Automated market makers eliminate intermediaries and address issues of limited liquidity across decentralized platforms. Balancer is one innovative AMM platform that aims to transform the way people trade. It has replaced traditional transaction methods such as order books and facilitates the exchange of tokens through the use of smart contracts. This guide covers everything to know about the platform in 2024.

KEY TAKEAWAYS

➤ Balancer is a decentralized exchange (DEX) that uses a unique multi-asset liquidity pool model, allowing up to eight assets in a single pool.

➤ BAL, Balancer’s native token, is as a governance token that enables users to vote on platform changes and incentivizes liquidity providers.

➤ Balancer pools are customizable, with adjustable fees and token weightings, making them flexible tools for portfolio management and automated rebalancing, akin to index funds.

➤ Balancer introduced a V2 upgrade which created consolidated liquidity vaults and reduced transaction costs, also introduced further integration efforts like CoW Swap for MEV protection.

What is Balancer?

Balancer is an AMM that creates liquidity pools to exchange various assets. It operates without the use of a third-party or centralized system. An AMM is a collection of algorithms that establish trading rules for facilitating trade orders and setting asset values.

Balancer is a decentralized exchange built on the Ethereum blockchain. It makes it easier for consumers to become liquidity providers to earn fees on trades.

Balancer has become one of the most popular decentralized exchanges (DEXs) and the largest DeFi apps in terms of the trading volume in 2024.

The Balancer exchange was initially distinctive because its protocol could support several assets in a single trading pool, which was not common in the early days of DeFi. Additionally, it has a predetermined trade cost agreed upon by pool creators.

As with many DeFi apps, Balancer has its own token BAL, enabling users to vote, govern the platform, and earn tokens by providing liquidity to the network.

Background and history

In early 2018, Balancer Labs, a technology and research firm, acquired Balancer, a research initiative run by Blockscience. This project aimed to provide liquidity on your terms and create an automated market maker pool capable of providing diverse assets.

This feature establishes a platform that is essentially identical to index funds in that it may rebalance continuously. The distinction is that it will compensate you for providing liquidity and not just for buying and holding tokens.

Balancer connects a liquidity provider to a pool to execute a swap transaction. The non-custodial exchange allows traders to swap assets for a fee that goes to pool liquidity providers.

Decentralized exchanges such as Kyber and Uniswap use the Balancer protocol.

The platform was founded by Fernando Martinelli, an entrepreneur and DeFi expert, and Mike McDonald (CTO), a seasoned security engineer. Both were critical to the project’s success.

Balancer Labs funded the project with a seed round of $3 million.

Since mid-2020, the network has developed its liquidity mining system in which liquidity providers to the Balancer pool can earn BAL tokens. Additionally, it has introduced staking, where miners earn income for holding their assets.

In Aug. 2020, BAL token holders voted to reward liquidity providers that include BAL in their pool. Similarly, BAL allows users to vote on and control the platform, ensuring that it functions appropriately while rewarding adopters to enhance liquidity. Lastly, Balancer also launched its V2 iteration in 2021.

How does Balancer work?

As an AMM, Balancer can evaluate the value of an asset by comparing it to other assets and the liquidity pool. When users add or remove assets from the liquidity pool, the ratio immediately changes, resulting in a change in the price of each asset.

As with many AMM networks, Balancer can route trades and determine the percentage of each token to calculate the price of an asset for its users. Swaps can be direct (ETH to BAL) or indirect (ETH>USDT>BAL).

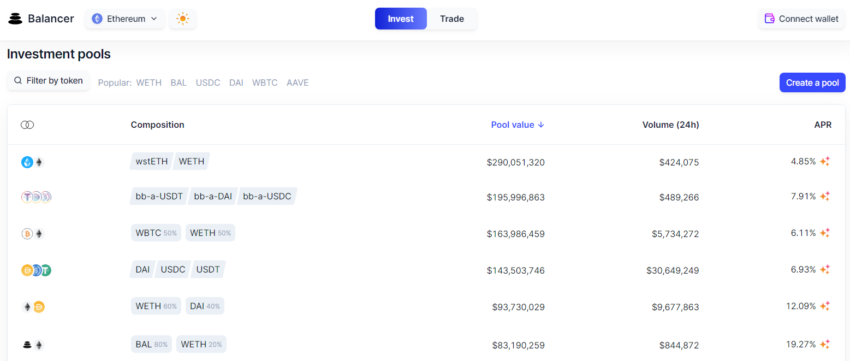

Below are three distinct pools:

- Shared: This pool is open to anyone willing to provide liquidity to the network, and remove or swap tokens. Besides that, it has fixed parameters (fees, asset types, and weights). This is helpful for customers with small holdings who wish to earn fees from the most popular liquidity pools.

- Smart: This is a customized program type of pool regulated and managed by smart contracts. It ensures that the pool has the correct digital asset ratio regardless of the digital currency used. Additionally, this capability enables additional functionality, such as weights or the creation of index funds capable of tracking a property portfolio.

- Private: In this case, only the pool owners can add or remove liquidity and define settings such as fees, weightings, and the assets accepted. This pool is ideal for users with large portfolios who wish to earn fees on their digital assets.

Balancer vs. Uniswap

Balancer and Uniswap are both top-ranking decentralized exchanges (DEXs) with specific unique characteristics, even though one may appear to be more popular. The following are critical differentiating characteristics to consider that may assist you in making an excellent choice between one or the other.

| Uniswap | Balancer |

|---|---|

| Pioneered the AMM model | Pioneered multi-asset liquidity pools |

| LPs can utilize concentrated liquidity | Customizeable liquidity pools |

| Introduced hooks | User-adjusted trading fees |

Uniswap

- Uniswap is credited for pioneering the AMM concept, enabling users to provide as much liquidity as possible while also trading tokens. Additionally, the network lacks a decentralized oracle, so it rewards arbitrageurs for keeping prices as low as possible.

- Through the use of LP and token swaps, Uniswap users can purchase UNI tokens, which give voting rights to future platform advancements and governance.

- Uniswap has the highest TVL and volume, making it a more attractive option for high-volume asset traders. Currently, the DEX offers liquidity that none of the DeFi exchanges can match.

Balancer

- The primary distinction is that Balancer may manage up to eight digital assets in a single liquidity pool. This means that a liquidity pool can store a large amount of liquidity of various forms, which benefits its users.

- Liquidity providers can change trading fees in the Balancer liquidity pool. This makes the market more competitive, as users seek better liquidity to profit from their trades.

- Liquidity pool assets are arbitrary, meaning users do not have to supply the same liquidity when trading on a pool.

Roadmap and development

May 11, 2021 V2: Balancer unveils its v2 protocol upgrade, which aims to address the issue of DeFi liquidity as it offers a generalized AMM. V2 enables aggregates of liquidity in one vault, so users can maintain the internal balance of the token they hold.

The 2022 Year Of DAO: Due to their initial success with the protocol phase, Balancer now focuses on the DAO2DAO framework to provide building blocks for other platforms to employ. The team expects to strengthen the Balancer’s ties to other networks based on its protocol.

Oct. 2024 CoW Swap integration: Balancer introduced CoW Swap, an AMM that introduced intents markets and offers MEV protection for traders.

What is BAL?

BAL is an ERC-20 token native to Balancer built on the Ethereum blockchain. BAL can regulate Balancer protocols and development, including voting on proposals and significant fundamental changes.

This feature distinguishes Balancer from other DeFi protocols as a decentralized autonomous organization (DAO). Moreover, the proliferation of Balancer in the DeFi space has resulted in the need for BAL in areas other than voting.

The maximum supply of BAL is 100 million. When BAL first launched it minted 145,000 BAL tokens every week. To curtail this high emission rate veBAL was introduced in 2022, it is an extension of BAL and is used for voting in decentralized governance.

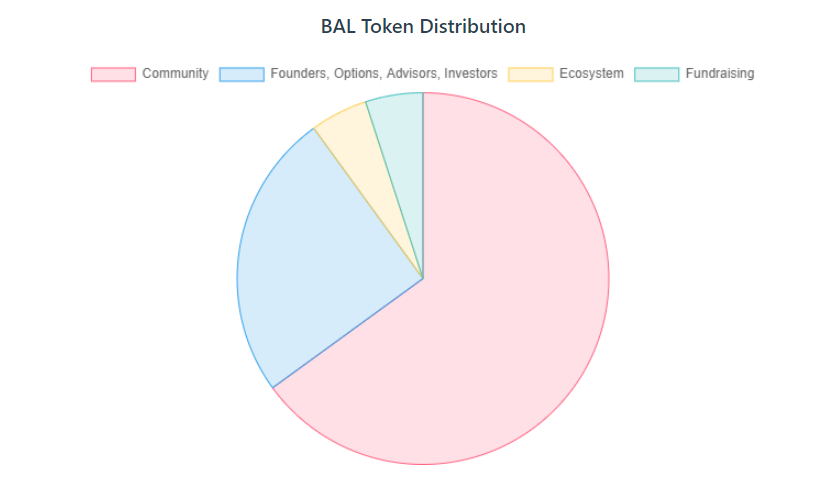

Tokenomics

When Balancer hit the scene, it did not have its token. However, on Jun. 23, 2020, the company began releasing its native token.

Balancer initially distributed 25 million tokens to its founders, investors, and key developers, all of which were subject to an ownership period. The total amount of BAL allocated was 100 million BAL.

- 5 million donated to its ecosystem to support protocol development, and another 5 million will fund future use.

- The remaining 65 million will be allocated to its liquidity providers, with 7.5 million a year or 145,000 BALs designed to be mined and given weekly.

- The network will supply 1.76 million annually based on the company’s liquidity provider’s share.

Is the Balancer token a good investment?

Balancer has grown thanks to its integration with other exchanges, including Coinbase Pro, Binance, and the ICONOMI platform, as well as its presence on Gemini.

The more appealing feature that has increased user interest in Balancer is the generalization of the Uniswap Bonding Curve feature to a more advanced option of the multidimensional surface. As the token increases in popularity, other exchanges are expected to integrate it, giving investors more options to buy it.

This protocol has made significant strides, including the use of BAL tokens to regulate the platform. Furthermore, BAL serves as a reward for its users’ efforts to supply liquidity while protecting them from impermanent loss.

Equally important, Balancer provides a self-balancing portfolio tool that works without incurring portfolio management fees.

However, while the utilization of the platform has increased, the price of the token has not necessarily followed suit. User’s should keep this in mind before investing.

This article is not investment advice, it is for informational purposes only. Trading cryptocurrency is risky and you could lose money. Invest responsibly.

How to buy Balancer (BAL)?

To trade on Balancer:

- You’ll need a web3 digital wallet like MetaMask.

- Deposit ETH into your wallet to pay for gas and transaction fees.

- Go to the Balancer exchange and swap ETH for BAL.

Below is a more detailed set of instructions. This guide generally applies to most DEXs, so you can use any decentralized platform that holds BAL.

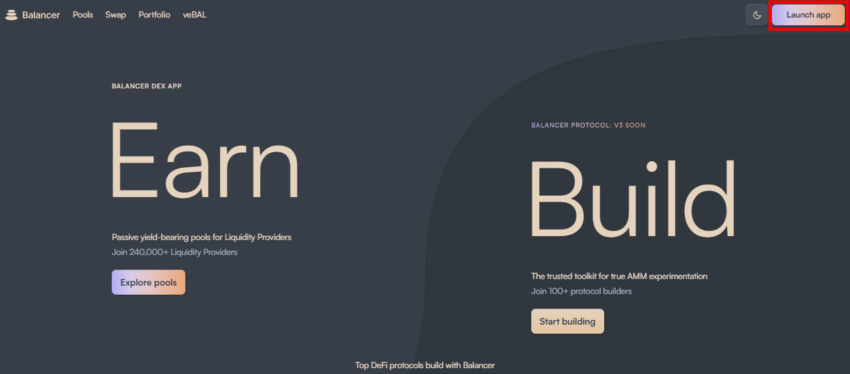

1. To begin, you must navigate to the Balancer website. Select “Launch App.”

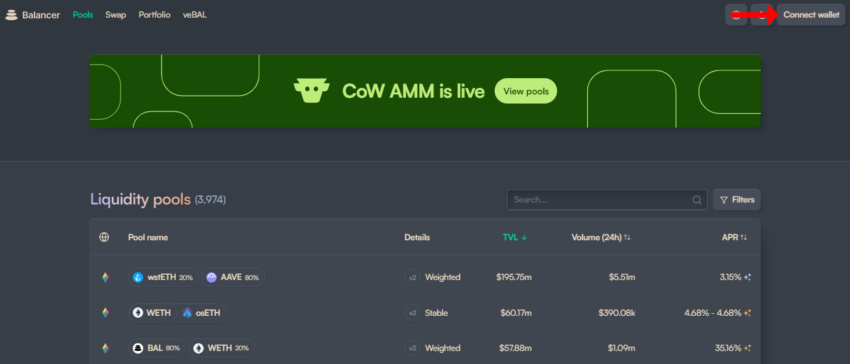

2. Once on the website, no registration or know-your-customer (KYC) is required. All you need to do is connect your MetaMask wallet, and you’re ready to go.

3. Select the cryptocurrency you wish to buy or sell from the drop-down menu. This can be accomplished by entering the name or symbol and proceeding to the next step.

If you are satisfied with your currency name selection, enter the amount you intend to sell or buy.

While selecting the amount to choose from. Balancer will present you with many options, as it will filter many pools containing the token you requested.

4. Finally, click “Swap,” and MetaMask will prompt you to confirm the transaction. Following that, the cryptocurrency you sold will be hidden from view, and the token purchase will appear.

As you make your picks, keep in mind that the higher your transaction amount, the more liquidity will be required to fill it. Which means slippage will increase. Slippage is a phrase that refers to the divergence of orders throughout the trade process between order and execution. Once this is complete, you’ll have the option of viewing your anticipated slippage or even adding extra limits to help you manage your payments.

Balancer — a wider trend in DeFi

Balancer is one of the most advanced decentralized exchanges available in the DeFi space. This protocol innovatived popular DeFi functionalities and has created its own native BAL tokens to aid in platform governance. The platform is beneficial for market makers and developers who require liquidity for their applications.

Frequently asked questions

What is Balancer token?

Is Balancer safe?

Should I buy Balancer crypto?

Is Balancer an ERC-20 token?

What is the Balancer protocol?

Is Balancer a scam?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.