Yield farming is a common way to generate passive income from crypto. This comprehensive guide covers the intricacies of yield farming. We’ll examine its mechanisms and evaluate its potential rewards and risks in 2026.

KEY TAKEAWAYS

➤ Yield farming is one of the most common ways to earn passive income in crypto. Users deposit crypto into a liquidity pool and stake LP tokens on platforms to earn compounded rewards.

➤ To start yield farming, users need to deposit assets into a liquidity pool, receive LP tokens, and stake the in another platform.

➤ While yield farming can be lucrative, it carries risks, including market volatility and platform-specific risks.

What is yield farming?

Yield farming is the process of depositing your crypto into a liquidity pool and then taking the LP tokens to deposit or stake on another platform. The aim is to earn more crypto as passive income. Essentially, you’re adding liquidity to multiple platforms and earning compounded rewards in the form of interest for doing so.

The process is similar to holding traditional fiat in a savings account. Money held in a savings account is added to the bank’s balance sheet. Banks utilize those deposits to make investments. Yield farming is the same idea, except you’re contributing to a liquidity pool rather than a bank.

To understand yield farming, you will need to understand beforehand how staking and liquidity pools in decentralized exchanges (DEXs) as well as borrowing and lending platforms work in cryptocurrency.

How do you yield farm?

When you engage in yield farming, you earn rewards over time. The amount you receive in payouts depends on the platform you choose, with each offering different rates and terms.

This method compounds the rewards you would have earned by only staking on a single platform.

Note that the success of yield farming often hinges on market conditions and the performance of the underlying assets. It’s important to consider these factors, along with platform-specific risks and rewards, to make informed decisions.

How to start yield farming

To start yield farming, you need to deposit into a liquidity pool on platforms like Aave, Uniswap, Compound, or Curve Finance. You’ll also need to hold assets, generally Ethereum or ERC-20 tokens, in your connected wallet. A popular ERC-20 wallet to use is MetaMask.

Then, you’ll pick the liquidity pool of whichever asset you wish to lend and input the desired amount. The platform will state any fees as well as projected earnings. Once you’ve contributed to the liquidity pool, it’s time to start earning.

Varying rewards are paid out depending on the lending platform and asset you choose. Also, keep in mind that you’ll need to dedicate a significant amount of liquidity to see any meaningful returns.

Finally, deposit the LP tokens you receive on another platform. You can redo this process as many times as you like to compound rewards but keep in mind that this increases the risk. This process is known as rehypothecation.

Yield farming vs staking

| Yield farming | Staking |

|---|---|

| Taking the LP or LST tokens from a protocol or staking platform and depositing them on another platform to earn compounded yields | Depositing cryptocurrency into a smart contract to secure a blockchain by producing blocks or into a protocol to earn certain privileges or rewards |

| Higher returns | Stable returns |

| Primarily accomplished through DApps | Primarily accomplished with blockchains and DApps |

| Higher risks | Minimal risks |

Yield farming and staking are very similar, but each has subtle nuances. Staking is the act of storing or locking up your assets into a smart contract. There are generally three different types of staking:

- Blockchain: Staking coins allows you to validate transactions and provide security to a blockchain network. In this scenario, stakers are called validators.

- Decentralized application (DApp): On DApps, staking simply involves locking cryptocurrency into a smart contract to perform some task or fulfill a function, after which you are rewarded with some digital asset (e.g., token/NFTs).

- Protocol: Protocol staking is similar to DApp staking. The best example of this is Chainlink. Those who stake on Chainlink do not necessarily use a DApp, as Chainlink is not a DApp but a protocol. You still earn rewards in exchange for depositing crypto into a smart contract.

After depositing, the assets are used to fulfill the contract and can be released back to you in addition to any interest or rewards you have earned. Stakers and farmers both earn interest on their cryptocurrencies. They differ in that, with yield farming, you take the rewards and deposit them on another platform.

Is farming crypto worth it?

“As cryptocurrency gains wider acceptance, yield farming will enter the mainstream. Like traditional banking practices, this simple concept is essentially a digitalized form of lending with interest, providing a means for investors to generate profit.”

Daniel R. Hill, president of Hill Wealth Strategies: LinkedIn

Farming crypto can be very worthwhile, as you’re earning interest on cryptocurrencies that were just sitting in your wallet in the first place. Depending on how much you lend or deposit, yield farming can be lucrative.

Let’s imagine a scenario where Bob wants to yield farm. Bob deposits 100 ETH into a decentralized exchange (DEX) liquidity pool. He receives liquidity provider tokens (LP tokens) representing his share of the pool. If Bob’s deposit is 50% of the pool, he will receive 50% of the fees when traders swap in the pool and pay a fee.

He then takes his LP tokens to a borrowing and lending platform and deposits them into another liquidity pool for a loan. They then take that loan for crypto and deposit it into another DEX to earn more fees.

Hypothetically, Bob has just doubled his rewards using a single amount of liquidity, 100 ETH. If Alice swaps some crypto using either DEX, she pays a fee. This fee will go to Bob.

Risks of yield farming

Yield farming is an extremely complex process and there are many factors to consider to remain safe. In other words, the risks are not very simple to understand.

Example 1

The most obvious risk is smart contract risk. This means that some smart contract(s) within the yield farming strategy may not be properly audited, or can misbehave or break, leading to the loss of funds via burning (funds being stuck at an address) or an exploit.

Example 2

Another risk is that you deposit funds, the smart contracts work, yet you still lose funds due to some exploit. In this scenario, the culprit likely has utilized some sort of price manipulation strategy or flash loan. This risk affects the liquidity providers (LP) and the platform.

For example, you deposit cryptocurrency into a yield farming pool to earn yield. Someone manipulates the price of the assets in the pool through flash loans, becomes an LP, and withdraws a larger share of the pool than they actually own, slowly draining the pool.

Example 3

It is also important to note the risks associated with businesses built using yield farming strategies. In this scenario, retail users and institutional investors provide funds to a business that engages in yield farming strategies.

If the business does not implement proper hedging strategies or adequate withdrawal periods, this could lead to a bank run and the eventual bankruptcy of the business. Your assets will become stuck in legal limbo, and if you receive a payout, it will be in-kind, at par value, or at a haircut.

Celsius is a popular example of this scenario. Many retail users and businesses deposited crypto onto Celsius and when they could not get back their funds, they could not pay off the promises that they made to their own customers. This led to a chain reaction of bankruptcies and effectively tanked the price of multiple assets in DeFi.

Example 4

The last example we will explore is the risks associated with rehypothecation, which is notorious in traditional finance (TradFi). In DeFi, rehypothecation occurs when users provide collateral, such as LP (liquidity provider) tokens, which the platform then uses to generate yield, borrow additional assets, or provide liquidity elsewhere.

This recursive use of collateral increases risk exposure because if one link in the chain fails, it can trigger liquidations, insolvencies, or even platform-wide crashes. You can learn about this by analyzing the Anchor Protocol on Terra case study.

Summary of yield farming risks

Many DeFi platforms are highly interdependent, with liquidity and collateral flowing between different protocols. The recursive use of LP tokens or other derivative assets creates complex, fragile chains.

If a single link in this chain fails — whether it’s a borrower defaulting, an asset being liquidated, or collateral becoming illiquid — it can trigger a chain reaction of defaults across the entire system. In summary, yield farming is associated with user risks, platform/application risks, and systemic/market risks.

Best platforms for yield farming

There are various platforms for yield farming. Let’s get into a few.

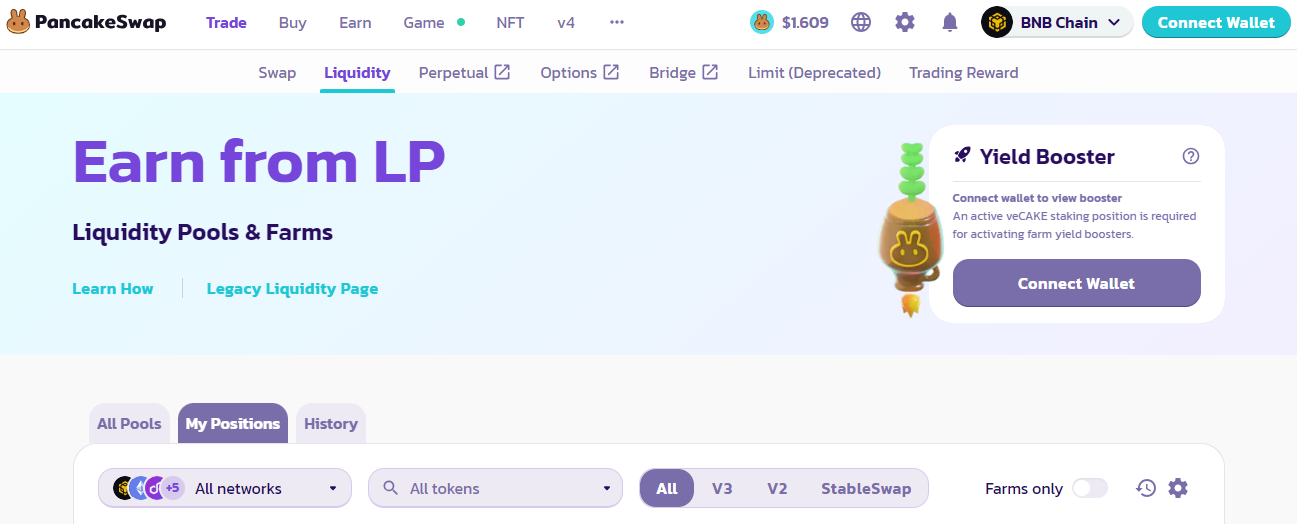

1. PancakeSwap

PancakeSwap is a DEX built on the Binance Smart Chain. It functions similarly to other automated market makers, enabling users to engage in direct cryptocurrency trading from their digital wallets without relying on intermediaries.

The platform allows users to contribute their tokens to different liquidity pools, which in turn facilitates trading activities. By staking LP tokens, users can use yield farms to earn CAKE while supporting PancakeSwap.

Liquidity providers earn fees proportional to their share of the total pool on trades executed within their respective pools. This mechanism incentivizes users to contribute liquidity to the platform and participate in its ecosystem.

Trading fees on PancakeSwap can be as low as 0.2% per trade, making it an affordable option for frequent traders looking to cut costs.

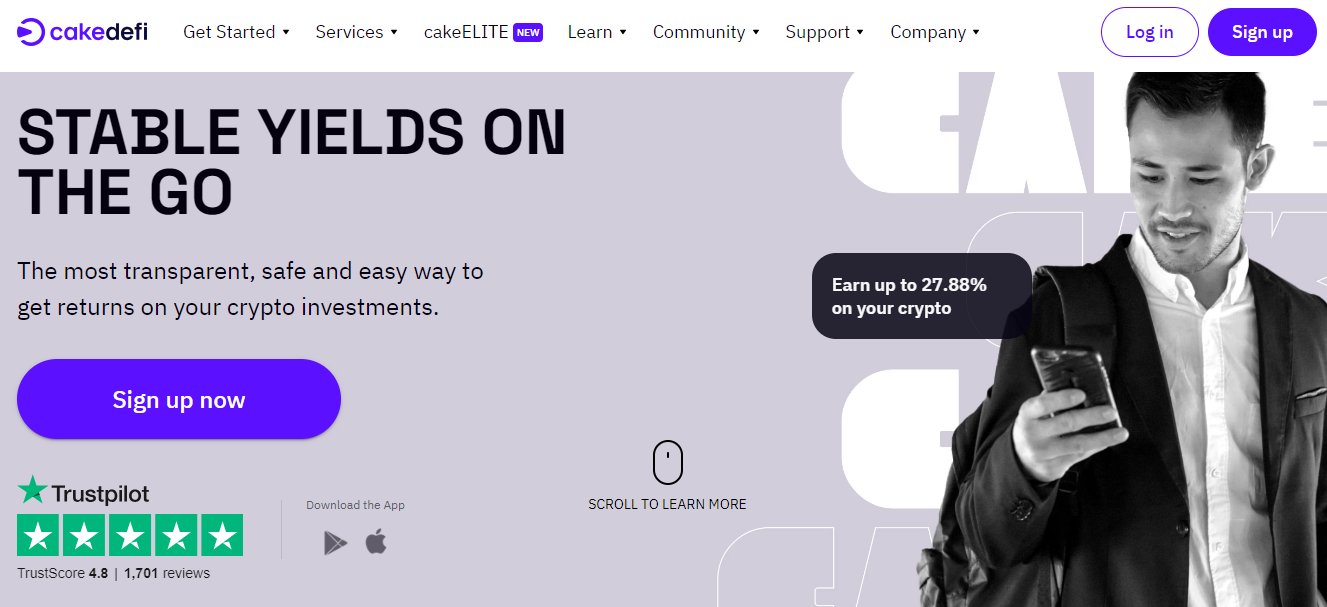

2. Bake (ex. Cake DeFi)

CakeDeFi is a user-friendly platform that caters to all your DeFi requirements.

This yield farming app offers key products including staking, borrowing, yield mining, and YieldVault. YieldVault allows investors to earn high returns on their crypto assets by utilizing DeFiChain vaults and leveraging negative interest rates.

Liquidity mining, in simple terms, allows crypto investors to earn rewards by providing liquidity to a decentralized exchange. For users who want to maintain ownership of their crypto assets but need funds to support their cash flow, Cake DeFi’s “Borrow” service enables them to use their assets as collateral and receive the necessary funds.

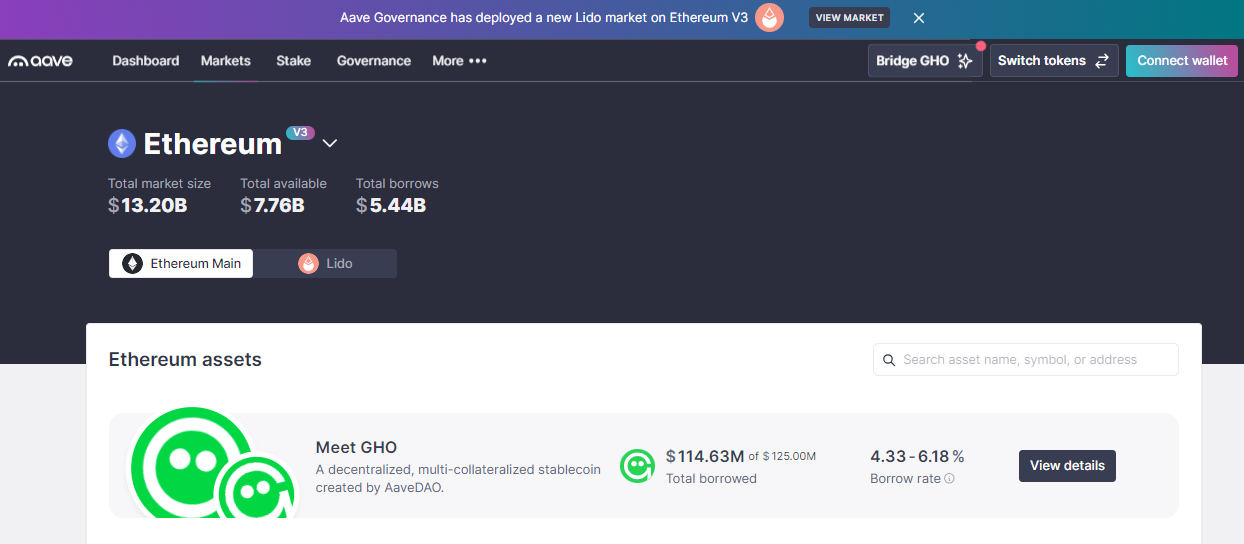

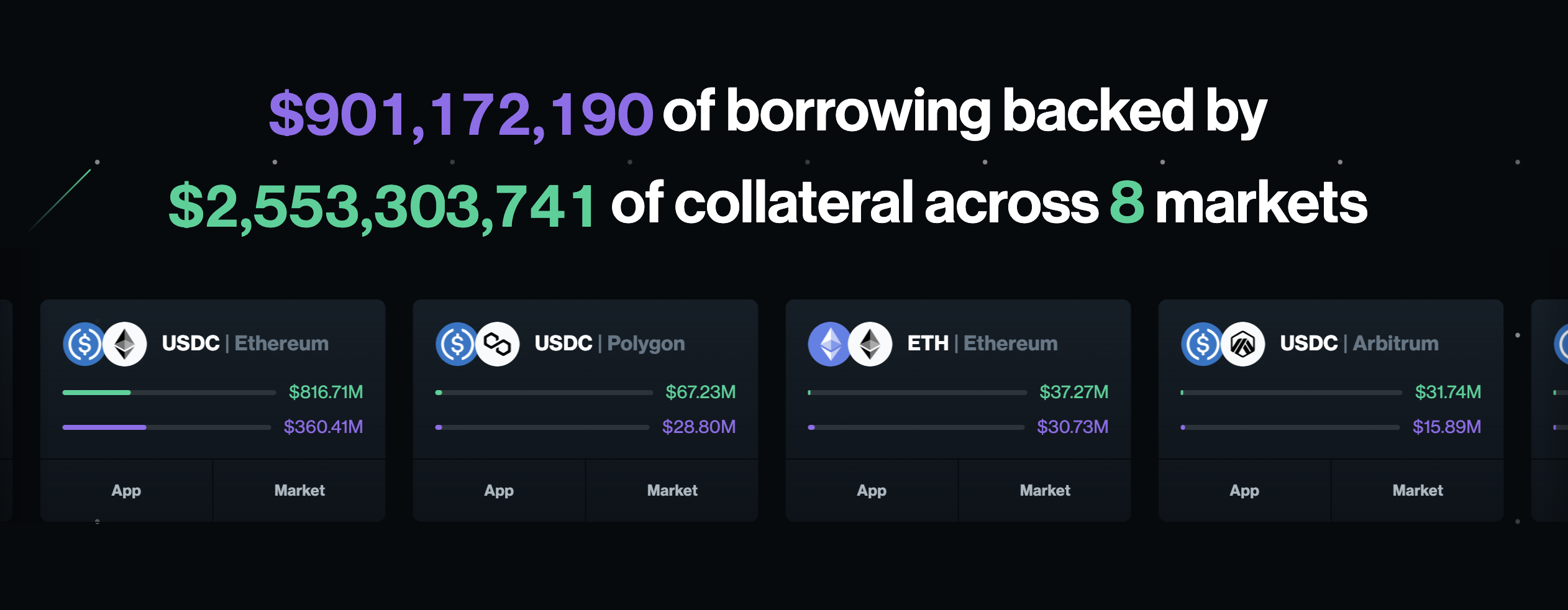

3. Aave

Aave is a non-custodial liquidity platform for lending and borrowing cryptocurrencies. It supports various stablecoins and other assets, such as DAI, USDT, BAT, and yearn.finance.

The website’s main page provides an overview of supported assets. Here, you can see the market size, total amounts borrowed, and yearly interest paid on deposited assets as well as borrowed ones.

4. Compound

At first glance, the popular lending platform Compound is very similar to Aave. It offers lending and borrowing for many of the same assets.

What makes Compound stand out is its implementation on other cryptocurrency platforms. For example, you can earn the platform’s COMP token via assets stored in your Coinbase or Ledger wallets. This saves you time and money as you don’t need to pay transaction fees to move assets into the Compound Wallet.

5. Uniswap

Uniswap was one of the first borrowing and lending platforms to take off during the DeFi boom of 2021. The exchange supports over 200 integrations with decentralized finance platforms such as Compound, Aave, and even the centralized platform Coinbase.

Apart from Uniswap’s liquidity pool, the platform offers governance based on its UNI token, swaps for all types of cryptos, and various chart information for both lenders and borrowers.

6. Balancer

As a popular DEX, Balancer enables anyone to trade Ether against ERC-20 tokens in a liquidity pool they create. A created pool contributes to the overall balancer liquidity and rewards users in the platform’s BAL token.

Basically, liquidity moves around in a pool of two assets as users borrow, lend, and withdraw assets from it. This activity consistently changes the price of assets within said pool. To counteract this, Balancer automatically converts assets through pools that create the best user value.

7. Sushiswap

Finally, we have Sushiswap. This DEX platform is actually a hard fork of Uniswap, meaning it’s also an AMM. The protocol supports various assets not listed on other providers, making it appealing to experienced providers and borrowers.

By providing liquidity, lenders yield SUSHI as a reward. They can then take those rewards and place them in the SushiBar for staking, which earns them xSUSHI to profit even more. xSUSHI is an asset minted when investors buy SUSHI, utilizing transaction fees to do so.

Stay safe when yield farming

Understanding the risks and rewards, keeping abreast of market trends, and choosing the right platform are crucial steps in your yield farming journey. By doing so, you can maximize your opportunities for profit while managing potential risks.

Disclaimer: This article is for informational purposes only and does not contain financial advice. Yield farming carries risk and profits are not guaranteed.