YouHodler is a long-time player in the crypto loans space. It claims to offer some of the highest yields in the industry. But is it safe and reliable for crypto investors? Given the collapse of similar crypto lending platforms, it’s important for potential users to have a complete understanding of YouHodler’s operations, strengths, and weaknesses. Here is everything you need to know about how the platform shapes up in this comprehensive YouHodler review.

KEY TAKEAWAYS

• YouHodler is an E.U. based cryptocurrency trading and lending platform.

• The company offers some of the highest yields and loan-to-value (LTV) ratios in the crypto industry at low costs.

• While YouHodler has solid loan products and is regulated, it could benefit from more transparency and a proof of reserves.

• Crypto lending platforms do not carry the same user protections as traditional platforms; users should exercise caution.

- YouHodler at a glance: Our overall rating

- What is YouHodler?

- How to sign up for YouHodler in July 2025?

- Welcome offer/bonus

- History of YouHodler

- Number of users

- How does YouHodler compare to others?

- Features and tools from YouHodler

- Pros and cons

- How we tested YouHodler

- Regulatory compliance and safety

- Invest responsibly

- Solid products with room for growth

- Frequently asked questions

YouHodler at a glance: Our overall rating

Overall, YouHodler is one of the few crypto loan businesses that is actually able to sustain a viable business model. The products that it offers are comprehensive. On the other hand, the company could benefit by showing transparency from financial reports, proof of reserves, or third-party audits.

| Features | Prices | Features | Security | Compared to Competitors | Customer Support | BIC Score |

| Score | 3/5 | 4/5 | 3/5 | 4/5 | 5/5 | 3.8 |

What is YouHodler?

YouHodler is a cryptocurrency financial platform that offers various services related to digital assets. It is a veteran in this industry, has survived multiple crypto winters, and has a primary focus on crypto loans.

If you have been around for some time, you may remember that this platform gained recognition for its crypto lending, borrowing, and interest-earning services, which catered to users looking to leverage their idle crypto holdings for various trading strategies.

Moreover, YouHodler was designed to provide traditional fiat financial services to the crypto community while also connecting the fiat and crypto worlds.

Our future is web3 banking with both custodial and non-custodial wallets in one app, investment services from both worlds: crypto staking, & traditional bonds; industry best trading services and complete 360-degree payments.

Ilya Volkov, YouHodler founder

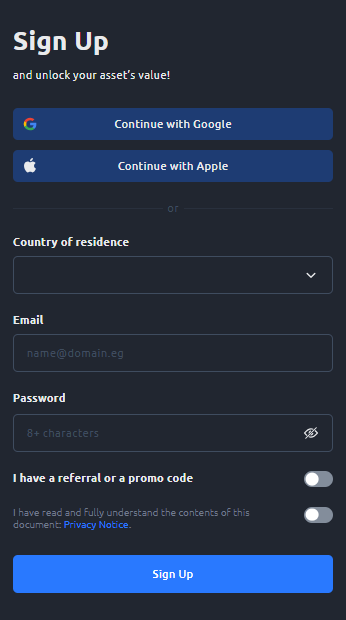

How to sign up for YouHodler in July 2025?

1. First, go to the YouHodler website and select sign up.

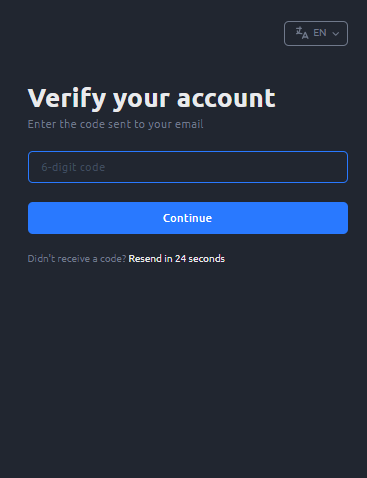

2. Secondly, enter your email and password to create your account. After this step, you will need to verify your email.

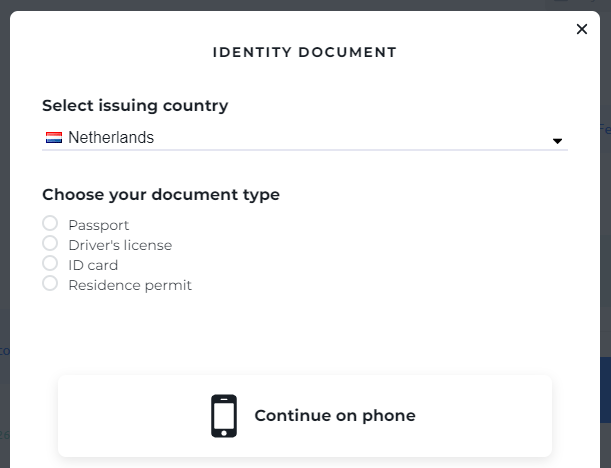

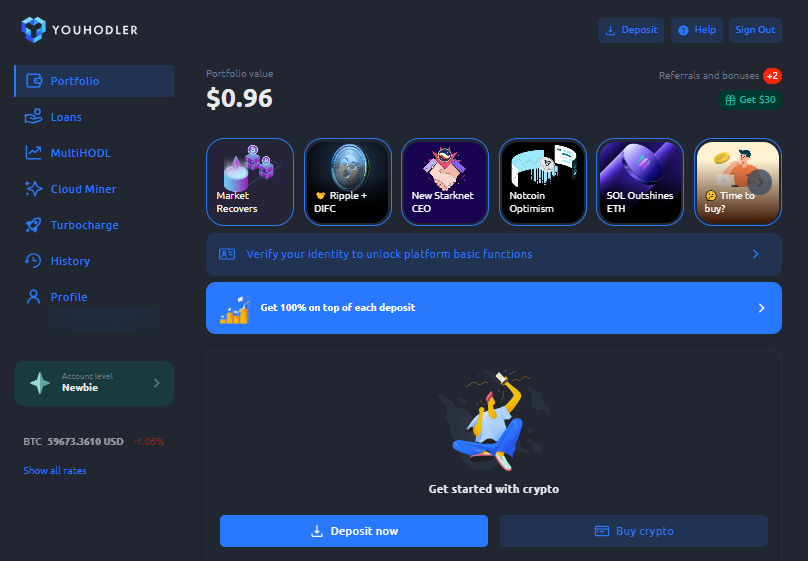

3. Congratulations! You have officially created a YouHodler account. However, if you want to access more features, you need to KYC.

4. In order to KYC, you will need to submit government documentation. This will vary for users by region.

Welcome offer/bonus

YouHodler’s offers and bonuses are not unlike most of the platforms you will encounter working in this industry, although it does add a few unique spins to common products.

It has a diverse promotions program, including, but not limited to, an affiliates program, a partners program, and rewards for completing various tasks. Some of these include rewards for trading select tokens, discounts on loans, double profit, NFT rewards, and a host of other offerings.

For instance, you can receive rewards for reaching a trading quota on meme coins, which we found to be very unique. You can also take advantage of the Cloud Mining simulator. With this product, you can earn up to 0.5 BTC a month. When you collect SPARKS (a platform-specific, off-chain token), you can “mine blocks” to complete tasks and earn BTC.

History of YouHodler

YouHodler was founded in 2018 by Ilya Volkov. Ilya is a member of the Swiss Crypto Valley Association’s Board of Directors and an ambassador for Innovaud, a Swiss agency that promotes innovation and investment in the canton of Vaud. He also is an active member of the Blockchain Association and the Crypto Valley Association.

YouHodler is headquartered in Cyprus — a common location for cryptocurrency and fintech companies due to its favorable regulatory environment and strategic location within the European Union.

Number of users

YouHodler serves a global clientele, boasting an impressive user base of 2.2 million clients spanning 110 countries. However, it’s important to note that there are certain regions where YouHodler’s services are not available due to regulatory and compliance considerations.

The platform, at this time, cannot provide its services to residents of several countries and regions, including the United States, Canada, and various unincorporated territories of the United States.

Additionally, access to YouHodler’s services is restricted in countries such as China, Afghanistan, Belarus, Bolivia, Cuba, and about 15 more nations.

These restrictions are in place to ensure compliance with the diverse and evolving regulatory environments governing cryptocurrency-related services across the globe. It’s crucial for users to be aware of these limitations when considering YouHodler’s offerings and whether they are eligible to access them from their respective locations.

How does YouHodler compare to others?

Based on the features, let’s compare YouHodler with its competitors (i.e., Nexo, Aave, and Maker). All four platforms offer varying Loan-to-Value (LTV) ratios, which determine how much users can borrow in relation to the value of their collateral.

YouHodler provides the highest LTV ratio, allowing borrowers to access up to 90% of their collateral’s value. Nexo follows closely thereafter. While YouHodler supports more than 50 cryptocurrencies, including fiat currencies, Nexo caters to diverse preferences with support for 30+ assets.

YouHodler provides users with earning opportunities through its platform. Nexo also offers opportunities for users to earn interest on their holdings. In contrast, Aave, as a DeFi protocol, enables users to earn interest by supplying assets to the lending pool. However, MakerDAO, despite its decentralized governance, doesn’t offer direct earning opportunities for users.

Lastly, the type of platform varies between centralized and decentralized models. YouHodler and Nexo operate as centralized platforms, providing a user-friendly lending experience with centralized control and governance. Aave and Maker, in contrast, operate in the DeFi space.

| Platform | YouHodler | Nexo | Aave | Maker |

| LTV | Up to 90% | Up to 83.33% | ~77%-80% | ~60%-70% |

| Interest Rate | 0.0082% – 0.0712% per day | 0%-15.9% | Variable (~0.35%-19.8%) | Variable (~0.8%-6.3%) |

| Assets (Borrow) | 50+ (including fiat) | 30+ | ~19 | Dai |

| Collateral | 51 | 70+ | ETH/ ERC-20 tokens | ETH/ ERC-20 tokens & real world assets (RWA) |

| Earn | Yes | Yes | Yes | No |

| Type | Centralized | Centralized | Decentralized | Decentralized |

Features and tools from YouHodler

YouHodler offers a wide range of cryptocurrency-related financial products and services, mostly related to earning opportunities. The above image shows some of the yields offered for depositing crypto on the platform, which typically ranges from 7-20%. Similar platforms like Binance, OKX, or Bybit typically reward 1-5% from simple Earn products.

YouHodler backs up its claims to have some of the highest yields in the industry for many of its products. Here are a few of the said products, including the ones not related to earning strategies.

- Crypto savings accounts: This is a product where users can deposit various cryptocurrencies into their YouHodler accounts and earn interest on their holdings over time, paid out in the crypto of their choice. It is the equivalent of a traditional savings account but offers much higher yields.

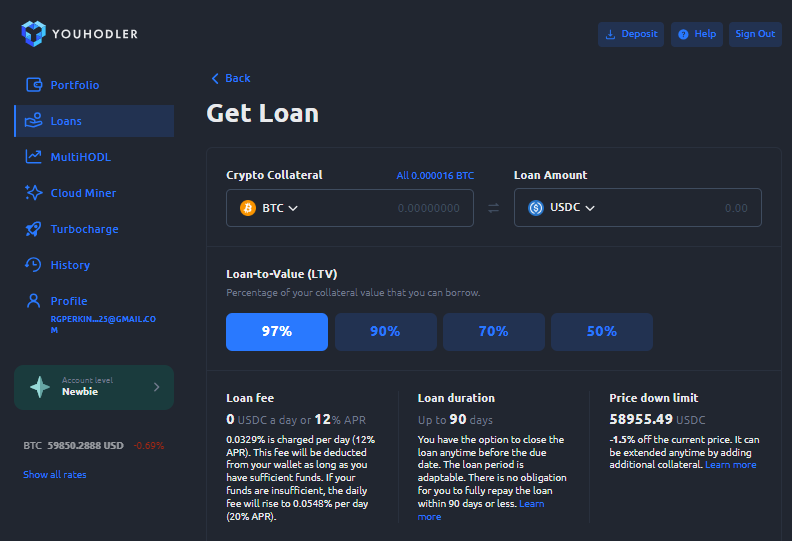

- Crypto loans: YouHodler provides cryptocurrency-backed loans, allowing users to borrow fiat currency or stablecoins by using their cryptocurrency holdings as collateral. This service enables users to access liquidity without selling their crypto assets.

- Turbocharge loans: This unique feature allowed users to use their crypto assets as collateral to open leveraged positions in cryptocurrency markets, potentially amplifying their returns (but also increasing risk).

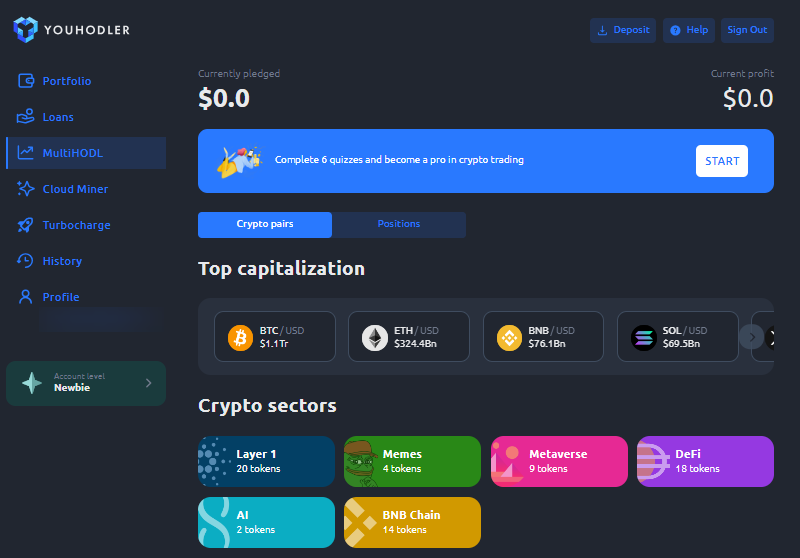

- Multi HODL: Users can use their crypto holdings as collateral to simultaneously open multiple loans, providing a way to manage their exposure to cryptocurrency markets.

- Exchange: YouHodler offered tools for converting one cryptocurrency into another and trading various cryptocurrencies against each other.

- Crypto cards: In some versions, YouHodler provided a feature for users to fund their accounts and withdraw funds to a credit card.

- Interest accounts for stablecoins: Apart from traditional cryptocurrencies, YouHodler often supported stablecoins like USDT, allowing users to earn interest on these stable assets.

- Affiliate program: Users can earn rewards by referring friends and acquaintances to the platform.

Pros and cons

Having covered the key aspects of YouHodler, it’s time to highlight some of its notable advantages and drawbacks. Let’s explore the platform’s pros and cons to help you make an informed decision.

Pros

- Wide range of supported assets: YouHodler supports a diverse selection of assets, including over 50 cryptocurrencies, making it a versatile platform that accommodates various user preferences.

- Earning opportunities: YouHodler provides users with opportunities to earn through its platform, allowing users to generate additional income while holding their assets.

- High LTV ratio: YouHodler offers one of the highest Loan-to-Value (LTV) ratios in the industry, allowing borrowers to access up to 90% of their collateral’s value. This can be advantageous for those looking to maximize their borrowing capacity.

- Data security: YouHodler employs security measures, including secure KYC data handling, strong password encryption, SSL data encryption, and OAuth 2.0 tokens for authentication, ensuring user data protection.

- Exchange services: YouHodler offers exchange services, allowing users to exchange cryptocurrencies, fiat currencies, and stablecoins with real-time execution prices.

Cons

- Regulatory considerations: Regulatory status may vary by region, restricting certain products or the platform altogether from certain users.

- High interest rates: YouHodler’s interest rates are generally higher than those offered by traditional financial institutions.

BeInCrypto assessment

First and foremost, YouHodler is one of the very few crypto lenders that survived the crypto winter triggered by the Tera Luna contagion. That feat alone deserves some applause.

Additionally, the platform receives overwhelmingly positive feedback online. Although customers have some criticisms, the reviews are mostly positive. Be that as it may, the lending platform has some room for improvement.

When we compare it to traditional lenders, YouHodler’s interest rates are relatively high. While the platform offers more features than the average crypto lender, it could do more in the realm of security features.

For example, the platform does not publish any publicly available financial reports, attestations, or proof of reserves. While its commitment to customers (especially customers’ data security) is admirable, a commitment to transparency regarding customer funds would be better.

In the past, we have seen how the obfuscation of a platform’s financial well-being can result in massive losses. This is why it is important for these types of platforms to be transparent in their financial standings.

How we tested YouHodler

The objective of our evaluation is to assess YouHodler’s trading features, the yields offered and cost for borrowing, and its suitability for meeting the diverse needs of investors. We assessed the following products:

- Cryptocurrency offerings: Examined the range and diversity of cryptocurrency-related financial products and services.

- Crypto savings accounts: Tested the deposit process for various cryptocurrencies and assessed interest rate accumulation over a set period.

- Crypto loans: Evaluated the process of securing fiat or stablecoin loans using cryptocurrency as collateral.

- Turbocharge loans: Tested the mechanism of using crypto as collateral for leveraged market positions.

- Multi HODL: Examined the ability to use crypto to collateralize multiple simultaneous loans.

- Exchange tools: Tested cryptocurrency conversion tools and functionalities and evaluated the trading process of different cryptocurrencies against each other.

- Crypto cards: Tested the process of funding accounts and withdrawing funds to a credit card.

By evaluating the aforementioned products and criteria, we were able to assess the platform’s viability, its unique value-add for customers, and its safety.

Regulatory compliance and safety

YouHodler has taken a significant step in strengthening its European presence by obtaining registration and regulatory approval in Italy. The Organismo Agenti e Mediatori (OAM) in Italy officially registered and approved YouHodler as a cryptocurrency service provider.

YouHodler positions itself as an E.U. and Swiss-based brand, indicating it operates within the regulatory framework of the European Union and Switzerland. This suggests that the company complies with the relevant financial regulations and requirements in these jurisdictions.

It’s important to note that while YouHodler is regulated in Italy and other E.U. countries, its Swiss legal entity, YouHodler SA, is not yet regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Invest responsibly

Investing in cryptocurrency and any other asset carries an inherent risk. Therefore, investors should never invest more than they can comfortably afford to lose.

Secondly, crypto loans typically do not offer the same consumer protections offered by traditional, regulated institutions. Customers should remain aware of the potential for loss when taking out crypto loans.

Furthermore, this review is not a formal endorsement of the YouHodler platform. As always, readers should conduct their own thorough analysis when making investment decisions.

Solid products with room for growth

Overall, this YouHodler review concludes that the crypto lending platform is a monolith in its field but has room for improvement. YouHodler has one thing that some businesses lack — genuine product market fit. Presumably, this has allowed them to survive the harsh crypto winter. The platform has products that users actually want and need. However, some relatively important concerns still hold the platform back.

The lack of public proof of reserves or any financial reports is cause for concern and hurts the perception of security. A proof of reserve, published incrementally throughout the year, where customers can verify their accounts, would go a long way.

Frequently asked questions

Who is the owner of YouHodler?

Is YouHodler legit?

Which country made YouHodler?

Is my money safe in YouHodler?

Who owns YouHodler?

Does YouHodler have fees?

What is the limit on YouHodler?

Can YouHodler be trusted?

Which countries cannot use YouHodler?

Why not use YouHodler?

What is the disadvantage of YouHodler?

How do I withdraw money from YouHodler?

What can I trade on YouHodler?

Is YouHodler regulated?

What is the minimum deposit on YouHodler?

Does YouHodler require KYC?

What are the withdrawal times on YouHodler?

Does YouHodler have a mobile app?

Does YouHodler offer any special offers or bonuses?

Does YouHodler have good customer support?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.