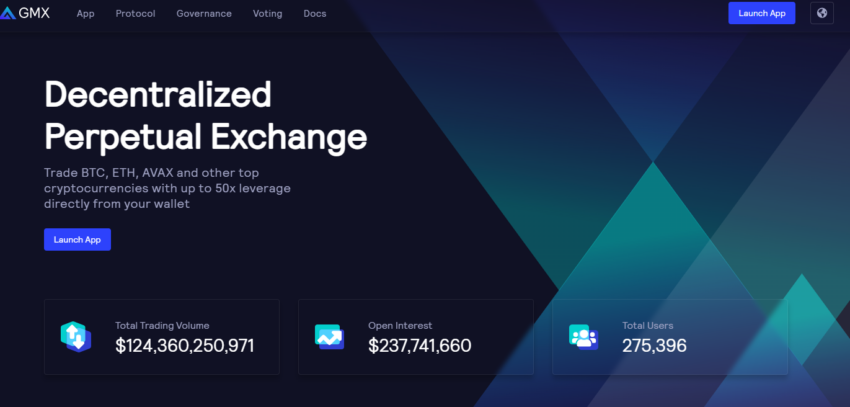

Crypto traders have a wide range of decentralized exchanges to choose from, whether they want to trade spots or derivatives. GMX is one of the more recent additions to the DEX landscape. But does GMX stand apart from the rest? This guide covers everything you need to know about this spot and perpetuals trading-focused decentralized exchange and its native GMX crypto.

BeInCrypto Trading Community in Telegram: read reviews on the best crypto projects, get technical analysis on coins & answers to all your questions from PRO traders & experts!

What is GMX?

Origin

GMX is a decentralized exchange (DEX) focused on spot and perpetual trading. It launched on Arbitrum, an Ethereum layer-2 network, in September 2021. Before migrating to Arbitrum, GMX went by the name Gambit Financial.

Gambit was a DEX on the BNB Smart Chain, previously Binance Smart Chain. The project merged the four tokens it had at the time into GMX to minimize complexity and then went on to launch on Arbitrum. These four tokens were XVIX, GMT, XLGE, and xGMT. The project made it possible to swap these assets at a rate of 2 USD for 1 GMX. The GMX crypto is now the exchange’s utility and governance token.

In January 2022, GMX expanded its supporting underlying blockchains to include Avalanche, an EVM-compatible smart contract chain for decentralized applications (DApps). According to data on DefiLlama at the time of writing, the total value locked (TVL) on GMX, inclusive of staked assets, is $1.16 billion. Arbitrum contributes $1.03 billion to this TVL, while Avalanche’s contributes only $125.99 million.

Team

GMX hasn’t offered clear information as to who its founders are. However, two of the people that can sign a multisig wallet connected to GMX are Krunal Amin, the founder of UniDex, and Benjamin Simon, the co-founder of Stealth Crypto. Also, one of the project’s developers is someone using the pseudonym X on Twitter.

GMX has a governing community of 63,000 members as of this writing. People that hold the GMX token can vote for or against project proposals.

Funding

GMX hasn’t revealed much information on its funding rounds either. Nonetheless, an article on its Medium page indicates that the development treasury has about 1.8 million held in USDC to sustain the team until March 2024. Furthermore, Gambit raised funds through a token sale. These funds may have been migrated to GMX when the project was rebranded.

Some companies have invested in the protocol by holding significant positions in GMX crypto. For instance, Blocktower has purchased GMX worth more than 2,400 ETH and has staked 336,478 GMX. Flood Capital is also a top holder of GMX, although the exact holdings aren’t publicly known. GMX’s most prominent individual holder is Arthur Hayes, founder and former CEO of BitMEX. He is said to own over 200,000 GMX.

Roadmap

According to the last roadmap update published in May 2022, GMX’s to-do list consisted of increasing platform security and monitoring and introducing support for synthetic markets to improve user experience. Moreover, the exchange is considering deploying on new chains such as Coinbase’s Base, an Ethereum layer-2 network.

Another plan on GMX’s roadmap is creating a new automated market maker that gives projects and pool creators full control over a pool’s functions. This improvement will allow creators to customize functions like adding and removing liquidity and setting flexible fees.

How does GMX work?

GMX is a decentralized exchange where people can trade assets on-chain by simply connecting their wallets. Users can also earn rewards by providing liquidity to the exchange or by staking the GMX crypto.

Here are the various components that make up the exchange:

The pool & liquidity providers

A multi-asset pool facilitates trading on the GMX exchange. It comprises an index of assets that traders use to swap and trade perpetual contracts using leverage. A perpetual contract is a type of financial derivative that is an agreement without expiry dates that expose traders to the underlying asset without owning it. At the time of writing, index assets included USDC, BTC, ETH, LINK, FRAX, DAI, and USDT. This multi-asset pool, also referred to as the GLP pool, is community-owned.

Liquidity providers (LPs) are in charge of adding liquidity to the GLP pool. They do this by locking any of the index assets in the pool. The protocol then mints the GLP token representing the liquidity provider’s stake. Next, the protocol automatically stakes the newly minted GLP tokens.

LPs earn 70% of platform fees and rewards (see below) in the form of escrowed GMX (esGMX). The exchange pays platform fees in ETH on Arbitrum and AVAX on Avalanche. Platform fees originate from GMX users swapping and conducting leverage trading. LPs can withdraw their locked assets, triggering a burning mechanism, where the staked GLP tokens are permanently removed from circulation while the corresponding amount of GMX is unlocked.

The GMX exchange features a rebalancing mechanism determining the fees for swapping, minting, and burning GLP. Additionally, it adjusts token weights to protect GLP holders depending on traders’ positions.

GMX staking

Users can stake GMX tokens to earn rewards. Stakers receive three types of rewards namely: multiplier points, escrowed GMX, and rewards in ETH or AVAX (coming from the platform’s trading fees), depending on the chain.

Long-term GMX stakers receive multiplier points (MPs) at a rate of 100% APR. For instance, 1,000 GMX staked for a year can earn you 1,000 MPS. Additionally, stakers can compound their MPs to boost their ETH or AVAX rewards. The protocol rewards stakers 30% of the platform fees originating from swapping and leverage trading.

Traders

Traders on GMX enjoy low swapping fees and can enter and exit trade positions with minimal spread. The spread is the difference between an asset’s bid and ask prices. Also, traders benefit from zero price impacts, which means they can make large trades precisely at the market price.

In leverage trading (borrowing funds to boost your trading position), the fee to open or close a position is 0.1% of the position size. The exchange also charges leverage traders a borrowing fee, which it deducts at the beginning of each hour. GMX calculates borrowing fees as follows:

Borrowing fees = assets borrowed / total assets in the pool * 0.01%.

There’s also an execution fee. This is the cost traders pay to the blockchain network for keepers to execute their trades. The role of keepers is to calculate prices using the median price of Coinbase, Binance, and Bitfinex and submit them for swaps and leverage trades on GMX. Watcher nodes verify these prices to ensure they’ve not been tampered with. The exchange also pulls prices from Chainlink’s oracles. Liquidation fees are another type of cost that traders pay. They pay these fees to keepers when they want to liquidate their positions.

The floor price fund

The exchange’s governance token, GMX, has a floor price fund in GLP and ETH. It exists to ensure that the pool remains liquid. Moreover, it offers a reliable flow of ether for staked GMX tokens.

The fund receives money from users’ fees to trade the GMX/ETH pair. The protocol then converts the fees to GLP and deposits them into the fund. Also, 50% of Olympus bond funds go to the floor price fund. GMX has collaborated with Olympus to sell GMX WETH bonds. As of this writing, the value of the floor price fund is $3,266,295.

What is GLP?

GLP is the liquidity provider (LP) token of GMX and the index of a basket of assets. It represents the amount of liquidity an LP has deposited into the pool. The index assets in the GLP pool determine the value of GLP.

GLP tokens are minted when LPs deposit assets into the pool and burned when LPs redeem their deposited assets. LPs earn rewards in return for providing the pool with liquidity. Holders of GLP provide liquidity to leverage traders where they profit when traders make a loss and lose when traders make a profit.

Users cannot transfer GLP from Avalanche to Arbitrum and vice versa. At the time of writing, the price of GLP was $0.976, and its total supply was 512,451,855. Its market capitalization was $500,548,472.

Benefits and risks of using GMX

Benefits

- GMX aims to reduce impermanent loss for its liquidity providers.

- GMX aggregates prices from the leading exchanges by trading volumes. This prevents liquidity risks from temporary wicks.

- Users can interact with the exchange via a self-custodial wallet.

- The swapping interface is easy to use.

- GMX aims to offer zero price impacts.

- Users can earn a passive income through staking or liquidity provision.

- ABDK Consulting has audited GMX contracts, reducing smart contract risk.

- Traders can access up to 50x leverage.

Risks

- The GLP pool is the counterparty to traders, meaning traders could deplete it if they are too profitable.

- Users are vulnerable to security risks when bridging tokens from Ethereum to Arbitrum and vice versa.

Tokenomics

GMX is a revenue-sharing and governance token with a projected maximum supply of 13.25 million. It’s possible to mint tokens beyond this number with the governing body’s approval. This can happen if there’s a need to launch new products. However, there will be a 28-day time lock on new issuance. The current supply as of this writing is 8,612,831 GMX, while the price is $77.99. The token’s market cap is $669,964,895 at the time of writing.

The project allocated 6 million GMX tokens (45.28%) to the migration from Gambit and XVIX, and 2 million tokens (15.09%) were put aside to allow users to vest from escrowed GMX rewards. It also paired 2 million GMX (15.09%) with ETH for liquidity on Uniswap, while another 2 million (15.09%) went to the floor price fund. The exchange set aside 1 million tokens (7.55%) for community developers, marketing, and partnerships. It has also allocated 250,000 (1.89%) tokens to contributors linearly over a period of two years.

GMX crypto uses

GMX users need the GMX token to stake and earn yields. Stakers earn 30% of platform fees, among other rewards, incentivizing them to hold the token long-term. They also receive escrowed GMX tokens through vesting, which they can convert to GMX tokens.

Furthermore, GMX is a governance token, meaning it gives holders the right to vote on governance proposals.

GMX wallet

To use GMX on Arbitrum or Avalanche, users can use MetaMask, Coinbase Wallet, and WalletConnect. Connecting any of these wallets enables users to stake GMX, provide liquidity, conduct leverage trading, or swap tokens.

Did you know that you can get $10 cashback for inviting friends to ZenGo wallet?

- Create a blockchain wallet ZenGo using THIS LINK

- Go to Settings in your ZenGo wallet app and copy your personal promo code

- Invite your friends using the promo code. Once your friend buys $500+ worth of crypto both of you will get $10 cashback.

Can GMX make its mark as a fresh new DEX?

GMX is making a name for itself in the crypto derivatives market since it has surpassed its predecessor and competitor, dYdX, in total value locked. The protocol is also innovative in the way it operates, solving issues of impermanent loss and liquidity. Going forward, it will be interesting to see how this platform and its native GMX crypto evolve and compete with other crypto space exchanges.

Frequently asked questions

Is GMX a good exchange?

Why is GMX better than dYdX?

What is the GMX trading platform?

What is GMX in crypto?

Who is the owner of the GMX token?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.