Trading can be difficult for both the inexperienced and experts alike. As a result, traders often need a helping hand to give them the extra edge they need to remain profitable. Artificial intelligence (AI) is one solution many use to strengthen their weak points. So, which tools can help optimize your performance and profits? This guide lists the best crypto AI trading apps in 2024.

Methodology

Our methodology for selecting the best crypto AI trading apps was thorough with product testing conducted over a six month process. Many platforms were considered; however, only the top apps were chosen. BeInCrypto considered:

- Availability

- Fees

- Features

- Exchange integration

- Supported assets

Here’s a quick description of our choices along with some of the reasons each app has been highlighted:

AlgosOne: AlgosOne is an AI-driven trading platform designed to democratize access to advanced trading algorithms for investors with a minimum investment. It uses sophisticated models to analyze market data and execute trades, aiming to enhance profitability and manage risk effectively.

Stoic: Stoic is an automated crypto trading bot that leverages AI to manage and trade cryptocurrencies efficiently. By connecting to users’ cryptocurrency exchange accounts, it applies advanced strategies to optimize portfolio performance with minimal user intervention.

Quadency: Quadency is a comprehensive platform that simplifies cryptocurrency trading and portfolio management. It offers a variety of automated trading bots, extensive charting tools, and integration with major exchanges, catering to both novice and experienced traders.

CryptoHero: CryptoHero is a cloud-based crypto trading bot platform that enables traders of all levels to automate their trading strategies across multiple exchanges. It focuses on user-friendliness and offers features like backtesting and a mobile app for trading on the go.

HaasOnline: HaasOnline is a sophisticated cryptocurrency trading platform known for its advanced automated trading bots and customizable trading algorithms. It caters to professional traders by providing detailed analytics, backtesting capabilities, and support for numerous cryptocurrencies and exchanges.

CryptoHopper: CryptoHopper is a cloud-based trading platform that allows for easy automation of trading strategies across various cryptocurrency exchanges. It offers a user-friendly interface, backtesting, market-making, and social trading features, making it suitable for beginners and seasoned traders alike.

To learn more about BeInCrypto’s verification methodology, follow this link.

What are crypto AI trading apps?

Crypto AI trading apps use AI technology to conduct trades on behalf of users. These apps are programmed to analyze market data, learn from trends and unsuccessful trading patterns, and execute trades based on predetermined criteria.

AI-driven trading, in contrast to conventional algorithms, can recognize patterns, anticipate future events, and learn from past market data. This capacity for adaptive learning enables traders to navigate volatile markets more skillfully.

In the hands of the right users, AI trading applications optimize strategies, enhance decision-making, and increase profitability by identifying opportunities that may not be apparent to the naked eye.

These apps can provide a more efficient and data-driven approach to trading in various financial markets by processing large amounts of data and adapting to real-time market fluctuations.

What are the best crypto AI trading apps?

AlgosOne

AlgosOne is an AI trading app designed to democratize access to advanced financial technologies for individuals with as little as $300 to invest. The process is super simple, allowing users to trade in one click. The app limits each trade to 5%-10% of the total balance to prevent liquidation and offers a reserve fund for additional protection.

The platform continuously enhances its capabilities by diversifying market data sources, thereby improving access to high-quality, real-time data. It also features advanced risk management tools to identify potential risks and detect high-probability trading opportunities with greater precision.

Moreover, AlgosOne introduces a unique reward system. Users can earn “Stars” by completing various tasks, such as making referrals, engaging with trade signals, and participating in social media activities. These Stars can be exchanged in the AlgosOne Marketplace for trading credits, level points, merchandise, votes, and more.

- Reduced signal window to an eight-hour period

- Enhanced risk management and a reserve fund

- User friendly interface and experience

- Users can now deposit in Solana

- Not available in the U.S.

- Early withdrawal penalty

CryptoHero

With CryptoHero, you can simply and affordably automate transactions from your phone. All levels of traders can use this cloud-based cryptocurrency trading bot platform. Coding knowledge is not required. Users can deploy trading bots in minutes and with a few clicks.

Trade well-known cryptocurrencies around-the-clock, such as Ethereum and Bitcoin. Users can automate and manage deals across several platforms by connecting their bots to popular Bitcoin exchanges. There is a free version available. For those who want more advanced capabilities, the premium version is simply $13.99 or $29.99 per month.

- Supports a free version with low fee for premium version

- Is available on both mobile and desktop apps

- 24/7 live customer support

- Web, mobile, Android, and iOS have separate payment methods for subscriptions

HaasOnline

HaasOnline is one of the oldest Bitcoin trading bots on the market. It supports a wide selection of cryptocurrency exchanges, allowing customers to trade across several platforms. You may construct bots without writing a single line of code by utilizing the platform’s drag and drop features.

HaasOnline’s pricing options cater to all levels of experience and budgets, with packages ranging from beginner to institutional. You may also use bots on its cloud server or use its own scripting language, HaaScript.

- Use crypto trading signals from expert traders

- Develop custom trading strategies

- Low cost for amount of features offered

- Complex tools may not be suitable for beginners

CryptoHopper

Cryptohopper is an automated bot trading platform. It provides a social trading platform where users may purchase bot templates, debate trading tactics, and subscribe to trading signals. The platform collaborates with exchanges and authorities to ensure account security.

CryptoHopper also provides numerous bots that can conduct a variety of functions, including trading bots, market-making bots, exchange arbitrage bots, and market arbitrage bots. You can also enjoy learning resources to get you up to speed on various trading topics.

- Trading bot marketplace

- Learning resources for beginners

- Suitable for both beginners and experts

- Limited features for free users

- Limited customer support

Stoic

Stoic.ai is an AI crypto trading app developed by Cindicator. It is designed to accommodate both beginners and experienced traders. Stoic requires no extensive knowledge of crypto trading or manual strategy development. Users simply connect their exchange accounts to Stoic, and the AI takes over from there.

The AI trading app uses three unique strategies with different risk profiles and potential profit. So far, traders can utilize Stoic and three of the most widely used cryptocurrency exchanges. These include Coinbase, KuCoin, Binance Global and Binance US.

- Low monthly subscription fee

- Automated trading without constant monitoring

- Withdrawals at any time, based on the supported exchange

- Can not create custom strategies

- Limited number of supported exchanges

Quadency

With the help of the crypto trading platform Quadency, customers can buy, sell, and manage cryptocurrency assets on several exchanges. It can establish connections with accounts on well-known exchanges like Coinbase, Bittrex, and Binance. For traders of all experience levels, Quadency provides a wide range of tools.

On Quadency, users can create trading bots using a variety of trading strategies. This includes everything from dollar cost averaging (DCA), GRID trading, to portfolio rebalancing, smart orders and more.

Not only does the platform provide trading bot automations, but it also integrates an AI-powered trading assistant. Cody is AI assistant like ChatGPT. It allows traders to write trading strategies in plain English and convert them to code.

- Integrates multiple exchanges

- Supports both pre-built and custom trading bots using AI

- User-friendly interface and dashboard

- Requires QUAD tokens to access premium features

Trading apps compared

| Apps | Price | Availability | Backtesting | Assets |

|---|---|---|---|---|

| AlgosOne | Commission up to 20% on trades | 150+ countries | No | Crypto, forex, and stocks |

| Stoic | $20-25 per month | Global | Yes | Crypto |

| Quadency | Free at the moment | 150+ countries | Yes | Crypto |

| CryptoHero | $14-30 per month | 100+ countries | Yes | Crypto, stock, forex, and CFDs |

| HaasOnline | $7.50-82.50 per month | 100+ countries | Yes | Crypto |

| CryptoHopper | $24-107.50 per month | 50+ countries | Yes | Crypto |

Why use AI trading apps?

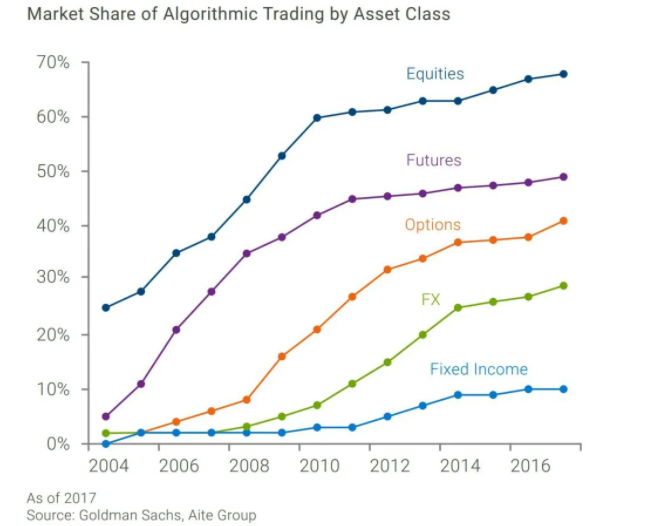

In 2017, AITE Group released a report that provided insights into the adoption and impact of algorithmic trading in the 21st century. Algorithmic trading uses computer programs to trade at high speeds and volumes, often called high-frequency trading (HFT). The chart below illustrates how deeply algorithmic trading has penetrated various financial markets since 2004.

Algorithmic trading started to become a significant part of financial markets in the early 2000s, and by the early 2010s, it had become the majority of trading volume in certain markets. It has significantly transformed financial markets by enhancing efficiency and lowering transaction costs.

In 2024, AI is currently in the same stage as algorithmic trading was in the early 2000s. In the same way that HFT gave institutional trading firms large advantages, AI is poised to create the same incongruities between the best and more average traders.

Due to an oversaturated market and heavy competition, users are increasingly looking to AI trading apps, anticipating an eventuality where AI will be necessary for most traders to remain profitable. This is perhaps the most important reason for becoming familiar with these platforms.

AI is not going to replace humans, humans with AI will replace humans that don’t use AI.

Emad Mostaque, the former CEO of Stability AI: YouTube

How do AI trading apps work?

Crypto AI trading apps operate in a couple of different ways. Some operate by connecting directly to your cryptocurrency exchange account rather than depositing money into the platform itself. Here’s a general outline of how the process works:

- Account setup: You start by creating an account on the trading platform. Link it to your existing cryptocurrency exchange account through API keys. These keys allow the platform to execute trades on your behalf within your exchange account. However, they don’t typically grant the platform access to withdraw your funds.

- Algorithm initiation: Once connected, the platform’s AI and algorithms analyze the market and your portfolio. Based on its analysis and the trading strategies it’s been programmed with, it decides when to buy, sell, or hold various cryptocurrencies.

- Automated trading: The platform automatically executes trades on your behalf according to the AI’s decisions. It continuously monitors the market and adjusts its trading strategies based on real-time data, aiming to optimize your portfolio’s performance.

- Portfolio management: You can monitor your portfolio’s performance directly through the platform’s interface or app. Track the trades the AI has made and see how your investments are performing over time.

The key benefit of using such a platform is that it takes on the heavy lifting of making trading decisions. This allows you to rely on AI to navigate highly volatile markets. This can potentially offer a more disciplined approach to trading as it removes emotional decision-making and requires minimal time for users.

How do you choose the best crypto AI trading bot app?

When thinking about choosing a crypto trading bot, there are several key factors to keep in mind:

1. Ease of use

Opt for a bot platform that uses a straightforward and intuitive interface. This is important for those new to trading who might not yet grasp complex trading mechanisms.

2. Learning resources

Investigate whether the bot provider offers comprehensive guides, tutorials, or any form of educational content. These can assist you in understanding bot operations and crafting effective trading strategies.

3. Demo/paper trading and backtesting

Look for platforms that feature a paper trading or demo account. This will enable you to hone your trading skills and test strategies without the risk of losing actual money. This feature is invaluable for newcomers to the trading scene.

If you are a more experienced trader, you may want to use backtesting to test your trading strategies more thoroughly. Backtesting is the process of testing an automated trading strategy against historical data to determine how it would have performed in various market circumstances.

4. Customer support

The availability and quality of customer support can set a platform apart. Apps with prompt and supportive customer assistance can be incredibly beneficial, particularly for those navigating the trading field for the first time.

5. Risk management tools

Check for risk management features within the app, such as stop-loss orders and mechanisms for controlling the size of your positions.

Before deploying a trading bot, it’s important to conduct your own research, find user testimonials, and familiarize yourself with the platform’s terms and conditions. It’s also important to remember that trading in the cryptocurrency market comes with its own set of risks, and profits are not guaranteed, even when utilizing trading bots and crypto AI trading apps.

AI will transform day trading

Contrary to popular belief, AI is not a “great equalizer.” Those who have experience and are prepared for future technological shifts will be more successful using crypto AI trading apps. However, a good crypto AI trading app can democratize the success that comes with using AI. Remember never to invest more than you can comfortably afford to lose, and stay safe when trading. Practice good crypto wallet security and be wary of crypto scams. While AI is fast becoming an indispensable tool, it is best complemented with solid crypto knowledge and market understanding

Frequently asked questions

Crypto AI trading apps are applications that use AI technology to make trades on behalf of users. They are programmed to analyze market data to make the best trades. AI trading apps can also learn from analyzing patterns.

Algorithmic trading uses algorithms to execute trades based on successful patterns. AI trading not only analyzes successful patterns and trends, but can also learn new strategies. However, AI trading uses algorithms, but algorithmic trading does not use AI.

Platforms like AlgosOne, Stoic, Quadency and more offer AI crypto trading services in some capacity. Fees on these platforms may vary. You should also keep in mind that some features may only be available for premium or paid users.

You will need to register for a crypto AI trading application to start using AI. Some platforms offer automated services, while others allow you to build your own strategies. You can also use trading bots to employ different strategies based on your particular trading style.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.