BingX simplifies the futures trading process, making it easy for both crypto beginners and pros to manage leverage with confidence. With the platform hosting up to $14 billion in perpetual futures trades, learning how to trade futures on BingX is a handy skill to have. Here’s everything you need to know in 2024.

KEY TAKEAWAYS

• BingX offers high leverage for futures trades while providing risk management features like stop-loss orders, take-profit options, and margin choices to help minimize potential losses.

• The platform’s Pre-Launch Futures feature allows users to speculate on the future prices of new tokens before they are officially listed, using synthetic prices.

• Trading futures with leverage carries significant risk. Traders should proceed with caution and note that profits are never guaranteed.

How to trade futures on BingX: Step-by-step

In short, to start trading derivatives on BingX, users must:

- Sign up and verify their account

- Deposit funds to the Funding Wallet

- Transfer funds to the Futures Wallet

- Choose a trading pair

- Select an order type

- Zero in on the required leverage, if any

- Open and close orders accordingly

Let us dig into each step in a little more detail.

1. Create an account

Here are several sub-steps to fully complete your sign-up on the BingX trading platform:

- Sign up: Visit the homepage and hit “Sign Up.” You need to fill in the email address/ phone number and create a password to move to the verification process. You can also sign up using your existing social account.

- KYC verification: Upload your ID and wait for approval from the team.

- Locate the trading interface: Once inside the platform, you need to look for the Derivatives section and choose “Perp Futures” or “Standard Futures,” depending on your experience level and trading performance.

After completing the above, you can consider funding your BingX account to start trading. To trade futures on BingX, you must transfer funds to your Futures Wallet. This is separate from the Spot Wallet or Funding Wallet used for spot trading and deposits.

Transfer to your Futures Wallet by selecting the amount you wish to allocate for futures trading. This can be done directly within the app or web interface under the “Transfer” option.

2. Navigate around the platform

Once you locate the right segment of BingX’s “Derivatives” trading ecosystem, there are a few more mini-steps involved:

- Activate futures trading: As futures trading is high-risk, users must read through the user agreement and risk disclosure and answer a trading-related questionnaire before gaining access to the dashboard.

- Check out the dashboard: Once you have successfully answered the questions related to futures trading, you can activate this option and access the dashboard. Sift through the markets tab, trading tools, and the order book to see how the elements work in synergy.

3. Open and close positions

This step involves selecting the pair you want to trade. Once done, you need to choose “Long” or “Short,” depending on how you see that pair moving in time. When expecting the asset to rise, choose Long. If you are bearish about a specific digital asset, consider shorting the trade instead.

To close a trade, you can either use the market levels or the take profit option. Or, choose risk management tools like stop loss or trailing stop loss, which automatically closes the trade if key levels are triggered.

Notably, any variant of stop loss shouldn’t be regarded as a way to close trades. It is more like a failsafe to minimize loss if and when your trade goes sideways.

The “take profit” option, on the other hand, helps you book profits in a volatile market.

Once these elements are taken care of, you then need to do two things:

- Set the order type: BingX allows you to place market orders (immediate execution at the current market price) or limit/trigger orders (executed when a certain price is reached).

- Adjust leverage: Leverage allows you to amplify your trading position by borrowing funds. On BingX, you can use leverage up to 125x, meaning you can control a much larger position with a smaller amount of capital. However, higher leverage increases both potential gains and risks. You need to enter the desired margin multiple.

Your futures trading positions can be liquidated based on leverage and market volatility. While a higher leverage can be useful to book more profits, it might backfire in a volatile market where a 2% to 5% dip is common and expected.

The potential of liquidation increases if you ramp up the leverage in a volatile space. For instance, if you are using 50X leverage, you will be liquidated if BTC drops by 1.8%. This is why trading with high leverage is riskier.

For 1X or the lowest leverage, your BTC’s price will need to fall by almost 50% to liquidate you. Therefore, low leverage is better if you feel that the market is going to go topsy-turvy for a while.

What is derivatives trading and Pre-Launch trading?

If you are learning how to trade Futures on BingX, it makes sense to know a little more about derivatives trading in general.

Derivatives trading, especially in the crypto space, allows traders to profit from the price movements of assets without having to own them directly.

Derivatives are financial contracts whose value is derived from an underlying asset, such as cryptocurrencies, stocks, or commodities. In the context of crypto, derivatives allow traders to speculate on price changes or hedge their positions, often using leverage to increase potential gains.

BingX offers multiple derivative options, such as futures contracts and perpetual futures contracts, allowing users to speculate on the price of cryptocurrencies without actually owning them.

Pre-Launch Futures trading: Inside BingX’s latest offering

The Pre-Launch Futures feature on BingX allows users to speculate on the future prices of new tokens before they are officially listed on the market.

BingX even allows users to trade Pre-Launch Futures, providing early access to potential profits. Traders can leverage market predictions and speculative models to determine token value.

Unlike traditional pre-market spot trading, which may freeze funds and limit liquidity, Pre-Launch Futures enable more efficient use of capital and offer superior flexibility.

Here is how it works:

- Users can enter futures contracts on new tokens, predicting whether the token price will increase or decrease. This gives traders an opportunity to secure potential profits before the token becomes available for trading across the broader market.

- Like traditional futures trading on BingX, Pre-Launch Futures allow users to trade with leverage. This enables traders to amplify their potential gains (or losses) by borrowing funds to increase their position size.

- Unlike Pre-Market Spot Trading, where liquidity can be restricted, Pre-Launch Futures offers superior liquidity. Users can trade without freezing funds, which typically occurs in pre-market trading.

- As with any futures contract, Pre-Launch Futures carry a risk of liquidation if the market moves against a trader’s position. BingX provides tools like stop-loss orders and margin management to help mitigate risks.

The process involves a synthetic price mechanism derived from market makers. The price isn’t based on the spot trading values but instead on speculative models and other factors like pre-sale prices, market demand, and initial trading volume expectations.

Once the token is officially launched or listed, the futures contracts are typically settled based on the real market price.

Here is a quick flowchart explaining the process:

Types of derivatives

On platforms like BingX, you will encounter perpetual futures and standard futures. Options are not present on BingX but still represent a popular choice of derivative instrument.

- Futures: A contract to buy or sell an asset at a set price on a future date. This is the most popular derivative, as it allows traders to capitalize on price predictions.

- Perpetual futures: Just as the word “perpetuity” implies, these contracts have no expiration date, making them ideal for long-term strategies.

- Options: These contracts give the trader the right, but not the obligation, to buy or sell the underlying asset at a predetermined price before a certain date.

Trading options is like reserving a hotel room. Imagine you’re booking a room for a vacation. You pay a small fee to reserve the room, but you’re not obligated to actually stay there. If your plans change, you can simply walk away, and the only expense you’ll incur is the reservation fee.

How does the BingX derivatives trading interface work?

As mentioned earlier, BingX offers category-specific choices for derivatives trading. These include standard futures and perpetual futures — one with expiration dates and the need to roll over contracts and the other with support for holding contracts until perpetuity.

It is worth noting that BingX’s perp futures ecosystem supports USD-M and Coin-M settlements. USD-M settles in USD, whereas Coin-Msettles in the trading pair-specific crypto asset.

Standard futures are similar as the operation is simpler for regular traders/investors.

Features of BingX derivatives trading

Let’s take a closer look at the features BingX offers its 10 million+ users:

High leverage: BingX offers up to 125x leverage on perpetual futures, giving traders the opportunity to magnify their positions. However, it’s important to use leverage carefully, as it can increase both potential gains and risks.

Low fees: Trading fees on BingX are competitive, with 0.02% maker and 0.05% taker fees for futures trading. VIP users enjoy even lower fees.

Did you know? VIP tier 1, with a 30-day trading volume of at least 50,000 USDT, can result in low maker and taker fee slabs of 0.0140% and 0.04%, respectively.

Global reach: The platform operates in over 100 countries, allowing traders worldwide to access its services in multiple languages.

Transparency: BingX places a strong emphasis on user security, offering features like proof-of-reserves and multiple compliance certifications in regions like Europe and Australia.

Risk management on BingX

Prioritize your asset safety at all times. Only ever click official links, double-check your figures before confirming trades, and ensure you are confident with the required steps before embarking on futures trading.

Futures trading offers the potential for significant profits, but it also carries inherent risks, especially when using leverage. To mitigate these risks, BingX provides several tools and strategies that traders can employ to protect their capital.

These include:

- Stop-loss orders: These allow traders to automatically close their positions when the market hits a specific price, minimizing potential losses.

- Take-profit orders: By setting a take-profit level, traders can automatically lock in profits when the market reaches a favorable price point.

- Choice of margin: You can choose between isolated margin and cross margin, with the former allocated to a specific position at risk, limiting potential losses to that trade alone. Cross margin uses the trader’s entire account balance to maintain positions, offering higher flexibility but also higher risk.

- Leverage management: Traders should adjust leverage based on their risk tolerance. Using high leverage can result in larger profits but also amplifies losses.

- Calculator: BingX provides a futures calculator, helping you ascertain the liquidation price, possible profit levels, and more for the given price of the asset.

Did you know? BingX offers a Dual Price Mechanism to protect users from forced liquidations caused by extreme volatility. This ensures that forced liquidations happen only when market conditions are truly critical.

Why BingX?

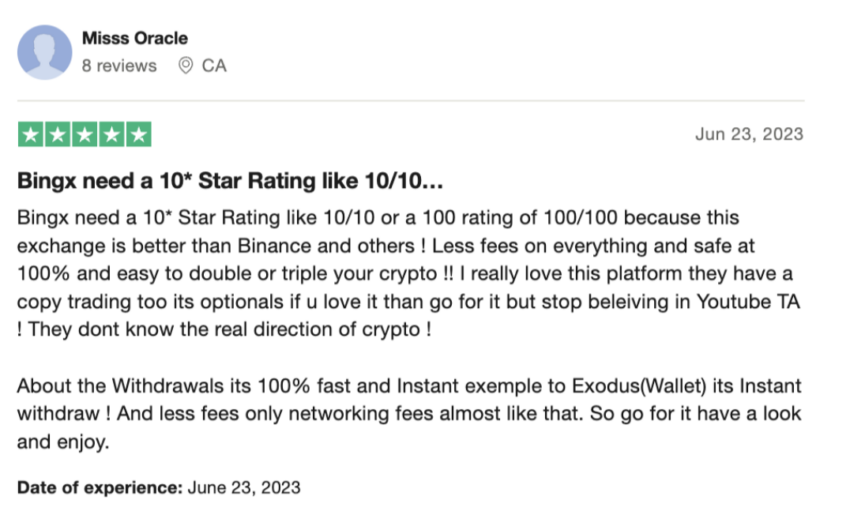

There are many crypto exchanges to choose from, and users should try a number to understand which ones are best for them. Here’s what to know about BingX and its benefits.

As a global centralized exchange (CEX), BingX was founded in 2018 and provides spot, derivatives, and copy trading services, as well as crypto-related asset management services. BingX supports over 780+ coins and more than 840 markets or trading pairs.

As per CoinMarketCap’s rankings, BingX is one of the top 15 spot trading exchanges in 2024, ranked on traffic, liquidity, trading volumes, and the legitimacy of its trading volume reporting. The platform is also known for its high-profile campaigns and array of sports partnerships, including those with Chelsea Football Club and two UFC champions.

BingX offers several unique features that enhance the trading experience for both beginners and experienced traders. Let’s take a close look at a small selection of its strengths and features.

User-friendly UI

The simple design ensures that even new traders can access advanced features like futures trading and risk management without feeling overwhelmed.

Copy trading support

One of BingX’s best features is its Copy Trading tool, which allows users to follow and replicate the strategies of successful traders. The platform provides various customization options, enabling traders to copy based on fixed margins or position ratios.

BingX enhanced this feature with a Feed section, where professional traders share their insights and market analysis, fostering a collaborative trading environment.

Grid trading options

BingX also supports Grid Trading, offering different versions like Spot Grid, Futures Grid, and more.

“In the fast-paced world of cryptocurrency, finding time to manually execute trades can be a challenge, especially for busy individuals. That’s where spot grid trading comes in with @BingXOfficial!

Vivien Lin, Chief Product Officer, BingX: X

These tools automatically buy low and sell high within a predefined price range, making them an ideal way to potentially profit from crypto market volatility.

Multilingual support

In 2024, the platform supports a number of languages, including English, French, Italian, and Vietnamese, making it easy for traders around the globe to engage with the platform without language barriers.

Advanced trading tools

The platform offers in-depth trading analysis tools, including detailed asset graphs, volume data, and various patterns for technical analysis.

BingX academy

BingX offers educational content through its BingX Academy, which includes guides, tutorials, and articles on topics like technical analysis, futures trading, and market trends. The platform also hosts webinars and regular market updates.

The academy provides access to a wide range of tutorials, articles, and guides, covering topics like cryptocurrency basics, technical analysis, and advanced trading strategies including for futures and derivatives trading.

For users looking for something more than futures trading flexibility, BingX offers a wealth section, including the Shark Fin offering with principal protection and several interest-earning tools for flexible and fixed-term products.

Stay safe when futures trading on BingX

While this guide has demonstrated how to trade futures on BingX, the best way to get the lay of the land is to test out the waters yourself. To maximize the experience and get the hang of futures trading, you should start with a small sum and leverage and see how it goes from here.

Prioritize your asset safety at all times. Only ever click official links, double-check your figures before confirming trades, and ensure you are confident with the required steps before embarking on futures trading.

Disclaimer: Trading futures, especially with leverage, carries significant risk and may not be suitable for all investors. The cryptocurrency market is highly volatile, and traders can incur substantial losses, including the potential loss of their entire margin.

It’s important to understand the risks and employ proper risk management strategies thoroughly. The information provided here is for educational purposes only and should not be construed as financial advice. Always conduct your own research and consult with a financial advisor before engaging in futures trading.

Frequently asked questions

What is the difference between futures and perpetual futures on BingX?

How does BingX ensure the security of its platform and users’ funds?

How do I contact BingX customer support?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.