Decentralized finance (DeFi) relies on the power of its users. dYdX, with its commitment to community governance, stands out as a prime example.

This article explores how dYdX’s community governance works, its impact on the dYdX exchange, and its challenges. Understanding these aspects will help readers see how dYdX users are shaping the platform’s future.

Understanding Community Governance

Community governance in DeFi means that the people who use a platform can have a say in how it runs. Instead of decisions being made by a central authority, they are made by the community of token holders. This system allows users to propose changes, discuss them, and vote on them. In the world of DeFi, this approach ensures that the platform remains transparent, accountable, and inclusive.

Why is community governance important? It brings in a variety of ideas and solutions from users with different backgrounds and expertise, leading to important developments. It also means that the platform evolves based on the needs and preferences of its users, which helps maintain their trust and engagement. Lastly, it promotes accountability, as decisions are made openly and the community can hold decision-makers responsible.

The Governance Structure of dYdX

dYdX is a decentralized exchange where DYDX token holders can participate in governance. The governance model uses the x/gov module of the Cosmos SDK. This setup allows DYDX holders who are staking their DYDX tokens to a dYdX Chain validator to propose and vote on changes to the platform.

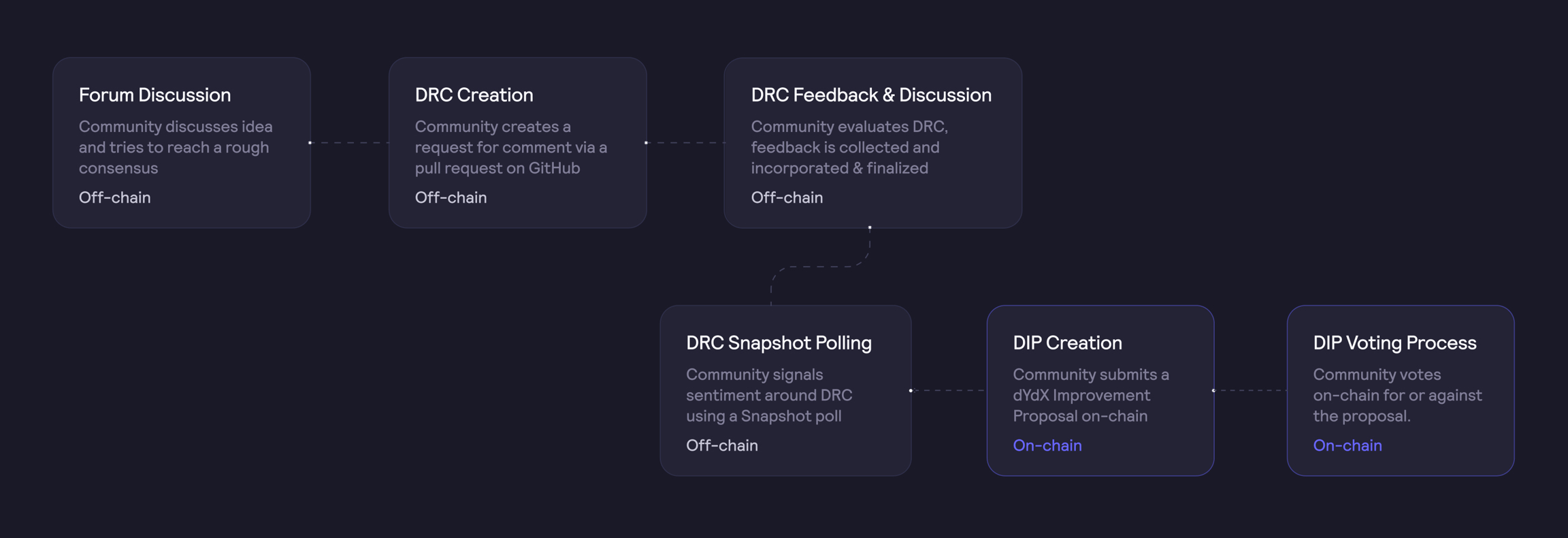

Proposal and Voting Process

The process is straightforward: DYDX token holders propose changes by depositing unstaked DYDX tokens. They must meet the minimum initial deposit ratio, currently set at 20% or 400 unstaked DYDX. A vote will not enter the voting period until the minimum deposit of 2000 unstaked DYDX is met. If a proposal doesn’t meet the minimum deposit, other token holders can support it by pledging additional unstaked DYDX tokens.

Proposals can cover various topics, including changing a parameter on the dYdX Chain, spending treasury funds, or updating the software for validators and full nodes.

Once the minimum deposit for a proposal is satisfied, the proposal will enter the voting period. DYDX stakers can cast their votes during this time. If a staker does not vote, their vote weight is inheretied by their validator, allowing passive holders to have their stakes represented in the decision-making process.

The weight of each vote depends on the amount of DYDX staked, with 1 staked DYDX token equaling 1 vote. This system gives those with a larger stake more influence on decisions. Note, tokens that are not staked or are in the unbonding period do not count towards a holder’s voting weight. This system allows those most invested to have a significant say in its direction.

Impact on Exchange Development

Community input has significantly shaped dYdX. This influence is clear in several major decisions and initiatives driven by community votes.

Migration to DYDX as Layer-1 Token

Following a vote by the dYdX community, DYDX was adopted as the Layer-1 token of the dYdX Chain. On dYdX Chain, the utility of the DYDX token includes Security, Staking, and Governance:

- Security. Approximately 228 million DYDX, or 22.8% of the total supply, have been staked to 60 validators in the active set to secure the dYdX Chain.

- Staking. The protocol has distributed over 30 million USDC to 23,000+ dYdX Chain stakers as a result of staking to Validators in the active set.

- Governance. dYdX community members have initiated 126 governance proposals to date, demonstrating active participation in the network’s decision-making process.

Addition of New Markets

In January 31, 2024, a New Market Listing Widget was included on the dYdX Chain front-end to streamline proposals for market listings. The widget enables users who wish to do so to create a governance proposal to add a new market to the protocol in three simple steps:

- Select a market.

- Confirm the details of the transaction.

- Sign the transaction to deposit 2000 DYDX and launch the governance proposal.

Since the launch of the market listing widget, the dYdX community has listed 95 new markets on dYdX Chain. This demonstrates that the widget has empowered the dYdX community to launch new markets in a decentralized and permissionless fashion.

Emission Reductions and Treasury Management

Since the launch of $ethDYDX, the community has voted on several proposals that resulted in emission reductions. These reductions increased the amount of DYDX in the Community Treasury by 211,133,225 DYDX. Effective treasury management through community governance ensures the platform’s long-term sustainability and financial health.

Launch Incentives Program

On November 28, 2023, the dYdX community approved Chaos Labs’s 6-month Launch Incentives Program. This program allocated $20 million in DYDX to incentivize early adopters of the dYdX Chain and ensure a smooth transition from dYdX V3 to the dYdX Chain.

Based on the reports published by Chaos Labs, the Launch Incentives Program has been successful throughout seasons 1-4 in driving user adoption, TVL and trading volume on the dYdX Chain. Trading fees collected by the protocol exceeded program costs by $4.7 million, indicating sustained trading activity and long-term engagement within the dYdX ecosystem.

On April 28, 2024, the dYdX community voted to extend the Launch Incentives Program for two additional seasons with an additional budget of $10 million in DYDX rewards. Season 6 is currently live with the following additional criteria:

- Multiplier for DYDX stakers to earn up to 50% more points.

- 1.5x points multiplier for trades placed via web or mobile apps.

- 2x multiplier for trading in non-major markets to enhance liquidity.

Additionally, new enhancements include a first deposit bonus for new accounts, continuation of trading leagues with a $800,000 prize pool, and $1 million in rewards for market makers who significantly contribute to trading volume, especially in less liquid markets.

Ecosystem Development Program

On February 23, 2024, the community voted to fund the dYdX Ecosystem Development Program (formerly the dYdX Grants Program) with 3,858,500 DYDX tokens from the community treasury. The dYdX Ecosystem Development Program’s mandate is to support infrastructure, chain services, protocol development, and growth.

Liquid Staking with Stride Protocol

The dYdX community voted to liquid stake 20 million DYDX tokens with Stride Protocol. The dYdX community cited the following reasons for voting in favor of the proposal:

- Increasing the security of dYdX Chain.

- Earning yield on some of the DYDX in the community treasur.

- More equally distributing stake weight among dYdX Chain validators.

The initiative shows the community’s strategic thinking in managing its treasury to benefit the overall decentralization of the network.

Challenges in Decentralized Governance

- Governance proposals can often be technical and complex, making them hard for the average user to understand. This complexity can deter participation, as users may feel overwhelmed or unsure about the implications of their votes. Ensuring that proposals are clear and easy to understand is crucial for broader engagement.

- Voter apathy and fatigue are other significant challenges. Over time, users may become disengaged, feeling that their votes have little impact or that the governance process is too time-consuming. Addressing these issues requires continuous efforts to make the governance process more accessible and meaningful for all participants.

dYdX has implemented several strategies to ensure its governance model is inclusive and encourages broad participation.

- Token holders can leverage the x/authz module to delegate their voting power to trusted representatives. The delegation streamlines the process by allowing experienced and knowledgeable individuals to represent larger groups of token holders, ensuring broader community representation while maintaining efficiency in decision-making.

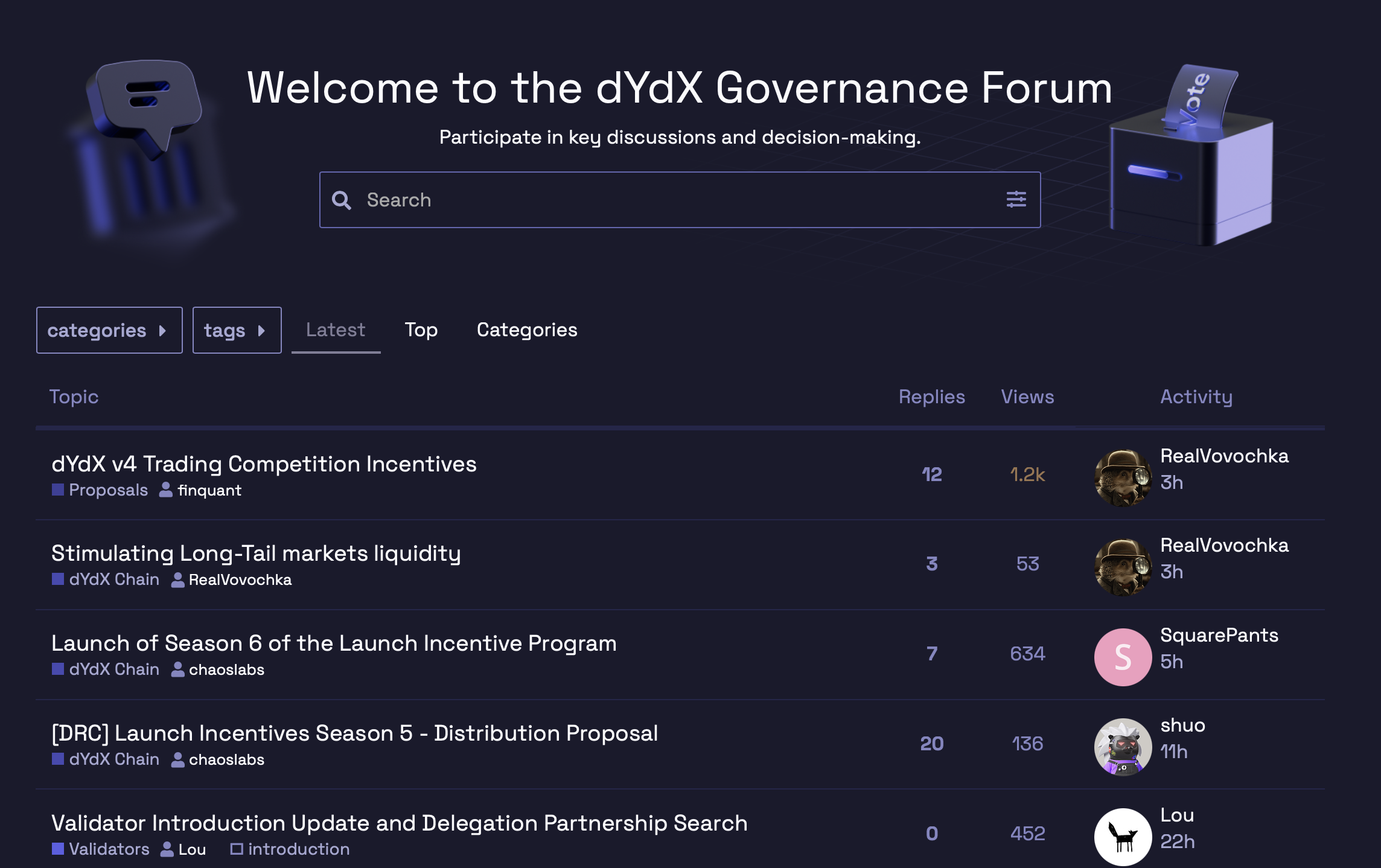

- Most proposals are posted on the dYdX Forum, where community members can provide feedback and engage in discussions. The platform supports open dialogue, allowing users to share their perspectives and insights. The forum acts as a hub for community engagement, ensuring that everyone has a voice in the governance process.

Except for expedited proposals, the on-chain voting period is set to four days, providing ample time for participants to review proposals and cast their votes. This duration strikes a balance between giving users enough time to consider their options and ensuring that decisions are made in a timely manner.

Community Engagement Strategies

To keep the community engaged and informed about governance matters, dYdX employs several strategies.

The dYdX Foundation has a dedicated governance team that provides information to the community through various channels, including social media platforms like X (formerly Twitter), Discord, and Telegram. This team maintains close relationships with major stakeholders, such as validators, market makers, and token holders, ensuring that they are kept up-to-date on important governance matters and platform changes.

The governance process is designed to be transparent and inclusive, allowing any user to submit proposals on-chain and on the dYdX Forum. Open communication helps build confidence in the governance process, encouraging more active participation.

Future of Governance on dYdX

Looking ahead, the governance model on dYdX is expected to evolve further. Planned improvements aim to streamline decision-making processes. One significant development on the horizon is the introduction of permissionless markets.

The introduction of open-source software enabling the fully permissionless creation of new markets without a governance vote is expected later this year, as highlighted in dYdX Trading’s product roadmap for 2024. This will allow any party to create and launch a new market by specifying its oracle, market parameters, and potentially providing initial liquidity, without needing approval through a governance vote.

This approach, similar to Uniswap’s pool listing model but designed for perpetual markets, will make the process of creating new trading markets exponentially more efficient. Empowering users to permissionlessly scale the number of assets tradable on the dYdX Chain with minimal friction helps to focus more on broader protocol improvements and strategic decisions, building a more dynamic and user-driven ecosystem.

Conclusion

dYdX’s governance model shares similarities with other decentralized platforms but also has unique features. While its use of the Cosmos SDK’s x/gov module is similar to other Cosmos-based projects, dYdX stands out with its emphasis on permissionless markets, offering greater flexibility and user empowerment.

Learning from other models has highlighted valuable lessons. Clear communication and education are crucial for encouraging participation. Ensuring users understand the governance process and its impact helps maintain engagement and trust. Additionally, making the governance process more accessible can reduce voter apathy and fatigue.

dYdX demonstrates the power of community in shaping a platform. Through a robust and inclusive governance model, DYDX holders directly influence the platform’s evolution. dYdX continuously evolves and introduces new features, so community governance will play an even more critical role, driving growth in the DeFi space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.