The Apecoin (APE) price has increased since reaching a new all-time low price of $0.99 on October 9.

So far, the price has created seven consecutive bullish candlesticks, accelerating its rate of increase further today.

Apecoin Bounces After All-Time Low

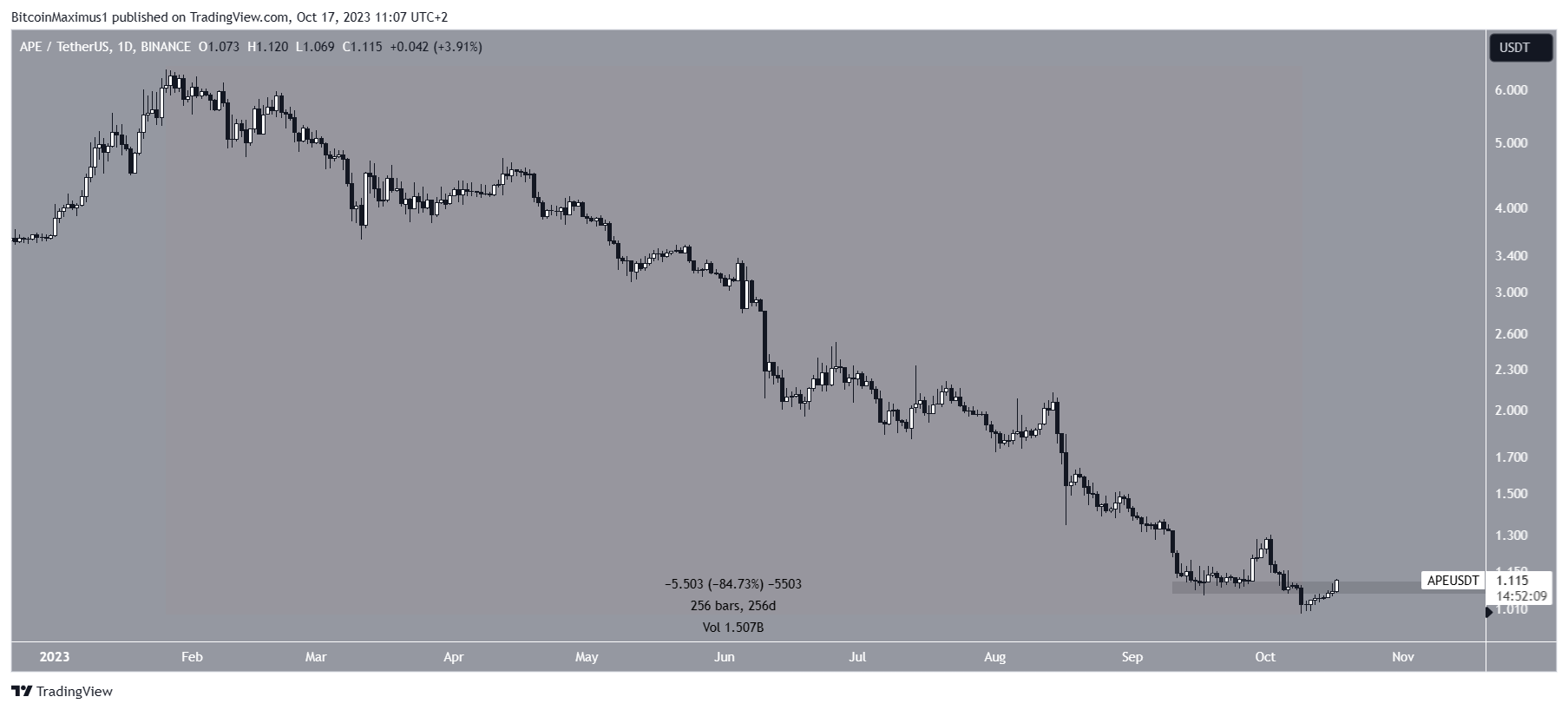

The APE price has decreased since reaching a high of $6.41 on January 26. The downward movement has been swift but has not followed any specific pattern.

In a span of 256 days, the APE price lost 85% of its value.

On October 9, the APE price reached a new all-time low of $0.99. While this caused a breakdown from the $1.10 horizontal support area, the price has increased since and is in the process of reclaiming the area.

It is interesting to note that several large whale accounts are buying significant amounts of the APE token.

Machi Big Brother has bought $7.43 worth of APE since August 12 while also withdrawing 2.5 million APE tokens from Binance.

Another unknown whale address withdrew 1.37 million APE from Binance earlier today. This heavy accumulation can also be seen by the considerable volume every time the price has approached the $1 range.

However, it is also worth mentioning that the APE Foundation will release 15.6 million new tokens on October 17, further inflating the current supply. APE has a circulating supply of 368 million, so the release will add a little more than 4% to the current supply.

Read More: 9 Best Crypto Demo Accounts For Trading

APE Price Prediction: Is the Bottom In?

Market traders use the RSI as a momentum indicator that traders use to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

The daily RSI supports the possibility that the price has bottomed. The main reason for this is that it has generated a bullish divergence (green line). This occurs when a momentum increase accompanies a price decrease.

Also, the divergence took the indicator outside of its oversold territory, another sign associated with bullish trend reversals.

But, the RSI has yet to move above 50. If this occurs, it will confirm the bullish trend reversal.

In that case, the two closest resistances will be at $1.30 and $2.05, 15% and 85% above the current price, respectively.

Despite this bullish APE price prediction, a close below the $1.05 horizontal area will invalidate the bullish reversal. Since the price is at an all-time low, the use of a Fib retracement will be required to determine the next potential area for a bottom.

The 1.61 external retracement of the previous bounce is at $0.91, 17% below the current price. This is a likely area to act as a bottom in case of a bearish reversal.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.