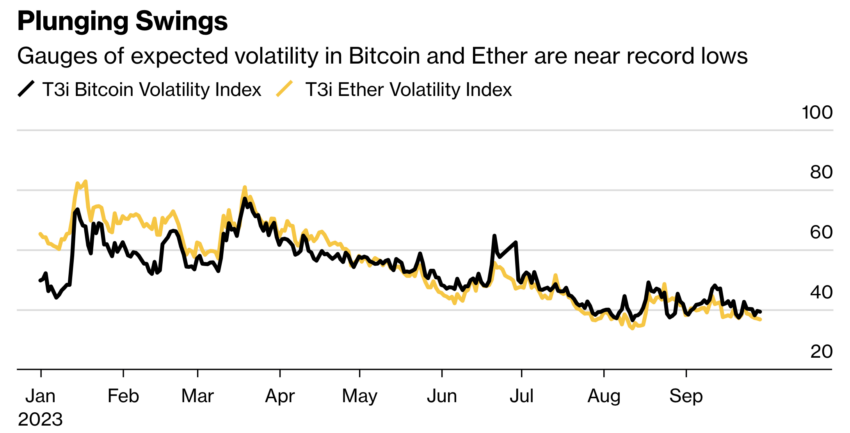

Deribit, the largest cryptocurrency options exchange, has confirmed that it will offer altcoin options for Solana (SOL), Ripple (XRP), and Polygon (MATIC) despite the slump in crypto prices. It hopes the derivatives will offer investors a better hedge than Bitcoin (BTC) and Ethereum (ETH), whose volatility indexes are at all-time lows.

Deribit’s Chief Commercial Officer Luuk Strijers emphasized that the lack of volatility has not deterred their plans. He predicts the company’s new altcoin options contracts will increase volatility when they go live in January.

Deribit Delayed Launch Due to Low Volatility

The company spent many sleepless nights deciding on the correct launch window, Strijers said.

“Is this the best environment to launch new products, or should we defer? That’s what keeps us awake.”

Digital Asset Capital Management founder Richard Galvin said that ETH has fallen out of favor because it has low volatility. Other altcoins like SOL, XRP, and MATIC have lower liquidity, making it easier for smaller trades to move prices.

According to K33 analyst Vetle Lund, most market manipulation is taking place in altcoins more than Bitcoin. Deribit has not officially revealed whether it will surveil markets to lower the risk of manipulation for its options contracts.

The exchange, which racked up significant losses after Three Arrows Capital failed to meet its margin requirements, will launch the options contracts after it completes a move from Panama to Dubai.

ETH Derivatives Show Poor Volumes

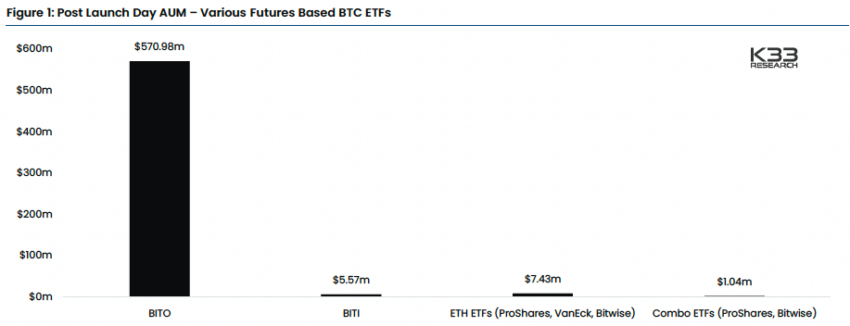

Deribit’s expansion comes after US regulators delayed approving a spot Bitcoin ETF a few weeks ago. In the meantime, institutional investors have also not warmed to ETH futures ETFs that several companies rolled out.

Read more: 11 Best Crypto Portfolio Trackers in 2023

According to Lund, the trading volume of ETH futures made up only 0.2% of the volumes Bitcoin futures ETFs experienced in 2021.

“The first day numbers were well below expectations, and we no longer see a strong bull case for BTC/ETH in the short term.”

He confirmed that, despite traders on the CME anticipating better launch days, the success of futures ETFs are tied to institutional demand. The ETH derivative, despite being fully regulated in the US, will not drive significant inflows without investor interest, he observed.

Read more: Best Crypto Derivative Exchanges in 2023

On Sunday, the UK Financial Conduct Authority advised locals to avoid Huobi and KuCoin as new advertising restrictions became effective. His Majesty’s Treasury has given the FCA powers to regulate crypto, and the recent passage of an online safety bill allows the regulator to clamp down on companies that have not been authorized to promote crypto.

Both Huobi and KuCoin’s websites do not list the UK as a restricted country. Spokespeople for both companies claim they do not serve UK customers.

The UK will likely propose more detailed rules for regulating crypto in Q1. Europe’s Markets in Crypto-Assets bill, which offers crypto companies a license usable across the entire European Union (EU) bloc, will come into effect in 2024.

Deribit announced it has applied for a license to run a crypto brokerage in the EU.

Do you have something to say about Deribit altcoin options, new ETH futures ETFs, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.