DeFi protocols handle billions of dollars in daily trading volumes, signaling just how substantial their contribution is to the Web3 ecosystem. This guide will explore GMX, the native token of one of the top 30 DeFi protocols in 2023. Read on to learn how to buy GMX with a credit card using an easy-to-follow, step-by-step process.

Do you want to buy GMX? Use and test these exchanges

Best for demo and spot trading

Secure exchange with high deposit & withdrawal limits

Trustworthy exchange with complete crypto ecosystem

Methodology: How did we select the best platforms for GMX?

This piece covers everything needed to know about purchasing GMX using credit cards. But for that, the best exchanges must be listed. We tested three of the most active ones, especially when it comes to GMX trading volume, liquidity, support for additional services, UI, and more. Here is what was inferred:

OKX for trading GMX

Trading GMX on OKX is easy, courtesy of the high liquidity score of 509, per CoinMarketCap data. The trading volume exhibited by the GMX/USDT pair on OKX comprises almost 7.2% of the global GMX flow. OKX even supports 300+ assets for quick GMX-to-crypto conversions. The trading fee structure is straightforward, with 0.1% set by the platform for initiating trades. Plus, OKX even lets you trade GMX perpetual pairs.

Kraken for buying GMX

On Kraken, you can trade the GMX/USD pair without worrying about liquidity, which is sufficiently high at 390, per CoinMarketData. Kraken even supports 120+ cryptos, supporting quick swaps. Plus, Kraken’s compliance with FinCEN makes it a go-to platform for purchasing GMX and other crypto assets.

Buy GMX on Binance

Buying and holding GMX on Binance is advisable as the GMX/USDT pair enjoys a high trading liquidity of 573. Plus, the Binance USDT pair makes almost 23.20% of the total volume. Binance also supports GMX perpetual trades with 20X leverage. The trading fee is set to 0.1%, and you can seamlessly convert GMX to any of the other 350+ supported cryptocurrencies.

Binance also supports GMX staking as part of the fixed and flexible Earn plans. The APRs can go as high as 9.6%.

Each of the mentioned exchanges or platforms tick boxes related to decent GMX liquidity, quick trade initiations and conclusions, additional features related to passive income generation, and more. For additional info regarding BeInCrypto’s methodology verification, click on the provided link.

What is GMX?

GMX is the native token of the DeFi protocol GMX, a decentralized exchange that offers spot and perpetual futures trading. GMX functions as a governance and utility token, allowing holders to stake it and vote on protocol proposals.

Stakers earn rewards generated from 30% of all protocol fees and receive escrowed GMX (esGMX) tokens, which they can stake or vest. Additionally, the GMX platform rewards long-term holders with multiplier points that boost their yields.

The GMX crypto has a total supply of 9,467,444. Its maximum supply is predicted to be 13.25 million GMX tokens.

What is the GMX exchange?

GMX, formerly Gambit, is a decentralized exchange (DEX) built on the Arbitrum and Avalanche blockchains. It launched on Arbitrum in September 2021 and on Avalanche in early 2022.

GMX uses an automated market maker (AMM), which facilitates spot and perpetual trading. Users can trade digital assets and earn an income from providing liquidity on the protocol. The GMX platform focuses on providing low swap fees and minimizing the price impact of trades. It has also improved its offerings by launching v2, which is in beta as of October 2023.

“Amid concerns about popular CEX and the FTX incident, the rise of perpetual DEX is crucial. GMX is stepping up to fulfill this role.”

Yoda HODL, market analyst and derivative trader: X

How to buy GMX with a credit card

GMX is available on several centralized crypto exchanges, including KuCoin, Binance, OKX, Bybit, and Kraken. The token also trades on Uniswap v3. This guide will use OKX as an example to explain how you can buy GMX with a credit card. Here’s the step-by-step process you should follow.

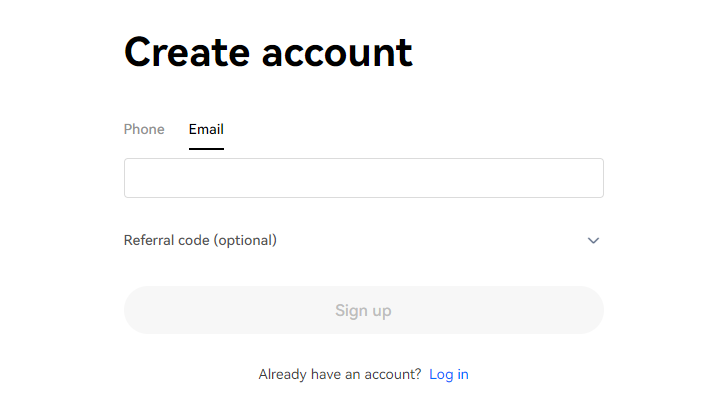

- First, open the OKX website in your browser.

- Enter your details and click “Sign Up.”

- Input the verification code delivered to your email address or phone number to activate your OKX account.

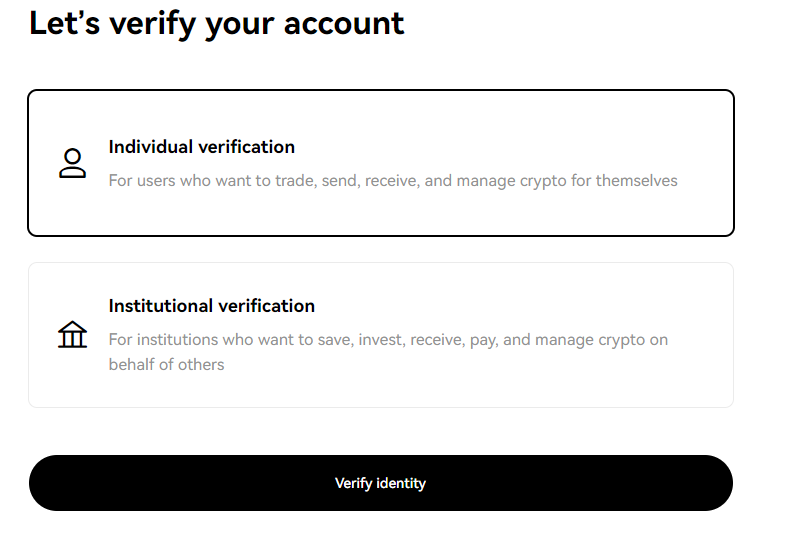

- Next, enter your country of residence and proceed with the verification process.

- Once your account is ready, go to the profile icon and select “Verification” from the drop-down menu.

- Choose “Individual verification” and click “Verify identity.”

- Follow the prompts and provide all the required details.

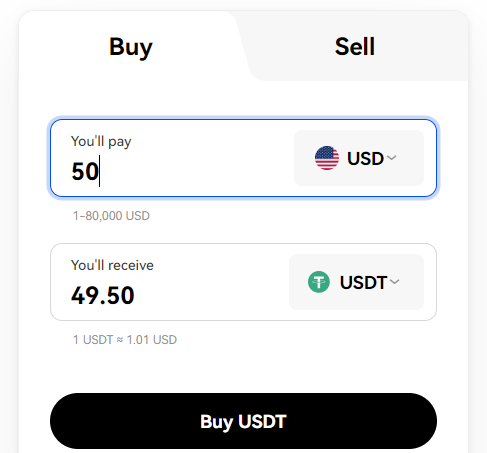

- Once OKX has verified your identity, go to the “Buy crypto” tab and select “Express buy.”

- Start by purchasing USDT, which you will then convert to GMX tokens.

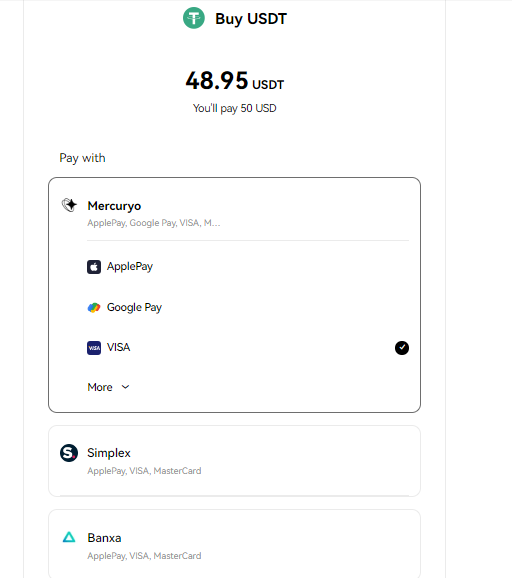

- Enter the amount of USD you want to spend and click “Buy USDT.”

- Next, choose one of the partners listed and use your credit card to buy USDT.

- Complete the transaction and wait for USDT to hit your OKX account. You should find your USDT by going to the “Assets” tab.

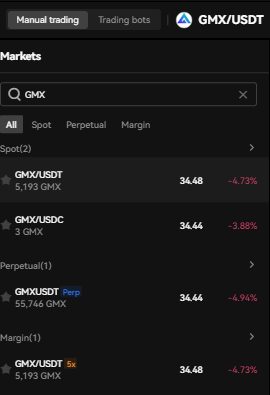

- Now that you own USDT, you must trade it for GMX on the spot market. To do this, go to the “Trade” tab and choose “Spot” under the “Basic Trading” option.

- Search for the GMX/USDT trading pair on the left side of the spot trading dashboard.

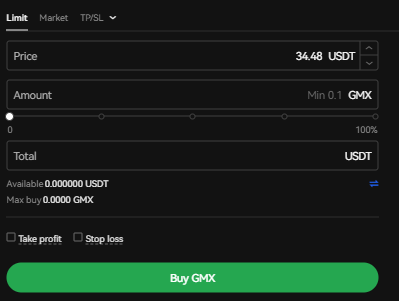

- Select this pair, then scroll down to enter the amount of GMX you wish to buy.

- You can purchase GMX using a limit or market order. A limit order tells the exchange that you want to buy GMX at the specified price or better. On the contrary, a market order is an instruction to the exchange to immediately buy GMX at the current market price.

- Once you have typed in the amounts, click “Buy GMX” and wait for the exchange to fulfill your order. Remember that the exchange could take days to complete a limit order as it waits for the asset to reach the specified price. However, it will carry out the market order immediately.

- You can view your GMX tokens by clicking ‘My assets” under the “Assets” tab.

- Since the OKX wallet isn’t non-custodial, you might want to transfer your GMX tokens to a hot wallet like MetaMask or Rabby. Alternatively, you can move your digital assets to air-gapped wallets like Coldcard and NGRAVE ZERO. A non-custodial wallet gives you 100% control over your cryptocurrency investments since you hold the private keys.

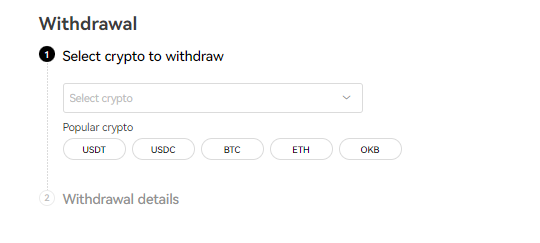

- To transfer your GMX tokens, go to the “Assets” tab and select “Withdraw.”

- Enter the amount of GMX you want to withdraw and the address of your hot or cold wallet.

- Complete the transfer and hold on to your GMX tokens or stake them to earn rewards.

To learn how you can keep your GMX and other tokens safe after purchasing them using a credit card, check out these tips on crypto wallet security.

Should you invest in GMX?

Purchasing GMX tokens on a centralized exchange like OKX is arguably the easiest way to get your hands on the crypto. You can even use a credit card to buy GMX tokens. You just need to purchase USDT or another more mainstream cryptocurrency first and then trade it for GMX.

Overall, the native token of the innovative DEX has clear utility. GMX users need the token to stake and earn yields. Furthermore, GMX stakers earn 30% of platform fees, which incentivizes long-term holding. Ensure you only invest in GMX if you believe in the project. Crypto is a volatile market, and you should never invest more than you can comfortably afford to lose.

Frequently asked questions

Where can I buy GMX crypto?

How to invest in GMX?

Can you perform a swap trade on GMX?

Who owns GMX crypto?

Is GMX coin a good investment?

What is the total supply of the GMX coin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.