Industry experts and analysts are confident that the US Securities and Exchange Commission will approve an Ethereum futures product in early October. If they’re right, it will be the first ETH futures ETF to be launched in the United States.

Exchange-traded fund analysts are eyeing signals that an Ethereum-based product could get the green light early next week.

Ethereum ETFs Before Shutdown?

Bloomberg intelligence analyst James Seyffart said he was “watching for filings to indicate Ethereum futures ETFs are indeed being accelerated for launch next week,” on September 28.

“We expect a lot more filings from the SEC today as they continue to clear their desks as much as possible before the shutdown. Normalcy is out the window.”

Unless Congress can reach a deal to pass a spending bill by the end of this month, the US government faces a shutdown. This will impact all federal agencies, including the SEC.

ETF Store President Nate Geraci commented that if SEC is allowing Ethereum futures ETFs to launch:

“You have to assume forcing closure/delisting of BTC futures ETFs is off the table.”

He added that he was fascinated to see the SEC’s response to the Grayscale court ruling.

“Seems like the only options are to allow spot BTC ETFs or find another reason to deny [them which could be] custody”.

Read more: What Is Wrapped Ethereum (WETH)?

Earlier this week, fellow Bloomberg analyst Eric Balchunas said there was a 90% chance that Ether futures would start rolling out in early October.

According to the pair, there are 15 Ethereum futures ETFs from nine issuers currently awaiting approval. Issuers waiting for ETH of or hybrid ETF products include Valkyrie, VanEck, ProShares, Grayscale, Volatility Shares, Bitwise, Direxion, and Roundhill.

Business as Usual

However, it has been business as usual at the SEC this week. The regulator has been busy postponing crypto ETFs and procrastinating on decisions.

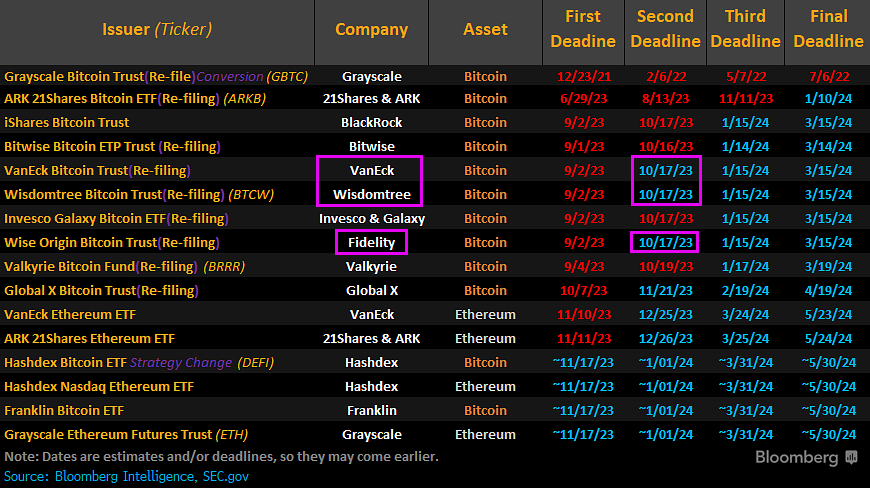

On September 28, the regulator extended the review period for BlackRock, Valkyrie, and Bitwise’s spot Bitcoin ETF applications.

Seyffart said, “We’re expecting the other three Bitcoin ETF delay orders tomorrow before the government shut down.” The remaining issuers are WisdomTree, VanEck, and Fidelity.

Earlier this week, the SEC delayed its decision on the ARK 21Shares Ethereum ETF and the VanEck Ethereum ETF until the end of 2023.

Seyffart concluded,

“Everything the SEC has done this week is due to the shutdown.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.