UNI, the native token of Uniswap, peaked at $7.37 in 2023, in line with our Uniswap price prediction levels. The popular DeFi protocol is built on Ethereum, supports token swaps, and even works as an automated market marker, offering liquidity to decentralized exchanges. While the project itself is bursting with top-notch fundamentals, the Uniswap price forecast for 2024 and beyond will focus on the future and price of Uniswap (UNI) via tokenomics, technical analysis, and other insights.

Want to get UNI price prediction weekly? Join BeInCrypto Trading Community on Telegram: read UNI price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders!

- Uniswap price forecast and the role of fundamentals

- Uniswap’s DeFi presence and the price forecast

- UniSwap price prediction and the associated tokenomics

- Key metrics that might have an impact on the Uniswap price prediction

- Uniswap price prediction and technical analysis

- Uniswap (UNI) price prediction 2023

- Uniswap (UNI) price prediction 2024

- Uniswap (UNI) price prediction 2025

- Uniswap (UNI) price prediction 2030

- Uniswap (UNI’s) long-term price prediction until the year 2035

- Is the Uniswap price prediction theory accurate?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Uniswap Price Prediction tool.

Uniswap price forecast and the role of fundamentals

Uniswap enables users to engage in trading, join liquidity pools, swap tokens, and much more, all without the need for centralized oversight.

The protocol is also a decentralized exchange (DEX) that allows users to trade algorithmically using bots and build cross-chain bridges with other blockchains and ecosystems. It also works as a foundation for other DeFi products like yield farms and staking.

UNI, the native token, works as a governance token, giving rights to the holders in regard to voting on decision changes. As a DeFi protocol, decision-making holds weight, courtesy of supposed upgrades, fee structure changes, and token integrations. But that’s not all holders can do with their UNI. The tokens can also earn passive income for the stakers, provided they use the right liquidity pools.

Here are some other interesting facts about Uniswap:

- Low entry barrier

- Regular protocol developments

- The AMM model supports instant trades without the order book shenanigans.

- Helps create DeFi aggregators, monitoring tools, and other impactful web3 projects on top of the base layer.

- Recorded an all-time high trading volume in October 2023 — reaching $100 billion for the first time.

- Expanded reach to Rootstock — a Bitcoin sidechain

Did you know? In Q2, 2023, Uniswap recorded over 66% spot trading volume among all DEXs, making it a market leader in the decentralized exchange space.

Uniswap’s DeFi presence and the price forecast

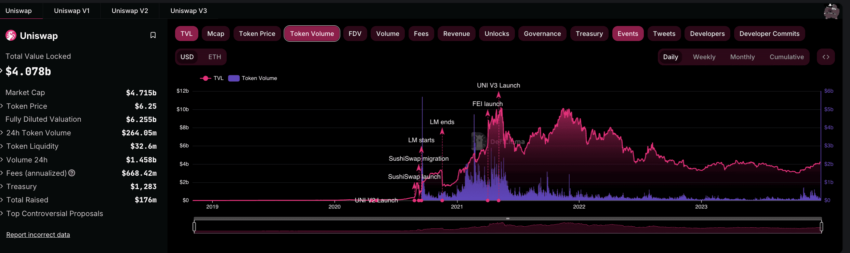

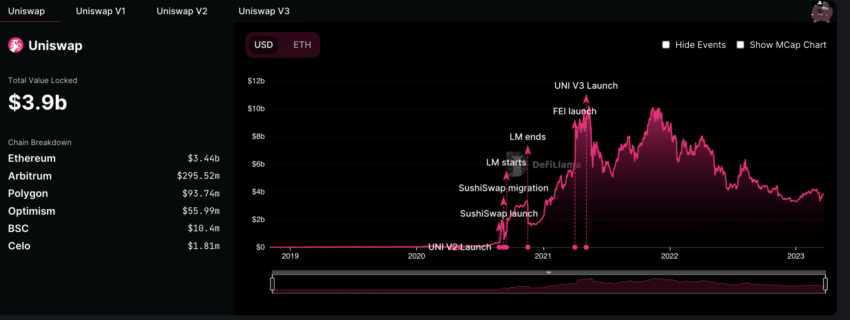

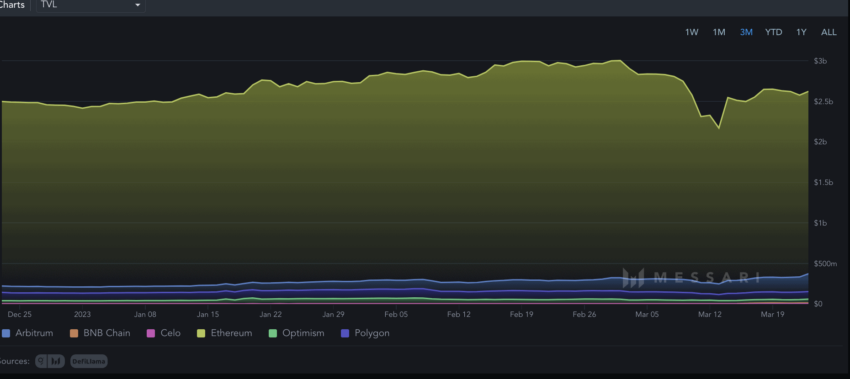

Yes, Uniswap started on the Ethereum blockchain, but as of March 24, 2023, it had a TVL worth $3.9 billion, locked across six chains — Ethereum, Arbitrum, Polygon, Binance Smart Chain, Celo, and Optimism.

By December 2023, it will be spread across 12 chains and will also see a minor TVL uptick, which might be a good sign for its native UNI token.

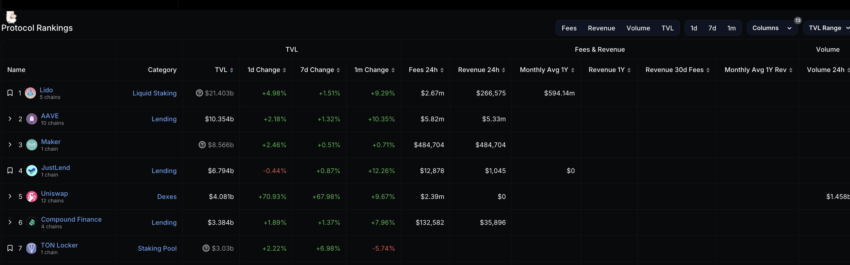

Uniswap ranks 5th regarding DeFi protocols listed by TVL, showing a net positive change of 9.67% over the past 30 days.

“UniSwap at its peak had a market cap of 22.5Bn$. BYJU’s is valued at ~21Bn. Just for context: UniSwap was founded 3 years ago. DeFi firms like UniSwap are killing margins for CeFi. And, that is why DeFi has revolutionary potential.”

Akshat Shrivastava, Founder of Wisdom Hatch: X

But that’s not the only reason why there is optimism around Uniswap’s (UNI) price prediction. Uniswap fares better than some of its immediate competitors like SushiSwap (in terms of popularity), PancakeSwap (in terms of Ethereum’s user base as PancakeSwap is a BSC original), Curve Finance (in terms of supported token types), and more.

However, for the Uniswap price forecast to further improve, it needs to expand its TVL and reach. With Avalanche bringing Uniswap V3 to its network and LuxWorld announcing its Uniswap foray, things might look more optimistic in the short term.

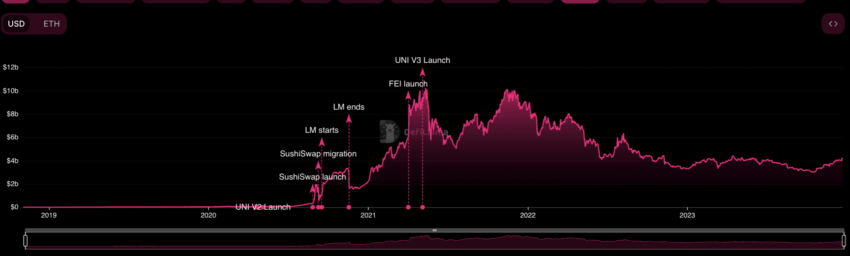

Note: The price of Uniswap reached an all-time high of $44.97 immediately following the rise of Uniswap V3 — a protocol version with a better focus on liquidity and trade execution — in May 2021.

This shows which aspects of DeFi and AMMs are more popular with the users. Also, 2021 was the year when the crypto market was bullish. It will be interesting to see what happens to Uniswap’s price once the next bull run shows up, expectedly in 2024.

UniSwap price prediction and the associated tokenomics

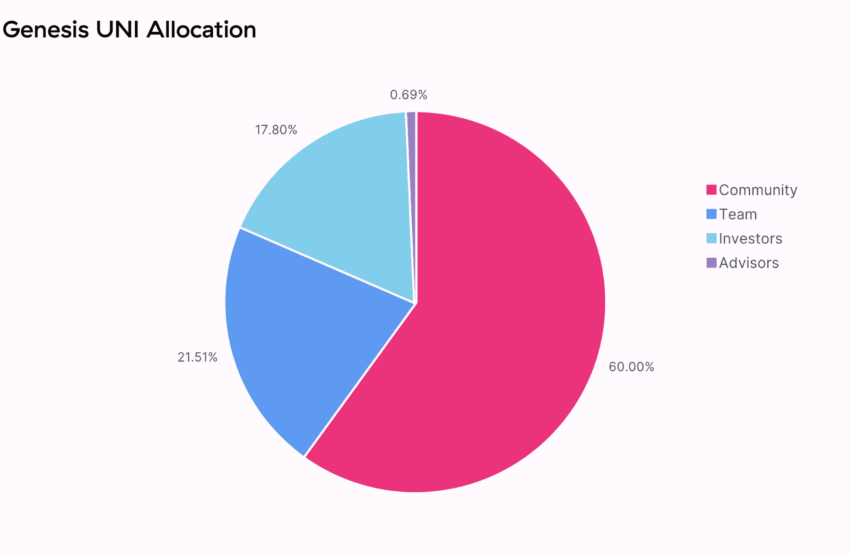

The initial token allocation saw 60% of the UNI tokens moving to the community and 18% moving to the investors. Also, the total supply till 2024 is capped at 1 billion. Once the entire supply gets vested, there will be a perpetual inflation of 2% each year to keep the network sustainability, participation incentives, and the extent of decentralization intact.

Here is what the initial token distribution breakup looked like:

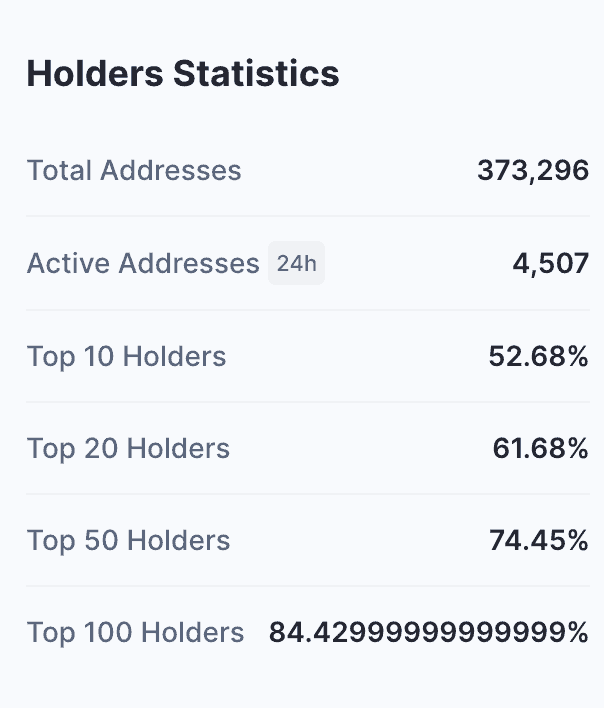

Moving to the token-holding statistics, the top 100 UNI holders, as of March 2023, managed almost 84.43% of the total supply. Also, if you go by the current market cap, 59.82 of the total supply cap — 1 billion — is in circulation.

The perpetual inflation and the concentrated token-holding practices might not be the best pieces of news for the long-term price of Uniswap. They aren’t all that bad, either. However, an increasing trading volume over time can offset some of these effects.

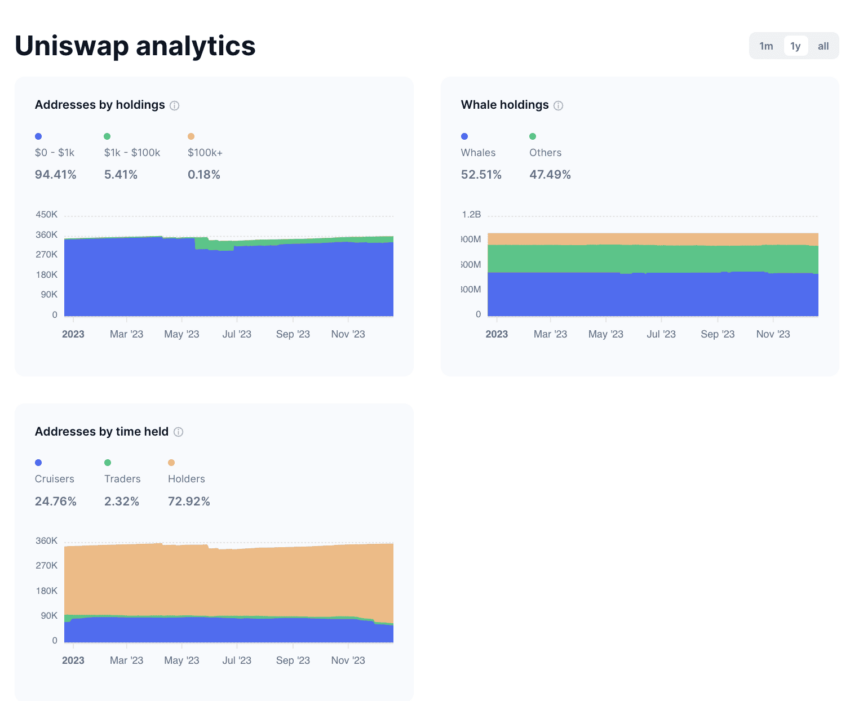

Also, per Uniswap analytics, almost 73% of UNI players are holders who seem to be optimistic about the price action.

Key metrics that might have an impact on the Uniswap price prediction

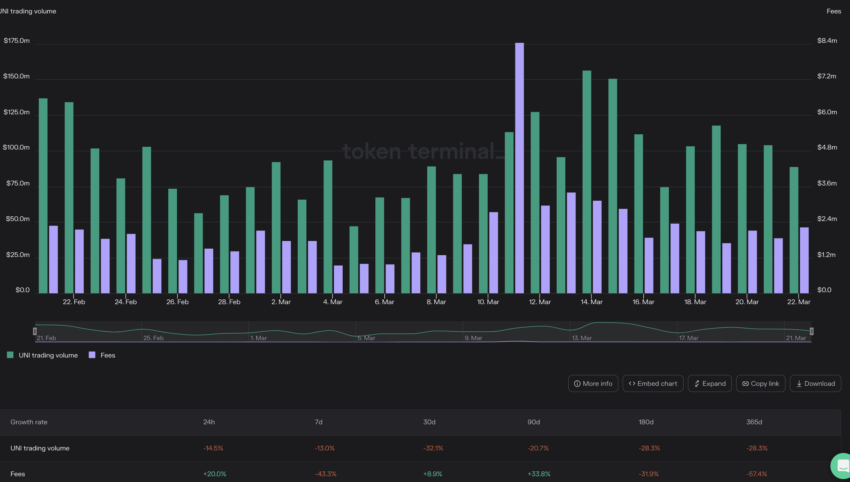

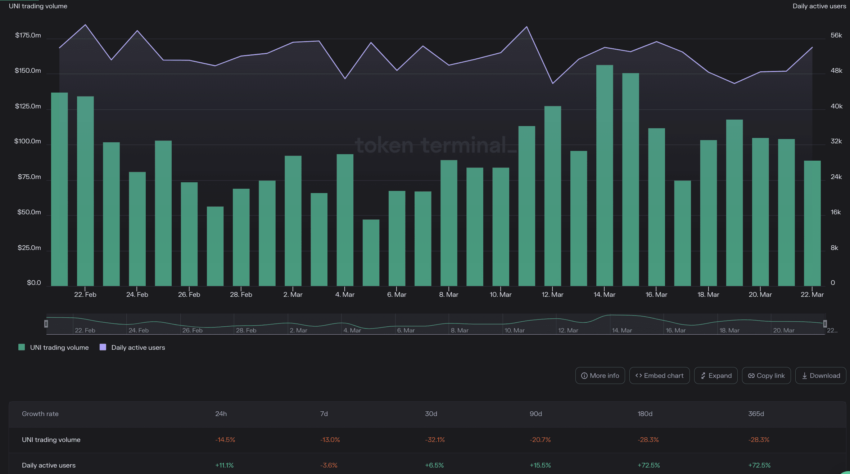

The 30-day trading volume of Uniswap has dipped 32%, which isn’t a great sign for the project. Yet, despite the drop, the green (trading volume) pillars in March 2023 were higher than in February 2023.

On the contrary, trading fees, or rather, network fees, have surged close to 9% month-on-month in early 2023, showing that participants are willing to pay more for network activity.

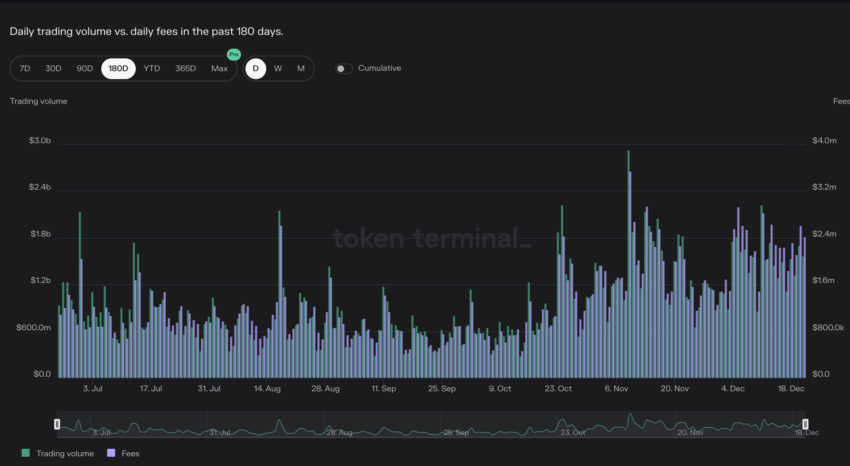

As we approach the end of 2023, the trading volume and fees have started surging, hinting at growing adoption.

Daily active users have grown by 6.5% over the past 30 days in March and even in December 2023, per the charts below. This might hint at the growing popularity of the Uniswap ecosystem and its wide range of offerings.

The TVL activity over the past 90 days showed a spike around March 1, 2023. Even though a significant dip surfaced around March 13, 2023, things have been moving rather well since then.

Do note that a majority of the TVL activity concerns the Ethereum blockchain. Uniswap’s TVL on Arbitrum is also growing but is still far off from its exposure to Ethereum.

As of December 2023, the TVL appreciation has slowed down a bit but there is a slight uptick now that the year is ending and people are putting more money into the DeFi space.

Overall, the metrics look well-placed in the short-to-mid-term. Also, with the Ethereum Shanghai Upgrade unlocking a lot of ETH and the Arbitrum airdrop claims speeding up by the hour, we might see a trading volume surge citing new liquidity mining gigs.

Uniswap price prediction and technical analysis

Before locating the long-term Uniswap (UNI) price predictions, it is important to look at the short-term prognosis.

Our early 2023 analysis

Remember how we projected $7.53 as the crucial resistance for UNI? It failed to break the same; therefore, the high was bottlenecked at $7.37. Here is what our analysis comprised:

Notice how UNI is trading inside the wedge pattern, with previous attempts made at breaching past the upper trendline. The immediate resistance is placed at $6.92, but only a breach past the $7.53 mark can send the Uniswap price forecast toward $10.

Yet, the moving average crossover between the 100-day moving average and the 200-day moving average might decide the next leg of Uniswap price prediction. If the 100-day MA moves higher than the 200-day MA, we can expect the prices to surge and UNI to move toward the upper trendline.

Our December 2023 analysis

UNI is currently trading inside an ascending wedge, with the pattern threatening a breach under the lower trendline. And the lack of those green volume pillars isn’t helping either. At present, the $5.6 level is working as a strong support line.

However, a breach past the $7.2 level mark and then the previously analyzed resistance of $7.53 can push UNI towards new highs.

With the short-term analysis sorted, let us move to the weekly chart to ascertain the long-term Uniswap price predictions.

Please note that although the 2023 price prediction was only partially accurate due to unpredictable DeFi adoption and other fundamental factors, the long-term price trajectory remains valid.

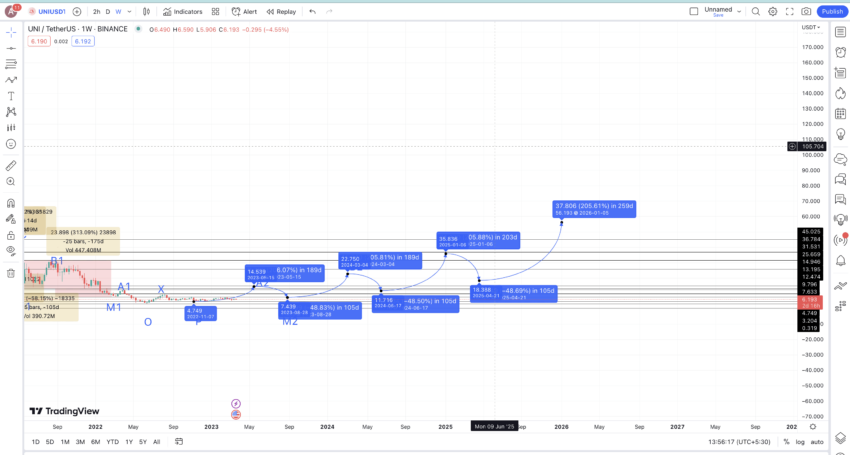

Pattern prediction

The unmarked weekly chart illustrates a clear pattern. Notice how UNI started making higher highs, only to make a few lower highs before going rangebound. Yet, the pattern might break as a higher high might be on the cards, courtesy of the RSI divergence — marked using black lines.

Therefore, once we start predicting the long-term prices, our next stop could be to look for a higher high — something that even the weekly price chart indicates.

Let us now mark the lows and highs on the chart to secure data points.

Note: There can be several other highs and lows on the chart, but we have marked only a handful to make the analysis easier to understand.

Price changes

Assuming that the pattern changes and we can locate a new high or the start of a new pattern (A2), we need to locate the next high from the last low of P.

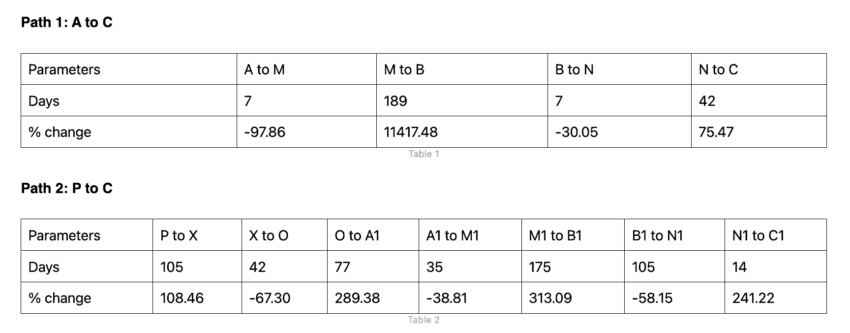

Paths A to C and P to C look like mirror images, courtesy of the foldback pattern. So we can now locate the price change percentages and distances between every point from A to C and P to C.

We can now utilize the values from the negative and non-negative columns to ascertain the average high-to-low and low-to-high price percentages. We can disregard the A to M and M to B price percentages, as the 97.86% drop and the 11417.48% gain are not realistic in the current market conditions.

The high-to-low average is calculated at 48.58%, with the time taken for this change varying from 7 to 105 days. On the other hand, the low-to-high average stands at 205.52%, with its timeframe ranging from 14 to 189 days.

Having gathered these preliminary details, we can now start identifying the minimum and maximum price points spanning from 2023 to 2030 and possibly beyond.

Uniswap (UNI) price prediction 2023

Despite the predicted $14.54 price level, UNI could only manage half—flatlining at $7.37. However, we can still use the same bit of analysis for 2024, considering the fact that UNI first needs to breach the important resistance of $7.53. Here is what our detailed 2023 analysis read like:

Assuming that the Uniswap price forecast pattern might change, courtesy of the bullish weekly divergence, the next high or A2 could surface at $14.54 somewhere in May 2023. The timeline can vary depending on the conditions of the broader crypto market and other macroeconomic factors. The expected growth considers the low-to-high average price percentage point from above.

Do note that our earlier technical analysis suggested a bullish Uniswap level of $15 or higher in 2023.

Coming to the Uniswap price prediction low in 2023, the drop from the projected high of $14.54 can be as deep as $7.44 — using the average drop percentage of 48.58%. We have taken the timeframe as 105 days, the maximum projected timeline for the drop.

This means the price of Uniswap in 2023 already touched its lowest level of almost $5.25 in early 2023. The massive Whale-based dumping pushed the prices to a new low — $3.88 in 2023.

Uniswap (UNI) price prediction 2024

Outlook: Bullish

Now that we have the 2023 low (the second one) at $7.44, we can again use the low-to-high average to project the next high or B2. Consequently, this level surfaces at $22.75 and in early 2024. Therefore, the Uniswap price prediction high for 2024 might surface at $22.75.

Note: This prediction keeps the optimistic bull market factors into consideration.

However, based on the 2023 levels, UNI should first look to reach $14.54 in 2024. The low for 2024, for the high to form, should settle at $7.53 — with the resistance becoming support.

Projected ROI from the current level: 264% max

Uniswap (UNI) price prediction 2025

Outlook: Bullish

The next low, or N2, using the high-to-low average of 48.58%, puts 2024 low or the minimum price in 2024 at $11.72. From this low, using the low-to-high average price percentage of 205.52%, the Uniswap (UNI) price prediction for 2025 surfaces at $35.836.

Note: While this level could surface in late 2024, we have pushed the maximum price prediction for UNI to 2025 for the sake of simplicity. From this high, or rather C2, the next low, or the low in 2025, could surface at $18.39.

Projected ROI from the current level: 474%

Uniswap (UNI) price prediction 2030

Outlook: Very bullish

The next level from the lows of 2025 could again follow the average growth percentage of 205.52%. Even though we might see this Uniswap price forecast level increase in 2025, the broader crypto market conditions might push this to 2026.

Hence, we can expect the Uniswap price prediction for 2026 to settle at a high of $56.19, higher than its current all-time high.

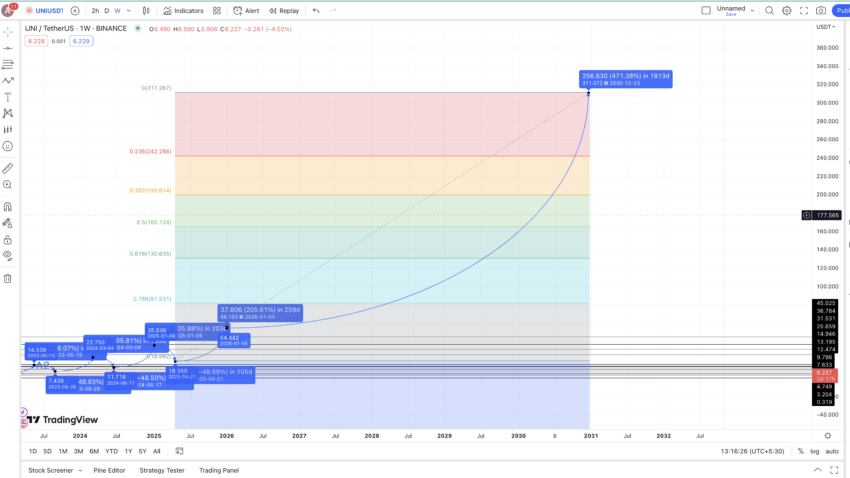

Now that we have 2025 low and 2026 high, we can extrapolate the data to locate the maximum price of Uniswap through 2030. This puts the Uniswap price prediction for 2030 at $311.072.

Projected ROI from the current level: 4885%

Uniswap (UNI’s) long-term price prediction until the year 2035

Outlook: Very bullish

Now that we have the Uniswap (UNI) price predictions till 2030, long-term holders might be interested in looking at the price forecasts till 2035. The table below maps out possible highs and lows.

You can easily convert your UNI to USD here

| Year | | Maximum price of UNI | | Minimum price of UNI |

| 2023 | $7.37 | $3.88 |

| 2024 | $14.54 to $22.75 | $7.53 to $11.72 |

| 2025 | $35.836 | $18.39 |

| 2026 | $56.19 | $34.84 |

| 2027 | $70.23 | $43.54 |

| 2028 | $115.89 | $71.83 |

| 2029 | $173.83 | $135.58 |

| 2030 | $311.07 | $192.86 |

| 2031 | $373.28 | $231.43 |

| 2032 | $503.93 | $393.06 |

| 2033 | $604.72 | $471.68 |

| 2034 | $755.90 | $589.60 |

| 2035 | $1133.86 | $884.41 |

Is the Uniswap price prediction theory accurate?

This Uniswap price prediction model considers both short-term and long-term technical analysis. It brings fundamentals, on-chain metrics, and token-holding statistics into play in order to form a holistic perspective on the future of UNI.

Yet, projected levels might vary depending on the sentiments surrounding the project and the state of the broader crypto market.

Frequently asked questions

What will Uniswap be worth in 2025?

Will Uniswap reach $1000?

Is Uniswap a stablecoin?

What will Uniswap be in 2030?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.