If traditional finance got a blockchain makeover, DeFi protocols would inevitably be the result. Here, decentralized apps (DApps) and smart contracts reign supreme, offering you control over your financial future.

From staking your digital assets for crypto yield to conducting anonymous crypto swaps, this guide introduces you to the top DeFi protocols to keep an eye on in 2024.

Methodology

BeInCrypto evaluated several leading protocols to determine the top offerings in 2024.

We based our evaluation on certain key criteria, looking for reputable protocols offering secure and user-friendly experiences. The following DeFi protocols were selected after a six-month testing period. Here’s how each stood out during our testing.

PancakeSwap:

Offers low transaction fees compared to other DEXs, appealing to frequent traders.

Provides a wide range of features including yield farming, lotteries, and NFTs, which enhances user engagement.

Operates on Binance Smart Chain for fast and efficient transactions, suitable for a broad user base.

Uniswap:

Pioneered the AMM model, providing high liquidity and enabling direct wallet-to-wallet trading.

Offers wide token support, facilitating access to a vast array of ERC-20 tokens.

Strong community and open-source nature ensure continuous improvements and transparency.

Curve:

Specializes in stablecoin swaps with minimal slippage, optimizing user investments.

High liquidity pools and low fee structure improve user trading experience.

Integrates advanced cryptographic methods, enhancing security and efficiency.

Balancer:

Offers customizable liquidity pools, allowing users to create pools with up to eight different tokens.

Acts as a self-balancing weighted portfolio and price sensor, automating portfolio management.

Provides high flexibility in defining pool parameters, catering to varied user preferences.

Summer.fi (previously Oasis.app):

Provides an intuitive interface for seamless DeFi interactions, suitable for beginners.

Offers various DeFi products and automation features for a holistic experience.

Prioritizes user control and transparency, aligning with the core principles of DeFi.

Aave:

Offers innovative features like flash loans for quick, uncollateralized borrowing.

Incorporates a range of interest rate options, catering to different risk appetites.

Utilizes a decentralized governance structure, ensuring community-driven development.

MakerDAO:

Provides a stable and reliable DAI stablecoin pegged to the U.S. dollar, reducing volatility.

Features a governance system allowing MKR token holders to vote on critical decisions.

Offers multi-collateral vaults, providing users with flexibility in collateral choices.

Compound:

Allows users to earn interest on deposited cryptocurrencies and borrow against them.

Implements an autonomous interest rate protocol, adjusting rates based on market demand.

Features a transparent, open-source interface that encourages user trust and security.

dYdX:

Specializes in decentralized margin trading, derivatives, and perpetual contracts for advanced traders.

Offers layer=2 scaling solutions, providing fast and cost-effective transactions.

Employs a hybrid model combining off-chain order books with on-chain settlements, enhancing trading speed and efficiency.

Lido:

Provides liquid staking solutions, allowing users to earn staking rewards without locking assets.

Supports multiple blockchain networks, expanding user options for staking different cryptocurrencies.

Implements decentralized and non-custodial services, promoting security and user control.

De.Fi:

Delivers comprehensive DeFi platform scanning for vulnerabilities, enhancing user security.

Offers real-time monitoring of user wallets and transactions, ensuring transparency and control.

Provides a range of investment tools and features for an informed DeFi experience, catering to various user needs.

Overall, these DeFi protocols were selected based on their unique features, security measures, and ability to offer a user-friendly experience. Each protocol stands out for its practical solutions to common DeFi challenges such as liquidity, security, and accessibility. By addressing the needs of a diverse range of users, from beginners to advanced traders, these protocols are shaping the future of decentralized finance, making it more accessible, efficient, and secure for everyone.

For further insight into BeInCryto’s verification methodologies, click here.

- 11 Top DeFi protocols in 2024

- 1. dYdX

- 2. PancakeSwap

- 3. Uniswap

- 4. Curve Finance

- 5. Balancer

- 6. Summer.fi

- 7. Aave

- 8. MakerDAO

- 9. Compound Finance

- 10. Lido

- 11. De.Fi

- DeFi protocols compared

- What are DeFi protocols?

- How do DeFi protocols work?

- Should you use DeFi protocols?

- Pros

- Cons

- Could DeFi replace traditional finance?

- Frequently asked questions

11 Top DeFi protocols in 2024

Best decentralized exchanges (DEXs) protocols

1. dYdX

The dYdX protocol provides advanced financial instruments like perpetual and margin trading within the DeFi ecosystem. The leading exchange operates without KYC, allowing for anonymous, trustless trading. It supports perpetual and margin trading, alongside lending and borrowing, and offers competitive fee structures and gas-free trading experiences.

The platform provides lower collateralization levels compared to competitors, increasing accessibility. dYdX also utilizes StarkWare for increased efficiency and lower transaction fees and allows for community contributions and governance.

Notably, dYdX also transitioned to an independent blockchain within the Cosmos ecosystem, enhancing performance and furthering decentralization.

- Advanced trading options

- No KYC required

- Low fees

- Layer-2 scalability

- Dynamic interest rates

- Interoperability with Cosmos

- Complex for beginners

- Dependent on Ethereum

- Limited spot trading

- New chain transition challenges

- Ecosystem adaptation required

Trade features: Perpetual trading, margin trading, decentralized order book, layer-2 scalability, cross-margin capabilities.

Earning features: Lending, borrowing, dynamic interest rates, trading rewards.

Security features: Self-custodial security, third-party audits, secured by Ethereum protocol.

Platform and ecosystem features: No KYC, open-source code, integration with Cosmos ecosystem, decentralized governance, off-chain order matching.

2. PancakeSwap

PancakeSwap is a top-tier DeFi protocol. It focuses on the Binance Smart Chain blockchain, but supports a total of eight networks, including Ethereum.

PancakeSwap’s native crypto is CAKE, which has a total supply of 450 million tokens. This decentralized exchange leverages an automated market maker (AMM) model, allowing for direct, wallet-to-wallet trades without intermediaries, enhancing user control and security.

Moreover, it offers a range of services beyond simple trades, such as yield farming, staking, and lotteries, enabling users to earn rewards in various ways. Its user-friendly interface makes it accessible for beginners, while its innovative features, like the zkBridge technology, ensure secure and efficient transactions across different blockchain networks.

PancakeSwap’s growth is underscored by its status as the first billion-dollar project on the Binance Smart Chain and its continual upgrades, such as the current PancakeSwap V3, demonstrating its commitment to improving functionality and user experience.

- Intuitive interface

- High APY for liquidity providers (LPs)

- Supports staking and farming

- NFT marketplace

- No mobile app

- No native crypto wallet

Trade features: Instant crypto trading, liquidity pools, asset bridging, perpetual trading, and cryptocurrency purchasing.

Earning features: Farming, pools, liquid staking, simple staking.

Game and NFT features: Gaming marketplace, prediction market, NFT marketplace for NFTs on BNB Chain.

DeFi and ecosystem engagement: Governance, initial farm offerings (IFOs), gauge voting and revenue sharing, and farm booster.

3. Uniswap

Uniswap is another leading decentralized exchange. The native token is UNI, which has a total supply of 1 billion tokens.

Governed by its users through the UNI token, it offers a community-driven experience, unlike centralized platforms. Uniswap’s liquidity pools facilitate secure and direct token swaps, ensuring users maintain complete control over their funds. Originally built on Ethereum, it now supports other Ethereum-compatible networks like Polygon and Optimism, offering lower transaction costs.

Uniswap’s simplicity makes it accessible for beginners while providing advanced features for experienced users. This is rare when it comes to DEXs, which can often be tricky to use and less straightforward than their CEX counterparts. Uniswap also boasts broad token availability and deep liquidity, reducing price impact on large trades.

Additionally, the DEX has integrated NFT trading, enhancing its offerings. With nearly 5 million unique wallet addresses and surpassing $1 trillion in trading volume, its popularity and reliability are evident.

Finally, Uniswap’s swap fees are competitive, especially when compared to centralized exchanges, and users can choose cheaper networks to avoid high Ethereum gas fees.

- Easy-to-use interface

- Low-cost trades

- Multiple blockchain networks supported

- No mobile app

- High fees when purchasing crypto (third-party services)

Trade features: Instant crypto trading, liquidity pools, asset bridging, cryptocurrency purchasing.

Earning features: Funding liquidity pools, swap fee earnings.

Game and NFT features: NFT marketplace, prediction market.

DeFi and ecosystem engagement: Governance, concentrated liquidity, transaction fee structure.

4. Curve Finance

Curve Finance is a leading decentralized exchange (DEX) on the Ethereum blockchain, specializing in the efficient trading of stablecoins and wrapped tokens like wBTC, renBTC, and sBTC. Founded by Michael Egorov, it has quickly risen to prominence, and is particularly famed for its innovative use of liquidity pools and automated market maker (AMM) systems. These allow users to earn high annual interest rates — over 300% in some pools — on deposited cryptocurrency.

The platform distinguishes itself with its unique bonding curve. This is optimized for stablecoins to reduce slippage, allowing significant trades with minimal price impact. This has positioned Curve as a vital component in the DeFi space, especially for those interested in liquidity mining and yield farming.

Curve Finance operates as a decentralized autonomous organization (DAO), with its governance token CRV enabling holders to vote on changes and proposals. This shift to a DAO structure allows Curve to operate with enhanced transparency and community-driven development. Despite its complexity and the potential for impermanent loss, Curve Finance offers significant opportunities for liquidity providers and traders, underlined by security measures including multiple code audits and bug bounties to safeguard user assets.

- Specializes in stablecoins

- Reduced slippage

- Governed by DAO

- Multiple security audits

- Bug bounties for added safety

- Complex for beginners

- Focused mainly on stablecoins and wrapped tokens

- Reliance on Ethereum blockchain, leading to potential high gas fees

Trade features: Stablecoin specialization, efficient liquidity pools, unique bonding curve, minimal slippage in trades.

Earning features: High annual interest rates from liquidity pools, rewards in CRV tokens, participation in yield farming.

Security features: Multiple security audits, bug bounties, governed by decentralized autonomous organization (DAO).

DeFi and ecosystem engagement: Governance via CRV token, high total value locked (TVL), support for various wrapped tokens.

5. Balancer

Balancer is a versatile and innovative DeFi platform that redefines the concept of decentralized exchanges (DEXs) by combining elements of automated market makers (AMMs) and index funds.

Unlike traditional DEXs — which typically focus on two-token liquidity pools — Balancer’s USP lies in its ability to maintain a balanced portfolio through automatic rebalancing, adjusting the pool’s asset allocations in response to market price changes.

Balancer supports three types of pools: public pools, where anyone can add liquidity and earn trading fees; private pools, where only the creator can contribute liquidity and set parameters; and smart pools, which are private pools with adjustable parameters controlled by a smart contract. This flexibility caters to a wide range of user preferences and risk tolerances.

Furthermore, Balancer’s architecture is designed to function on Ethereum and also on six additional blockchain networks, expanding its accessibility and interoperability within DeFi ecosystems. By providing a decentralized platform for multi-asset liquidity, Balancer contributes significantly to the efficiency of the cryptocurrency market.

- Multi-token pools

- Automated rebalancing

- Interoperability

- Complex for beginners

- Limited on smaller chains

Trade features: Multi-token pools, automated portfolio rebalancing, customizable pool types (public, private, smart), wide asset variety, minimal slippage through dynamic trading fees.

Earning features: Rewards in BAL tokens, high yield from liquidity provision, participation in liquidity mining, diversified income streams through various pool types.

Security features: Regular security audits, bug bounty programs, non-custodial asset management, transparent smart contract operations.

DeFi and ecosystem engagement: Governance via BAL token, significant total value locked (TVL), interoperability across multiple blockchains, support for a variety of digital assets and wrapped tokens.

Top DeFi protocols for borrowing and lending

6. Summer.fi

Summer.fi, initially known as Oasis.app and one of the earliest MakerDAO projects from 2016, has evolved significantly beyond its original scope.

After Maker became fully decentralized, Summer.fi emerged as a standalone platform, dedicated to establishing a highly trusted application for DeFi capital deployment.

It now transcends being merely an interface for the Maker Protocol. It aims to be the most secure place for engaging with DeFi, providing users with advanced automation features like stop-loss, auto-buy, and auto-sell, as well as strategies such as Constant Multiples for optimizing Vault performance. If your Vault’s collateralization ratio hits your Sell Trigger, Constant Multiple will execute.

Summer.fi prioritizes user experience, offering clear insights into positions, returns, and associated risks, backed by a comprehensive knowledge base reflecting community feedback.

- Comprehensive DeFi services

- Advanced automation features, (stop-loss, take-profit, auto-buy, etc.)

- User-friendly interface

- Integration with multiple protocols (Aave and Maker)

- Complex for new users

- Limited to ERC-20 tokens

Borrowing features: Flexible repayment schedules, diverse collateral types, integrated with multiple protocols like Aave and Ajna, protection against market volatility through the Oracle Security Module and constant updates from Chainlink.

Multiplying features: Increase or decrease collateral exposure in one transaction, use borrowed funds to buy more collateral, integration with liquid platforms and the 1inch DEX aggregator for best execution prices, dedicated interface for managing positions.

Earning features: Self-custody solutions for yield earning, compatibility with Aave and Maker protocols, increase yield from StETH, participate in the Dai Savings Rate for passive income.

Automation features: Stop-loss to prevent liquidations, take-profit for efficient exits, auto-buy and auto-sell for Vault management, Constant Multiple to maintain predefined exposure levels.

Integration and partnerships: Support for various wallets like MetaMask and Ledger, integration with the 1inch Network for efficient token swaps, launched on Optimism layer-2 for reduced transaction costs, Ajna Protocol integration for curated borrowing and lending pools.

7. Aave

Aave (AAVE) is a pioneering entity in the DeFi sector. The comprehensive lending platform boasts a significant Total Value Locked (TVL), which surpasses $10 billion in crypto collateral.

Aave enables users to lend and borrow a wide array of tokens across multiple ecosystems, ensuring a versatile and inclusive financial experience.

The platform’s latest iteration, Aave V3, expands its reach beyond Ethereum to include 10 different blockchain networks, further solidifying its position as a key player in DeFi by enhancing accessibility and providing a range of options for its diverse user base.

- High TVL

- Wide range of tokens

- Multi-chain accessibility

- Flash loans availability

- Governance via AAVE token

- Complexity for beginners

- High gas fees on Ethereum

- Risk of liquidation

Trade features: Flash loans, real-time interest accrual, stable and variable interest rates, Ethereum network integration, multi-asset collateral support.

Earning features: aTokens for deposit interest, decentralized lending and borrowing, yield optimization strategies, liquidity mining.

Security features: Over-collateralization of loans, smart contract audits, safety module for risk mitigation, bug bounties for platform integrity.

Platform and ecosystem features: Governance via AAVE tokens, layer-2 solutions for reduced fees, decentralized autonomous organization (DAO) structure, no KYC requirements, multi-chain accessibility.

8. MakerDAO

MakerDAO is a pioneering DeFi platform that has revolutionized the way users engage with digital assets. The platform provides a decentralized borrowing and lending system with its stablecoin, DAI, at the core.

Built on the Ethereum blockchain, it allows users to leverage a variety of cryptocurrencies as collateral to generate DAI, maintaining stability through rigorous governance by MKR token holders.

The platform distinguishes itself with features like over-collateralization to ensure loan security, and a dual-rate model offering users the choice between stable and variable interest rates. However, users must navigate complexities such as liquidation risks and market volatility.

As MakerDAO evolves, it continues to solidify its status as a cornerstone of the DeFi landscape with the introduction of upgrades like V3 and the addition of the GHO stablecoin — balancing user empowerment with the intricate dynamics of decentralized finance.

- Decentralized lending

- DAI stability

- Ethereum-based

- Governance by MKR

- Over-collateralization

- Variable interest rates

- Complexity

- High gas fees

- Liquidation risks

Trade features: Flash loans, stable and variable interest rates, real-time aTokens, multi-currency collateral, governance-driven updates.

Earning features: Interest on deposits, participation in governance, yield farming opportunities, dynamic interest rates.

Security features: Over-collateralization, liquidation mechanisms, community governance for risk management, security modules for asset protection.

Platform and ecosystem features: Decentralized borrowing and lending, Ethereum-based, MKR token for governance, integration with multiple crypto assets, open-source development, Maker Vaults for asset management.

9. Compound Finance

Compound Finance is a prominent decentralized lending platform operating on the Ethereum blockchain, known for pioneering the DeFi lending space.

Established by Robert Leshner and Geoffrey Hayes in 2018, Compound simplifies the process of borrowing and lending cryptocurrencies without intermediaries, allowing over $2 billion in assets to be locked on its platform.

Unique for its innovations, such as yield farming and governance through COMP tokens, the platform aims to provide financial inclusion, eliminating traditional transaction minimums and credit checks.

While offering competitive returns through real-time interest rates, users engaging with Compound and its governance token, COMP, must be cautious of market volatility and conduct in-depth research prior to investment.

- Decentralized borrowing and lending

- No transaction minimums

- User-friendly interface

- Supports multiple ERC-20 assets

- Yield farming opportunities

- Market volatility risks

- Requires over-collateralization

- Complexity for new users

- High gas fees on Ethereum

Trade features: Real-time interest rate adjustments, supports diverse ERC-20 tokens, and a user-centric lending and borrowing system.

Earning features: Yield farming with COMP tokens, competitive APR for lenders, dynamic interest rates based on market conditions.

Security features: Extensive security audits (Trail of Bits, OpenZeppelin), economic risk analysis by Gauntlet, transparent and verifiable contracts.

DeFi and ecosystem engagement: Decentralized governance with COMP tokens, financial inclusion without traditional verifications, continuous platform innovation and updates.

Best DeFi protocols for liquid staking

10. Lido

Lido Finance is a DeFi staking protocol offering user-friendly, semi-custodial staking services across multiple cryptocurrencies. Known for its simple interface and decentralized structure, Lido allows users to stake their assets and receive liquid staking tokens, such as stETH, which can be utilized in the broader DeFi ecosystem for yield farming.

Supported by major players in DeFi and endorsed for its reasonable fees and rewarding referral program, Lido maximizes decentralization through its governance token, LDO, allowing stakeholders to partake in decision-making. While Lido streamlines the staking process, users should consider the semi-custodial nature, the staking rewards fees, and potential tax implications associated with rewards.

- User-friendly interface

- Liquid staking tokens

- Decentralized governance

- Supported by DeFi leaders

- Semi-custodial service

- Staking rewards fees

- Potential tax implications

Staking features: Easy and unrestricted staking, maximized earning potential, liquid staking tokens for yield farming.

Earning features: Daily staking rewards, assets used as collateral for lending and yield farming, participation in governance for reward optimization.

Security features: Smart contracts audited by Quantstamp and Sigma Prime, semi-custodial nature maintains user control.

DeFi and ecosystem engagement: Governance via LDO tokens, broad DeFi integration, supports multiple blockchains including Ethereum, Solana, Kusama, Polkadot, and Polygon.

Best DeFi protocol for portfolio monitoring

De.Fi provides detailed smart contract analysis to detect potential vulnerabilities and assign security scores. It offers an extensive dashboard for monitoring wallet transactions and balances, alongside powerful investment tools for analyzing and controlling positions in DeFi protocols, NFT collections, and lending markets.

Additionally, De.Fi includes specialized security features like the De.Fi Shield and Scanner for thorough contract examination. It also comes with user-friendly transaction tools such as secure crypto sending and De.Fi Swap for easy cryptocurrency exchanges across various blockchains, making it a well-rounded solution for utilizing the DeFi space safely and effectively.

- Advanced security scanning

- Comprehensive dashboard

- Real-time analytics

- User-friendly interface

- Multi-blockchain support

- Complexity for beginners

- Technical knowledge needed

- Frequent updates required

Smart contract and security features: Vulnerability scanning, smart contract security scoring, De.Fi Shield, De.Fi Scanner.

Portfolio and transaction monitoring features: Comprehensive dashboard, address book, wallet balance tracking, deposited and loaned balances overview.

Investment and exploration features: Market analysis tools, NFT portfolio management, exploration of DeFi opportunities.

Security and protection tools: Asset security assessments, approval checks, risk highlights for tokens and NFTs, customizable security settings.

Transaction and exchange features: Secure cryptocurrency sending, De.Fi Swap, slippage tolerance settings.

DeFi protocols compared

| Protocol | Type | TVL | Token | No. of blockchains supported |

| PancakeSwap | DEX | $2.224B | CAKE | 9 |

| Uniswap | DEX | $5.543B | UNI | 8 |

| Curve | DEX | $2.486B | CRV | 14 |

| Balancer | DEX | $1.242B | BAL | 8 |

| Summer.fi | DEX | $5.345b | summer.fi | 4 |

| Aave | Lending | $10.564B | AAVE | 12 |

| MakerDAO | Lending | $7B | MKR | 1 |

| Compound | Lending | $2.668B | COMP | 4 |

| dYdX | DEX | $401.81M | dYdX | 1 |

| Lido | Staking | $34.445B | LDO | 5 |

| De.Fi | Tracker and wallet | n/a | DEFI | 15 |

What are DeFi protocols?

DeFi protocols are sets of rules, procedures, and codes that govern decentralized finance (DeFi) systems, enabling users to engage in activities such as trading, lending, and staking tokens within blockchain ecosystems.

DeFi represents a paradigm shift leveraging blockchain technology, primarily Ethereum, to cultivate an open, permissionless, and borderless financial ecosystem. Unlike traditional systems, developers write smart contracts to deploy DeFi protocols that enable peer-to-peer interactions without intermediaries. By adhering to the same set of rules, DeFi protocols ensure a standardized experience for all participants.

An example of a DeFi protocol is MakerDAO. The popular DeFi lending platform allows users to borrow against their crypto assets by locking them in exchange for a stablecoin, DAI, thus offering more predictable repayment terms despite the volatility of crypto markets.

Other protocols allow you to earn a passive income by generating yield from your staked assets. One popular example is the Lido protocol, which allows you to earn on stETH. Platforms like Lido aim to offer the highest APY on crypto staking, allowing users to maximize returns on their staked assets within the Ethereum ecosystem.

The total value locked (TVL) is often used as a metric to gauge a protocol’s adoption and utility, with MakerDAO being one of the largest by TVL, highlighting its significant role in DeFi.

In 2024, new and more efficient technologies are being developed. For instance, some protocols incorporate asynchronous smart contracts, which allow transactions and agreements to be executed without needing all parties to be present or online simultaneously. This helps streamline operations within networks like Ethereum.

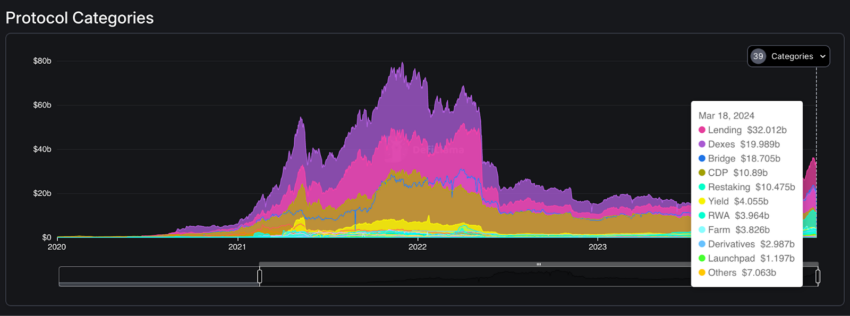

According to DeFiLlama, the top protocol categories are lending, DEXs, bridges, CDP (protocols that mint their own stablecoin using collateralized lending), and restaking.

Why do you need DeFi protocols?

DeFi allows decentralized apps (DApps) and platforms to provide services like crypto lending and crypto yield earning through staking. Users can participate in AMM (automated market maker) systems to improve liquidity.

These features offer a fertile ground for startups to innovate beyond conventional financial products, fostering rapid experimentation and potential disruption. The global accessibility facilitated by DeFi platforms makes them a significant tool for financial inclusion, allowing startups to reach a worldwide audience.

The interoperability among various DeFi protocols enhances this further, enabling seamless integration of services like web3 gaming and metaverse tokens, broadening the scope of what blockchain startups can achieve.

The total value locked (TVL) in DeFi platforms serves as a metric of trust and utility, indicating the number of cryptocurrencies staked, lent, or committed to liquidity pools, highlighting the ecosystem’s growth and stability.

By eliminating intermediaries, DeFi significantly lowers transaction costs, making it an attractive model for startups, especially in crypto lending and yield generation. Instead of being worried about your credit score, you can apply for a crypto loan with fewer restrictions than in TradFi. This reduction in costs, combined with the potential for high crypto yield through mechanisms like staking, positions DeFi as an increasingly popular option for both entrepreneurs and investors in the crypto market.

How do DeFi protocols work?

DeFi protocols function by leveraging blockchain technology. While most of them are based on Ethereum, some may also support other networks. At the heart of these services are smart contracts, self-executing contracts with the terms of the agreement directly written into code, which facilitate, verify, and enforce the negotiation or performance of a contract.

DeFi, however, requires thorough research and understanding of several factors, including security, liquidity, and the platform’s governance structure. It’s important to assess the user experience, the degree of interoperability with other DApps and blockchain systems, and the level of community involvement in decision-making processes.

1. Decentralized apps (DApps)

Users can engage with various DeFi platforms or DApps to access a wide range of financial services.

One common way to participate is through crypto lending on platforms. Protocols such as Aave or Compound allow you to deposit cryptocurrencies to earn interest. The earnings are measured as Annual Percentage Yield (APY), which is a volatile percentage that corresponds to the market’s demands.

2. Liquidity mining

Another popular DeFi activity is liquidity mining. You can provide liquidity to decentralized exchanges (DEXs) by depositing your assets into liquidity pools. This deposit is usually made for a pair of assets, such as ETH-USDT, but it can be anything else.

In return, you earn rewards, often in the platform’s native tokens. This process is critical for ensuring there is enough market liquidity for trading and is facilitated by AMMs, algorithms used by DEXs to determine the price of tokens and facilitate trades.

3. Swaps (trading)

Trading on DEXs is another key function of DeFi protocols. These platforms allow users to trade cryptocurrencies directly with others in a more private and accessible manner than on centralized exchanges.

This not only supports the decentralized ethos of blockchain but also contributes to the Total Value Locked (TVL).

Should you use DeFi protocols?

Pros

- Earn money: You can make your crypto work for you. Put your assets in DeFi platforms to earn interest or rewards.

- Trade easily: Swap cryptocurrencies directly with others. No need for a middleman.

- More control: You’re in charge of your money. No bank or institution can block your transactions.

- Open to everyone: Anyone with an internet connection can join. It’s global and inclusive.

- Transparent: Everything is recorded on the blockchain. You can see all transactions.

- New opportunities: Explore new financial services like crypto lending or web3 gaming.

Cons

- Risky: Crypto values can change fast. Your investments can shrink quickly.

- Complicated: Some DeFi stuff is hard to understand. It’s not always beginner-friendly.

- Security issues: Hacks happen. If a DeFi platform gets attacked, you might lose your money.

- No customer support: If you have a problem, there’s no customer service to call.

- Research needed: You need to do your homework before investing. Not all platforms are safe.

- High fees: Sometimes, you’ll pay a lot to make transactions, especially when the network is busy.

Could DeFi replace traditional finance?

Decentralized finance has the potential to usurp traditional institutions, specifically TradFi. Decentralized finance enables users to transact securely, anonymously, and efficiently and is thus likely to gain popularity as web3 and crypto adoption grows. From crypto lending to staking to market makers, DeFi is exciting but also risky.

Do not interact with any DeFi protocols until you have developed a solid plan and are entirely comfortable with the mechanisms of the platform. Always be aware of the potential for losses, and never invest more than you can afford to lose.

Frequently asked questions

What is the most popular DeFi protocol?

What are the top five DeFi tokens?

What is TVL in DeFi protocols?

How many DeFi protocols are there?

How many DeFi protocols are there?

Is TVL a good metric?

What is a good FDV TVL ratio?

What is the TVL formula?

How to calculate FDV?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.