DeFi lending is a novel financial service that has exploded onto the scene. This is largely due to its attractive rates and innovative products. DeFi lending platforms help anyone borrow or lend funds, and crypto holders can earn passive income. All this without having to pass all the time-consuming checks required in traditional finance.

Blockchain technology has opened the gate to a new decentralized world ━ the world of DeFi. We explain what DeFi is, how DeFi loans work, and how it improves traditional financial systems. First, let’s take a quick look at how traditional finance markets work.

Like what you see? Join BeInCrypto Trading Community on Telegram with like-minded people: share your experience, discuss and read all the hottest news on DeFi lending. Join us

What is DeFi?

DeFi stands for decentralized finance. It was first introduced by the Ethereum network, thanks to the network’s smart contract features. The DeFi ecosystem allows users to benefit from financial operations without intermediaries or any third party. This is opposed banks in the traditional financial sector.

In DeFi, the network can have virtually countless decentralized applications (DApps) that can perform operations. DeFi enables users to manage their digital assets, regardless of their location or status. All of these are possible due to blockchain technology and its permissionless network, which is transparent and open-source.

Smart contracts enable this digital decentralized financial sector to perform similar to the traditional services — but without the need of the middle man. A smart contract is a special computer program deployed on the blockchain that is triggered only when the embedded predefined conditions are met.

Many DeFi applications are deployed on the Ethereum blockchain. Other networks that allow smart contracts and can be considered an alternative to Ethereum are Cardano, EOS, Solana, but there are more.

As the traditional financial system evolved together with our society, it faces many issues, some of these being negative interest rates and inflation.

How does traditional finance work?

The traditional financial system refers to institutions, banks, investment brokers, and all the other entities engaged in the fiat financial ecosystem. The main purpose of the financial system is to intermediate and facilitate the flow of money throughout society.

The financial system moves money around and supports investors by supplying them with funds put in by others. A large part of investments, if not all, require businesses to cooperate with actors from the traditional financial system to evolve. When it comes to financing, large and small businesses often require loans from a bank, and this process takes time and might not always be successful.

The traditional financial system is commonly broken down into three main areas:

- Public finance: All systems and services that concern the government

- Corporate finance: The managing of assets and revenue of a business

- Personal finance: All financial decisions of an individual

Negative interest

When borrowing money from a bank, people are charged interest on the loan. This interest rate is the effective cost of borrowing. But in times when consumers hold money instead of spending it, the economy faces a decline in demand and prices plummet. This is called deflation, and it is a sign of a weakened economy.

To balance the effects of deflation. Central banks need to stimulate credit and money lending. An unusual method is that they offer a negative interest and pay borrowers to take a loan to encourage investment and recover the economy from the recession.

Unlimited money printing

Until 1971, the U.S. dollar was backed by gold. Paper money had a value backed by gold, and anyone could exchange it for an equivalent amount of gold. But that is not the case anymore.

With that, fiat currency was no longer backed by anything other than the word of the government. It is used as a convention, but there is nothing stopping governments from printing more money. If only the amount of money increases, but all else remains the same, then people will have more money chasing the same goods, which will drive prices up, causing inflation.

Central banks need to carefully tackle both inflation and deflation to ensure that the global economy works properly. The two might not always be properly addressed, as the central entities responsible might face external pressures to incline the balance.

The shortcomings of the traditional financial system are partly solved by the emerging DeFi industry and decentralized economies in general.

What is DeFi lending?

DeFi lending, or decentralized finance lending, is similar to the traditional lending service offered by banks, except that it is offered by peer-to-peer decentralized applications (DApps).

In traditional finance, people set up a savings account and deposit fiat to receive interest on their deposit. But for DeFi, crypto investors can lock their funds or use them to provide liquidity to liquidity pools and receive interest.

Furthermore, with crypto trading, no central entity exists to ensure sufficient liquidity of both pairs being traded. Decentralized platforms rely on and incentivize crypto investors to use their funds to provide that liquidity.

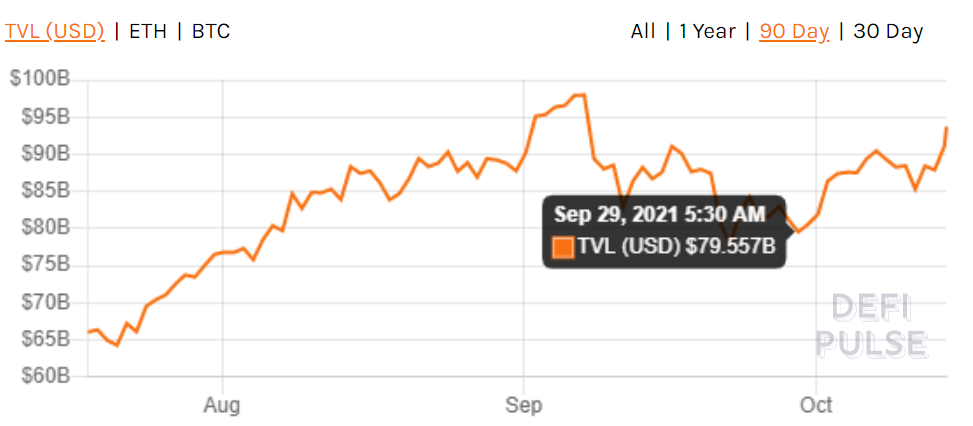

The DeFi lending market has risen substantially since 2020. The Total Value Locked (TVL) in DeFi protocols is over $80 billion, increasing more than 20-fold in the last year.

Notably, DeFi rates are much greater than those offered in the traditional financial space, making DeFi lending a much better option for earning passive income.

DeFi lending vs. traditional lending

The traditional financial system offers services such as lending, borrowing, spot trading, and margin trading. The DeFi ecosystem has adapted and can offer the same services and financial products as traditional systems.

One of the main differences between traditional lending and DeFi is that traditional banking requires time-consuming and onerous checks on a customer’s status. On the other hand, with DeFi, a loan is granted much quicker, so long as the individual meets the collateral requirements. Smart contracts take care of much of the review process, making it easier for both the lender and borrower.

DeFi loans also typically offer much better returns when compared to traditional lending markets — and even equity. While the specific rate varies greatly, loans can often be 10% or higher than other assets. This is one of the key reasons why DeFi’s popularity exploded in 2020.

How does DeFi lending work?

DeFi lending is fairly straightforward. The borrower has to make a deposit on a DeFi lending platform via a smart contract associated with a particular currency, and it must match the loan amount. This deposit is called collateral, and it can take the form of a wide variety of cryptocurrencies.

The good news is that anyone can be a lender. There are many ways to lend crypto funds, and it is worth researching all options, as some may generate more passive income than others.

Borrowers should also research the different lending pools and choose the best one for their specific needs.

Let’s say a borrower wants a DeFi loan of one bitcoin. The borrower has to deposit the equivalent value of one bitcoin in another cryptocurrency.

An issue that may arise is the fluctuating crypto prices, and the value of the collateral drops below the price of the DeFi loan. That’s why some DeFi lending platforms, such as MarketDAO, require a minimum deposit for the collateral of 150% to 200% for the DeFi loan.

If the value of the collateral drops below the price of the loan, it is subject to a liquidation penalty.

Advantages of DeFi lending

DeFi loans have multiple advantages for all parties involved, when compared to the traditional system.

Lending consistency

DeFi loans are granted on a consistent basis. All DeFi rates and rules are clearly stated, leaving little room for human error.

Accountability

Blockchain is a public ledger that can provide on-demand records of all DeFi loans and the rules and policies that granted that loan. The public distributed ledger serves as proof of all financial transactions when a DeFi loan is granted.

Speed

DeFi loans are quickly processed, and the lent amount is available immediately if the loan is approved. The fast processing is a result of DeFi lending platforms being powered by cloud services, which help identify any attempt at fraud, as well as other risks.

Lending analytics

Having a completely digital process for lending helps monitor and assess the lending and borrowing market. These lending analytics can be useful for those looking to optimize their funds. It also helps DeFi lending platforms gain insights such as loan sources, which can further help them improve loan performance.

Transparency and immutability

A blockchain is a public distributed ledger that can be easily verified by any user of the network. Transparency allows data analysis, and the decentralized nature of the blockchain ensures that all transactions are legitimate.

Disadvantages of DeFi lending

As a crypto holder, you should know there are a few different types of risks if you want to participate in DeFi lending.

Impermanent loss

Crypto lenders that participate in a liquidity pool can earn passive income for lending their cryptocurrency, but they are also at the risk of impermanent loss.

Impermanent loss happens when the price of the crypto locked in a liquidity pool changes. Commonly, this event takes place when there is an uneven token ratio in the liquidity pool. Impermanent loss isn’t realized until the funds are withdrawn from the liquidity pool.

Liquidity providers (LPs) are protected by the impermanent loss and receive rewards from the trading fees to offset the loss. For instance, Uniswap has a 0.3% trading fee that is distributed to LPs.

The best way to avoid or at least minimize impermanent loss is to provide liquidity to liquidity pools that have stablecoins. These are less volatile and have a much smaller chance of price change.

DeFi rug pulls

Unlike traditional lending platforms, DeFi still lacks the required regulations that would protect users from bad actors.

Crypto traders have to trust the DeFi lending platform, and it can so happen that users misplace their trust.

A DeFi rug pull is a crypto scam in which the DeFi developers create a new token and suddenly abandon the project, after obtaining funds from early investors. Rug pulls often occur with tokens on DEXs such as PancakeSwap or Uniswap because they allow anyone to list tokens without any audit.

Flash loan attacks

Flash loans are unique to the DeFi space, and it represents a type of loan that doesn’t require any collateral. Because blockchain transactions can actually include multiple transactions, the flash loan allows a user to execute multiple actions. This includes borrowing cryptocurrency, executing value transfers and smart contracts with that loan, and repaying the initial loan at the end.

If the loan isn’t repaid, the lender can roll back the transaction. As it is a decentralized process, there is no credit score to prevent anyone from accessing a DeFi flash loan.

DeFi lending: the financial revolution

DeFi lending is an ecosystem moving full steam ahead with development, but crypto holders have already shown great interest in all crypto financial services, in addition to lending and borrowing. These platforms are gaining more trust than ever and help pave the way to a world of more decentralized financial services.

This article is not intended as financial advice. It serves an educational purpose only. As always, we strongly advise you to do your own research before engaging in any crypto activity.

< Previous In Series | Crypto | Next In Series >

Frequently asked questions

What are the risks of DeFi lending?

What are DeFi lending protocols?

How do I get a loan from DeFi?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.