Mirror Protocol’s goal was to allow crypto users to interact with the financial system through innovative means. Using smart contracts, crypto users could purchase synthetic assets that mirror the price of real-life assets, such as stocks and precious metals. Let’s find out how it worked in this guide.

KEY TAKEAWAYS

► Mirror Protocol allowed users to create and trade synthetic assets that mirrored real-life financial assets, such as stocks and precious metals, without holding the underlying assets.

► Launched by Terraform Labs in 2020, Mirror Protocol used the Terra blockchain and CDPs (collateralized debt positions) to stabilize synthetic asset.

► Users could participate in Mirror Protocol by minting, trading, providing liquidity, staking, and farming, earning rewards in MIR tokens.

► The collapse of the Terra-Luna ecosystem led to the cessation of Mirror Protocol operations in 2022.

What is Mirror Protocol?

Mirror Protocol allowed its users to trade and create synthetic assets. It helped unify the worlds of traditional assets with blockchain technology. Moreover, it was a DeFi protocol that used the Terra blockchain to create synthetic assets known as Mirrored Assets or mAssets.

Mirror used the CosmWasm smart contract programming language; mAssets replicated the price behavior of digital and traditional financial assets. The trade was done without intermediaries. And the underlying assets didn’t need to be purchased directly.

mAssets could be transferred across the Terra, Ethereum, and Binance Smartchain networks. Terra stablecoins were, in fact, exchanged for mAssets. mAssets could then be deposited into Collateralized Debt Positions (or CDPs). The protocol used CDPs to stabilize the mAsset value.

After the collapse of Terra-Luna and the subsequent contagion, Mirror protocol ceased all operations in 2022.

How Mirror Protocol originated

Terraform Labs is responsible for launching Mirror Protocol in early 2020. The Terraform Labs company was based in South Korea and also created the Terra network. Do Kwon was the CEO and co-founder of Terraform Labs and Mirror Protocol.

Terraform Labs introduced Mirror Protocol in Dec. 2020 to create price-stable derivative assets on Terra Network. Mirror Protocol aimed for complete decentralization. MIR holders conducted governance of the protocol.

Participants in the network benefitted from MIR tokens’ distribution. Their roles in the protocol determined the distribution model. The project’s main objective was to make it easy to access financial markets and to facilitate liquidity that can be used to create synthetic assets.

Mirror’s native token is MIR. It was first issued to Terra liquidity providers via Uniswap and Terraswap between Nov. 11 and Dec. 4, 2020. Mirror’s genesis event began a four-year-long issuance of MIR tokens to Terra and Mirror users. Mirror was the fifteenth-largest DeFi protocol, according to TVL, by May 2021. It had $118 billion in collateral locked in the protocol.

The team behind Mirror Protocol

Do Kwon and Daniel Shin founded Terra in Jan. 2018. They conceived the project as a way to promote the adoption of cryptocurrency and blockchain technology by focusing on usability and price stability. Kwon assumed the role of CEO at Terraform Labs.

Do Kwon was born in South Korea to a family of medical equipment distributors. He often speaks of his commitment to cryptocurrency’s global goals.

Anyfi was Kwon’s first company back in 2016. It received grants of $1 million from South Korean government officials and angel investors. Kwon first learned about cryptocurrency by experimenting with the use of blockchain technology.

Starting Terraform Labs

Daniel Shin is a co-founder of the company Ticket Monster. In the Korean tech scene, Shin is widely appreciated. In 2010, he began his e-commerce website. It quickly grew to be one of the largest internet companies in the country. Shin expressed his desire to invest in the new generation of Korean tech companies. This is how Kwon and Shin struck a partnership.

How does Mirror Protocol work?

Mirror functioned as a synthetics-trading tool alternative. The ultimate goal, according to Do Kwon, was to create a genuine alternative to the classic financial system.

Mirror Protocol allowed users to trade tokens that “mirror” important financial assets without having any of the financial assets, such as stocks or precious metals.

The system of tokenizing real-life assets reduces the barrier to entry for traders worldwide. Mirror Protocol made it possible for anyone anywhere to trade tokenized assets around the globe.

Buying synthetic stock using the Mirror Protocol

How did Mirror work, exactly? Let’s take one of tech’s biggest companies, Apple, as an example. Apple stock is traded on the NASDAQ market daily. Purchasing stock is equivalent to purchasing shares in the company.

With Mirror, you could create a new asset based on Apple stock. We simply go to the website and find the stock labeled mAAPL. AAPL is the name of the stock traded on NASDAQ.

The website required that you stake funds into the protocol to generate mAssets of mAAPL. This resulted in what is referred to as over-collateralization on the Mirror Protocol. This process helped protect against sharp price volatility.

It essentially meant that there was enough provision of collateral in the case of default. Finally, the created mAsset would reflect the actual price of the asset it mimicked. It was, essentially, a method to use the crypto market while investing in the classic stock market.

As a result, when purchasing the mAAPL you would pay a higher price. This represents the over-collateralization. Furthermore, the price of the actual stock was subject to price change. It could be worth $100 when you purchase it and $80 or $120 in the following weeks.

How could you have profited from Mirror Protocol?

Once you minted the asset, in our example, mAAPL, there were a number of ways to earn profit:

- Provide the assets as liquidity and earn a portion of the exchange fees.

- Sell their assets and profit from the price fluctuation of their stock. If they purchased the same stock cheaper, they were able to unlock their collateral and make a profit from the difference.

- Stake or yield farm the mAAPL and earn MIR.

Naturally, you could also buy mAAPL from someone who has minted the token. The Mirrored Assets were tradable on the protocol. This was, overall, the best strategy for investing in a company. Also, the tokens were transferable to other chains or tradable off-chain.

Roles within Mirror Protocol

The concept of decentralization was at the heart of Terra’s ecosystem. Mirror Protocol, like their other products, encouraged governance participation. In keeping with this spirit, users could hold different roles within the ecosystem. There were incentives for each role. And each contributed to the daily operations of the protocol.

Crypto users had five roles within the Mirror Protocol: trader, minter, liquidity provider, staker, and farmer. There was also an auxiliary role, the oracle feeder. Each protocol participant contributed differently. Let’s take a look at the characteristics of each.

Minter

Essentially, a minter created synthetic assets. Once created, the asset could be traded in a variety of ways. The minter may choose to keep their asset or short it for profit. They are different from traders in that their strategy for earning profit may have been more complex. This is one of the reasons why they accepted to pay higher collateral for minting.

A minter was an individual who entered into a collateralized loan position (CDP) to receive newly minted tokens from a mAsset. CDPs accepted collateral in the form of UST, mAssets, or whitelisted collateral. They also had to maintain a collateral ratio that was higher than the mAsset minimum multiplied with a premium rate. Governance determined this rate.

The shorter was a similar role with a few distinctions. The same CDP was taken shorter. However, they sold the tokens immediately to get new-minted sLP coins. If Terraswap prices were higher than the oracle price, sLP tokens could be staked for MIR reward. Shorters effectively had a short position against the price direction of the reflected asset.

As long as the CDP’s minimum collateral ratio was not exceeded, excess collateral could be withdrawn. Minters had the option to adjust the collateral ratio of CDP by depositing or burning more collateral.

Traders

Traders were the ones that took advantage of the price fluctuation of stocks that the mAssets mirror. They could show their support and trust in a company’s stock by trading assets that have already been minted on the protocol. The traders used the UST stablecoin through the Terraswap network.

This was the most straightforward way to use Mirror Protocol to your advantage as a user. Engaging with the platform as a trader allowed you to utilize the protocol in the same way that you would use any other stock-trading app.

Liquidity providers

The liquidity provider added the same amount of mAsset and stablecoin to the Terraswap pool. This increased market liquidity for the entire market. In this way, newly minted LP tokens were rewarded to the liquidity provider. This represented their stake in the pool. They also received rewards from pool trading fees.

Stakers

A staker, as the name implies, was a user who staked LP tokens, sLP tokens (with staking contract), or MIR tokens (with Gov contract) to earn staking rewards as MIR tokens. While staking token holders of LP tokens and sLP tokens were eligible for rewards from inflation-related MIR tokens, stakers of MIR tokens could earn staking rewards through CDP withdrawal fees.

Users who had staked MIR tokens were eligible to vote and participate in governance. The amount of staked MIR would determine how much voting power they’d receive.

The governance token helped approve various items for inclusion in the protocol. For example, the whitelisting of mAssets. Furthermore, voting determined changes to protocol parameters. Users could unstake MIR Tokens at any stage. Votes, however, counted towards future elections solely.

Farmers

Crypto farming was also possible on the Mirror Protocol. Users received MIR as an incentive. In exchange, they had to stake LP tokens, minted when providing liquidity for mAssets and MIR. Yield was calculated on a yearly basis.

Features of Mirror Protocol

There were a number of features that made Mirror Protocol highly interesting. The key aspect was, of course, its mirroring of regular stocks. Besides this, the protocol provided incentives for users who could adopt various strategies.

Also, the Mirror Protocol had three token types: the MIR token, the LP token, and the mAsset token. The LP tokens were used by liquidity providers to add liquidity to pools. The mAsset was a blockchain asset that acted like a mirror of real-world assets by reflecting the exchange prices. And, MIR encouraged users to stake LP tokens for governance.

ATQ Capital managed Mirror Protocol’s wallet, the Mirror Wallet. It was used to buy crypto and ETFs with crypto. Users had unlimited access to financial markets. Mirror Wallet was a simple wallet that allowed users to connect with the protocol, and it provided a variety of synthetic investment options.

In addition, the Mirror Protocol website included four essential features that corresponded to the roles we previously outlined.

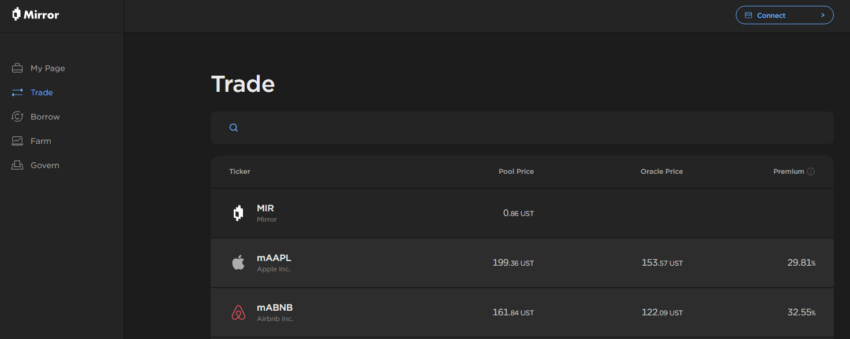

Trade

This tab allowed users to trade MIR and minted stock. Information about the asset’s estimated pool and oracle prices were provided. When purchasing, for example, mAAPL users were shown the Oracle price, the total liquidity, and the tax fees. The Terra blockchain facilitated trades.

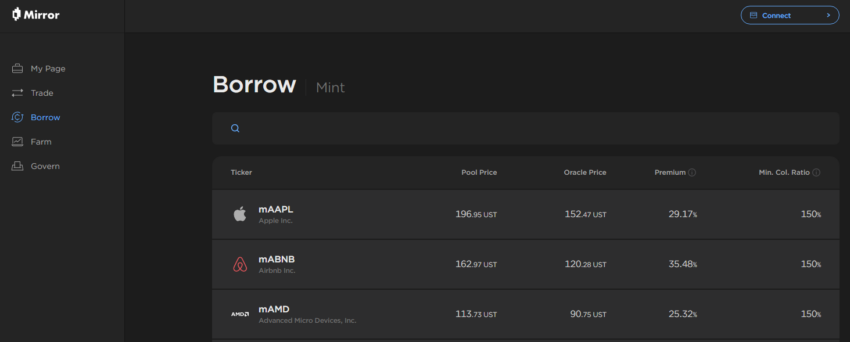

Borrow

This tab showed borrowing conditions. For example, a user had to pay at least 150% collateral for mAAPL stock. The transactions included fees also. Users had to repay their loan under the conditions stipulated before the purchase.

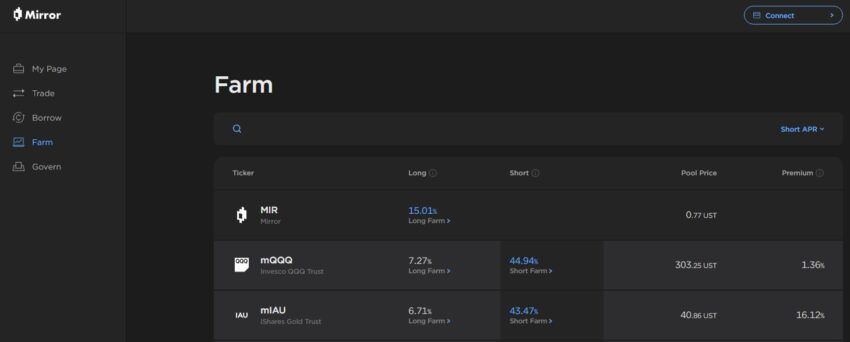

Farm

On the Farm tab, users were provided with the available list of staking pools. Users could earn MIR rewards through both long and short positions. The difference between the Terraswap and Oracle prices was the Premium.

When choosing a Long Farm position, users provided an equal value of the asset and UST. When choosing a Short Farm position, users had to lock collateral assets in the protocol and then mint mAssets. At any point, users could unstake LP tokens.

Govern

Voting on various proposals was done using MIR tokens. This ensured the decentralization of the network. Collateral values and whitelisting assets were issues discussed on the Govern tab.

What gave Mirror Protocol value?

Mirror Protocol’s value came from its technical capabilities and the technology behind it. This made it possible for anyone to create synthetic assets without having to own the underlying assets.

To maintain the assets’ value, the system used collateralization. It is worth remembering that the various roles of users provided incentives that exist outside the scope of the native token.

How to use Mirror Protocol

Using Mirror Protocol was a relatively straightforward process. Users had to access the website and connect to the Terra blockchain using their crypto wallet. They then had the option to mint and trade synthetic assets. They could also farm, borrow, or take part in the governance process. On the dashboard (My Page), users could see all of the active transactions.

The MIR token

The MIR token was the native token of the Mirror Protocol. It facilitated all transactions on the protocol and functions on the Terra blockchain. It was a part of the reward system for stakers and was the token that measured the voting power of its holders in the decentralized governance of protocol.

To ensure its revaluation, the MIR token was essential within the protocol. Therefore, developers decided to limit its supply to a maximum of 370 million tokens. These were supposed to be distributed over four years.

Tokenomics

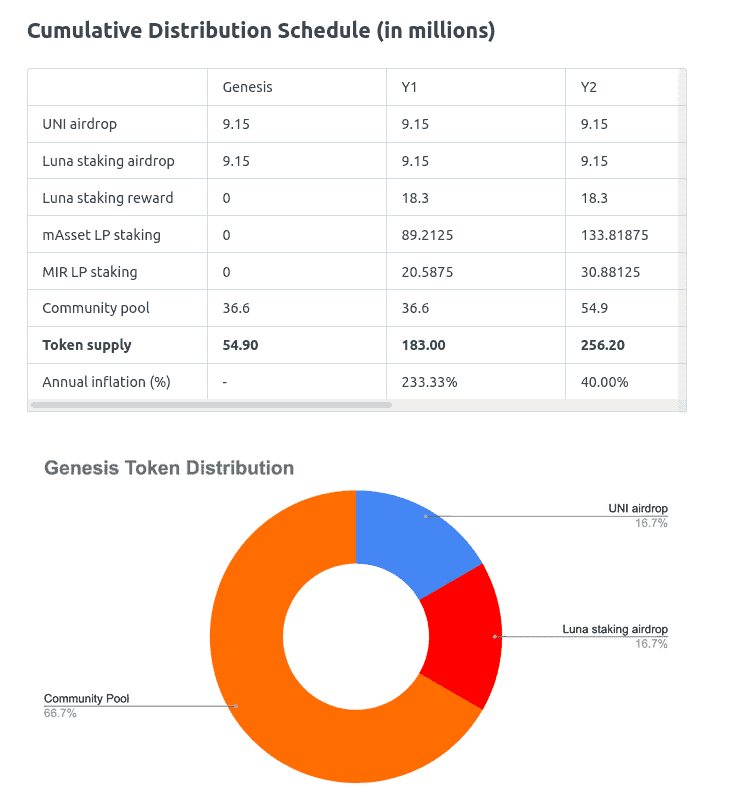

The total token supply was 370 million MIR tokens. Mirror Protocol had a restricted supply of MIR coins. The finite supply acts to prevent inflation and devaluation of MIR tokens. The distribution went as follows:

- 16.7% for UNI airdrop

- 66.7% towards the Community Pool

- 16.7% for the Luna staking airdrop

MIR price and price prediction

Though the protocol has ceased operations, one unit of MIR costs less than a dollar. It has decreased in price significantly since the Band Protocol ceased price feed services for the protocol. It is safe to say that the price performance does not inspire confidence for potential investors.

Will Mirror Protocol change crypto finances?

Mirroring of stocks through synthetic assets is an interesting prospect for the crypto world. As has been stated before, this made Mirror a crypto-rival to platforms like Robinhood. Although the protocol has ceased all operations, the concepts that the protocol revolutionalized may still have potential.

Frequently asked questions

What is the Mirror Protocol?

Is Mirror Protocol a good investment?

Can you mine the Mirror Protocol (MIR)?

What Oracle does Mirror Protocol use?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.