There are multiple ways to earn passive income in the crypto market. One of the most carefully considered questions is that of yield farming vs. staking. Yield farming and crypto staking are the two main ways that cryptocurrency investors use to earn additional income. We cover both these methods and how you can get started in this guide.

KEY TAKEAWAYS

➤ Yield farming and staking are two key methods for earning passive income in the crypto market.

➤ Staking secures blockchains by locking tokens, while yield farming involves depositing funds into DeFi platforms to provide liquidity.

➤ Staking typically provides fixed APYs and involves lower risk, whereas yield farming can yield higher returns but carries more risks.

➤ Yield farming requires more crypto expertise and active management, while staking offers a more passive and beginner-friendly way to earn stable rewards.

- Yield farming vs. staking

- What is staking?

- How does staking work?

- How to stake PoS cryptocurrencies

- Top 5 cryptocurrencies for staking

- What is yield farming?

- How does yield farming work?

- Best yield farms

- Bake (ex. Cake DeFi)

- Pancake Swap

- Yearn Finance

- Curve Finance

- What are the risks of yield farming?

- Yield farming vs. staking: Which one is better?

- Frequently asked questions

Yield farming vs. staking

Yield farming and staking have many similarities, and they are both excellent methods to generate a passive income as a crypto holder.

Staking is when crypto investors lock up their funds to support a blockchain or protocol and earn a percentage on the fees collected or receive a stipend of newly issued tokens or coins. Yield farming is when users stake their crypto funds on DeFi platforms and take their liquidity provider (LP) tokens to stake again on other platforms to multiply their returns.

With that in mind, let’s dig in to summarize the main differences between yield farming and staking.

| Staking | Yield Farming | |

|---|---|---|

| Profit | Staking has a set reward, which is expressed as an APY. | Yield farming requires a well-thought investing strategy. It is not as straightforward as staking, but it can yield much greater rewards. |

| Rewards | Staking rewards are the network incentive given to validators that help the generate new blocks. | The rewards for yield farming are determined by the liquidity pool and can fluctuate as the token’s price changes. |

| Security | If bad actors try to trick the system, they risk losing their funds. | Yield farming relies on DeFi protocols and smart contracts, which might be vulnerable to liquidation risks. |

| Impermanent Loss Risk | There is no impermanent loss if you stake crypto. | Yield farmers are exposed to risks caused by the volatile prices of digital assets. |

| Time | Different blockchain networks require users to stake their funds for a fixed period of time. Some also have a minimum amount requirement. | Yield farming doesn’t require users to lock up their funds for a fixed period of time. |

What is staking?

Staking is like purchasing treasuries or a government bond. When you purchase a bond, you are lending the government money, which they pay back through taxation or printing more currency.

Similarly, when you stake, you are putting your crypto into a smart contract and, in the case of blockchain staking, earning a portion of the transaction fees (similar to taxes for a state) and earning newly minted cryptocurrency. Blockchains that allow staking use a proof-of-stake (PoS) mechanism.

PoS is an alternative to the PoW. Instead of mining, validators stake their crypto to generate new blocks. The process of staking is far less energy-consuming. Many platforms prefer staking because it is a much more eco-friendly mechanism for blockchains.

How does staking work?

Users are required to stake either a fixed amount of crypto to become validators or they can participate in liquidity pools. Each staking platform may have slightly different rules; the most common way is using staking pools.

Staking typically involves locking your crypto funds, akin to a crypto savings account, and necessitates an investment in cryptocurrency. In many cases, staking mechanisms will slash your crypto funds if you behave maliciously against the blockchain network.

It’s kind of like you go to a mall, right? You go to a mall and then you have to pay $100…at a store and you promise that you won’t steal at the store. And that’s staking.

Sreeram Kannan: Creator of EigenLayer

In the example provided by EigenLayer creator, The mall is Ethereum and the $100 you pay is your stake. If you steal from the store, or double spend on Ethereum, you lose your stake.

Each liquidity pool, including those involving stablecoins, comes with its own conditions and APYs (Annual Percentage Yields), which represent the annual income potential for that specific pool. It’s important to note the conditions of a liquidity pool before staking, as they may vary in terms of fixed timeframes or offer different APYs compared to others.

To generate the highest possible passive income from staking, study all the different ways of staking your particular crypto.

To sum things up, you can stake crypto on both blockchains and decentralized applications (DApps) for different purposes. However, the key takeaway is all staking mechanisms, whether blockchain or DApp-based, require users to lock up their crypto to earn. Furthermore, DApp-based staking is not considered proof-of-stake.

How to stake PoS cryptocurrencies

Staking is easy, and it can be done with any relevant cryptocurrency. Only cryptocurrencies native to a Proof-of-Stake mechanism can be used for staking. Bitcoin, for instance, belongs to a PoW blockchain and cannot be staked.

The most common ways to stake crypto are:

- Using a wallet

- Using a crypto exchange

- Participating in a staking pool

- Becoming a validator

Each cryptocurrency may have slightly different methods for staking, and that’s why it is important to research each cryptocurrency and its staking process.

The most common steps for staking cryptocurrency are:

- Set up a crypto wallet for staking.

- Transfer your crypto funds to that wallet.

- Decide on one staking pool. A crypto exchange might not offer too many options.

- Lock your funds for staking.

- Wait to collect your staking rewards (aka your passive income).

Cold wallet staking is also available. This offers maximum protection for your staked funds, as there is no internet connection.

Ethereum allows staking. You can become a validator if you have 32 ETH and the technical knowledge to set up a validator node. Or you can use a crypto exchange, such as Binance, to stake ethereum.

Cardano is already well-known for its wallets used for staking ADA. It only requires a wallet connected to the network, and staking begins immediately. You’ll choose the staking pool.

Users who don’t want to use a crypto wallet for staking can use a crypto exchange instead, and you can start right after you buy cardano. Another asset that can be staked using a crypto wallet is theta. Other top staking cryptocurrencies are Polkadot and CAKE on the PancakeSwap exchange.

Top 5 cryptocurrencies for staking

Crypto staking has already locked up hundreds of millions of dollars, and the DeFi space continues to rise. Staking platforms allow regular crypto investors to increase their earnings and generate a passive income.

A lucrative blockchain network requires an active team of developers and real use cases for the platform. The more investors are interested in it, the more the network will grow and gain interest from new investors and developers.

These are the most staked cryptocurrencies:

- Ethereum

- Cardano

- Tezos

- Polygon

What is yield farming?

Yield farming is the DeFi version of rehypothecation, a practice where financial institutions re-use collateral to secure a loan or other obligations. The important factor here is the re-using of assets.

The process of yield farming is pretty basic. Crypto holders can use a lending platform, such as Compound or Aave, or they can provide liquidity directly on DEXs, such as Uniswap or PancakeSwap. These DeFi platforms allow users to earn interest on their assets.

Users need to deposit their funds on one of these platforms and receive an APY and the platform’s LP token, which in turn can be used to deposit or stake on another DeFi platform.

If you prefer to use a DEX, you will need to provide a pair of coins, according to the available liquidity pools. Each liquidity provider will receive a percentage of the rewards of the pool, according to the amount provided.

The passive income for yield farmers comes from the interest rate paid by the borrower or the users of the liquidity pool, in the case of the DEXs. Yield farming is deemed more reliable than crypto trading, and the most risk-free earnings are generated by stablecoins.

Yield farming, also known as token farming, has been around since 2020 when Compound — the first DeFi lending protocol — was launched. Today, we have multiple DeFi lending platforms used for yield farming, each with its own benefits.

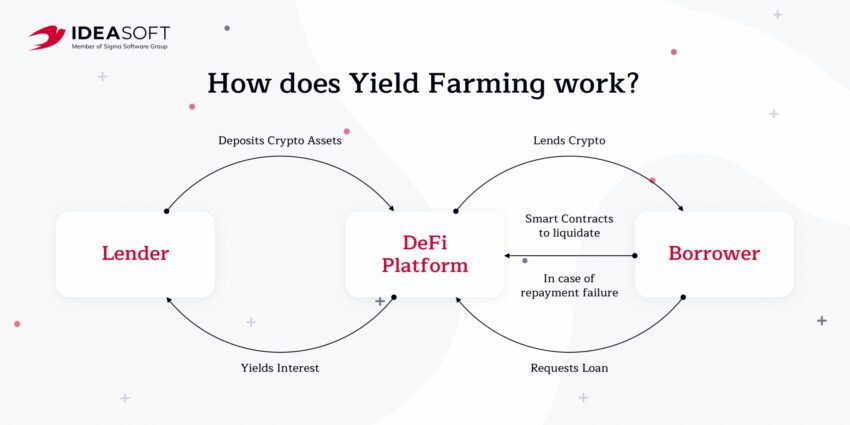

How does yield farming work?

Yield farming uses smart contracts or automated market makers (AMM) to facilitate crypto trading. Liquidity providers (LPs) deposit funds to the liquidity pool to sustain the system, and they earn a reward for it.

Because of the liquidity providers who offer their funds to certain liquidity pools, other users can lend, borrow, and trade crypto. All crypto transactions have a service fee, which is distributed among the LPs.

Besides that, all lending protocols have a native token distributed to the LPs to incentivize liquidity pool funding further.

Liquidity providers (LPs) and liquidity pools

The liquidity (or token pairs) is managed by the AMM system, and the liquidity pools and the liquidity providers (LPs) are the two main components. So, what is a liquidity pool?

Basically, it is a smart contract that collects funds to facilitate crypto users to lend, borrow, buy, and sell cryptocurrency. Those who deposit funds into liquidity pools are called liquidity providers (LPs) and use their funds to power the DeFi ecosystem. They earn incentives from the liquidity pool.

Oftentimes, low trading volume tokens are the ones benefiting the most from yield farming, as this is the only way to easily trade them.

Best yield farms

| Platform | Blockchain | ROI | Assets |

|---|---|---|---|

| Bake | DeFi Chain | Up to 30% | 25+ |

| PancakeSwap | Ethereum and 3+ | Up to 59% | 50+ |

| Yearn Finance | Ethereum | Up to 50% | 70+ |

| Curve Finance | Ethereum | Up to 40% | 71+ |

As with any system, yield farmers support the system because they earn an incentive from the platform they use. The best yield farms are usually the ones that are most secure and provide the highest yields.

Each blockchain has a bunch of yield farms, and they all offer different conditions. Some investors opt to buy the funds required to become a yield farmer. Others focus on finding the best yield farm for the assets they already own.

Considering the latest trends and interest in the crypto space, here are a few of the top-yield farms:

Bake (ex. Cake DeFi)

CakeDeFi is a platform that covers all your DeFi needs. It’s designed to be user-friendly and help you earn more. The available products include Staking, Borrowing, Yield Mining, and YieldVault.

With YieldVault, investors can make high returns on their crypto assets by using the DeFiChain vaults, which take advantage of current negative interest rates. Staking, Borrowing, and Yield Mining work just as their names suggest.

Pancake Swap

PancakeSwap is a DEX that is based on the BNB Chain. It works similarly to other automated market maker (AMM) platforms in that it allows users to trade cryptocurrencies directly from their digital wallets, eliminating the need for intermediaries.

PancakeSwap employs a liquidity pool model, in which users contribute their tokens to various liquidity pools, which are then used to facilitate trading. Fees are charged to liquidity providers on trades made in their pools in proportion to their share of the total pool.

Yearn Finance

Yearn Finance is a DeFi protocol that aims to optimize yield generation for crypto assets. It provides an automated platform that helps users find the highest yield opportunities across various lending and liquidity protocols.

Yearn Finance is known for its yield farming strategies, which dynamically allocate funds to maximize returns. It has gained popularity for its community-driven approach and the ability to generate passive income through its yield optimization services.

Curve Finance

Another yield farming app, Curve Finance, is a DEX protocol designed specifically for stablecoin trading. It focuses on providing low-slippage and low-fee transactions for stablecoin swaps, making it ideal for stablecoin traders and liquidity providers. Curve Finance utilizes advanced automated market-making algorithms to maintain stablecoin pegs and optimize trading efficiency.

The protocol has gained popularity for its ability to minimize impermanent loss and its integration with other DeFi platforms, allowing users to participate in yield farming and earn additional rewards.

What are the risks of yield farming?

When comparing yield farming with staking, it is worth noting that there are different ways these two processes work. Here are some risks of yield farming that every crypto investor should be aware of.

Collateral liquidation

When a user wants to borrow crypto, they have to deposit collateral on the lending platform, which will cover the loan. This is how DeFi loans work. Some lending protocols require as much as 200% of the value borrowed to be deposited as collateral.

This means that a user needs to deposit an asset to borrow another one. If the deposit or collateral suddenly plummets in value, the pool will try to recuperate the loss by selling the collateral on the open market, but there still can occur a loss of value, which leaves the liquidity providers exposed to loss.

The borrower then loses the collateral. That’s why it is better to borrow from a high ratio collateral pool, to avoid collateral liquidation, in case the price of an asset drops.

Moreover, it is possible that there is not enough liquidity on the open market to purchase the collateral. This leaves the lending platform with “bad debt.” Bad debt on a lending platform is bad for liquidity providers because it increases the risk of the platform being unable to repay deposits or fulfill withdrawals, potentially leading to losses for LPs.

Price fluctuations

The crypto market is very volatile. While this can yield great rewards for traders and some investors, yield farmers can experience loss when tokens suddenly lose value. This can happen when certain trends make the market buy or sell certain tokens.

Protocol glitches

Yield farming and the entire DeFi ecosystem rely on smart contracts to facilitate all financial operations provided by these Dapps. But smart contracts are pieces of programming code that are still written by humans. Humans can make errors. A poorly designed protocol or smart contract can lead to hacker attacks or other malfunctions, which leads to the loss of funds.

Yield farming vs. staking: Which one is better?

Whether yield farming or staking, each method demands a different level of expertise. Yield farming might seem more lucrative regarding potential returns, but it requires a deeper understanding of the crypto market. It often involves more complexity and demands consistent attention and research, making it challenging for new crypto investors.

On the other hand, staking offers a simpler, more hands-off approach. While the rewards might be lower than yield farming, it doesn’t require constant monitoring, and investors can lock in their funds for longer periods. The choice ultimately depends on the type of investor you are and your experience level in the DeFi space.

Frequently asked questions

Is farming on PancakeSwap worth it?

Is yield farming the same as staking?

Is staking profitable?

Is yield farming still profitable?

Is yield farming riskier than staking?

What is the best way to earn yield on crypto?

Is yield farming the same as liquidity staking?

How does liquidity mining differentiate from yield farming and staking?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.