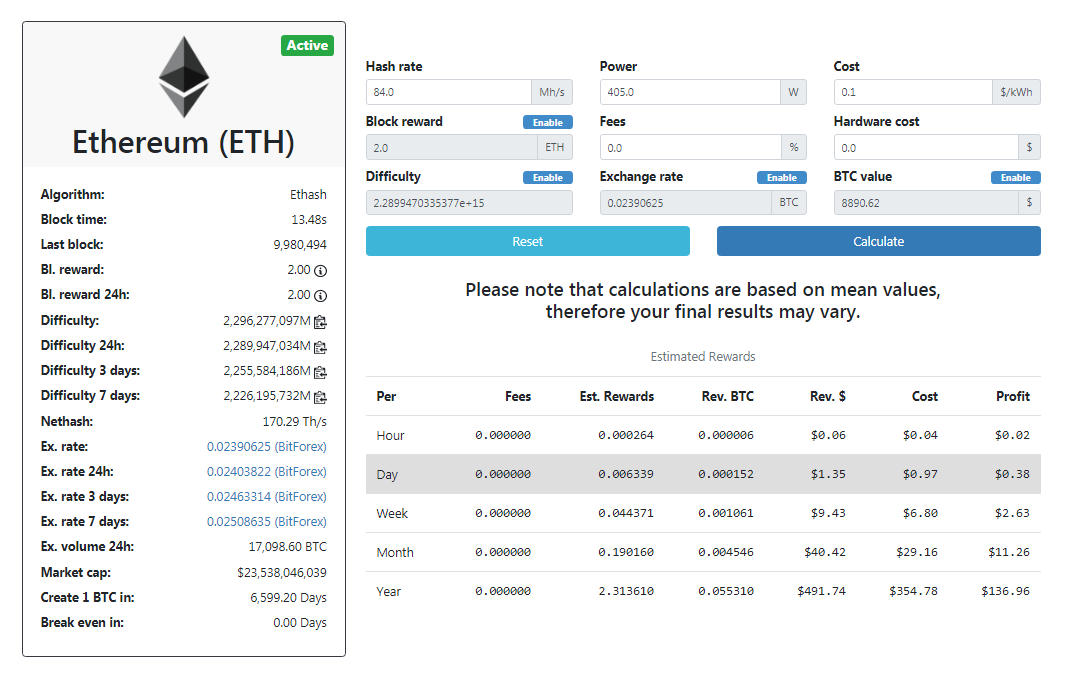

But how much do you earn by mining ETH and is it worth it?

This depends on the hardware you’re using and the cost of electricity in your location. There are several helpful calculators available that give you an estimate of your profitability, including WhattoMine and CryptoCompare.

However, Ethereum will soon switch to using the Proof-of-Stake (PoS) algorithm. The staking model will render mining obsolete so it may not be worth entering mining at this time. Staking allows you to stake some of your funds onto the network to maintain the upkeep. You’ll receive rewards for it proportional to your contribution.

Mining will likely still be in place until the end of 2020. If you have the hardware to spare and would like to earn a modest amount of Ethereum, then perhaps it is worthwhile.

Storing your ETH safely

Before you learn how to sell ETH, you must first learn how to store it. Of the utmost priority for any investor is the safe storage of assets. Numerous incidents over the years have underscored the risk associated with storing assets on exchanges, tallying to billions of dollars worth of assets since the great bull run of 2017. Malicious attackers have made it a point to target the uninformed using phishing attacks. Furthermore, centralized entities themselves have shown to have weaknesses.

Once stolen, it is very difficult to retrieve those funds. It is advised to never put yourself in a position where you may be at risk. The safest storage options are either cold wallets or paper wallets. While the former is a little more expensive, it is disconnected from the internet (hence the name ‘cold’) and is demonstrably safe. Paper wallets are also extremely safe, but they can be inconvenient to manage, as the keys require safe storage. However, they are free to create.

Choose carefully, but make sure that, if you’re planning to invest in large sums of Ethereum or hold it already, you do choose a safe storage option.

Ethereum wallets: Where to store your ETH

Before you learn how to sell ETH, you must first learn how to store it securely, especially as an extension of the section you read through earlier. Proper storage is essential for any investor to safeguard their assets from malicious attacks and vulnerabilities in the crypto market.

- Hardware wallets: These are physical devices that store your Ethereum offline, making them immune to online hacks. Popular hardware wallets include Ledger Nano S and Trezor. They are a bit pricey but offer top-notch security for your assets, helping you save on gas fees during transactions.

- Software wallets:These are applications or programs you can install on your computer or mobile device. Examples include MyEtherWallet and MetaMask. They provide a balance between security and convenience but are more vulnerable to online threats compared to hardware wallets. They also help you manage transaction fees efficiently.

- Paper wallets: A paper wallet is a physical document that contains your private keys and public addresses. It’s extremely secure from online attacks but requires careful handling and storage to prevent physical damage or loss. This method can also help you avoid gas fees.

- Exchange wallets: Many users store their Ethereum on the crypto trading platform where they trade. While convenient, this method is riskier due to the possibility of exchanges being hacked. It is advisable to transfer your funds to a more secure wallet if you are not actively trading on ethereum exchanges.

Choosing the right cryptocurrency wallet depends on your trading habits, security needs, and convenience. For large amounts of Ethereum or long-term holding, hardware or paper wallets are recommended. For daily transactions and ease of access, software wallets are suitable.

Selling Ethereum: Easier than You Think

So where to sell Ethereum? As mentioned, you’ll have to use an exchange, either centralized or decentralized, to sell Ethereum. We recommend choosing an exchange that complies with all of the regional laws in your jurisdiction.

“The low is approaching for Ethereum. The upcoming ETF news is a ‘Sell the rumour, buy the news’ type of event, most likely. Looks good.”

MIchael Van De Poppe, Founder of MN Trading: X

Coinbase and Binance are two popular exchanges that serve dozens of countries across the world; perhaps this may be a good starting point for you. Both exchanges have implemented KYC procedures, but these typically process in a few days and should put you in a place to start selling Ethereum quickly enough. You’ll need to provide some basic personal information about yourself, as well as photographs of yourself and government-issued identification.

It is also well worth noting that both exchanges also have their own tokens – USD Coin (USDC) and Binance Coin (BNB) – which come with benefits if used on the exchange.

So, to begin selling ETH:

- You’ll need an account on an exchange. On whatever exchange you choose, you should see options like ‘deposit’, ‘withdraw’,’ trade’, and ‘sell’ – something to that effect. If you’ve already got Ethereum, then it is likely that you should already be familiar with the process of using an exchange.

- If you don’t have Ethereum, and this is the first time you’re purchasing the asset, then you’ll have to deposit some fiat funds with which you can purchase Ethereum. Fortunately, there is no minimum limit to purchasing assets. You could buy $10 worth or $1000 worth.

- Depending on the exchange, you may be able to use debit and credit cards, bank transfers or PayPal. Once you’ve deposited some funds, you can begin trading. This requires to place an order for the trade, which will then have to be taken up by someone else. This usually happens quickly, especially for smaller sums of the asset.

Selling Ethereum for fiat currencies

Many, though not all, cryptocurrency exchanges will let you sell Ethereum for fiat currencies like the US Dollar or the Euro. Some will only let you trade it for other cryptocurrencies, like Bitcoin. One thing to note is that all exchanges have withdrawal fees, which vary in rate depending on the exchange, method of withdrawal and the currency in which it is withdrawn. Some, however, may have no withdrawal fees for a certain period or certain sum, such as the Gemini Exchange.

Assuming you’d like to sell Ethereum for USD or EUR, you have the aforementioned options of Coinbase and Binance – but do check the documentation for whichever exchange you decide to use. The actual matter of selling your Ethereum for fiat is quite simple, as all it requires is going to the respective sell tab and trading your ETH for whatever fiat currency of your choice.

A greater number of exchanges are offering fiat options, and payments channels such as PayPal, so you needn’t worry about withdrawing your assets like one had to just a few years ago. Wire transfers are also available on some exchanges.

Trading Ethereum for Bitcoin and other crypto

Selling Ethereum to Bitcoin is even easier than trading it for fiat currencies, as all it requires is a simple trade that will convert Ethereum to Bitcoin and deposit it into your account. Bitcoin and Ethereum are the two most popular tokens on the market and have sufficient liquidity. You’ll find them on every exchange.

Wallets even allow you to do this directly from your wallet, so it even avoids the hassle of having to log onto an exchange. Bear in mind that in such cases the trading fees can be higher, so do your due diligence.

Which centralized exchanges could you use?

Given that Ethereum is the second-largest digital asset by market cap, you should have no problem finding an exchange that operates in your country. However, not all exchanges are entirely reliable or safe, so consider the following list of exchanges, and check if they operate in your country. These exchanges have been in operation for some time and entrenched themselves in the market:

This list is by no means exhaustive but it serves as a good starting point. Some of these exchanges even offer attractive benefits for first-time users. Always read the fine print and the user reviews on the exchange. However, these are generally a good starting point for those who want to know how to sell Ethereum.

A few words on selling Ethereum on decentralized exchanges

Decentralized exchanges (DEXs), which are exchanges that conduct transactions directly between peers, are growing in popularity, as such exchanges refine their infrastructure and technical capabilities. Examples of such services include Loopring (which actually offers a decentralized protocol for exchanges to use), 0x (ZRX), Kyber Network (KNC), and Binance DEX.

The primary difference between centralized and decentralized exchanges is that the latter involves no centralized party – you are in control of your assets and trades. As there is no centralized party, DEXs are safer, cheaper, and much safer. Loopring has described how its protocol allows 1000 trades to be conducted at the negligible cost of $0.124.

While there are certainly attractive qualities to decentralized exchanges, they remain a little complicated for all but the tech-savvy, and as such is not recommended for all but the most ardent of investors and traders. However, if selling Ethereum and other assets is something that you may do over a long period of time, do note that you may save a lot in withdrawal and other fees if you were to use a decentralized exchange.

There is also the option of selling Ethereum to someone you know directly, but this has its own risks, namely that you must trust the buyer. Be doubly sure of the public address you are sending the Ethereum to, make you sure you meet in a public place and ensure that the both of you execute your respective transactions at the same time.

Congratulations, you know how to sell Ethereum!

Now you know how to sell Ethereum (ETH). Selling ETH for fiat or crypto is straightforward once you’re set up on a crypto trading platform. Exchanges are expanding payment options, making the process more accessible. The crypto market is growing, with increased activity on the Ethereum network indicating rising interest.

Many believe Ethereum is poised for a price rally, especially after Ethereum 2.0 upgrade, which promises improved scalability and lower gas fees. From an investment perspective, Ethereum, along with Bitcoin, is a crucial part of a diversified portfolio. The ease of selling Ethereum further encourages its inclusion in investment strategies.

Frequently asked questions

What is Ethereum?

What is the difference between Ethereum and ETH?

How do you buy and sell ETH?

How do you store ETH?

What are the benefits of using a hardware wallet for storing Ethereum?

Can I store my Ethereum on a crypto trading platform?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.