GMX and dYdX are among the two most popular decentralized exchanges (DEXs), allowing traders to crypto with leverage. This article compares GMX vs. dYdX, judging them according to various criteria, including features, functionalities, and fees. Read on to find out which platform suits your needs best.

BeInCrypto Trading Community in Telegram: read reviews on the best crypto exchanges, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

Introducing GMX

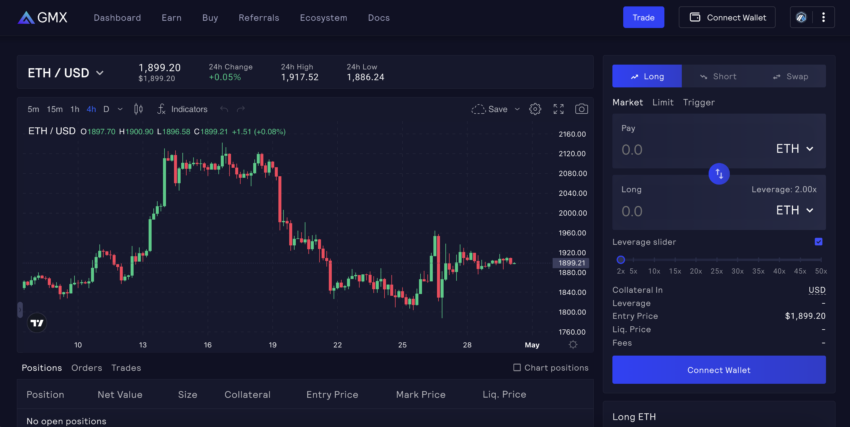

GMX is a decentralized exchange that allows users to trade spot and perpetual contracts with up to 50x leverage. The platform operates on Arbitrum and Avalanche, offering a seamless trading experience with low swapping fees and (presumably) zero price impact trades.

Additionally, GMX is unique in its liquidity model since the exchange employs a GLP liquidity pool instead of the traditional order book or default AMM model. Instead, it operates with a multi-asset liquidity model. This allows users to directly purchase and stake the liquidity token GLP issued by the GMX Protocol and thus participate in market making. To establish prices, the platform utilizes Chainlink oracles and price feeds from large CEXs. As a result, it claims to offer zero-price impact trades.

With the upcoming launch of GMX V2, the platform will introduce a new liquidity structure, more trading pairs, new asset classes, and lower fees. Despite the broader crypto bear market, GMX has experienced impressive growth and is expected to accelerate even further.

Introducing dYdX

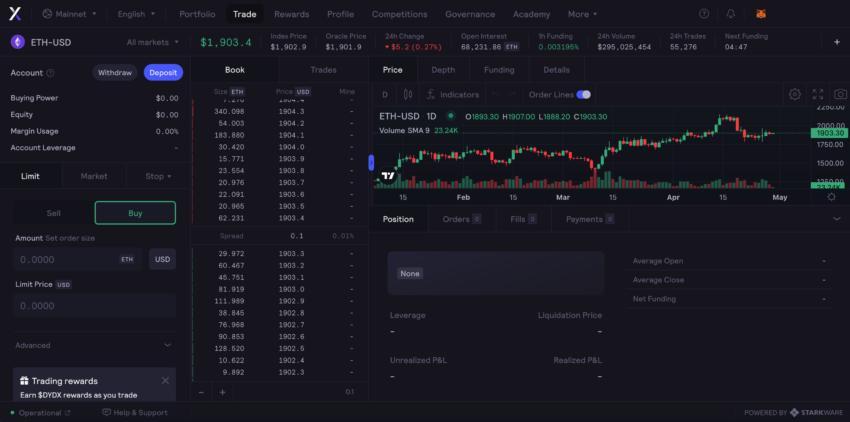

dYdX is a decentralized exchange originally built on the Ethereum blockchain that allows traders to trade perpetual contracts with up to 20x leverage. It currently still uses a layer-2 solution to facilitate efficient cryptocurrency trading with reduced gas costs for users.

More precisely, dYdX’s V3 utilizes StarkWare’s StarkEx as its layer-2 scaling solution and receives price feeds through Chainlink’s Oracle network. dYdX has a user-friendly interface, low fees, and efficient transaction processing. However, the exchange plans to migrate the protocol to a standalone Cosmos-based blockchain with its V4 upgrade, which is poised to happen later this year.

This new public chain uses the Cosmos SDK and Tendermint proof-of-stake consensus protocol. It will be open to the Cosmos ecosystem, an interconnected system of application-specific blockchains. Through this upgrade and the transition to Cosmos, the dYdX exchange intends to be able to offer its various products, such as margin trading, spot trading, and lending, for a fraction of the current costs.

Trading fees

dYdX and GMX have different fee structures for trading on their platforms.

GMX charges network execution fees and trading fees when opening or closing a position. The trading fees are fixed at 0.1%. In addition, the trading platform charges a variable borrowing fee, which is deducted from the deposit every hour. Users also pay swap fees, which are set at 0.33%. Furthermore, GMX charges additional fees for actions such as setting a trigger or staking GMX.

It is worth noting that gas fees are relatively low on GMX because it uses Arbitrum or Avalanche instead of directly being deployed on Ethereum’s base layer blockchain. Nonetheless, there are various fees on the trading platform, and traders need to be aware of them when deciding to use the platform.

In comparison, dYdX charges traders with monthly trading volumes under $100,000 per month zero trading fees. For traders who trade more than $100,000 on the platform, dYdX utilizes a volume-weighted maker-taker fee model to raise its trading fees. Maker orders add liquidity to the order book, while taker orders remove liquidity. The volume-weighted maker-taker fee schedule is based on a 30-day volume, with six levels ranging from free to VIP, as shown below.

| Level | | From (30D Volume in USD) | | To (30D Volume in USD) | | Maker | | Taker |

| Free | $0 | $100,000 | 0.000% | 0.000% |

| 1 | $100,000 | $1,000,000 | 0.020% | 0.050% |

| 2 | $1,000,000 | $5,000,000 | 0.015% | 0.040% |

| 3 | $5,000,000 | $10,000,000 | 0.010% | 0.035% |

| 4 | $10,000,000 | $50,000,000 | 0.005% | 0.030% |

| 5 | $50,000,000 | $200,000,000 | 0% | 0.025% |

| VIP | $200M+ | – | 0% | 0.020% |

Furthermore, dYdX does not charge any deposit or withdrawal fees. However, users must pay network fees, which vary depending on the network pressure. The platform also charges a variable borrowing interest rate which is paid directly to lenders.

Margin trading

Next, let’s see how margin trading in GMX vs. dYdX compares:

GMX offers leverage trading services and provides an opportunity to trade perpetual contracts with up to 50x leverage on a handful of cryptocurrencies, including BTC, ETH, AVAX, UNI, and LINK trades.

Contrarily, dYdX provides an opportunity to trade perpetual contracts with up to 20x leverage. There is a wide range of supported leveraged pairs available on the platform, including BTC/USDT, BTC/USDC, ETH/BTC, ETH/USDC, ETH/DAI, DAI/USDC, AGLD/USDT, DYDX/USDT, SHIB/USDC, DOGE/USDC, and many more compared to GMX.

Derivatives trading

Both GMX and dYdX enable traders to speculate on the price of crypto assets using perpetual futures contracts. However, GMX provides traders with up to 50x leverage, while dYdX only provides up to 20x leverage.

Perpetual futures contracts (perps) are a type of derivative instrument used in trading that does not have an expiration date, allowing crypto traders to hold positions indefinitely. They are settled daily based on the difference between the contract price and the price of the underlying crypto asset.

The dYdX founder recently tweeted his belief about the bright future of DeFi perps, partly in response to the news that Coinbase will launch Coinbase International Exchange and offer BTC and ETH perpetual futures settled in USDC with up to 5% leverage.

“One year from now, DeFi perps will have the fastest and most widespread market listings in all of crypto.”

Antonio Juliano: Twitter

Governance token

GMX and dYdX both have governance tokens.

The GMX protocol has two native tokens: GMX and GLP. GMX is the utility and governance token, while GLP represents the index of assets used in the protocol’s multi-asset trading pool.

The GMX token has a maximum supply of 13.25 million, with 8.67 million circulating as of early May 2023. GMX token holders can use their tokens to vote on proposals to help decide the exchange’s future direction.

Furthermore, token holders can stake their GMX tokens to get three types of rewards:

- 30% of all generated protocol fees are distributed to GMX stakers.

- Stakers earn escrowed GMX tokens (esGMX), which can be staked for further rewards as well or vested.

- Stakers earn “Multiplier Points” that boost their yield and reward long-term holders.

The dYdX token is the governance token of the dYdX protocol, built on the Ethereum blockchain as an ERC-20 token. It was designed to incentivize users to contribute to the development of the dYdX protocol and provide users with a voice in dYdX’s governance.

The maximum supply of dYdX tokens is 1 billion, which will be released over five years. Holders of dYdX tokens have a say in the development of the platform, and they can also stake their tokens to claim a portion of the rewards generated by the platform. The circulating supply of dYdX is more than 150 million as of early May 2023.

Cross-chain support

What’s the cross-chain support between GMX and dYdX?

The GMX exchange is available on two blockchain networks, Arbitrum and Avalanche. GMX runs on these blockchains to provide users with low fees, instant liquidity, and a secure environment for trading digital assets.

Arbitrum is an Ethereum layer-2 rollup, a solution designed to boost the speed and scalability of Ethereum smart contracts. On the other hand, Avalanche is a layer-1 blockchain with its own EVM architecture and 3-chain structure. It is one of the largest L1 networks.

Comparatively, dYdX is built on a second-layer solution as well. It leverages StarkWare’s StarkEx layer-2 solution to facilitate efficient cryptocurrency trading with reduced gas costs for users.

dYdX is actively working on its next version, V4, which aims to be a completely decentralized standalone blockchain on the Cosmos Network and controlled by the community. While this version is currently dYdX’s top priority, it remains to be seen how it will fare in terms of cross-chain support compared to GMX’s approach. As it stands, the current version does not offer the same level of cross-chain support as GMX.

Trading volume

Trading volume is an important metric in the world of decentralized exchanges. It indicates the level of activity and liquidity present on the platform. So, how does GMX compare to dYdX in this respect?

GMX’s trading volume has been on an upward trend. The exchange is currently recording a 24-hour trading volume of $21,397,998, with an annualized trading volume of $129.18 billion. This represents an increase of 33% in the past year.

dYdX has a higher trading volume, with a 24-hour trading volume of $85,831,296 and an annualized trading volume of $389.76 billion. However, it is important to note that dYdX’s trading volumes have been shrinking, with a 5.59% decrease in annualized trading volume.

Insurance fund

dYdX and GMX have different approaches to protecting traders from losses due to market volatility.

GMX offers a Floor Price Fund, which helps to protect traders from sharp market moves by providing insurance for losses that might happen due to sudden price drops. This fund is used to:

- Ensure that the GLP pool has sufficient liquidity.

- Provide a reliable stream of ETH rewards for staked GMX.

- Maintain a minimum price of GMX against ETH.

The fund grows thanks to fees accrued through the GMX/ETH liquidity pair and support established through OlympusDAO bonds.

dYdX has an insurance fund that serves as the first backstop to maintain the system’s solvency. The insurance fund is funded by 5% of all interest payments from borrowers. However, it is worth noting that the dYdX insurance fund is not decentralized, and the dYdX team is directly responsible for deposits to and withdrawals from the fund.

If the insurance fund is depleted, dYdX has a mechanism called “deleveraging” that requires profitable traders to contribute part of their profits to offset underwater accounts. This mechanism is used as a last resort to close underwater positions and maintain the system’s stability.

GMX vs. dYdX: Which DEX is better?

So, is it better to trade on GMX or dYdX? Let’s try to find out.

Trading fees

For traders with 30-day volumes of less than $100,000, there are no trading fees on dYdX. For traders who trade more than that, dYdX has a more complex trading fee structure with volume-based maker-taker fees and variable borrowing interest rates. However, it does not charge deposit or withdrawal fees.

Alternatively, GMX has fixed trading fees of 0.1% but charges additional fees for actions such as setting a trigger or staking GMX.

Supported cryptos

Regarding supported cryptocurrencies, dYdX has an extensive list of over 35 cryptos available for trading, including popular perpetual trading pairs such as ethereum, bitcoin, solana, polygon, avalanche, and uniswap.

Conversely, GMX supports a handful of cryptocurrencies on the Arbitrum and Avalanche networks, including ETH, WETH, WBTC, LINK, UNI, USDC, USDT, DAI, FRAX, AVAX, WAVAX, ESDC.e, and BTC.b. Also, note that GMX allows multiple assets to be used as collateral, whereas dYdX only allows USDC.

In terms of supported cryptocurrencies, dYdX is the clear winner.

Liquidity

In terms of liquidity, GMX might be in a stronger position than dYdX. First of all, although dYdX may have a higher trading volume, GMX has been experiencing an upward trend in its trading volumes. This indicates a growing level of activity and liquidity on the platform. At the same time, dYdX’s annualized trading volume has been in decline.

Additionally, GMX’s multi-asset GLP pool has a higher total value locked (TVL) of over $558 million and a larger market capitalization of $628 million.

In contrast, dYdX has seen a consistent decline in its TVL over the past year, and at the time of writing, it stands at $341 million, with a market capitalization of $430 million. While dYdX’s hybrid approach may enable it to provide good liquidity, it’s decreasing TVL suggests it may struggle to attract liquidity providers.

User interface

When it comes to individual user interfaces, GMX and dYdX offer different experiences for traders.

GMX’s interface is user-friendly, providing traders with an abundance of information regarding their assets, trading volumes, and fees. The system is relatively simple and standard, enabling a smooth trading experience that is easy to navigate. Traders can quickly find the collateral size, leverage amount, entry price, liquidation price, fees, available liquidity, slippage, spread, and profits and losses.

Thanks to its detailed dashboards, GMX gives off an impression of transparency, making it easy for traders to understand the protocol’s mechanisms.

On the other hand, dYdX’s trading interface is more professional, offering an interactive web interface and a mobile application for iOS devices. The exchange also integrates features and strategies from TradingView into a dYdX trading account, making it easier and more efficient for traders to implement their trading strategies. Overall, dYdX’s platform is relatively easy to use, giving traders a professional trading experience.

Open-source

Both GMX and dYdX are open-source projects, working in line with the free, open-source software (FOSS) ethos of web3.

Decentralization

GMX and dYdX are both decentralized trading platforms. However, the level of decentralization varies between the two. dYdX is currently a hybrid decentralized exchange, meaning that some components of the platform are still centralized. However, with the upcoming release of V4, dYdX aims to become fully decentralized, with no central points of control or failure. The primary aspect of this move is decentralizing the order book and matching engine.

On the other hand, GMX Exchange claims to operate as a fully decentralized perpetual exchange, utilizing the Arbitrum L2 solution and Avalanche blockchain. GMX is designed to be a trustless, transparent, and decentralized exchange.

Therefore, GMX is more decentralized than dYdX.

Gas fees

In terms of gas fees, GMX runs on top of Arbitrum and Avalanche, which offer low gas fees. dYdX operates on StarkEx, which, similarly to Arrbitrum, also offers low gas fees as a layer-2 protocol on top of Ethereum.

GMX and dYdX: features & functionalities compared

| Feature | GMX | dYdX |

| Blockchain network | Arbitrum (Ethereum L2 solution) Avalanche | StarkEx (Ethereum L2 solution) |

| Gas fees | Network execution fees | No gas fees |

| Trading fees | 0.1% of position size when opening and closing a position. | Tiered trading fee structure: 0% taker and maker fees for trading volumes below $100,000. 0.02% taker fees and 0.05% maker fees for trading volumes between $100,000-1,000,000. Tier-based fee deductions after $1,000,000. |

| Amount of leverage | Up to 50x | Up to 20x |

| Governance token | GMX Token | DYDX Token |

| Liquidity token | GLP Token | None |

| Trading volume (24H) | $21,397,998 | $85,831,296 |

| Insurance fund | Yes | Yes |

| Level of decentralization | Fully decentralized | Partially decentralized |

GMX and dYdX are titans of the on-chain perpetual exchange sector

GMX and dYdX compete in the on-chain perpetual exchange sector, with each platform having strengths and challenges. For instance, while GMX has limitations such as constrained asset selection and a sub-optimal UX, dYdX still has a higher volume and a more professional UX.

In the same breath, dYdX’s TVL has been on the decline, losing almost 6% of its value between 2022 and 2023, while GMX’s has seen a significant rise of 33% in the same period. In all, user preferences and priorities will determine your choice when considering GMX and dYdX.

Frequently asked questions

What is a decentralized exchange?

What is the difference between GMX and dYdX?

Is GMX crypto legit?

What are perpetual futures?

What is a governance token?

What is derivatives trading?

What is layer-2 scaling?

What is a cryptocurrency options contract?

How does an insurance fund work in a decentralized exchange?

Is GMX safe?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.