Those who like to trade may be interested in GMX, a spot and perpetuals trading-focused decentralized exchange (DEX). But what should you know about the DEX and its native crypto, GMX? This guide explores one of the more recent additions to the decentralized sector.

KEY TAKEAWAYS

➤ To buy GMX, choose an exchange, select GMX, choose a payment method and complete your transaction.

➤ You can buy GMX on exchanges like Binance, OKX, Kraken, KuCoin, and Huobi Global.

➤ GMX is a spot and derivatives decentralized exchange, built on Arbitrum and Avalanche.

➤ While it is ideal for low fees and profit sharing, it has a limited selection of assets and its fees are higher than competitors.

How to buy GMX

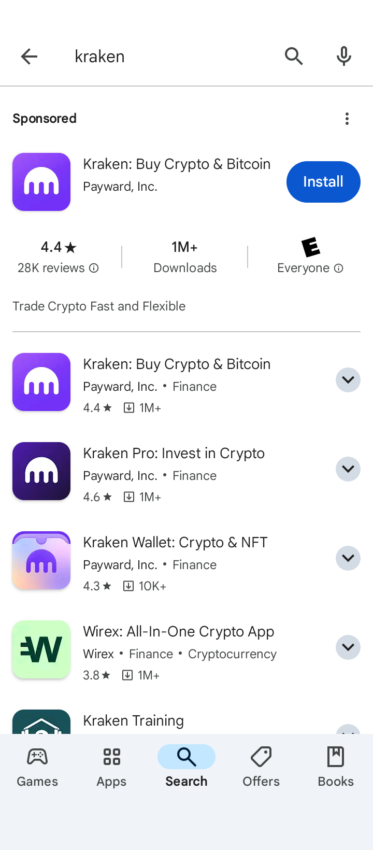

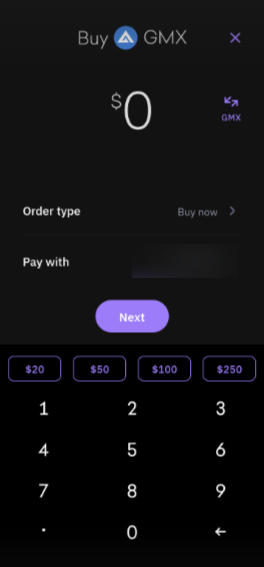

There are a few exchanges where you can buy GMX. For the purpose of this demonstration, we will use the Kraken app.

In short, to buy GMX (on mobile) you must:

- Install your chosen GMX supporting app, in this case, Kraken.

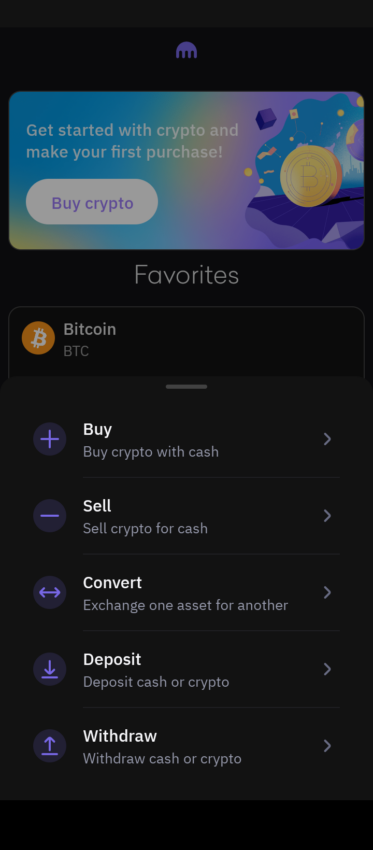

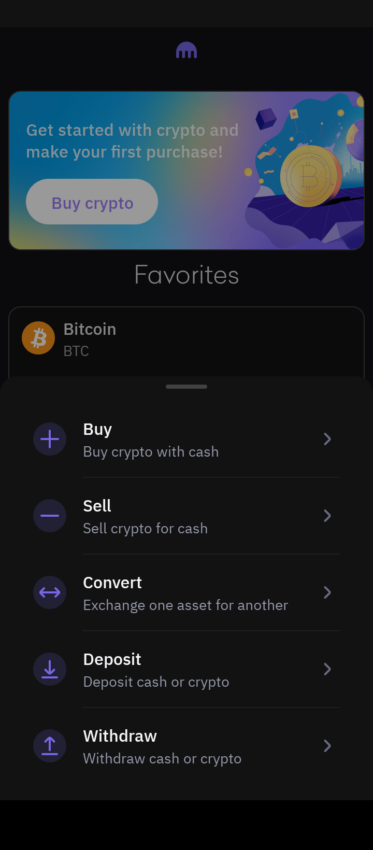

- Open the app and press the purple button exchange button (Kraken specific) shown at the bottom of the screen.

- Select “Buy”, then choose GMX.

- Enter the amount of GMX you plan to buy.

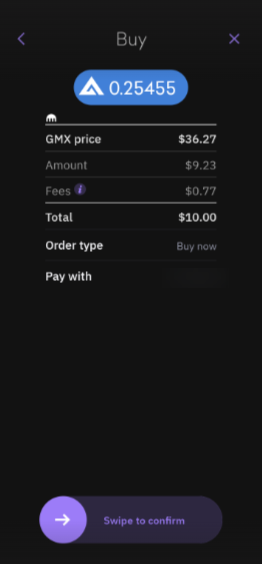

- Swipe to confirm.

Here’s a closer look at this process in a little more detail.

1. Go to the app store on your mobile phone, search for Kraken, and press install.

3. Secondly, select “Buy” and choose GMX.

4. Select the amount that you would like to purchase.

5. Swipe the slider at the bottom to complete your purchase.

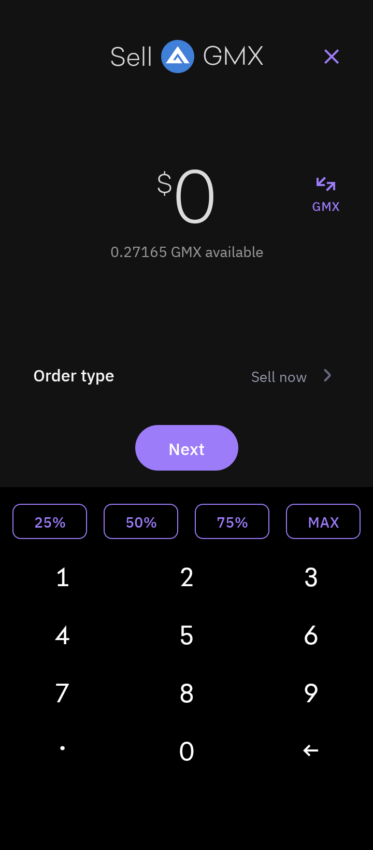

How to sell GMX

Selling GMX via the Kraken app is equally straightforward.

You must:

- Open Kraken and select the purple exchange button.

- Click Sell, and choose GMX.

- Enter the amount of GMX you want to sell

- Confirm via the swipe mechanism.

Here’s a look at the process in more detail, with screenshots demonstrating each stage.

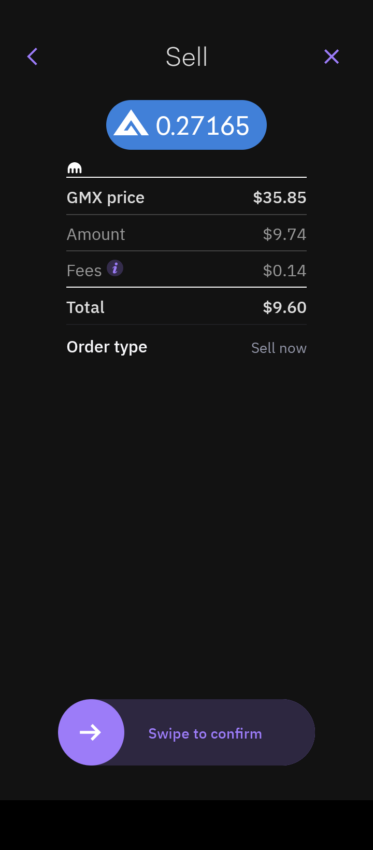

2. Select “Sell” and choose GMX.

3. Enter the amount that you would like to sell.

4. Lastly, swipe the slider at the bottom of the screen to confirm.

How to buy GMX with a credit card

Those looking to buy GMX with a credit card must follow a process similar to purchasing other cryptocurrencies. Here are the general steps:

- Find a crypto exchange supporting GMX: First, you must identify a cryptocurrency exchange that lists GMX and accepts credit card payments. Not all exchanges may support GMX, so you’ll need to do a bit of research. Popular exchanges like Binance, Coinbase, or Kraken might be good places to start.

- Create an account on the exchange: Once you’ve found an exchange that meets your needs, sign up for an account. This process typically involves providing some personal information and email verification.

- Complete identity verification: Most exchanges require users to verify their identity to comply with regulatory requirements. This step usually involves uploading documents like a government-issued ID or a passport.

- Add your credit card as a payment method: Link your credit card to your account on the exchange. You’ll likely need to enter your card details and confirm a small transaction for verification purposes.

- Deposit funds using your credit card: You can deposit funds into your exchange account with your card linked. Be mindful of potential fees and interest rates associated with credit card transactions.

- Purchase GMX: Navigate to the trading section of the exchange, select GMX as the cryptocurrency you wish to buy, enter the amount, and complete the purchase.

- Transfer GMX to a secure wallet (optional): For enhanced security, especially if you plan to hold your GMX for an extended period, consider transferring your tokens to a private wallet that you control.

Always remember investing in cryptocurrencies can be risky, so it’s essential to do your own research (DYOR) and understand the risks involved. Additionally, consider the fees and interest charges that may apply when using a credit card for such transactions.

Where to buy GMX

GMX is a popular cryptocurrency, but where can you buy it? Here’s a list of a few exchanges that allow you to purchase GMX:

1. Binance

Trading GMX on Binance was characterized by the platform’s strong liquidity, facilitating swift and effective trade execution. Binance’s breadth of trading options, including futures and options for GMX, allowed us to explore various investment approaches. We found the platform’s advanced charting and analytical tools particularly useful in making our trading decisions.

2. OKX

OKX provided a comprehensive trading experience for GMX, offering a diverse array of trading options tailored to suit a wide range of investment strategies. The platform’s liquidity ensured our GMX trades were executed efficiently, a critical factor in responsive trading. We liked OKX’s balance of sophisticated features with a user-friendly interface, catering well to both newbies and experienced traders. Their mobile app is also pretty handy, enabling effective portfolio management and trading while on the go.

3. Kraken

Trading GMX on Kraken proved a secure and comprehensive experience. The platform’s wide range of order types allowed us to tailor our trading strategies precisely for GMX. Kraken’s emphasis on security and regulatory compliance instilled confidence in the safety of our transactions. The platform’s detailed analytics tools were also instrumental in tracking our GMX investment performance and planning future trades.

4. Huobi Global

Our experience with GMX on Huobi Global was marked by the platform’s wide selection of trading pairs and advanced trading tools. The platform’s liquidity pools facilitated the rapid execution of GMX trades, which was crucial for capitalizing on market opportunities. Huobi Global’s interface, combining advanced functionality with ease of use, was well-suited for our diverse trading requirements.

5. *KuCoin

Buying GMX on KuCoin is simple thanks to its user-friendly interface. KuCoin’s staking options were also a valuable aspect, offering an alternative way to benefit from your GMX holdings.

*In 2024, KuCoin is facing charges from the Department of Justice following allegations that the platform knowingly flouted AML rules in the U.S. The company’s legal woes have dramatically dropped its market share, with many concerned users withdrawing funds from the platform. For a detailed overview of the current situation, please check our explanation of KuCoin’s legal status. If you are considering alternatives to KuCoin, explore our recommended exchanges here.

Platforms to buy GMX compared

| Platform | Availability | Cryptos | Trading fees | Bonuses |

|---|---|---|---|---|

| Binance | 100+ | 350+ | 0.00% and 0.01% | Up to $600 |

| OKX | 100+ | 300+ | 0.080% (maker) and 0.100% (taker) | $100 |

| Kraken | 100+ | 200+ | 0,26% | No bonus |

| Huobi Global | 180+ | 600+ | 0.20% | Up to 700 USDT |

| *KuCoin | 100+ | 700+ | 0.1% | Up to 700 USDT |

All of these platforms are solid choices if you’re looking to buy GMX on a centralized exchange. All have a good reputation for security, intuitive interfaces, and various trading tools available for more advanced users. If you fancy buying GMX anonymously or simply via a decentralized exchange, you can choose the GMX DEX itself.

What is GMX?

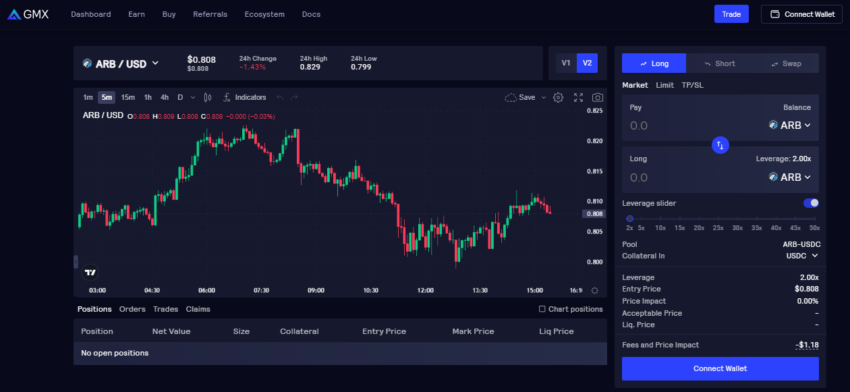

GMX is a derivatives market built on the Ethereum layer-2, Arbitrum. The exchange allows you to spot trade and trade perpetuals. It was launched in September 2021.

GMX was initially called Gambit Financial and existed on the BNB chain. The project rebranded, merged four tokens into GMX, and relaunched on Arbitrum.

There is not much information on the creators of GMX; however, Krunal Amin (UniDex founder) and Benjamin Simon (Stealth Crypto co-founder) have access to a multi-sig connected to GMX.

The platform extends beyond just trading; users can earn rewards in two significant ways. Firstly, by contributing liquidity to the exchange’s pools, and secondly, by staking GMX crypto. These features allow users to engage actively with the platform’s ecosystem, enhancing its utility and incentivizing broader participation and investment.

How does GMX work?

GMX operates a multi-asset liquidity pool known as the GLP pool, which supports the trading of perpetual contracts on the platform.

Liquidity providers (LPs) add liquidity to this pool by locking in various assets. In return, they receive GLP tokens representing their share in the pool. When traders engage in leveraged trading using perpetual contracts, platform fees are generated.

Most of these fees (70%) go to the LPs. The GMX exchange also employs mechanisms to adjust fees and token weights to ensure stability and protection for those holding GLP tokens.

Why is GMX popular?

GMX is popular in part as it was one of few exchanges that offered derivatives trading when similar platforms were far and few between.

Moreover, it launched on Arbitrum — allowing it to offer low fees — at the time, rollups were gaining a lot of attention.

GMX crypto vs. other cryptocurrencies

The GMX crypto has a market cap of $250 million, which ranks it 219th among the top cryptocurrencies by market cap. While this may seemingly be a low number, it is important to note that most cryptocurrencies do not reach this high a market cap.

GMX vs. dYdX: An ultimate comparison

| Feature | GMX | dYdX |

|---|---|---|

| Token | GMX | DYDX |

| Fees | 0.1% | 0.02% and 0.05% |

| Blockchain | Arbitrum and Avalanche | StarkWare |

| Liquidity model | Liquidity pool | Order book |

The two popular exchanges, GMX and dYdX, are often mentioned in the same conversation. Here is a brief comparison of the two. Both are decentralized exchanges on Ethereum layer-2s. GMX resides on Arbitrum and Avalanche, while dYdX exists on StarkWare.

They are both decentralized exchanges but take a different approach to handling orders. While GMX utilizes the liquidity pool, while dYdX uses an order book model.

Additionally, the GMX token has a much higher spot price than the DYDX token. Finally, dYdX has lower fees than GMX. That includes both gas fees and trading fees. GMX takes 0.1% trading fees, and dYdX has 0.02% taker and 0.05% maker fees.

GMX ecosystem

Unlike many cryptocurrencies with their own native token, GMX does not have its own blockchain. Therefore, it does not have an ecosystem like Ethereum, Avalanche, or Arbitrum.

GMX wallet choices

As GMX exists on Arbitrum, there are many EVM-compatible crypto wallets that can accommodate GMX. Here are a few of the best GMX wallets.

- MetaMask: A highly popular EVM-compatible wallet, MetaMask offers an easy-to-use interface for storing and managing GMX crypto on Arbitrum.

- OKX wallet: Known for its robust security and user-friendly design, this wallet is another excellent option for managing GMX on the Arbitrum network.

- Ledger: As a hardware wallet, Ledger provides an added layer of security for GMX, making it a solid choice for those prioritizing asset safety.

- Trezor: Another secure hardware wallet that supports GMX on Arbitrum and is ideal for users seeking offline storage and protection for their digital assets.

GMX staking

GMX staking allows users to lock up their GMX tokens in return for rewards. By staking GMX, users can earn in the form of multiplier points (MPs), escrowed GMX, and ETH or AVAX.

Participants earn MPs at a specified rate (100% APR), which can enhance their rewards from the platform’s trading fees in ETH or AVAX. Additionally, stakers receive a portion (30%) of the platform’s fees generated from swapping and leveraged trading.

GMX: Should you buy into the hype?

Having understood how to buy, sell, and grasp the workings of GMX, you might wonder if it’s a worthy investment. Let’s delve into some factors to consider before investing in GMX:

| Pros | Cons |

|---|---|

| Low fees | Higher fees than competitors |

| Spot and leverage trading | Limited asset selection |

| Profit sharing |

Crypto derivatives have a long way to go

Capitalizing on Arbitrum’s buzz, GMX has set a benchmark for future derivative exchanges. GMX stands is a top choice for crypto enthusiasts, but the overall field of crypto derivatives is still expanding and growing within the web3 sector. If you decide to buy GMX, prioritize security at every stage. Ensure you have a solid investment or trading strategy and only invest what you can afford to lose.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.

Frequently asked questions

What is GMX?

How do I buy GMX crypto?

Is GMX available on Kraken?

Can I buy GMX on Coinbase?

Is GMX available on Kraken?

Is GMX crypto legit?

Who created GMX crypto?

Why use GMX crypto?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.