What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade crypto. There are two main types of exchanges: centralized (CEX) and decentralized (DEX). They differ in that centralized exchanges act as intermediaries, holding users’ funds and transactions, while decentralized exchanges allow users to trade directly from their wallets, without an intermediary.

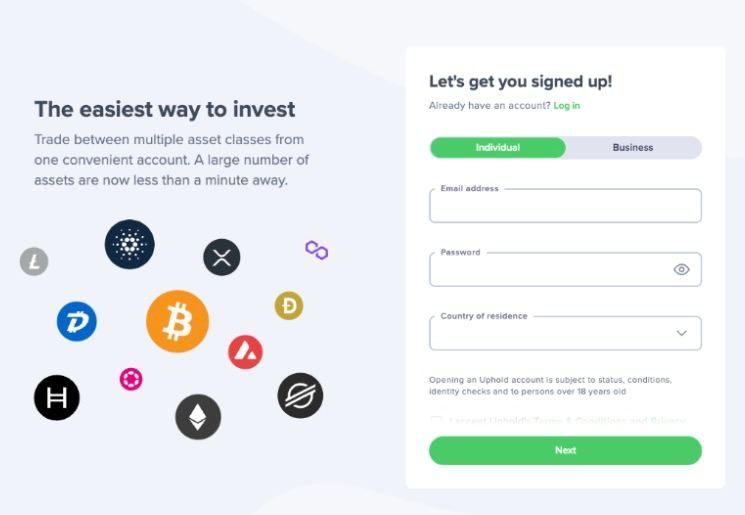

Today, cryptocurrency exchanges offer not only trading tools but also features like staking, lending, and yield farming, allowing users to earn crypto in various ways. For beginners, centralized exchanges are ideal. They offer a simple interface, high liquidity, and strong security, eliminating the need to manage private wallet keys independently, as with DEXs.

How to Choose an Exchange and Apps

Before selecting a cryptocurrency exchange, it’s important to carefully evaluate the platform to ensure it aligns with your trading goals and preferences. Here are 6 key factors to pay attention to:

- Security: The platform should ensure strong asset and data protection, including two-factor authentication (2FA), anti-phishing protection and regular security audits.

- Goals: Although most exchanges offer the necessary tools, some may have advantages on specific platforms, and you should define your trading goals. For example, low fees and high leverage are better suited for short-term traders. If you prefer automated trading, look for exchanges with a wide range of trading bot features.

- Customer support: Reliable customer support is crucial, especially when you’re new to trading. Check if the platform offers 24/7 support and multiple contact methods like live chat, email, and phone.

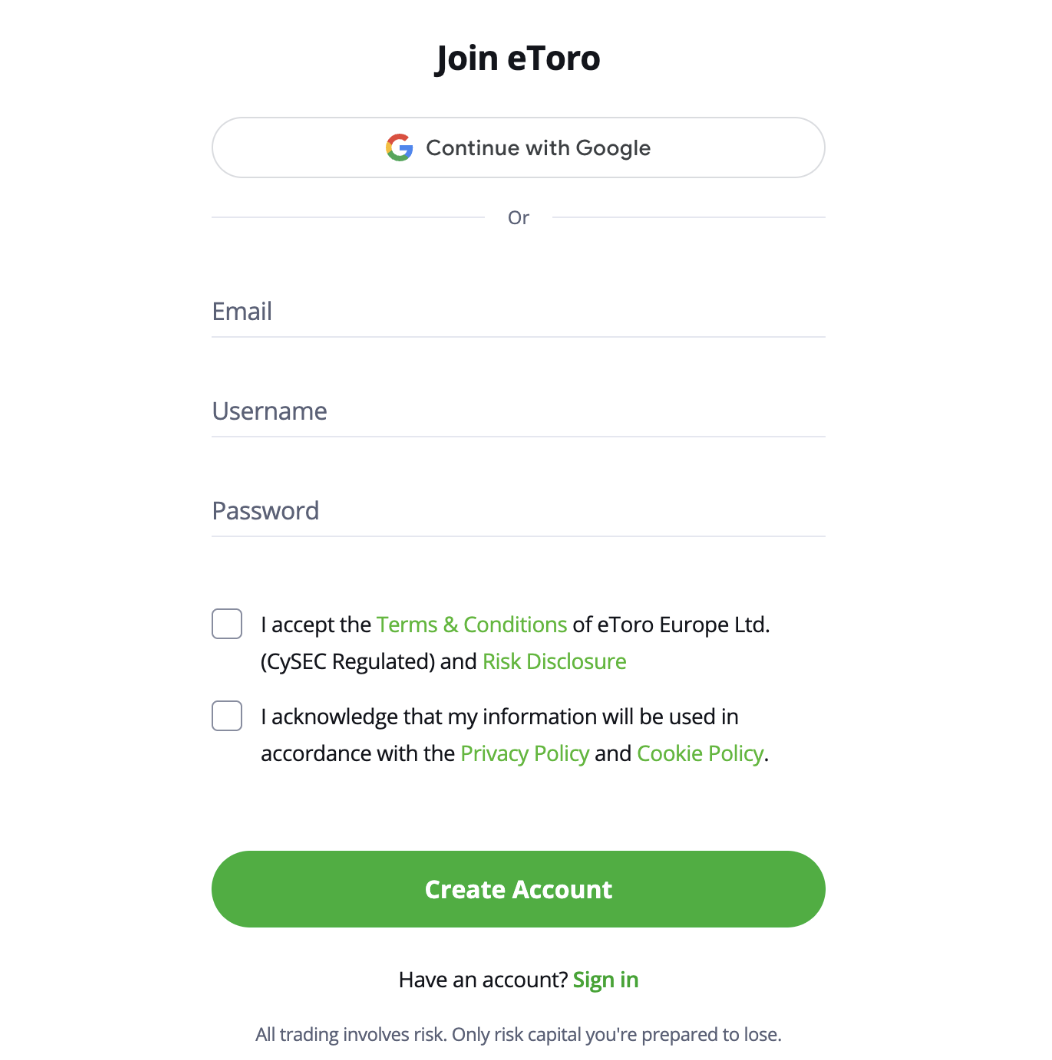

- Ease of use: A crypto exchange should have an intuitive interface that makes it easy for new users to navigate. Look for platforms that offer educational resources and guides specifically tailored for beginners.

- Fees, trading pairs & payment options: Consider the range of cryptocurrencies supported by the exchange and compare the trading fees across platforms. Also, evaluate the deposit and withdrawal methods to ensure they align with your preferred payment options.

- Regulatory compliance: Check that the exchange complies with local regulations and has a transparent KYC process for added security and legal protection.

Conclusion

Choosing a cryptocurrency exchange is an important step and a key consideration for any trader, whether a beginner or experienced. If you are a beginner, the focus should be on the simplicity of the interface, security, and active support. For more experienced traders, the key criteria might be more specific, such as the availability of advanced trading tools, fee structures, or the range of supported assets.

By following the guidance provided in this article, you can easily select one or more exchanges that will allow you to start trading crypto in 2025 with simplicity, security, and confidence.

BeInCrypto Bonus Hunter | All-in-One Crypto Rewards Hub

Here you can find all Crypto Airdrops from various crypto exchanges: Use this link

Frequently asked questions

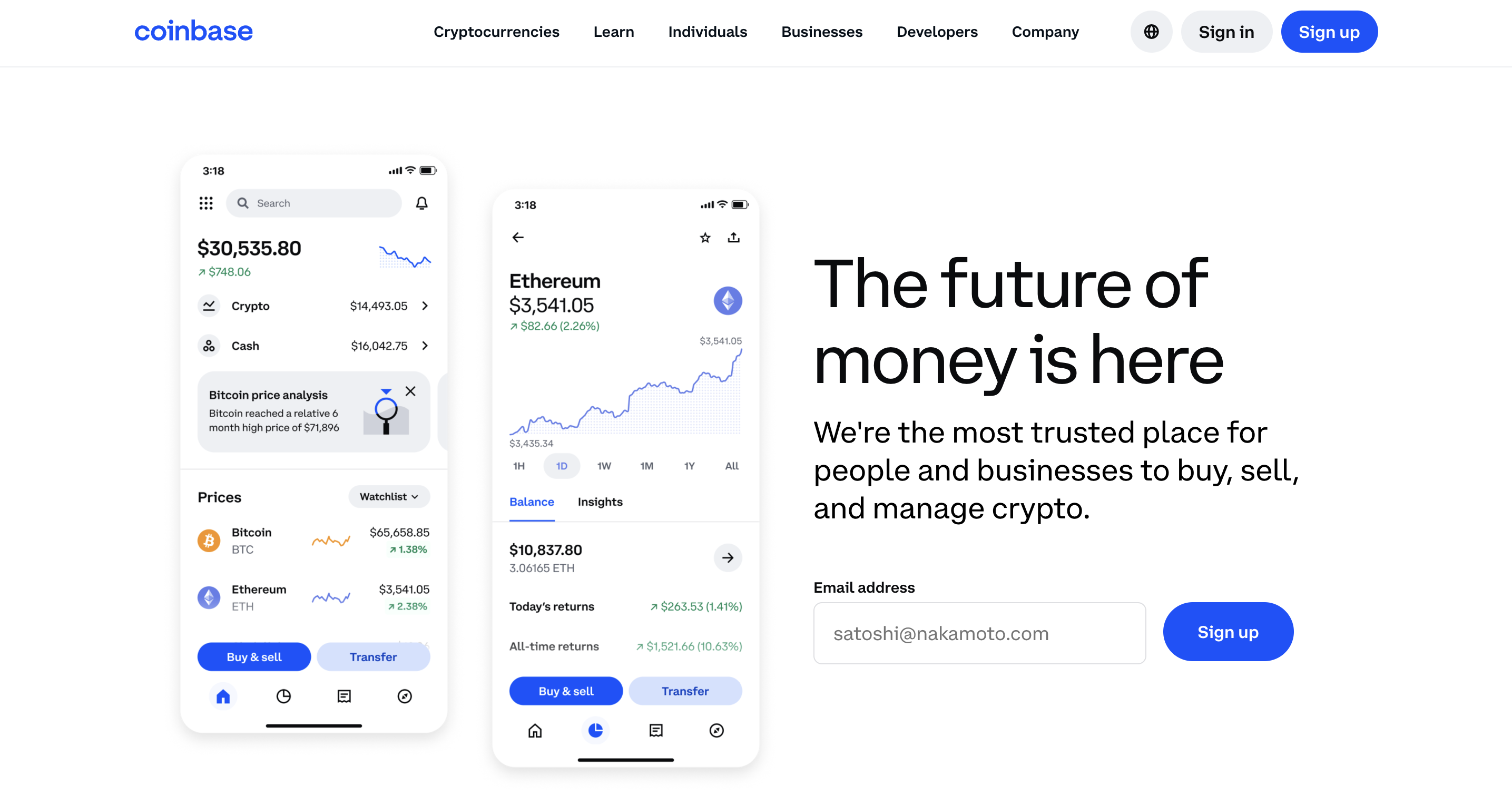

Coinbase is often considered one of the easiest crypto exchanges to use, especially for beginners. It has a user-friendly interface and offers a wide range of educational resources.

The most popular crypto is Bitcoin (BTC) due to its highest market capitalization and level of decentralization.

Beginners need cryptocurrencies and markets with the lowest risks. Bitcoin (BTC) and Ethereum (ETH) are among the best choices, as these assets are highly liquid and well-capitalized.

Exchanges from our Top Picks have competitive fees, but MEXC offers the lowest fees, with 0% for makers and 0.02% for takers.

KYC (Know Your Customer) is the process of verifying a user’s identity through their documents to comply with regulations and enhance security on crypto exchanges.

Certain cryptocurrency exchanges, such as BYDFi, do not require users to complete KYC verification.

Today, there are virtually no minimum limits for buying cryptocurrency—you can start with just $5–$10

Centralized exchanges (CEX) are managed by a central authority, offering higher liquidity but requiring KYC. Decentralized exchanges (DEX) allow users to trade directly through their wallets, providing more privacy and security but with lower liquidity