Alongside the DeFi revolution, another groundbreaking development is gaining momentum in the financial world — synthetic assets.

These financial instruments could drastically change how we invest, manage risks, and access global markets. They promise to unleash a new wave of opportunities that traditional finance can’t match. In this guide, we explore everything you need to know about synthetic assets, including how they work, their importance in financial markets, their benefits, and more.

- What are synthetic assets?

- Why synthetic assets are increasingly popular

- How do synthetic assets work?

- Smart contracts and decentralized platforms

- Types of synthetic assets

- Synthetic assets vs. traditional derivatives

- Pros and cons of synthetic assets

- Top synthetic asset platforms

- Are crypto synthetic assets right for you?

- Frequently asked questions

What are synthetic assets?

Synthetic assets, or “synths,” as they are often called, are essentially tokenized derivatives. For those out of the loop, a derivative is a financial instrument with a value that is locked to that of another asset via a contract. They mirror the price movements and behavior of traditional assets like stocks, commodities, or currencies but without requiring you to own the actual underlying asset.

In the crypto context, these are artificial assets rooted in complex financial derivatives and smart contracts on blockchain networks — often within DeFi ecosystems.

Some of the key traits of a crypto synthetic assets include the ability to:

- Create smart contracts on decentralized platforms like Ethereum

- Accurately track asset prices

- Secure the underlying asset’s value using collateral

- Create flexible derivatives.

The beauty of synthetic assets is that they open up possibilities for DeFi users. Suddenly, a whole range of financial assets and markets are within reach, meaning less reliance on traditional intermediaries.

However, it should be highlighted that these aren’t your run-of-the-mill investments. They’re intricate, they’re risky, and they demand a solid understanding of the underlying mechanics. So, do your homework and only then proceed (with caution).

Did you know: Unlike traditional markets that have set trading hours, synthetic assets can be traded around the clock on decentralized exchanges.

Synthetic assets: History and evolution

The concept of synthetic assets is rooted in traditional finance (TradFi), where derivatives such as futures, options, and swaps have long been used to hedge risks and gain exposure to various financial markets. However, the rise of blockchain technology has birthed a new generation of synthetic assets.

The evolution began with the introduction of DeFi platforms like Synthetix, which allowed users to create and trade synthetic assets on the Ethereum blockchain. Synthetix was launched in 2018. It disrupted the space within a relatively short span, enabling the creation of synths backed by its native token, SNX. Other platforms, like Mirror Protocol, soon followed, allowing the creation of synthetic assets representing equities, commodities, and currencies.

As DeFi gained traction, synthetic assets evolved to offer more sophisticated and diverse financial products. They began to offer exposure to real-world assets, such as stocks and commodities, in a decentralized and trustless environment, broadening their appeal and usability.

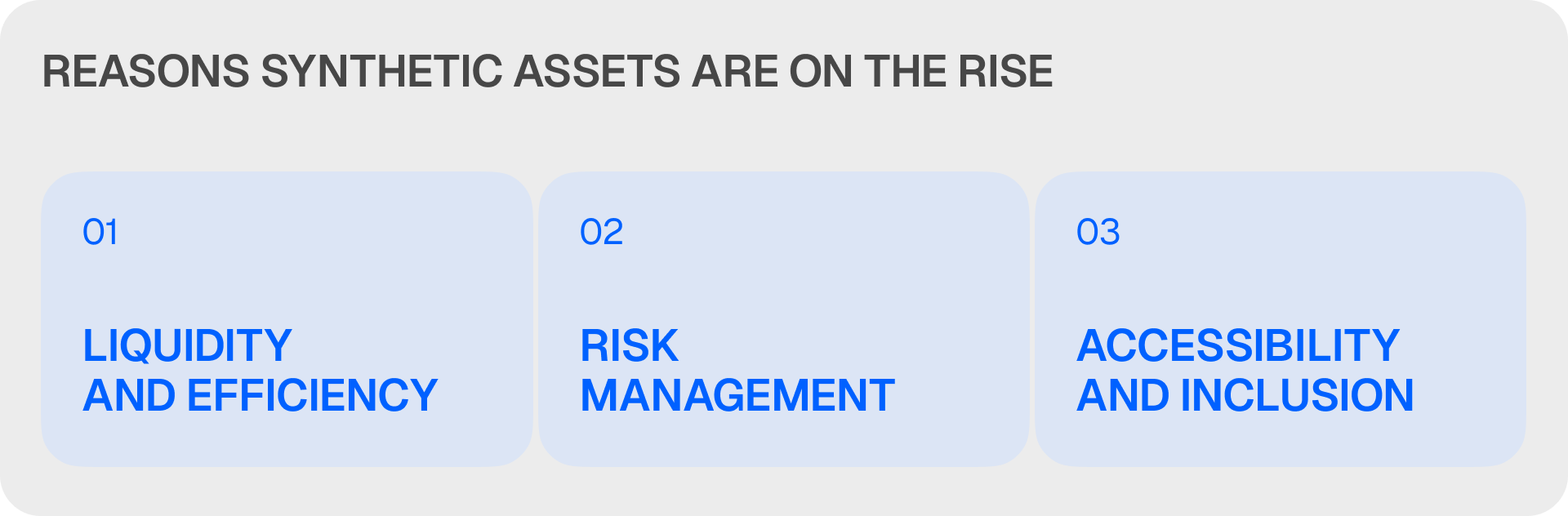

Why synthetic assets are increasingly popular

Synthetic assets play a crucial role in the financial market. Their importance can be highlighted in several key areas:

Accessibility and inclusion

No matter where you are or how limited your funds are, synthetic assets allow users to tap into various asset classes. Forget about hefty fees, regulatory hurdles, and geographical restrictions. This is particularly significant for investors in underserved regions, who now have a seat at the global financial table.

Liquidity and efficiency

Synthetic assets can improve market liquidity by turning real-world assets into tokens. They make it possible for investors to own fractions of the underlying assets, which eliminates the need for massive capital. Needless to say, this ensures smoother capital allocation.

Risk management

Just like their traditional counterparts, synthetic assets empower investors to tackle market volatility head-on. For instance, an investor can use synthetic assets to gain exposure to a commodity without holding the physical asset. This way, they don’t have to sweat over storage and transportation risks. This flexibility is invaluable for portfolio diversification and risk management strategies.

How do synthetic assets work?

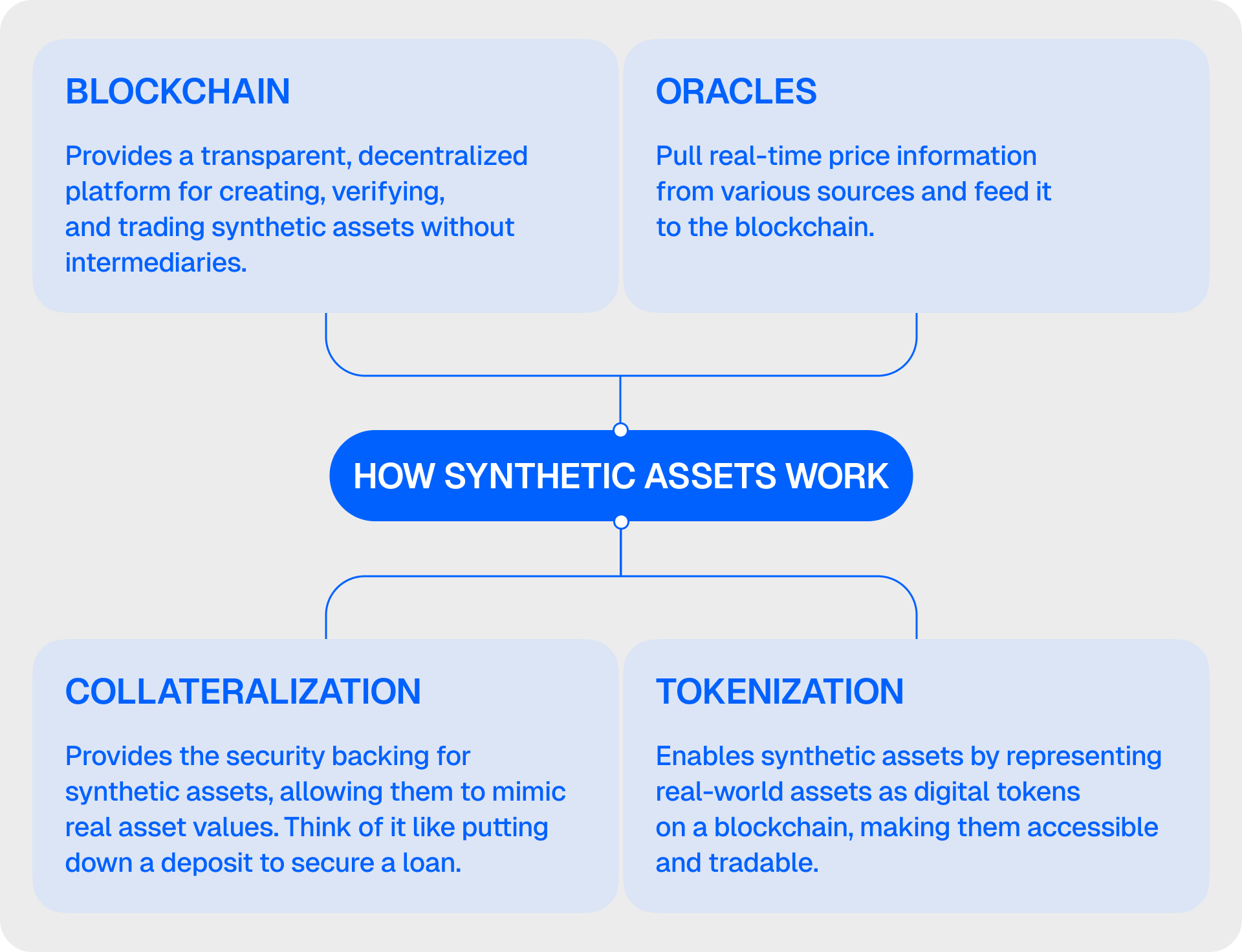

Let’s take a look under the hood of synthetic assets to see how they tick. At the core of this technology are several critical components:

- Blockchain: Crypto synthetics are built on blockchain platforms, which provide a decentralized, immutable ledger for recording all transactions. This ledger ensures transparency and security, ensuring that no one can fiddle with the data.

- Oracles: Oracles are crucial in the functioning of synthetic assets. They act as bridges between the blockchain and the real world by providing real-time data on the prices of the underlying assets. Oracles pull price information from various sources and feed it into the blockchain. This is crucial because it ensures that synthetic assets accurately reflect the true market value of the assets they represent.

- Collateralization: You need to put up collateral to create a synthetic asset. This is usually done in the form of cryptocurrencies like Ether (ETH) or a platform’s native token. It’s like putting down a deposit to secure a loan. The value of this collateral must be higher than the value of the synthetic asset being created, a practice known as over-collateralization. This is to ensure that the synthetic asset maintains its value even if the market goes haywire.

- Tokenization: Tokenization is the process of converting rights to an asset into a digital token on the blockchain. For synthetic assets, this means creating digital representations of real-world assets, such as stocks, commodities, or fiat currencies. These tokens can then be traded on decentralized exchanges, which provides investors with exposure to the underlying asset without direct ownership.

Smart contracts and decentralized platforms

Smart contracts and decentralized platforms are fundamental to the creation and management of synthetic assets. Here’s how they work in unison:

- Smart contracts automatically enforce and execute the terms when predefined conditions are met. In the context of synthetic assets, smart contracts handle the issuance, trading, and redemption of these assets. For example, when a user wants to create a synthetic asset, a smart contract will lock up the required collateral and issue the corresponding synthetic token. This process is trustless and automated, which reduces the need for intermediaries.

- Decentralized platforms like Synthetix and Mirror Protocol provide the infrastructure for creating and trading synthetic assets. They operate on blockchain networks, primarily Ethereum, leveraging smart contracts to manage the entire lifecycle of synthetic assets.

- The platforms often utilize liquidity pools to facilitate the trading of synthetic assets. Liquidity providers deposit pairs of tokens into these pools, thereby allowing users to trade synthetic assets without relying on order books. This mechanism provides continuous liquidity and reduces price slippage while improving the overall trading experience.

- Governance and incentives: Many synthetic asset platforms are governed by decentralized autonomous organizations (DAOs), where token holders can propose and vote on changes to the protocol. This decentralized governance model ensures that the community has a say in the platform’s development and operation. Additionally, platforms often incentivize participation through rewards for collateral providers and liquidity providers. This encourages the growth and stability of the ecosystem.

Types of synthetic assets

Crypto synthetic assets are available in various forms. Some of the more common ones are:

Synthetic stablecoins

Synthetic stablecoins mimic the value of fiat currencies, such as the U.S. Dollar, Euro, Japanese Yen, or the Indian Rupee. These digital assets enable users to trade and hold currency values on decentralized platforms, thereby providing a means for hedging against currency risk or participating in forex markets without needing traditional currency exchanges.

Synthetic equities

Synthetic equities replicate the value and performance of traditional stocks without requiring ownership of the actual shares. These digital assets allow investors to gain exposure to the price movements of publicly traded companies. This way, users can easily trade and invest in equities through decentralized platforms. For example, platforms like Mirror Protocol offer synthetic versions of major stocks.

Synthetic commodities

Synthetic commodities represent the value of physical commodities such as gold, silver, oil, and agricultural products. By holding synthetic commodities, investors can speculate on the price movements of these assets without dealing with the logistics of physical storage and transportation. This form of investment provides a convenient and efficient way to gain exposure to commodity markets.

Other types

Beyond equities, commodities, and currencies, synthetic assets can also represent other financial instruments and indices:

- Synthetic indices: These track the performance of market indices like the S&P 500 or the NASDAQ. Investors can gain diversified exposure to a range of assets within an index without holding the individual components.

- Synthetic real estate: These assets mimic the value of real estate properties (including fractionalized real estate), allowing investors to gain exposure to property markets without physical ownership.

- Synthetic cryptocurrencies: These are designed to replicate the value of other cryptocurrencies, which makes it easier for users to gain exposure to different crypto assets without actually holding those coins. This is useful for cross-chain trading and investment strategies.

Synthetic assets vs. traditional derivatives

Structure

Crypto synthetics are digital representations of traditional assets created using blockchain technology and smart contracts. They replicate the value and behavior of real-world assets without requiring direct ownership. These assets are managed on decentralized platforms, relying on collateralization and smart contracts to ensure their value and functionality. They use oracles to obtain real-time price data, ensuring that synthetic assets accurately reflect the value of their underlying counterparts.

Traditional derivatives, on the other hand, are financial contracts whose value is derived from an underlying asset, such as stocks, commodities, currencies, or indices. Common types include futures, options, and swaps. These contracts are typically traded on centralized exchanges or over-the-counter (OTC) markets. They involve legal agreements between parties to buy or sell the underlying asset at a future date, often involving intermediaries such as brokers or clearinghouses.

Accessibility and participation

Crypto synthetics are accessible to anyone with an internet connection and a digital wallet. They are traded on DEXs, which means they are available globally without requiring the services of any traditional financial intermediaries. These instruments democratize access to various asset classes by allowing retail investors to participate in markets that may have been previously inaccessible due to geographical, regulatory, or financial barriers.

Meanwhile, traditional derivatives markets often have higher barriers to entry, including regulatory requirements and capital constraints. Plus, they often require intermediary services. They are typically more accessible to institutional investors and high-net-worth individuals. Participation in traditional derivatives markets often requires a higher level of expertise and significant capital investment.

Transparency and security

Transactions involving synthetic assets are recorded on a public blockchain, which guarantees a higher degree of transparency. Similarly, smart contracts execute transactions automatically and reduce the potential for manipulation. However, the security of these assets also depends on the quality of the smart contracts and the integrity of the oracle data feeds.

Traditional derivatives markets, on the other hand, are often opaque comparatively. They offer limited visibility into the underlying transactions and positions held by market participants. These markets rely on established legal frameworks and regulatory bodies to ensure security and enforce contracts. However, they are also subject to risks such as counterparty default and systemic failures.

Liquidity and trading

Synthetic assets benefit from the liquidity provided by decentralized exchanges and liquidity pools. They offer greater flexibility and accessibility by enabling continuous trading without the constraints of traditional market hours. Trading synthetic assets is typically more efficient and cost-effective due to the elimination of intermediaries and the use of automated market-making mechanisms.

In contrast, liquidity in traditional derivatives markets is often provided by market makers and large financial institutions. These markets can experience significant liquidity variations depending on market conditions and regulatory changes. Moreover, trading traditional derivatives often involves higher costs due to fees charged by brokers, exchanges, and clearinghouses. The process can also be slower and more cumbersome due to the need for intermediary involvement.

Did you know: Synthetic assets can replicate virtually any asset, from stocks and commodities to fictional characters and fantasy sports teams.

Pros and cons of synthetic assets

Pros

- Accessibility: Synthetic assets are available globally via decentralized platforms. This eliminates the need for traditional financial intermediaries while lowering barriers to entry for retail investors.

- Diversification: They offer exposure to a wide range of asset classes and provide easy access to markets like commodities, equities, and currencies.

- Liquidity: Continuous trading on decentralized exchanges enhances liquidity, with liquidity pools making it easier to buy and sell compared to traditional assets.

- Lower transaction costs: Synthetic asset platforms can slash fees easily by cutting out the middlemen. This, in turn, gives you more bang for your buck. And it doesn’t stop there. Automated market-making also streamlines the trading process and minimizes costs.

Cons

- Volatility: The value of synthetic assets can be affected by price fluctuations, which can significantly affect the collateral value. Therefore, there is always the risk of high market volatility, leading to rapid changes in asset value.

- Regulatory concerns: There is an uncertain regulatory environment for synthetic assets, with the potential for future regulatory changes that could impact their usage and legality.

- Counterparty risk: The security of synthetic assets depends on the reliability of smart contracts, which are subject to bugs or vulnerabilities. Furthermore, their accuracy also depends on the reliability of oracles.

Top synthetic asset platforms

1. Synthetix

Synthetix is a decentralized platform on the Ethereum blockchain that allows users to create and trade synthetic assets. It uses its native token, SNX, as collateral to mint synths, which can represent a variety of assets including cryptocurrencies, fiat currencies, commodities, and indices. Synthetix uses a pooled collateral model where all SNX stakers share the risk and rewards of the platform.

Check out our SNX price prediction for an up-close look at the asset’s possible price trajectory over the short, mid, and long term.

2. Mirror Protocol

Similar to Synthetix, Mirror Protocol is also a decentralized platform, albeit on the Terra blockchain. It is designed to create and trade synthetic assets known as mAssets that mirror the price behavior of real-world assets such as stocks and commodities. Users provide collateral, typically Terra’s stablecoin (UST), to mint mAssets.

3. UMA (Universal Market Access)

As a decentralized protocol on Ethereum, UMA enables you to create synthetic assets and derivatives using financial contracts. There is minimal counterparty risk as the protocol leverages a decentralized oracle system and economic incentives to ensure contract performance. UMA’s protocol is designed to be highly flexible and it supports a wide range of asset types and contract structures.

Are crypto synthetic assets right for you?

Crypto synthetic assets are increasingly considered the next stage in the evolution of traditional derivative products. They offer a decentralized, accessible, and efficient way to gain exposure to various asset classes. It’s too early to call this asset class the future of finance. However, their transformative power in terms of accessibility, efficiency, and risk management opens up exciting possibilities for the future of finance.

That said, these assets come with risks such as volatility, regulatory uncertainties, and counterparty risk. So, if you plan on investing, make sure to conduct thorough research before dipping your toes in.