Broadly speaking, there are two main types of crypto trading: daily trading and long-term investing (set-and-forget). Daily trading relies on short-term price swings and can be extremely stressful. However, a middle-ground approach called dollar-cost averaging (DCA) spreads investments over time to reduce risk. This article explores DCA and how it can benefit your trading strategy.

KEY TAKEAWAYS

• Dollar-cost averaging (DCA) spreads investments over time, thereby reducing the impact of market volatility.

• DCA minimizes long-term investment risks by avoiding market timing and consistently investing at different price levels

• DCA can backfire if prices consistently decline, leading to potential losses over a prolonged period.

What is dollar-cost averaging (DCA)?

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount at regular intervals, regardless of the market’s performance. This approach helps reduce the impact of volatility by spreading your investment over time

Before we get into the specifics, let’s quickly address volatility in crypto:

Crypto market volatility

Cryptocurrencies are known for their high volatility, much like penny stocks in the traditional market. These assets react strongly to large trades, particularly those with small market capitalizations.

Larger market cap assets usually require much bigger trades to influence the market. However, small-cap cryptocurrencies (market caps under $2 billion) are more susceptible to price fluctuations caused by individual investors.

A single large investor, often referred to as a “whale,” can significantly impact the price of a small-cap cryptocurrency.

Whales can exploit the volatility of small-cap assets by creating artificial buy or sell walls. They do this to entice other traders to join the trend before executing large buys or sells to profit from the price swings.

Even mid-cap cryptocurrencies, with market caps up to $10 billion, can be influenced by these large trades.

Cryptocurrencies don’t inherently have the same value metrics as conventional assets do. Conventional assets, such as the stocks of a company, are valued based on products, production costs, and market demand. Cryptocurrencies, on the other hand, derive their value from speculation and their potential to replace or enhance traditional financial systems.

For instance, Bitcoin’s decentralized nature and capped supply of 21 million coins offer an alternative to central banking systems, where inflationary pressures can erode the value of fiat currency.

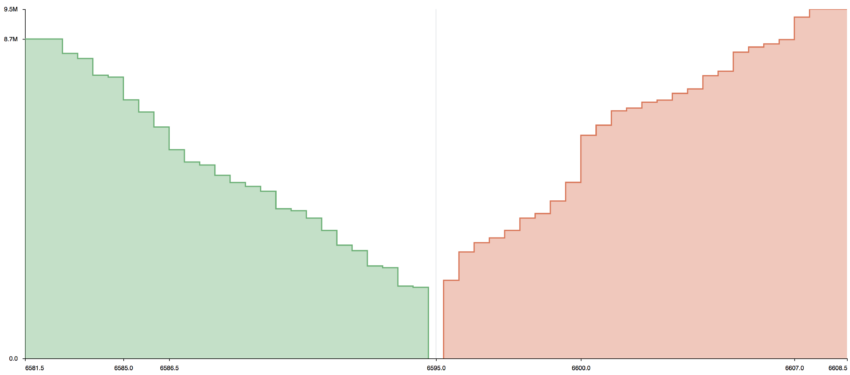

DCA beats volatility

With DCA, the investor takes advantage of market volatility by distributing the risk. For instance, as of Sept. 11, 2024, we have seen the BTC price hovering in the range of $52k to $64 over 30 days.

Therefore, instead of going all in with a sum of hypothetical $20k to invest in, an investor would use DCA to invest $20k in multiple smaller fractions daily at a regular interval. Otherwise, if the investor decided to invest the entire $20k immediately, they may do so at a higher price hill point. In this case, the overall gains would be much less than if investment increments all took place at low valley points.

With that said, the DCA investing strategy:

- Can also be used in all investment ranges, including $10, $100, $500, $1,000, $10,000, and so on. What might be considered a small investment for one person could be a significant sum for another.”

- Is applicable irrespective of whether the market is bearish or bullish so long as the investment distribution is consistent over time.

For this reason, an investor engaging in DCA must be certain of the asset’s fundamentals. After all, the core of the dollar-cost averaging strategy is to invest fixed amounts in regular intervals.

In a nutshell, dollar-cost averaging is dividing the risk by dividing the money allocated for investing over a prolonged period of time. This requires discipline and resistance to market FUD (fear, uncertainty, doubt).

Real-life example of DCA

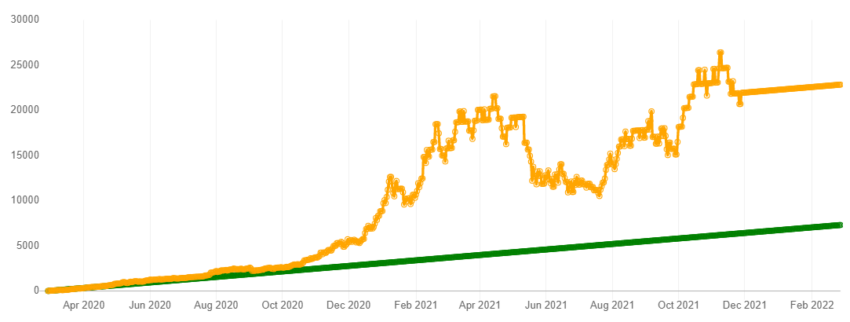

Let’s say you allocate $10 to invest daily in Bitcoin over two years between March 2020 and March 2022. At the end of March 2022, you would have invested a total of $7,310. So, what would you get in return?

By using a DCA calculator, you would have gained $22,965, which represents a 214.16% profit margin.

The difference between your total investment of $7,310, by $10 daily increments, and Bitcoin’s appreciation over two years, is the space where you gain profits.

While predicting Bitcoin’s future price is speculative, its historical chart shows a consistent upward trend. This means that even during the worst bear markets, Bitcoin’s new lows have always been higher than its previous lows.

This is understandable given that Bitcoin’s supply is eternally limited. There will only ever be so much BTC in existence. Then, if more people want to buy it, the remaining Bitcoins will appreciate in value. In short, it is a matter of supply and demand, the fundamental law of economics.

While dollar-cost averaging is a sound investment approach in any market, its advantages are more prominent in volatile markets like cryptocurrency, where price fluctuations are frequent and unpredictable.

Can DCA backfire?

Yes, it can backfire if you are not careful enough with your investment decisions. Dollar-cost averaging is most effective when prices fluctuate over time as it allows investors to buy into an asset at different price points.

However, if prices consistently rise, those using this strategy may end up purchasing fewer coins or assets at higher prices. Similarly, during prolonged declines, investors might keep buying when holding off would make more sense financially.

While DCA helps manage volatility, it doesn’t shield investors from potential losses in a bear market.

The strategy operates on the belief that, over time, prices will recover. For individual assets, especially without proper research, DCA may lead to continuing investments that should otherwise be paused or exited.

For less-experienced investors, DCA is generally safer when applied to diversified assets like index funds, as opposed to, say, hype-driven, lesser-known cryptocurrencies.

Dollar cost averaging: Pros vs. cons

| DCA advantages | DCA drawbacks |

|---|---|

| DCA investors focus on long-term gains and are less likely to panic-sell during price drops. | DCA may yield lower returns during prolonged bull markets compared to a lump-sum investment. |

| It encourages disciplined investing by allocating small amounts regularly, preventing emotional overtrading. | DCA requires more frequent trading, which can lead to higher transaction fees on crypto platforms. |

| DCA allows investors to bypass unreliable technical analysis and invest steadily based on confidence in the asset. | The strategy may not suit investors who can invest large sums upfront and take advantage of bull markets. |

| DCA helps diversify risk across different cryptocurrencies by spreading investments over time. | Fees from frequent trades could add up, though they are usually negligible in the long term. |

DCA: Best for volatile markets

Dollar-cost averaging provides a steady, disciplined approach to investing in volatile markets like cryptocurrency. By investing consistently over time, you can benefit from market fluctuations without the stress of timing your entries perfectly.

While DCA may not always maximize returns in certain market conditions, it offers a balanced approach for investors looking for steady, long-term growth in an unpredictable market.

Frequently asked questions

What is DCA in crypto?

Is DCA good for crypto?

When is the best time to invest in crypto?

Is DCA a good strategy?

What does DCA mean in investing?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.