If you want to buy Uniswap (UNI), you should first understand its utility as a decentralized blockchain project. Unlike some of the other prominent names in the cryptocurrency space, like Ethereum, Cardano, and Solana — which have multiple use cases — Uniswap is primarily a DeFi-focused project. Built on Ethereum, Uniswap revolutionizes the world of crypto liquidity and trading.

But the question is, if Uniswap is such an impactful DeFi product — does it make sense to buy its native token, UNI? Here’s what you need to know.

Buy uniswap (UNI) with few clicks on secure platform

YouHodler

Best for free BTC cloud mining

OKX

Best for mystery box offerCoinbase

Best for beginners

Methodology for choosing the platforms to purchase UNI

We carried out an extensive six-month testing period to identify the leading platforms for buying Uniswap. Our approach was thorough, focusing on several crucial aspects:

Features

• OKX: Spot trading, derivatives, trading bots, earn features, copy trading, peer to peer (p2p) trading, mobile app, platform token and blockchain.

• Binance: NFT trading, spot trading, derivatives, trading bots, earn features, copy trading, peer to peer (p2p) trading, mobile app, platform token, wallet and blockchain, staking, and cloud mining.

• Kucoin: NFTs, spot trading, derivatives, trading bots, staking, copy trading, peer to peer (p2p) trading, mobile app, platform token, wallet and blockchain, staking, and lending.

Regulation

• Kraken: Has secured a significant number of regulatory licenses, including a U.S. state-by-state money transmitter license and the coveted BitLicense from the New York State Department of Financial Services,

• Coinbase: one of the first platforms to receive the BitLicense from the New York State Department of Financial Services, and it holds licenses to operate as a money transmitter in numerous U.S. states. It also has a broker-dealer license regulated by the Financial Industry Regulatory Authority (FINRA)

• eToro: Regulated by financial authorities in multiple jurisdictions, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). It also holds money transmitter licenses and a broker-dealer license, among other U.S. licenses.

YouHodler: YouHodler’s assets are securely custodied by Ledger Vault, which is known for its robust security infrastructure, including a substantial security fund of approximately $150 million to further safeguard assets.

This approach steers individuals toward platforms that excel in providing a secure, affordable, and user-friendly setting for cryptocurrency dealings. Prioritizing aspects such as security, custody, pricing structure, fiat liquidity, user interface, adherence to regulations, trading fees, and the range of available digital currencies is essential for a reliable platform.

Learn more about BeInCrypto’s methodology verification here.

- Methodology for choosing the platforms to purchase UNI

- Unpacking Uniswap

- How to use Uniswap

- Which chains is Uniswap on?

- Comparing Uniswap with others

- The Uniswap ecosystem

- Which wallets work with uniswap?

- Where to buy uniswap

- How to buy uniswap

- How to sell uniswap?

- Uniswap price prediction

- What makes uniswap stand out?

- Frequently asked questions

Unpacking Uniswap

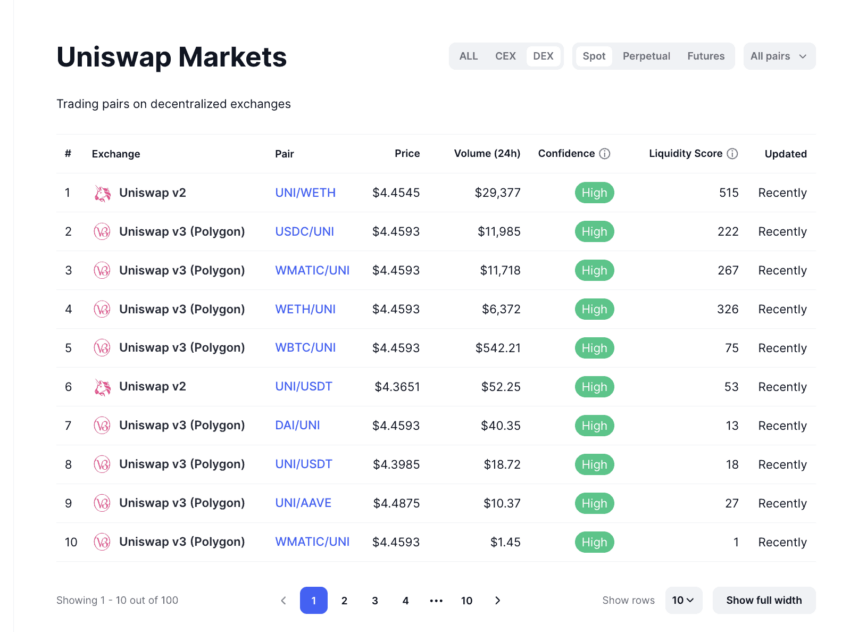

Uniswap is a DEX (decentralized exchange) on top of the Ethereum blockchain. While traditional exchanges rely on order books, Uniswap uses the concept of AMM or Automated Market Makers to ensure buyers and sellers can interact and trade directly.

Its native token, UNI, handles the ecosystem governance. This ERC-20 token acts as the liquidity provisioning reward. Plus, you can use the same to vote on fee switches. The handling of Uniswap treasury is also open for discussion if you hold UNI.

Did you know? The concept of Uniswap was ideated by Hayden Adams. Also, the initial name chosen for this DEX was Unipeg, which was later changed to Uniswap on Vitalik Buterin’s suggestion.

How to use Uniswap

Uniswap Labs is the driving body behind the Uniswap DeFi protocol. Despite this, it is completely decentralized and works independently of Uniswap Labs. Learning how to use Uniswap is key, as things can get tricky and complex in DeFi.

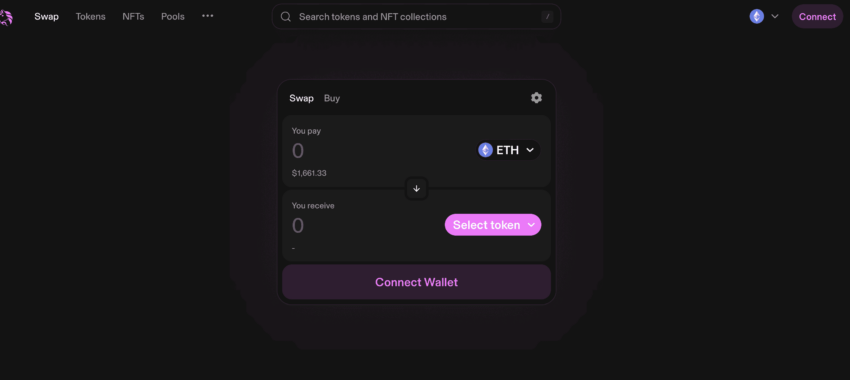

How to token swap and provide liquidity with Uniswap

When using Uniswap to token swap, the user planning to swap, for example, USDT for ETH, only interacts with the smart contract — and not any other individual. The process, therefore, is secure and trustless. From the latest memecoin to sentiment-driven tokens, Uniswap lists almost every ERC-20 offering there is. For instance, before PEPE was even listed on Binance, it was available on Uniswap.

But then, as any token can be listed, you should be mindful of crypto scams and other risks.

Yes, [the] crypto industry has too many scammers. But have you looked at [everywhere else]

Hayden Adams, inventor of Uniswap: Twitter

As for liquidity provisioning, you can deposit tokens equivalent to the value of two ERC-20 tokens — a pair that makes the pool. The Uniswap protocol ensures that you earn liquidity pool or LP rewards, in addition to a portion of Uniswap trading fees, whenever that pool is used for trading the concerned tokens.

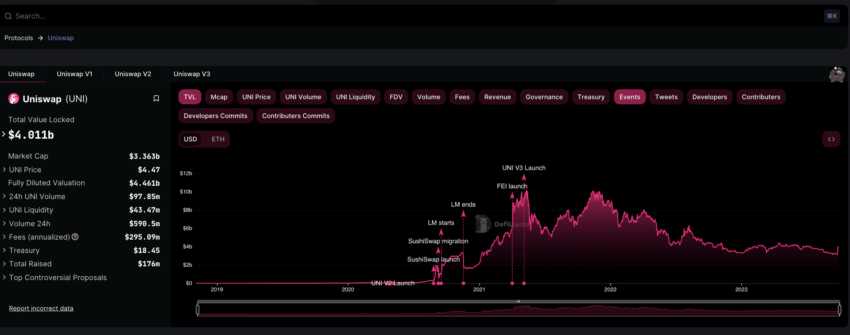

To date, three Uniswap versions — V1, V2, and V3 have been launched, with V3 offering liquidity provider efficiency via the AMM approach. All these factors can serve as reasons for you to set aside some sum to buy Uniswap (UNI).

Also, Uniswap mining isn’t supported, but you can use UNI tokens for staking, earning additional rewards, and doing more with your holdings.

Which chains is Uniswap on?

Uniswap started on Ethereum and since then has moved to seven more chains. These include the reputed Ethereum layer-2 scaling solutions like Polygon, Optimism, and Arbitrum, followed by BSC, Celo, Avalanche, and the newest — Base.

Comparing Uniswap with others

Uniswap is one of the more popular DeFi protocols around. Let’s see how it compares against similar projects.

Uniswap vs. Pancakeswap

While a host of differences exist between these two protocols, the most obvious one is their origin. While Uniswap is built on top of Ethereum, with UNI being an ERC-20 token, Pancakeswap is Binance Smart Chain based. Its native token, CAKE, adheres to the BEP-20 standards.

Uniswap vs. SushiSwap

SushiSwap started as a Uniswap fork but soon carved a niche of its own. The former brings forth the concept of additional rewards and now has a presence across 28 chains as compared to Uniswap’s eight.

/Related

More ArticlesThe Uniswap ecosystem

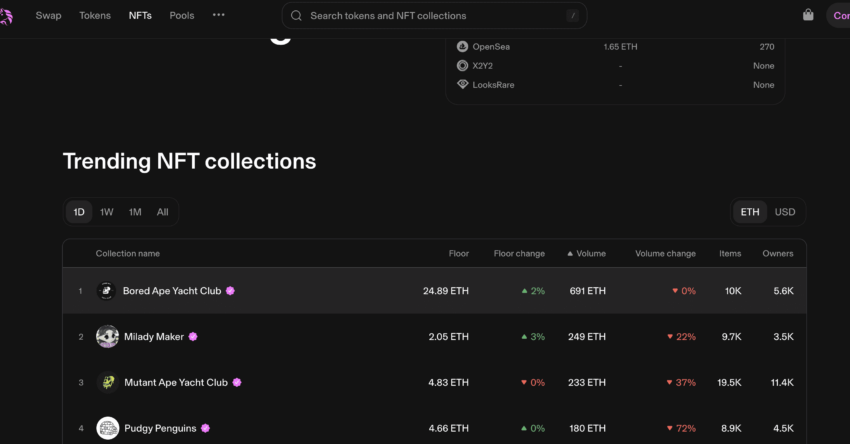

For those interested in exploring the Uniswap ecosystem further, understand that this protocol comprises smart contracts, pools, LP tokens, difference versions, and the built-in Uniswap protocol to handle swaps and other use cases. The Uniswap interface also brings forth an NFT marketplace, listing some of the biggest names in the space, including BAYC, Pudgy Penguins, and more.

Which wallets work with uniswap?

Uniswap sits atop Ethereum. Therefore, storing or staking UNI requires an Ethereum-compatible wallet. Some of the best options include MetaMask, Ledger Nano X, or even the Trust Wallet. Or, you can simply opt for the mobile-based Uniswap wallet.

Where to buy uniswap

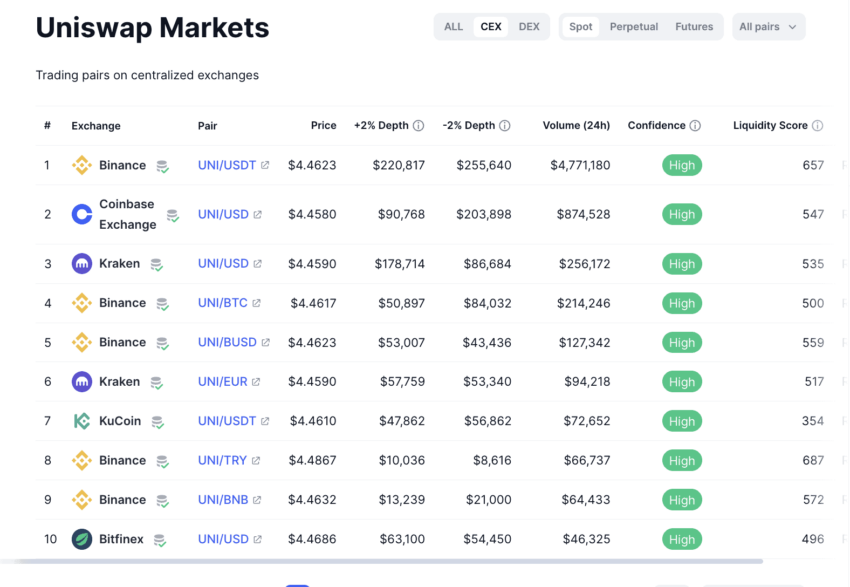

Here are our top centralized picks if you are looking to buy UNI:

Binance

We were particularly impressed by Binance’s Liquidity Swap feature, which aligns neatly with Uniswap’s ethos of facilitating liquidity pools and swaps. Execution speeds were decent, even during high volatility. Active UNI traders who utilize advanced strategies benefit from Binance’s robust feature suite and deep liquidity. Margin, futures, and options trading enable seasoned traders to implement complex risk management and speculative strategies.

Coinbase

Our experience buying Uniswap (UNI) on Coinbase has shown it to be well-suited for U.S. cryptocurrency traders, owing to its user-friendly interface, robust security measures, and strong liquidity for UNI. The exchange’s intuitive layout and educational resources make it ideal for beginners. More advanced traders can utilize Coinbase Pro for lower fees, detailed charts, and more sophisticated trading tools. Coinbase’s periodic learning rewards campaigns, including UNI quizzes and giveaways, provide added incentives to deepen one’s knowledge while earning crypto.

Kraken

Buying UNI on Kraken demonstrated the platform’s institutional-grade capabilities for advanced trading. Kraken’s range of order types, detailed charting tools, and reporting features provide active UNI traders with the functionality they need to implement trading plans effectively. Portfolio automation and tracking tools simplify complex tax accounting considerations. Kraken’s security-first approach gives us confidence in the platform’s ability to safeguard our funds. The deep liquidity pools facilitate seamless order execution, even for large block trades.

Kucoin

KuCoin has proven itself as a hub for accessing a diverse market for UNI trading and investments. The multitude of available UNI pairs, along with features like margin and crypto futures trading, provides seasoned traders with plenty of options to execute strategies. We also found value in KuCoin’s native KCS token rewards system that incentivizes using the platform. The discounted trading fees and other perks available when holding KCS alongside UNI provide a unique opportunity to reduce costs and maximize earnings potential from UNI trading.

eToro

Our experience buying UNI on eToro provided a social dimension that differentiates it from other platforms. Following and automatically copying successful UNI traders provided valuable insights into effective trading strategies. The platform’s Transaction Feed and comprehensive trader stats enabled us to make informed decisions about who to follow and mimic. While eToro caters more to passive investors, active traders can also execute manual trades with competitive spreads.

All of the platforms mentioned are reliable and well-established platforms in the crypto space. These exchanges have the best liquidity to offer for select trading pairs. The chosen CEXs have a widespread global reach, prioritizing customer security and protection. While no cryptocurrency transaction can be entirely risk-free, opting for one of these reputable options is smart if you’re looking to buy on a CEX.

And if you are unsure as to how to buy uniswap on a decentralized exchange, Uniswap itself is the most obvious place to head. You can access the DEX on any chain of your choice and swap any token for UNI.

How to buy uniswap

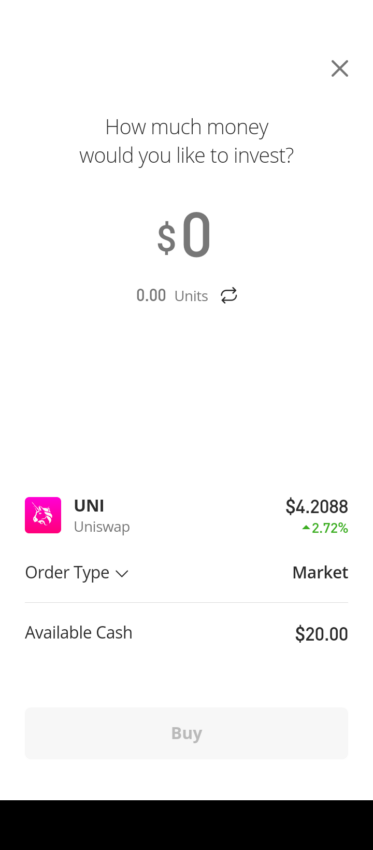

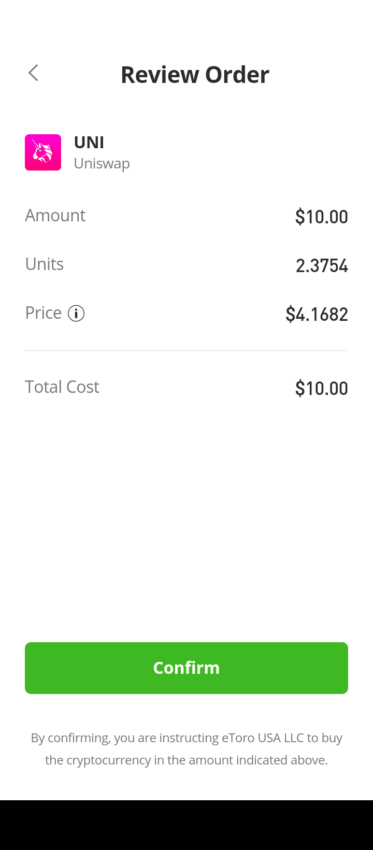

Here’s how to buy UNI on eToro, a leading broker that supports both crypto and other, more traditional assets.

1. Open the eToro app and select “Discover.” In the search bar, select Uniswap.

2. After you select Uniswap, select “Trade,” enter the amount you would like to purchase, and press “Buy.”

3. Lastly, press “Confirm” to finish your purchase.

How to sell uniswap?

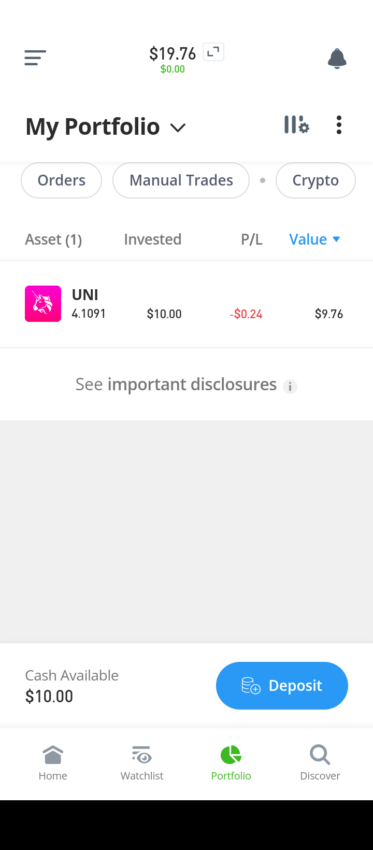

1. Open the eToro app and press “Portfolio” at the bottom of the screen.

2. Select “Uniswap” and enter the amount you want to sell.

3. Lastly, press the red button to complete your sell order.

To sell uniswap on a CEX, you simply need to hit “sell” and offload the UNI token holdings. If you hold UNI on an external wallet, you might have to deposit the same to the exchange to sell, paying the required amount of gas fees.

Uniswap price prediction

If you are interested in either trading or buying and holding uniswap, you might want to refer to our uniswap price prediction. Our detailed analysis expects the price of UNI to cross $100 by 2028. However, discretion is advised while referring to any prediction. The crypto market is volatile, and future prices can depend on a number of variables.

What makes uniswap stand out?

Uniswap, the exchange, lets you trade crypto anonymously. Plus, any Ethereum-compatible wallet works for storing UNI. Finally, while Uniswap mining isn’t supported, Uniswap lets you stake its native UNI crypto for additional profits, making this crypto an all-inclusive option for the crypto-curious.

Frequently asked questions

Where can I buy uniswap?

Can I buy directly from Uniswap?

Is uniswap worth buying?

How do I buy uniswap on Binance?

Can I buy on uniswap with BNB?

Can you transfer from Binance to uniswap?

Can you buy any tokens on Uniswap?

Why are Uniswap fees so high?

Do you need KYC for Uniswap?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.