In 2024, liquidity’s role in determining a digital asset’s price remains paramount, especially in the dynamic cryptocurrency industry. The best liquidity providers are crucial in ensuring the swift conversion of digital assets to cash at current market values without significantly impacting the market price. In contrast to highly liquid fiat currencies, which can be effortlessly transacted at market value, tangible assets such as real estate and collectibles exhibit lower liquidity.

This year, we’ve identified the top players in the crypto space who are ensuring efficient and stable market conditions for digital asset trading by setting the standard as the best liquidity providers.

Why is crypto liquidity important?

Cryptocurrency liquidity is often considered a way to measure the popularity of tokens and coins on various exchanges, as it can indicate transaction volumes.

A few years ago, options to buy, sell, or convert Bitcoin into fiat were limited. The leading exchange, Mt. Gox, known for its high liquidity, managed 70% of all Bitcoin transactions by 2014. However, its infrastructure struggled under this load, and in February of that year, Mt. Gox ceased all trading following the disclosure of a long-unnoticed theft of 744,408 BTC.

Fast forward to 2024, and the scene is totally different, with hundreds of different crypto exchanges spanning the globe, all injecting more liquidity into markets. Investor confidence will increase when liquidity does, and inflows will follow, resulting in increased prices and technological development for smaller projects. Before making an outlay, traders will often evaluate the liquidity of a crypto asset to determine whether they are worth investing in. Those with higher liquidity will be favored over those with little.

Best crypto liquidity providers in 2024

1. Galaxy Digital Trading

Galaxy Digital Trading is a pioneering firm dedicated to reshaping the future of finance in a digitally native world. They manage over $2.5 billion in assets for over 960 institutional trading counterparties. It offers world-class pricing so brokers and investors can trade at competitive prices.

As a leader in the industry, the firm offers diverse services that include trading, lending, asset management, investment banking, mining, ventures, and research. These services are designed to cater to the needs of innovators, entrepreneurs, and investors, playing a significant role in constructing a decentralized economy.

| Galaxy Digital Trading pros | Galaxy Digital Trading cons |

| ⊕ Allows investors to access the growing digital asset class, offering chances for growth and diversification in their portfolios | ⊗ It may seem daunting to those using it for the first time |

| ⊕ Boasts a decade of market knowledge | ⊗ It may not provide the complete range of services typically offered by traditional banks |

| ⊕ Utilizes unique proprietary trading technology | |

| ⊕ Serves high-net-worth individuals |

2. PancakeSwap

PancakeSwap is a Binance Smart Chain (BSC)-based DEX. It enables users to trade cryptocurrencies directly from their wallets, eliminating the need for intermediaries. PancakeSwap uses an automated market maker (AMM) model to facilitate trading, utilizing liquidity pools and smart contracts.

On the PancakeSwap platform, users can engage in yield farming, liquidity provision, and token swapping while enjoying fast transactions and low fees.

| PancakeSwap pros | PancakeSwap cons |

| ⊕ Multiple features for earning | ⊗ BTC and non-BEP-20 tokens are not tradable |

| ⊕ Deep liquidity | ⊗ Lacks a mobile app |

| ⊕ Low trading fees | |

| ⊕ Easy-to-use interface |

3. Binance

As of October 2021, according to an estimate by Earthweb, there are 28.6 million Binance users. Reflecting on Binance’s trajectory, the exchange had reached 120 million registered users by July 2022, a notable milestone reported by Wu Blockchain. This remarkable expansion, with an increase of 30 million users within a year, highlights Binance’s continued success in drawing a global and diverse user base of crypto enthusiasts and investors.

In 2023, former – Binance chief Changpeng Zhao stepped down and pleaded guilty to breaking U.S. anti-money laundering laws as part of a $4.3 billion settlement resolving a years-long probe into the world’s largest crypto exchange, prosecutors mentioned. Despite this unfortunate incident, the Binance user base grew up to 30% the same year.

Importantly, the growth was not just limited to Binance’s exchange products but also included Binance Pay, Binance Earn, and its peer-to-peer platform, with a notable increase in interest from institutional investors.

| Binance pros | Binance cons |

| ⊕ Security, SAFU (safe funds) | ⊗ Restricted options in the U.S. |

| ⊕ Multiple geographical locations | ⊗ Fiat is not supported on the primary exchange |

| ⊕ High volume and liquidity | ⊗ ID requirements for large withdrawals |

| ⊕ Advanced trading functionality | |

| ⊕ Low fees for the industry | |

| ⊕ Educational resources |

3. Coinbase

Coinbase is one of the most popular crypto exchanges for trading directly with fiat. It was founded in 2012 and has become a stalwart of the industry.

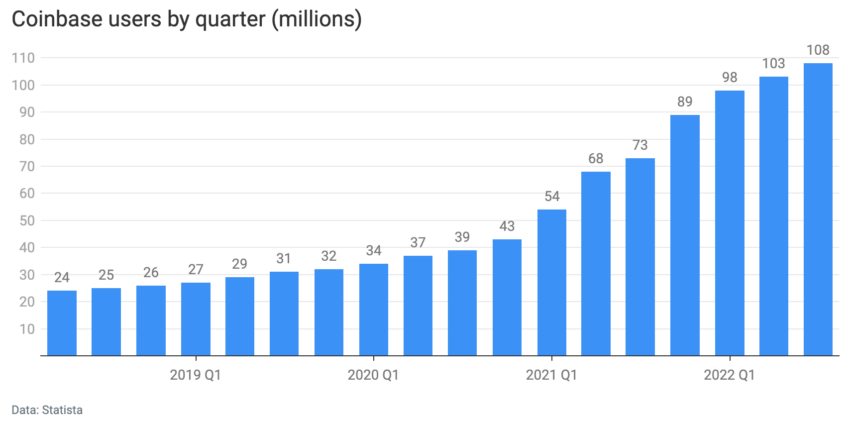

In 2022, Coinbase boasted a remarkable user base of 108 million, representing a significant leap from the 56 million users recorded in 2021. This surge amounted to an astounding 92.8% year-on-year growth. Over the past nine years, the platform witnessed an exponential increase in its user base, growing over 100 times. N

One of the most significant periods of growth was observed between Q1 and Q2 of 2021, where the user base expanded by over 20%. Another noteworthy surge occurred between Q3 and Q4 of 2021, with a 21.9% increase in users, reflecting the platform’s escalating popularity and the growing interest in digital currencies.

Finding accurate measures of daily volume and liquidity on Coinbase can be tricky, but there have been reports that the company has huge vaults of cryptocurrency holdings, so liquidity is unlikely to be an issue here.

| Coinbase pros | Coinbase cons |

| ⊕ Easy-to-use interface | ⊗ High fees and commissions |

| ⊕ Crypto token earning campaigns | ⊗ Lacking good customer support |

| ⊕ Pro version for serious trading | ⊗ Limited altcoins listed |

| ⊕ Many fiat deposit options | ⊗ Strict KYC requirements |

| ⊕ Excellent security and track record |

4. Huobi Global

Huobi Global, established in 2013, has grown significantly and is recognized for trading derivatives, ranking as one of the top exchanges globally. It’s noted particularly for its longevity, having survived China’s ban on Bitcoin trading.

The platform expanded internationally in 2017 and 2018, including launches in Japan and Singapore. However, regarding its ranking as the world’s second-largest crypto exchange behind Binance, this is specific to traded derivatives rather than overall daily volumes and liquidity.

| Huobi pros | Huobi cons |

| ⊕ Wide range of crypto tokens | ⊗ Unregulated |

| ⊕ Competitive feeds and spreads | |

| ⊕ Derivatives options available | |

| ⊕ Loose KYC requirements | |

| ⊕ High volume and liquidity | |

| ⊕ Good customer support |

How do you measure liquidity?

Measuring liquidity is pivotal for understanding market dynamics, and it primarily hinges on two key metrics: market liquidity and accounting liquidity. Market liquidity refers to the ease with which an asset can be converted into cash or another asset without significantly affecting its price.

High market liquidity implies enough buyers and sellers at any given time to facilitate smooth transactions, ensuring price stability. Conversely, accounting liquidity measures a company’s ability to meet short-term obligations using its most liquid assets. This is particularly relevant for crypto startups and blockchain companies, where the availability of liquid assets can be a critical factor in sustaining operations and funding ongoing development.

Factors influencing liquidity

There are two fundamental measures of liquidity: market liquidity and accounting liquidity. Here are some factors that shape and influence liquidity.

- Exchange listings: Exchange listings are critical for a cryptocurrency’s liquidity. The presence of multiple exchanges allows for easier trading and higher liquidity.

- Adoption and acceptance: Widespread adoption of a cryptocurrency boosts its liquidity. Its usage for transactions, such as with Bitcoin and Ethereum, results in higher turnover and liquidity.

- Regulatory and governmental hurdles: Government regulations significantly influence liquidity, particularly in specific regions. Restrictions on fiat conversions and bans on certain cryptocurrencies impact their regional liquidity.

- Media and public awareness: Increased public awareness, especially post-2017, has led to a surge in cryptocurrency liquidity. Media attention and the resulting investor FOMO dramatically boost prices and liquidity.

- Market capitalization and volume: Market capitalization and trading volume are key indicators of a cryptocurrency’s liquidity. High trading volume indicates active interest in buying and selling, while market cap reflects the overall investment in the cryptocurrency.

Is crypto liquidity trading for you?

In 2024, choosing the right crypto liquidity provider hinges on several key aspects. Providers like Huobi Global, Coinbase, Binance, and Galaxy Digital Trading stand out due to their established reputations, offering robust liquidity and a diverse range of crypto pairs. Importantly, some also present options for derivatives trading and high leverage.

The importance of liquidity in crypto trading cannot be overstated, as it ensures swift transactions at accurate market prices. Therefore, prioritize exchanges with large user bases and extensive token offerings, as these typically have higher trading volumes, translating to superior liquidity. Finally, remember to always conduct your research before making investment decisions.

Frequently asked questions

What is cryptocurrency liquidity?

What are some of the best crypto liquidity providers?

Why is crypto liquidity vital?

How should I start looking for a crypto liquidity provider?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.